| Investors Are 'All In' – But Selling Could Be a Terrible Mistake | | By Brett Eversole | Thursday, January 18, 2018

|

| Individual investors were "all in." It felt like the top.

The problem was that it wasn't the top.

It was early 1998. Investors were betting on a continued uptrend – they had gone "all in" on stocks, based on one measure.

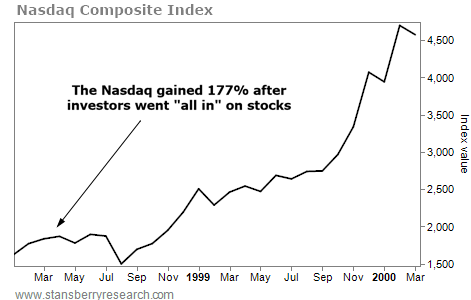

If you'd sold then simply because investors were "all in," you would have been kicking yourself later. That's because the market didn't peak until two years later – in early 2000.

Said another way, if you'd gotten out when investors first went "all in," you would have missed out on two years' worth of upside.

Today, we're seeing the same scenario. Investors are "all in" on stocks, just like they were in 1998. And just like that time, selling early could be a huge mistake.

Let me explain...

----------Recommended Links---------

---------------------------------

I always want to know what individual investors are doing with their money.

It tells us when investments are hated or loved... And how to act as contrarians.

Still, the timing around sentiment indicators can be tricky. That's the case with today's "all in" measure for stocks.

The American Association of Individual Investors (AAII) has been tracking investor portfolios for decades. One of its surveys covers the cash, stock, and bond allocations of individual investors.

According to the latest survey, individual investors' cash positions are at the lowest level we've seen in nearly two decades. Investors hold just 13% of their portfolios in cash right now.

Again, cash positions haven't been that low since the dot-com boom. But it doesn't mean stocks are peaking today. Here's how things went last time...

In January 1989, individual investors held 36% of their portfolios in cash. Stocks boomed over the next several years. And by March 1998, investors held only 11% of their portfolios in cash.

The dot-com boom was in full swing. And investors had gone "all in."

Sounds scary, right? Well, it wasn't.

From March 1998 to March 2000, the tech-heavy Nasdaq Composite Index gained 177%...

Getting out just as investors were piling in would have been a terrible mistake.

Today, we're in a similar position. Mom-and-pop investors' cash allocations are at 13%, according to AAII.

That tells us that sentiment is getting more positive. Investors are more excited to own stocks. But it doesn't mean a crash is imminent.

When cash positions hit similar lows in early 1998, the Nasdaq nearly tripled in less than two years.

Now, I'm not saying that stocks are certain to double or triple from here. But we have no reason to expect this is the top just because individuals have moved into the stock market, either.

History says the opposite is true... We could still have years of upside ahead of us – along with some of the biggest gains of this bull market.

Good investing,

Brett Eversole |

Further Reading:

This is not what a top looks like... To learn more, catch up on Steve's recent "Melt Up" essays right here: |

|

THE POWER OF A LONG-LASTING CRAZE

Today, we'll highlight a reliable investing strategy at work... In the past, we've looked at the benefits of investing in physically addictive products like soda, coffee, and alcohol. But what about psychologically addictive products? People crave hot items like Apple iPhones or Nike Air Jordan shoes. More important, they come back for the newest versions – often waiting in line for hours, or even days. Today, we're seeing this with video games... Activision Blizzard (ATVI) makes some of the world's most popular game series – like Call of Duty, Skylanders, and Destiny. It also produces well-known titles like Candy Crush, World of Warcraft, King's Quest, and Overwatch. Players are hooked. Currently, they're plugging in to these games for more than 50 minutes per day... And recently, some of the company's subsidiaries hit third-quarter records for online monthly active users. Sales for the same quarter reached a record $1.6 billion. As you can see below, ATVI is in a massive uptrend. Shares soared around 80% over the past year... And they recently hit multiyear highs. It's more proof that investing in addictive products works... |

|

| How to own stocks with leverage during the 'Melt Up'... You can't afford to miss the final explosive "Melt Up" in U.S. stocks. Specifically, we want to own a certain category of stocks as the market pushes higher... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

You won't hear about it from the White House... But the government's "Regulation D" could change all the rules about your retirement, beginning in 2018. If you're over age 50, it could have a major impact on your wealth. Learn more. |

| Start Building Your Wealth Now With These Four Financial Habits | | By Kim Iskyan | | Wednesday, January 17, 2018 |

| | If you want to grow your money in the years to come, start practicing these four good financial habits... |

| | All Right, Mr. 'Melt Up'... So When Does It End? | | By Dr. Steve Sjuggerud | | Tuesday, January 16, 2018 |

| | Here in 2018, it seems, all the Wall Street experts are getting onboard with my "Melt Up" idea... |

| | This Notoriously Cyclical Sector Is Starting to Boom | | By Justin Brill | | Saturday, January 13, 2018 |

| | One "left for dead" asset class is quietly moving higher again... |

| | Six Ways to Get Ready for the Next Crisis – Before It Strikes | | By Kim Iskyan | | Friday, January 12, 2018 |

| | Global stock markets keep heading higher and higher... credit markets are increasingly overextended... and geopolitics are more harrowing than ever... |

| | My Secret for Once-in-a-Lifetime Hires | | By Dr. Steve Sjuggerud | | Thursday, January 11, 2018 |

| | How quickly do you know if someone is B.S.-ing you? |

|

|

|

|