|

|

Today’s letter is brought to you by Bitcoin Investor Day!

I am hosting the first Bitcoin Investor Day in New York City on March 22nd this year. It is an annual meeting for sophisticated Wall Street investors who are interested in bitcoin.

Speakers include Cathie Wood, Mike Novogratz, Anthony Scaramucci, Mark Yusko, Head of Digital Assets at BlackRock, Bitwise CEO, Head of Research at Fidelity & VanEck, and many more.

Tickets are only $50 and the venue is incredible. This will be one of the highest quality bitcoin conferences of the year. See you there!

To investors,

A popular critique of bitcoin over the years has been that the first version of a technology is rarely the version that wins over the long run. Apple didn’t make the first computer or smart phone. Google didn’t make the first search engine. Facebook didn’t make the first social network. And Amazon didn’t make the first online marketplace.

But each of these companies and products won over the long-term because they innovated on earlier versions and found some unique combination of features that led to a widening moat.

Bitcoin is not the first digital currency. In fact, bitcoin was only launched after 40 years of research and development by many intelligent, hard-working people around the world. This group was working in silos trying to create a version of electronic money that could operate outside of the existing financial system.

The pursuit led to many technology breakthroughs, but no one seemed to be able to crack the exact combination of features to reach break out success.

Satoshi Nakamoto changed everything.

The creator of bitcoin was able to innovate on the long history of electronic cash research and development to create an asset worth ~$1 trillion within 15 years. The level of success that Satoshi had, especially when compared to the prior 40 years of attempts, is breathtaking.

But we shouldn’t only apply this framework of “first movers struggle to last” to bitcoin. The area where it becomes even more obvious is with Ethereum.

The second most popular blockchain in history was able to catapult itself into a leading position by being first to launch a blockchain that incorporated smart contracts.

This innovation has obviously been valuable. The asset is valued at $285 billion today and there are millions of people who use the technology on a daily basis.

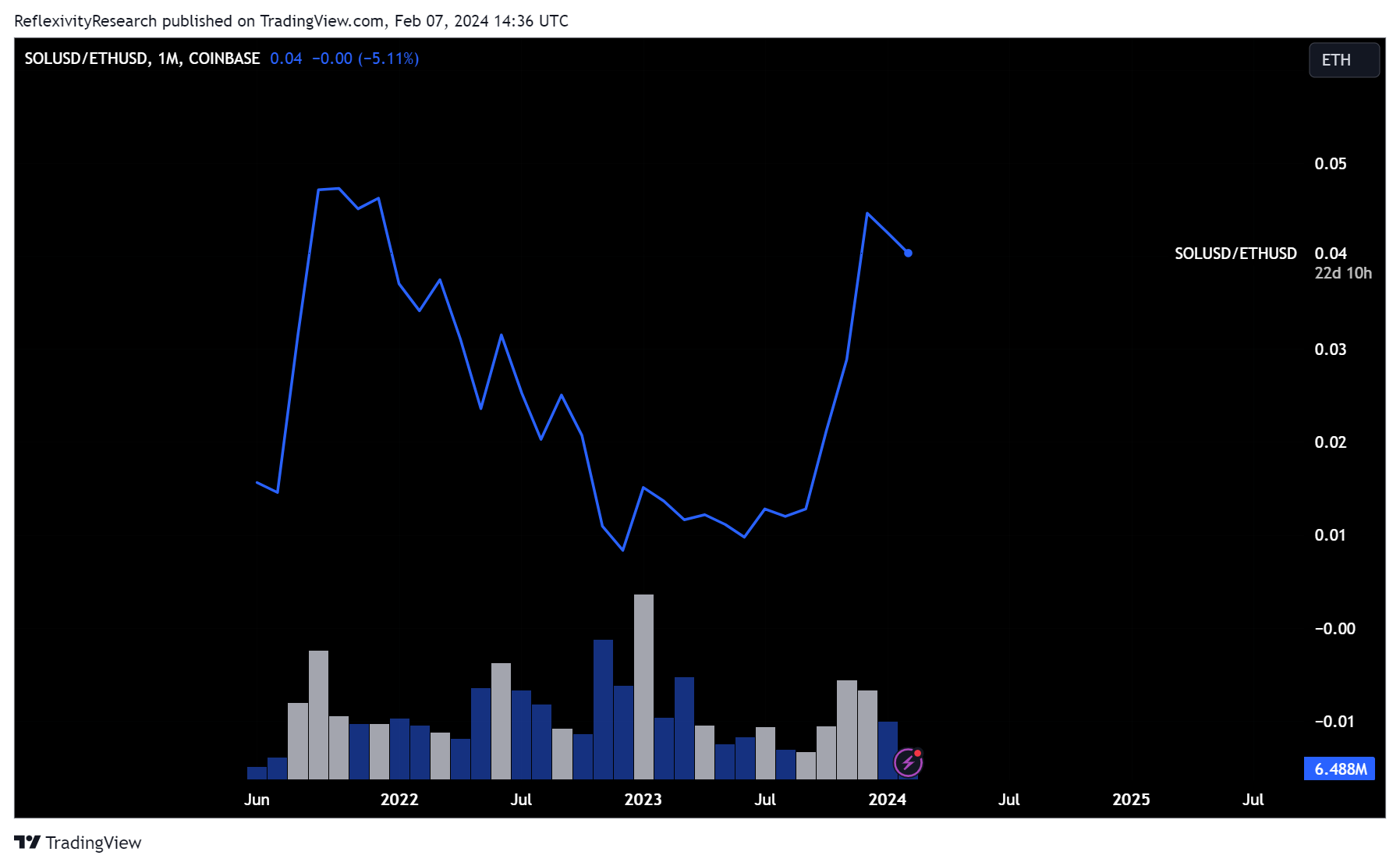

There is one problem though — it appears that Ethereum is under significant competition from various organizations that are making up significant ground. Take Solana as an example. The second most popular smart contract platform is up more than 300% in the last year, while Ethereum is only up 45%.

Price is not the only thing that matters, but it is a good indicator for what is happening in the market.

We can see in DEX volume by chain, Solana recently flipped Ethereum for a period of time. Ethereum is back on top for now, but you can see the long term trend of declining market share for Ethereum.

Why is this happening? It is hard to tell exactly, but a big reason is that Solana is faster and cheaper. The technology has been improved upon, so users are flocking to the thing that serves them best. There is going to be even more competition coming from Sei, Monad, and a host of other chains that want to improve upon Ethereum and Solana.

Improve or die. That is the name of the game here.

Bitcoin is playing a different game. It is not trying to be the fastest or cheapest, but rather the most fixed and decentralized. That is a much harder concept to dethrone for the competition. No matter how smart you are as a developer, this is not about improving the technology to unseat bitcoin, but rather you have to gain a structural advantage globally to unseat the multi-billion dollar mining industry.

I bring up this point because it is unlikely that bitcoin is the AOL of crypto. Bitcoin is the product of 40 years of R&D by some of the smartest people in the world. It is the last iteration, not the first. They were maniacally focused on creating a digital currency — eventually they succeeded. There doesn’t appear to be real competition to bitcoin as a global store of value in digital currency form.

Ethereum can not say the same thing. This doesn’t mean that Ethereum is bad. It doesn’t mean that Ethereum’s price won’t increase in the future. It doesn’t even mean that Ethereum will be surpassed by any of the competition.

But it does mean that if I had to make a bet now, Ethereum is more likely to be the AOL of crypto than Bitcoin.

The critics are correct in their critique. They just have been pointed at the wrong asset.

Hope you all have a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

READER NOTE: I am hosting a webinar Wednesday Februrary 14th at 930am EST for all paying members of The Pomp Letter. This webinar will be a review of a massive amount of data, charts, and graphs to explain the US economy, inflation, the global liquidity situation, and where I think various asset prices are going in the next 24 months.

You can join us by becoming a paying subscriber here. I will send out the Zoom link to all members. Thank you.

Stefan Rust is the Founder of Truflation, it’s an alternative economic measurement platform using new data to better measure inflation.

In this conversation, we talk about the problems with the current CPI measurement from the government, what Truflation is doing differently, how they are collecting data, personalized inflation, global opportunities, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Truflation CEO Explains How They Are Improving Inflation Measurement

Podcast Sponsors

Frec.com - Use tax-loss harvesting to save on your tax bill, while keeping the same investment exposure you already have.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.