|

|

Is Gold Now Safer than U.S. Treasuries?

Gold Up, Treasuries Down. Was Keynes right in calling gold a barbaric relic?

Based on “The Fourth Turning” by Strauss and Howe published in 1997, we are nearing the end of the current Fourth Turning. It began with the 2008 financial crisis and the election of America’s first black President in 2008. As this current Forth Turning nears its end, it looks more and more like the end of America as I have known it during my seventy-seven years on earth. In fact, this Fourth Turning is actually much bigger than any of the prior three.

Fourth Turnings take place after every 4 generations pass over an 80-to-100-year time frame. We are now in America’s Fourth, Fourth Turning. The first was the Revolutionary War. The second was the Civil War. The third was the Great Depression and World War II. These have been huge events in American history. But this current turning looks like the “mother of all Fourth Turnings.” Given the cultural revolution that has been engineered by George Soros and other elite billionaires, the current turn looks pretty much like the destruction of life, liberty and the pursuit of personal freedom and happiness that meant by our Founding Fathers to be an eternal right of all Americans. Regardless of the future, we must do all we can personally to provide four our loved ones as we encounter a massively different future.

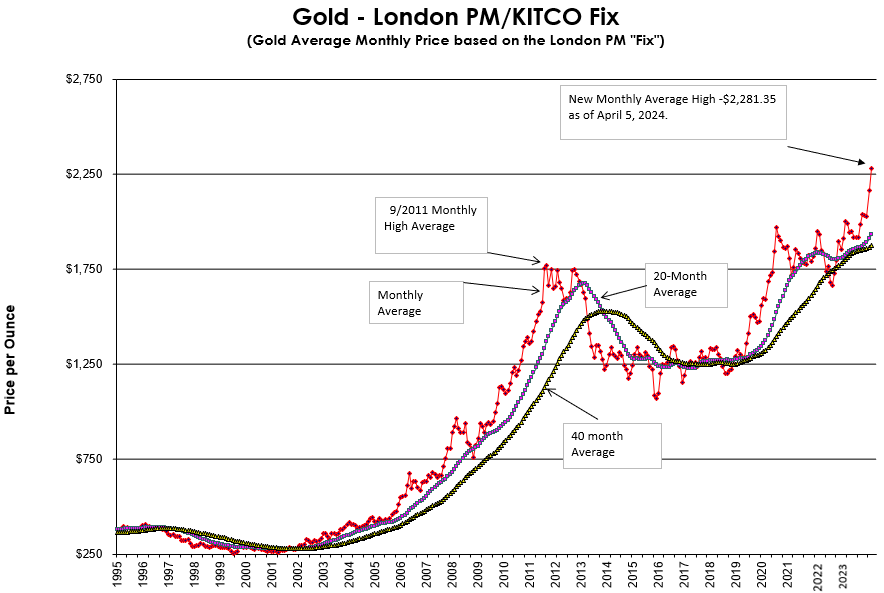

Incidentally, I do not think it is a coincidence that gold is breaking out into the wild blue yonder without any resistance point in sight just as this Fourth Turning draws to its conclusion over the next year or so.

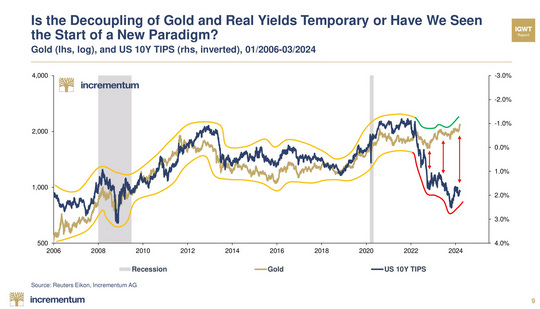

One of the most important charts, I have seen in recent years is the one below from Incrementum. It shows the acceleration of a decoupling between gold and 10-Year U.S. Treasuries. When the world had an insatiable appetite for the U.S. dollar, U.S. Treasuries and gold were in sync as go to safe havens. That tight correlation was halted during the 1970s soon after the U.S. went off the gold standard in 1971. It was eventually restored however thanks to the Nixon administration’s foreign policy that led to a backing of the dollar by OPEC and the U.S. military. From that point until recently, the “petrodollar” enjoyed its dominant international role as the world’s currency. But the weaponization of the dollar against Russia and the out-of-control U.S. budget deficits placing the U.S. in a debt trap has led many nations to prefer gold over U.S. Treasuries.

In this chart you can clearly see the decoupling of gold and the 10-yr. U.S. Treasury starting in 2022. The decoupling suggests that markets are increasingly betting the U.S. will opt for an inflationary route out of its debt trap. Interest rates are inevitably on the rise, even with massive monetary accommodation from the Fed because we are adding another $1 trillion of debt to be every 100 days at the same time that net export nations no longer are increasing their holdings of U.S. Treasuries, but instead are dramatically building their gold reserves. As interest rates rise and the U.S. debt burden surges higher, more and more dollars will have to be created out of thin air by the Fed simply to enable the government to meet interest payment obligations leading to the ultimate end of the dollar unless our politicians are willing to subject the U.S. economy to the deepest recession since the 1930s. I would suggest the chances of that are as good as a snowball’s chance of survival in that very hot place.

The 1970’s decade was not a major societal turning point of the magnitude of Fourth Turnings. America was in a much stronger fiscal position than it is now with its debt/GDP then a mere ~35% compared to a current debt/GDP of >120%. Simply put, the Fed cannot currently allow rates to rise to the market’s equilibrium rate as Chairman Volcker did then if it wants the U.S. government to stay solvent. It has no choice to that painful outcome other than to briefly delay pain by unleashing its printing presses to an extent that hyperinflation is inevitable. Putting it another way, the U.S. can either save the dollar by subjecting Americans to a severe recession or save the government for a little while longer by continuing to fund the government’s insane out of touch with reality spending, leading to the dollar to its ultimate destruction.

Few Americans are really aware of how dire our financial situation is but Robert Kennedy Jr. recently helped truth seeking Americans understand it when he pointed out that the U.S. is now spending as much to pay its interest obligations on U.S. Treasuries as it pays for our military. And he noted that 50% of tax dollars taken in by the treasury now goes to pay interest.

Alasdair Macleod wrote last week that Keynesians are at a loss to explain how gold could be rising so dramatically even as interest rates continue to rise. What they are about to learn the hard way is that their god, Lord Keynes didn’t know what he was talking about when he called gold a “barbaric relic” but that J.P. Morgan did when he said that “gold is money. Everything else is credit.” History reveals that when a country uses credit instead of gold as its currency, it’s only a matter of time before its currency ceases to exist. The U.S. got away with using legalized counterfeit currency for many decades because of its post-World War II military dominance and its agreement with OPEC to have all oil sold internationally be denominated by U.S. dollars.

With the U.S. debt/GDP > 120 and climbing fast without friendly net export nations left to buy treasuries, the handwriting seems to be on the wall. Even if Chairman Powell tries to replicate Paul Volcker, there will be no escape this time because the math simply doesn’t work with the current magnitude of debt. It will suffocate the U.S. economy that has been diseased with artificially low interest rates starting during with Chairman Greenspan until now.

A growing number of foreign participants understand that dollar hegemony is nearing its end even if that truth is being hidden from Americans by self-serving propaganda within the U.S. But as the mathematical handwriting is on the wall, gold is decoupling from Treasuries for the first time since the 1970s. I personally recall the pain of the 1981-82 recession as a young adult. It was the deepest recession at that time since the Great Depression. But at that time, the U.S. had the economic and financial strength to recover from the damage done by Fed’s “easy credit” printing machine and actually thrive for several decades. However, this time, either the Federal Budget will have to be massively cut if the dollar is to be saved or the government will keep on spending like drunken sailors leading to the destruction of the dollar. Is there reason why markets should bet on responsible monetary or fiscal policy by American policy makers?

So it appears that a new major secular gold bull market has begun with some well-known gold analysts calling for a number heading toward $10,000. Before you scoff at such a prospect, let me remind you than back in the 1970s’ when gold was trading at under $40, many ridiculed the idea the yellow metal could rise to $100. Then it rose to $850 in January 1980. But to understand how gold can explode higher you only need to realize that gold is not rising but that credit-based currencies are collapsing. That concept its totally alien to Keynesian economists who have put their faith in credit rather than money.

I can’t think of a better time now to be adding some gold and gold shares to your investment portfolio. If this is just the start of a departure from credit money to real money—gold, then as this current Fourth Turning comes to an end, there will likely be a massive reallocation of wealth from imaginary money (credit) toward gold and silver as well as commodities as a whole. If you see what I see, I hope you will join me as a paid subscriber. There are quite a number of junior gold exploration companies that are building world class gold and silver deposits that I cover in J Taylor’s Gold, Energy & Tech Stocks. These projects are evolving at just the right time into this new precious metals bull market. Yet few investors have focused on this emerging bull market sector. You might want to consider being among the few who are in the know.

Best wishes,

Jay Taylor

You're currently a free subscriber to J Taylor's Gold Energy & Tech Stocks. For the full experience, upgrade your subscription.