|

|

To investors,

Gold hit $2,400 over the last 24 hours, which is a new all-time high price for the precious metal. Most of you would not expect me to cover gold given my interest in bitcoin, but I think there are a few things worth calling out related to the recent rise in gold.

First, when the price of gold rises most people will point to existing geopolitical turmoil as the main driver. In a Reuters article this morning, Ashitha Shivaprasad writes:

“Safe-haven gold prices hit an all-time high on Friday on track for a fourth straight weekly gain as geopolitical risks in the Middle East and economic concerns about China spurred robust demand….There is potential for more upside in prices amid central bank purchases and as demand for safe-haven assets rise with growing anxiety among investors about geopolitical conflicts escalating, said Ricardo Evangelista, senior analyst at ActivTrades.”

It is not crazy to think that existing geopolitical events could be driving some of the price movement, but the question is whether the entire price movement could be explained by these issues which have been going on for months now.

That seems unlikely.

Joseph Wang, who runs FedGuy.com, has a different hypothesis: “Gold still surging - kinda concerning. Maybe someone is preparing for a big geopolitical move as they know they'll lose their dollars and euros after the fact.”

That is eye-opening because the seizure of your central bank assets are now a going concern for all foreign nations who step on the toes of the United States. Castle Island’s Nic Carter explained it well by responding to Wang with the following commentary: “Interesting thesis. For sure there’s no going back after 2022. Anyone that offends the US knows their FX reserves are getting frozen. New era.”

A new era is a great description.

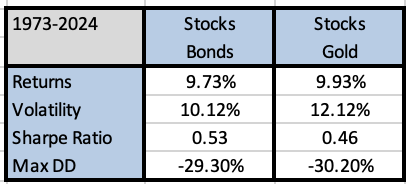

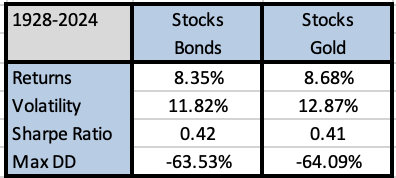

But the seizure of central bank assets may not fully explain the price appreciation either. Meb Faber, the founder of Cambria Funds, pointed out recently that gold’s performance in a portfolio will be quite shocking for most people:

“Here's a crazy stat that no one will believe. The universal investment benchmark is the 60/40 portfolio of stocks and bonds. What if you replaced the bonds entirely with gold....crazy right? Turns out it makes no real difference.”

If you widen the timeline to the last 100 years, the results are similar.

I love narrative violations. This one won’t sit well with the traditional financial advisor crowd that preaches a classic 60/40 portfolio, but data is data. The best counter-argument to putting gold/stocks instead of bonds/stocks is that the bonds will pay yield along the way, while gold does not.

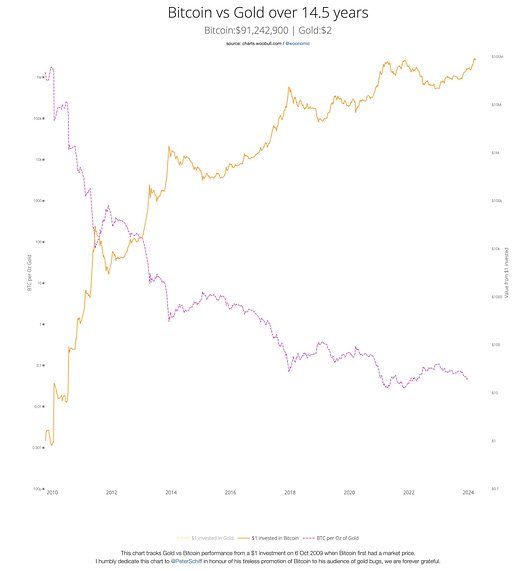

Before you all think I’ve gone all-in on gold, which I own exactly $0 of, I will remind you that digital gold (aka bitcoin) has been a much better investment over the last 15 years. For example, Bitcoin Archive on Twitter pointed out that $1 invested in bitcoin in 2009 is now worth $91 million, but $1 invested in gold in 2009 is now worth $2.

Just as bitcoin’s increase in price during January/February of this year probably was an early warning sign of incoming hot inflation, the current rise in gold may be telling us more about the future than the current geopolitical situation. This will be an interesting development to watch.

Hope you all have a great end to your week. I’ll talk to everyone on Monday.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Chris Kuiper is the Director of Research for Fidelity Digital Assets. Yassine Elmandjra is the Director of Digital Assets at Ark Invest. Matthew Siegel is the Head of Digital Assets Research for Vaneck. Will Clemente is the Co-Founder of Reflexivity Research.

This conversation was recorded at Bitcoin Investor Day in New York. In this conversation, they discuss bitcoin evaluation process, bitcoin ETFs, client demand, regulation, crypto industry, and future outlook.

Listen on iTunes: Click here

Listen on Spotify: Click here

Fidelity, ARK, VanEck Reveal How They Evaluate Bitcoin

Podcast Sponsors

Core Scientific is one of the largest public Bitcoin miners and hosting solutions providers for Bitcoin mining in North America.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA.

Supra- Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.