|

|

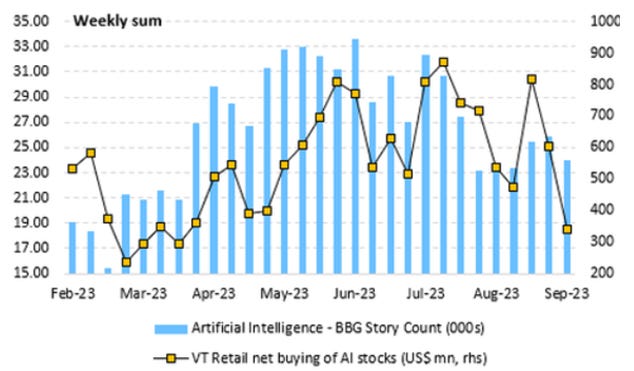

Remember in the very recent past how Wall Street cheerleaders were suggesting the Fed could pull off a soft landing and that our economy was on the verge a dramatic new growth thanks to artificial intelligence? Well, according to an article in Zero Hedge on September 19, the AI meme seems to be petering out, much as most of the other imaginary realities like GameStop, AMC Entertainment Holdings, and BlackBerry Limited are doing. Truth be told, artificial intelligence has been with us for quite some time. What do you think Google is doing when it follows you around to suggest the next product that might “float your boat”? Yes, it is real and will become ever more efficient over time. But it is not deserving of Wall Street hype and recent mania. The chart above on your right displays a cooling off in AI stocks, which has been a major driver of the equity market overall. Quoting Zero Hedge: “Don’t look now, but the AI bubble is going, going, almost gone.” It went on to point out that Goldman’s Prime Brokerage notes said that “the bottom is falling from under the US Semis and Semi Equip sector, where stocks have significantly under-performed the broader market in the past 6 weeks. SOX is down -9.8% since the start of August (vs. -2.8% for the S&P 500) and has recently broken below its 50-day and 100-day moving averages.”

Here’s the punchline: Amid the recent price weakness, “hedge funds have heavily net sold the group based on Goldman Prime data, which finds that in cumulative notional terms, Semis & Semi Equip is by far the most net sold US subsector not only within Tech but also across all sectors since the start of August, driven by short sales and to a lesser extent long sales (3.5 to 1).”

In a must-see interview on Wealthion, posted this past week, Gordon Long explained that in a sneaky way, the Biden Administration have effectively been carrying out Modern Monetary theory to supply massive amounts of liquidity into the market. That is why equities have continued to be so strong. But, he explained, this is not sustainable and basic changes in the American geopolitical and economic structure threaten to pull the rug out from under the financial markets as we enter the “great moderation” explained in the chart above on your left. (1) Interest rates are destined to rise dramatically over the longer term; (2) We are in a reversal of globalization, which will lead to higher costs of production and higher prices; and (3) We’re in a reversal of the mercantile system of the past 40 years, where the U.S. could consume more than it produces because net export countries like Japan and China would keep buying Treasuries. Add to those the anti-energy policies of the Biden Administration, and America is in for massive inflation over the longer term with ebbs and flows of higher prices. For the time being, equity markets may continue strong but skating on thin ice and with so much money flowing into ETFs and seven major stocks, any kind of reversal of money out of stocks into higher yielding bonds may well lead to a massive crash of financial markets with the trillions of dollars in the derivative markets leading the way to destruction.

Watch the Gordon Long interview here: https://tinyurl.com/mtxk5ftz

Meanwhile, regarding gold, Chen Lin wrote the following to his subscribers this past Tuesday:“The gold rush in China continues. At the end of last week, it reached a historical $121 premium in China. See attached chart and article. China was forced to lift the curb on gold imports this week in an effort to reduce the premium as people were smuggling gold into China at a historical speed. The way it goes, gold can easily appreciate a few hundred dollars or more once the people in the west wake up.”

The day for gold and gold shares must surely be close at hand. So, we keep up as best we can with several very exciting emerging world class gold and silver discoveries that our paid subscribers are privy to.

You're currently a free subscriber to J Taylor's Gold Energy & Tech Stocks. For the full experience, upgrade your subscription.