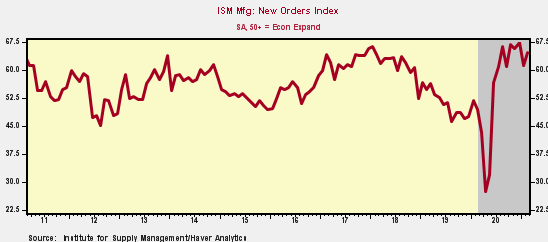

*The ISM manufacturing index increased to 60.8 from 58.7, its highest level during this recovery and tying its highest level reached in the prior expansion (February 2018). Chart 1. The details of the ISM manufacturing survey showed substantial across-the-board strength.

*Sizable increases were recorded in the ISM manufacturing survey for new orders (64.8 from 61.1), production (63.2 from 60.7) and employment (54.4 from 52.1), while a jump in the supplier deliveries index (70.2 from 68.2) suggested slower deliveries as manufacturers struggle to keep pace with strong product demand and low inventories (down to 49.7 from 50.8). Chart 2.

*The not seasonally adjusted prices index jumped to 86.0 from 82.1, higher than any recording during the last expansion, suggesting higher costs for inputs and production. Chart 3. Underlying this striking increase is the significant price increases in oil and industrial commodities.

*The high portion of manufacturing survey respondents reporting increases in new orders and a backlog of new orders (up to 64.0 from 59.7) indicates a robust pipeline of product demand.

Manufacturing industries are benefiting from the strong domestic consumption of goods and global demand for U.S. goods. This trend is expected to continue, driven by robust product demand fueled by unprecedented monetary and fiscal stimulus and the reopening of the economy.

While the production index is high, manufacturers are clearly struggling to keep up with the strong demand and depleted inventories. Some businesses continue to face disruptions due to supply constraints.

While the ISM manufacturing index is expected to remain elevated in the coming months, a critical issue is whether manufacturers facing higher production costs begin to increase product prices. Stay tuned.

Chart 1.

Chart 2.

Chart 3.

Mickey Levy, mickey.levy@berenberg-us.com