| 0:00 | -5:38 |

If you are not a subscriber of The Pomp Letter, join 220,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

To investors,

President Joe Biden is hosting Federal Reserve Chairman Jerome Powell at the White House for a meeting on inflation. Alister Bull of Bloomberg reported the gravity of the situation by writing:

“President Joe Biden will hold a rare Oval office meeting on Tuesday with Federal Reserve Chair Jerome Powell amid the highest inflation in decades, which has angered Americans and hurt his standing with voters.

The two will discuss the state of the American and global economy, according to a White House statement. It’s the first meeting between the two since Biden in November announced his intention to nominate Powell for a second term at the helm of the US central bank, according to a record of the Fed chief’s public schedule which is available through March.”

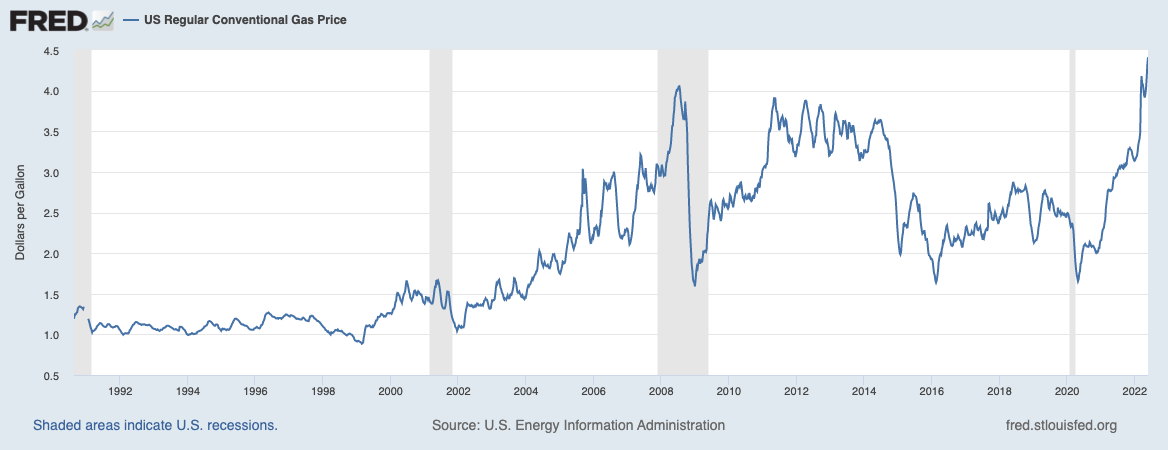

The idea of high inflation is hard to comprehend until you start looking at the data through the lens of an average American family. First, gasoline prices are at all-time high price levels.

Asking people to pay nearly $4.50 per gallon is crazy, but that is just the national average. Some folks in California are paying more than $7 per gallon currently.

Eating food at home is not doing much better. According to the US Department of Agriculture and CPI data, food prices are up 10.8% and they are expected to continue to rise through the rest of 2022.

The level of food price inflation varies depending on whether the food was purchased for consumption away from home or at home:

The food-away-from-home (restaurant purchases) CPI increased 0.6 percent in April 2022 and was 7.2 percent higher than April 2021; and

The food-at-home (grocery store or supermarket food purchases) CPI increased 1.3 percent from March 2022 to April 2022 and was 10.8 percent higher than April 2021.

Food price increases are expected to be above the increases observed in 2020 and 2021. In 2022, food-at-home prices are predicted to increase between 7.0 and 8.0 percent, and food-away-from-home prices are predicted to increase between 6.0 and 7.0 percent. Price increases for food away from home are expected to exceed historical averages and the inflation rate in 2021.

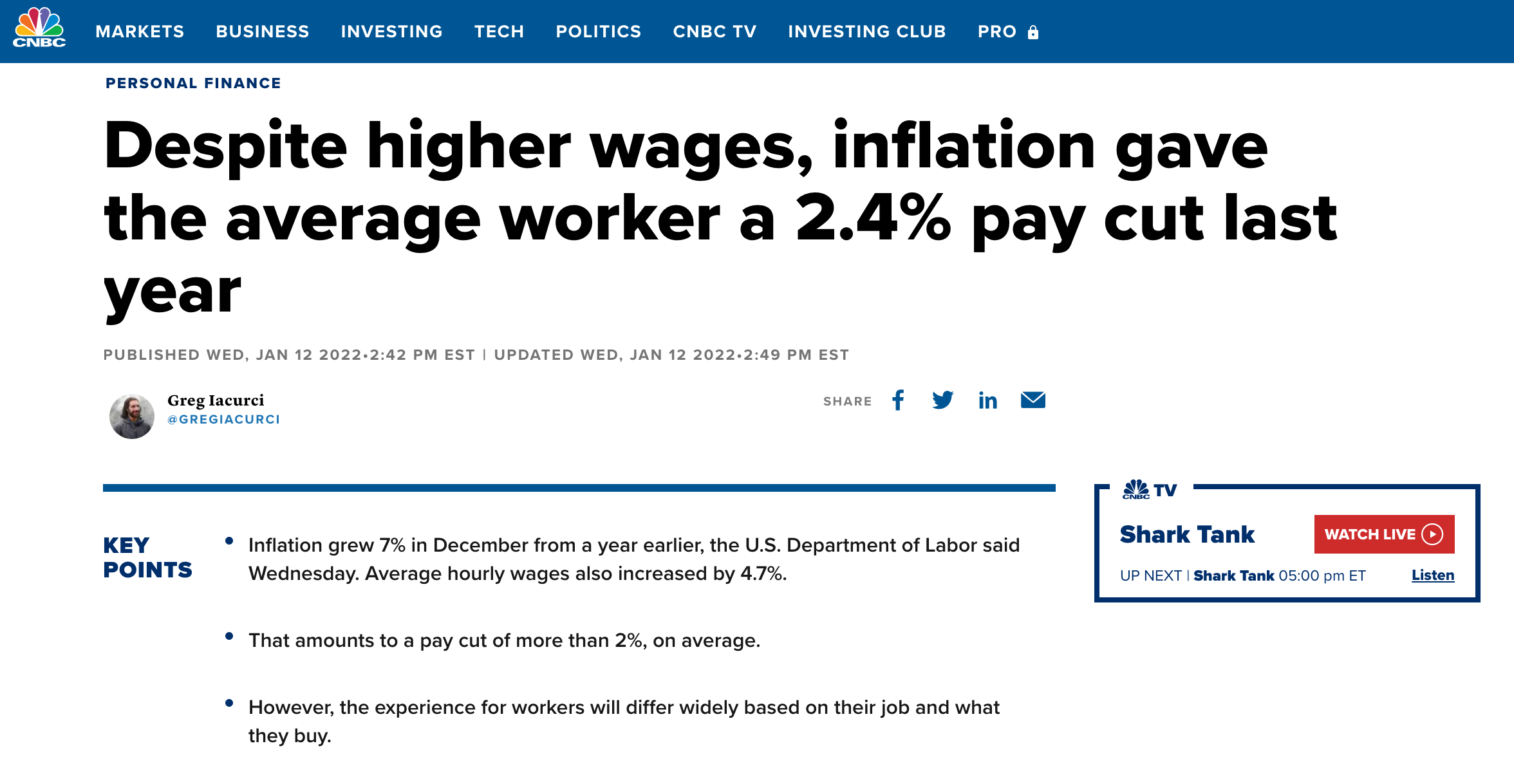

The average American worker already received a 2.4% pay cut in 2021 due to high inflation and wage growth that couldn’t keep up. Now add in accelerating costs of gasoline and food to get a really dire financial situation.

This brings me to the meeting today between President Biden and Fed Chairman Powell. It is no secret that high inflation is a problem for a sitting US President, especially during a year of midterm elections. The looming risk of a recession driven by the Fed’s increasing interest rates can’t make the President comfortable either. Usually economies have to choose between inflation or recession in these scenarios, but the consensus is that we are going to get both in a bout of stagflation.

So why is this meeting noteworthy?

A central bank must be both (a) independent and (b) predictable in order to be effective. We already know that the Federal Reserve is unpredictable — you just have to look at the billions of dollars that are wagered on every FOMC press conference results. It is wild that in the 21st century we are all watching a human speak at a podium in order to figure out a big reveal with our monetary policy. That isn’t exactly predictable in advance.

But the Federal Reserve has always claimed to be independent. When President Trump was aggressively tweeting at the Fed to devalue the dollar, the Fed claimed to be independent of political pressures. Now we have President Biden holding a rare Oval Office meeting with the Fed Chairman. No one believes they are simply going to have tea, chit-chat, and catch up on their weekend plans. President Biden is likely to deliver a message to Powell that he has to get inflation and economic growth in the right place.

So much for the central bank being independent.

This is equivalent to a teacher being called to the principal’s office. The teacher has all the control and leadership in their classroom, but that disappears in the principal’s office. Chairman Powell….welcome to Principal Biden’s office.

|

We are watching a perfect example of why I personally choose to store majority of my wealth in bitcoin as a savings technology. The digital currency’s monetary policy is programmatic. It is written into code, can be audited by anyone at any time, and is not controlled by any one person or group. Bitcoin is an automated central bank with a programmatic monetary policy. It is completely insulated from any political pressure. No change of demand, in either direction, affects the supply. Bitcoin is the most independent central bank in the world.

That detail doesn’t sound important when things are going well. But when you compare bitcoin to the current chaos of human-led monetary policy, bitcoin’s monetary policy looks incredibly attractive. Plenty of critics will point to the recent decline in bitcoin’s USD exchange price (~ 60%), but they will forget to mention that bitcoin is up almost 400% since the start of the pandemic and the US dollar is down double digit percent in purchasing power terms.

Bitcoin has outperformed stocks, bonds, currencies, and commodities during the most insane monetary and fiscal policy situation of our lifetime. There is no single perfect asset. Everything is relative. And if you could rewind history two years, you would dump every other asset in your portfolio and move into bitcoin, both for safety and for asymmetry. Bitcoin is the apex predator asset of the financial markets.

Short term price movements will distract many people from the true innovation — digital sound money. There are more than 150 million people around the world that have adopted bitcoin and the key underlying fundamental data continues to move up and to the right. Slowly, but surely, we will watch as the rest of the world begins to realize the signal among the noise. Bitcoin is doing exactly what it was designed to do. The legacy system and its players are just highlighting bitcoin’s superiority by absolutely losing their minds.

Stay safe out there my friends. No one wants to be called into the principal’s office. Talk to you tomorrow.

-Pomp

If you are not a subscriber of The Pomp Letter, join 220,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning.

SPONSORED: Over $9 trillion has been erased from U.S. equities and the Nasdaq is down 25% in 2022. But listen up: smart investors know how to allocate to sell-offs carefully, using rules-based (aka "quant") strategies to buy the dip. But quant investing historically required a degree in Python and Excel. Until now.

Composer gives you the power to invest like a quant, no PhD required.

Think tech has bottomed? Jump into Big Tech Growth Momentum. Think Inflation is heating up? Dive into Hot Inflation Summer Hedge. Want to stay in stocks with more security? Try Paired Switching: S&P 500 and Gold.

Composer is the next generation of active investing. No code, no spreadsheets, no Robos and no YOLOs. Just smart investing for smart investors.

Pomp Letter subscribers get premier access to Composer with this private link.*

Alex Kruger is an Economist and Trader.

In this conversation, we discuss the macro environment, how the Feds actions are deciding the market, how Alex trades in this economic environment, converting to trading 100% Crypto, and what may happen to Bitcoin & Crypto in the coming months.

Listen on iTunes: Click here

Listen on Spotify: Click here

ECB Will Drop Their Negative Interest Rate Strategy

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Fundrise is largest direct-to-investor real estate investment platform. Go to Fundrise.com/Pomp today and get $10 when you place your first investment.

Unstoppable Domains’ 10 NFT domain endings are now fully integrated with Trust Wallet. Claim your Unstoppable Domainhere today.

Brave Wallet is the first secure crypto wallet built natively in a web3 crypto browser. Download the Brave privacy browser at brave.com/Pomp today.

BetOnline allows you to use Bitcoin and other altcoins to bet on sports, casino games, horse racing, poker and more. Click here and use PROMO CODE: POMP100 to receive a 100% matching bonus on your first crypto deposit.

Abra lets you trade, borrow, and earn interest on crypto. Earn up to 13% interest on USD stablecoins or crypto, borrow USD stablecoins, and trade in 110+ cryptocurrencies in a simple, secure app. Download Abra and get $15 in free crypto when you fund your account.

FTX US is the safe, regulated way to buy digital assets. Trade crypto with up to 85% lower fees than top competitors by signing up at FTX.US today.

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in digital assets inside your IRA. Visit choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Those products include BlockFi Wallet, no fee Trading, crypto collateralized Loans and the World's First Crypto Rewards Credit Card. To get $75 back on the first swipe of your BlockFi Rewards Credit Card, sign up today at http://www.blockfi.com/Pompcc

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services. Learn more at LMAXdigital.com/pomp

Okcoin is the first licensed exchange to bring new cryptos to market. To get started, and go to okcoin.com/pomp

Exodus is the world’s leading desktop, mobile, and hardware crypto wallets, with over 150 assets. Founded in 2015 to empower people to control their wealth. Visit http://exodus.com/pomp today.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

*See important disclaimer

You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber.