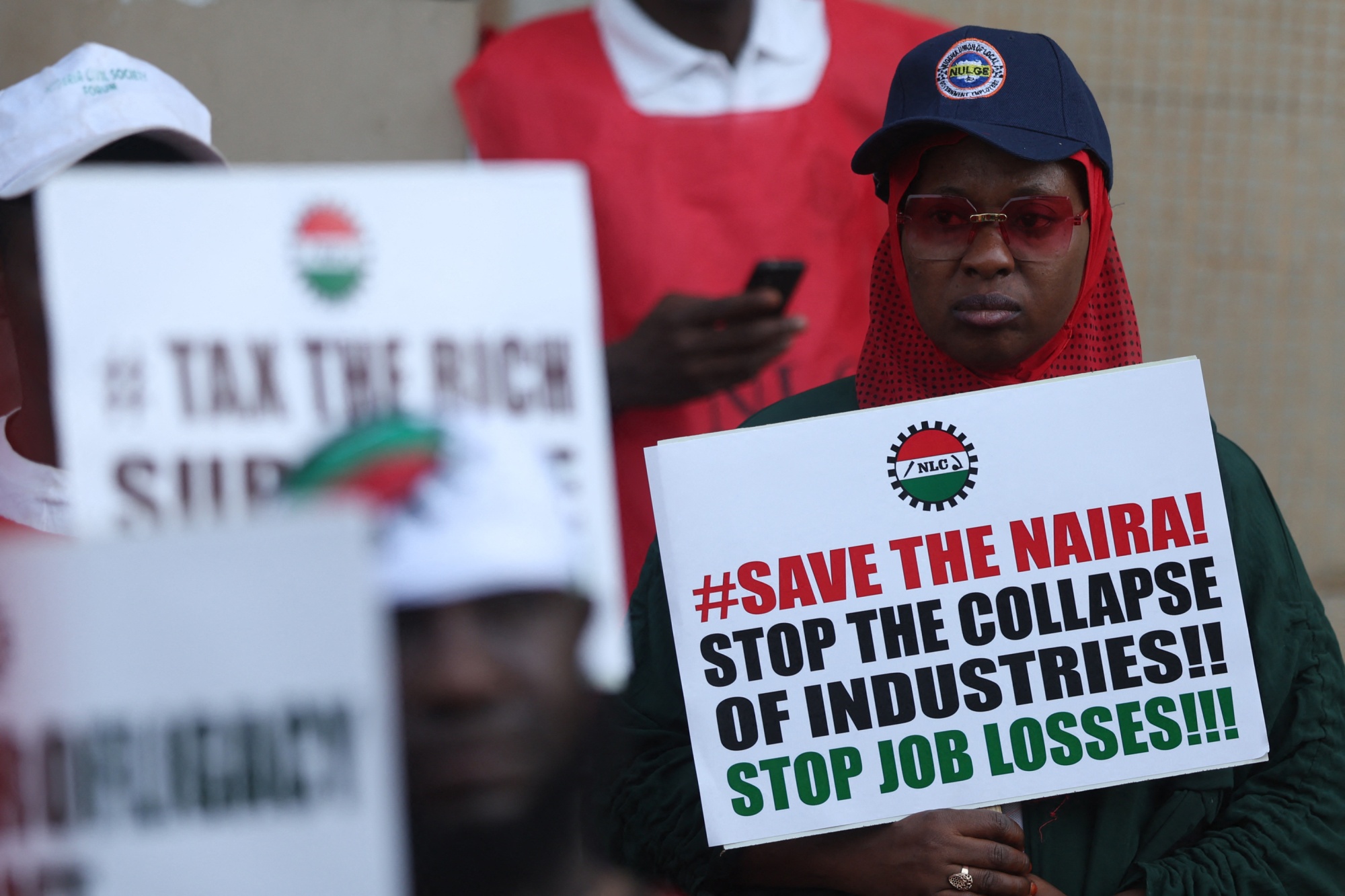

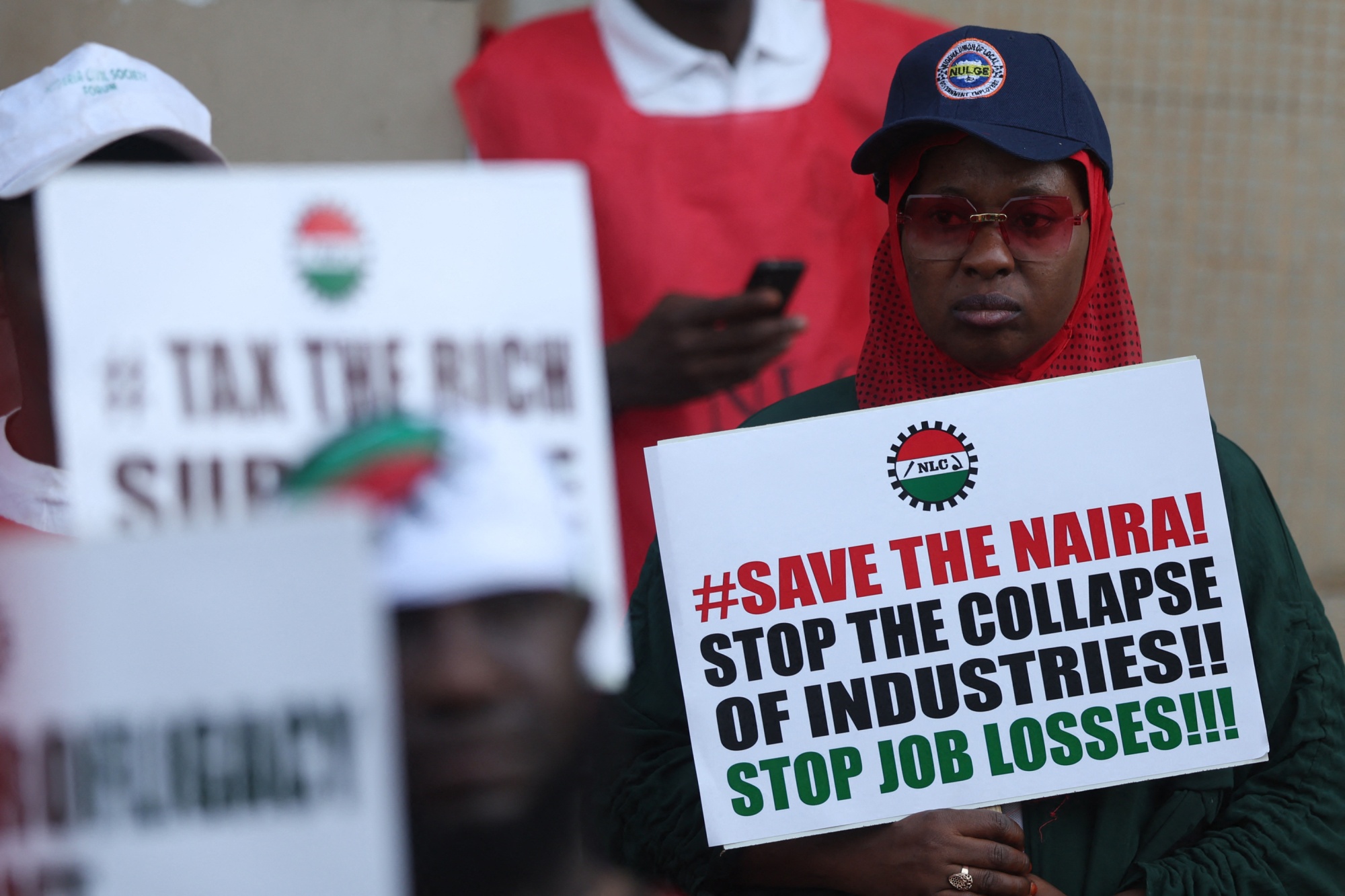

| The US jobless rate climbed to a two-year high in February even as hiring remained healthy, pointing to a cooler yet resilient labor market—just what the Federal Reserve has been hoping for. Nonfarm payrolls advanced 275,000 last month following a combined 167,000 downward revision to the prior two months, a Bureau of Labor Statistics report showed Friday. The unemployment rate rose to 3.9% and wage gains slowed. The report illustrates a labor market that is gradually downshifting, with more moderate job and pay gains that suggest the economy will keep expanding without much risk of a reacceleration in inflation. Digging beneath the surface, data showed some of the increase in the unemployment rate was due to people entering the labor force and not immediately finding work. “We’re seeing a labor market that is still tight, still strong, wages are moving up,” Fed Chair Jerome Powell said in testimony before Congress on Wednesday. “And we’re trying to use our policies to keep that growth going and to keep that labor market strong, while also achieving further progress on inflation.” —David E. Rovella Wall Street traders sent stocks sliding on speculation that recent records may have gone too far. Despite that jobs report, which for some signal Fed rate cuts won’t be too far off, technology companies came under pressure, sending the Nasdaq 100 down 1.5%. Nvidia halted a six-day winning streak and a troubled Tesla extended this week’s slump to 13%.Broadcom meanwhile tumbled on slow chip sales. Here’s your markets wrap. Coinbase Global has climbed back above its direct listing price for the first time in more than two years. The company’s stock rose 5.8% Friday to close at $256.62 a share, its highest since December 2021. When the biggest US cryptocurrency exchange went public in 2021, the reference price was set at $250 per share. Though there was early enthusiasm for the stock, it ended its first 12 months of trading down 38%. Coinbase shares remained under pressure for the next few years as a crypto-winter hit digital tokens and trading platforms came under increased scrutiny from the US Securities and Exchange Commission. But now digital currency has been given a new life thanks in part to exchange-traded funds: Bitcoin topped $70,000 Friday for the first time ever. President Joe Biden arrived at the US Capitol Thursday night looking to prove to the 28 million Americans watching that not only is he the one candidate for the job, but that his likely opponent could very well topple the Republic. “What makes this moment rare is that freedom and democracy are under attack, both at home and overseas, at the very same time,” Biden said, speaking at a brisk clip, transitioning from the Russian invasion of Ukraine to the Jan. 6 insurrection by Donald Trump’s followers, placing Trump and Vladimir Putin in the same neighborhood while wagging his finger at Republicans for their inaction. Nia-Malika Henderson writes in Bloomberg Opinion that, while Biden knew what he had to do and did it, this was nothing like a traditional State of the Union.  Joe Biden leaving the White House before boarding Marine One on Friday. Biden’s campaign is looking to seize momentum from his State of the Union address with a travel blitz in swing states. Photographer: Michael Reynolds/EPA A big part of Biden’s re-election argument has been the growing economic impact of massive legislation he’s pushed through in the past four years. It includes the Inflation Reduction Act, the bipartisan infrastructure bill and the so-called Chips act. Regarding the latter, Taiwan Semiconductor Manufacturing is now set to win more than $5 billion in federal grants to support a chipmaking project in Arizona, marking a major milestone in Biden’s effort to revitalize American semiconductor manufacturing. Simultaneously, China is in the process of raising more than $27 billion for its largest chip fund to date, accelerating the development of cutting-edge technologies to counter a US campaign to thwart its industry. The National Integrated Circuit Industry Investment Fund is amassing a pool of capital from local governments and state enterprises for its third vehicle that should exceed the 200 billion yuan of its second fund. Known as the Big Fund, the state-backed firm is expanding its remit just as the US prepares to sharply escalate technology curbs designed to curtail Chinese chip and artificial intelligence progress. Two of the most notorious ransomware gangs in the world are imploding, creating chaos in the cybercriminal underworld. In the last several years, the BlackCat and LockBit groups have thrived by embracing a ransomware-as-a-service model, leasing their malware to affiliate hackers to target thousands of victims and reap millions in extortion payments. But now the future of both groups is uncertain after US and authorities elsewhere seized LockBit and BlackCat websites, arrested alleged hackers and taunted the leader of one gang. Foreign investor demand for Nigerian assets and money sent home by citizens living abroad surged last month as reforms instituted by President Bola Tinubu’s administration may be starting to pay off. Foreign portfolio investor asset purchases exceeded $1 billion in February, bringing total receipts so far this year to at least $2.3 billion, the central bank said. That compared with $3.9 billion for the whole of 2023. But the price of reform has been high, fueling a calamitous cost-of-living crisis for everyday Nigerians. The International Monetary Fund warned that the Nigerian government must urgently address growing food insecurity, with almost one in 10 people facing hunger.  Thousands of Nigerians have rallied against soaring living costs as an economic crisis leaves many struggling to afford food. Above, demonstrators at a protest in Abuja on Feb. 27. Photographer: Kola Sulaimon/AFP Transportation is one of the biggest contributors to global warming, but electric vehicles remain largely impractical or unattainable in many parts of the world. And the power used to charge EV batteries is often derived from fossil fuel while other types of transportation, like air travel, remain resistant to sustainable change. In this episode of the Bloomberg Originals series An Optimist’s Guide to the Planet, host Nikolaj Coster-Waldau shows how energy generation and transportation are being transformed to reduce greenhouse gas emissions.  Nikolaj Coster-Waldau visits the Roam bike facility in Nairobi, Kenya Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Technology Summit: Led by Bloomberg Businessweek Editor Brad Stone and Bloomberg TV Host and Executive Producer Emily Chang, this full-day experience in downtown San Francisco on May 9 will bring together leading CEOs, tech visionaries and industry icons to focus on what's next in artificial intelligence, the chip wars, antitrust outcomes and life after the smartphone. Learn more. |