JOLTS: Gap between job openings and hires rises to new record in October

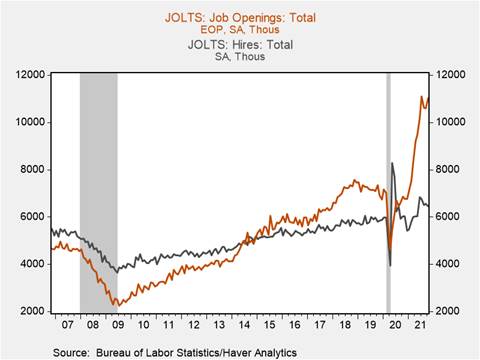

*The October JOLTS report showed a sharp rise in job openings, a decline in new hires, and elevated quits, all signaling ongoing heightened labor demand and supply shortages. Job openings in October surged 431k to a near record 11.03m from September’s upwardly revised 10.6m, reflecting continued strong labor demand despite the delta variant. Hiring fell 80k to 6.46m, contributing to a widening of the gap between job openings and hires to a record 4.57m, a 500k increase from September and more than 3m higher than its level in February 2020 (Chart 1). This suggests the imbalance between labor demand and supply intensified in October, with labor demand continuing to outstrip labor supply significantly.

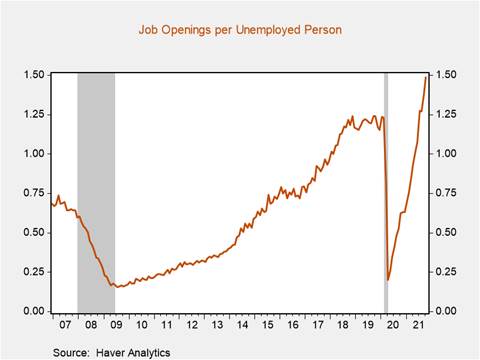

*The number of job openings per unemployed person has risen to a record high 1.49 and has allowed those looking for work to be more selective in their employment decisions (Chart 2). Labor shortages have constrained production amid strong product demand and contributed to supply shortages that have exerted upward price pressures. More importantly, current labor market tightness has tilted the balance of power in wage and contract negotiations toward workers and is reflected in nominal wage increases, which we expect to accelerate due to strong demand and in a “catch-up” to elevated inflation.

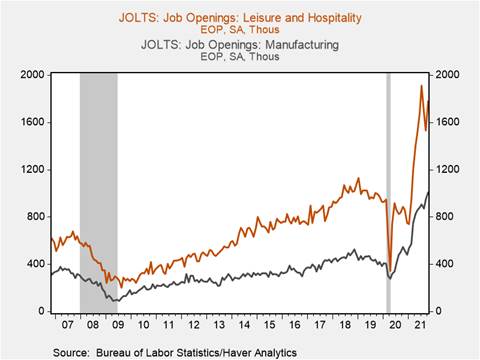

*Job openings in leisure and hospitality rose 250k following a cumulative decrease of 380k through August and September, likely reflecting a restoration of business confidence following the waning impact of the delta variant on high-contact in person activities (Chart 3). Job openings in manufacturing have surged over the course of the pandemic, rising a further 61k in October, lifting total openings over one million, a 600k+ increase relative to February 2020. Job openings in construction rose 56k to 410k, and construction activity is likely to accelerate as materials shortages dissipate and construction begins on permitted structures. State and local government job openings fell 77k, underscored by a 115k drop in job openings for state and local government excluding education. Healthy state and local government finances paired with substantial employment shortfalls should contribute to a robust recovery in state and local government employment.

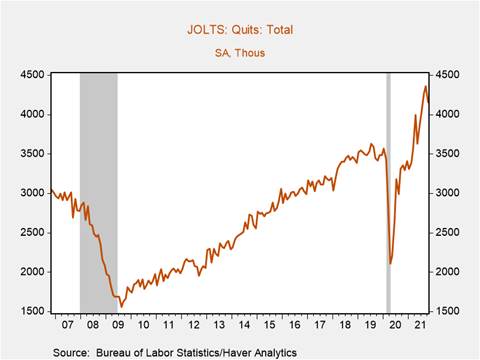

*Total private hires fell 100k to 6.1m, with substantial hiring declines in financial activities (-90k) and healthcare and social assistance (-50k). Quits declined to 4.16m (-200k), leading to a drop in the quits rate to 2.8% (-0.2 pp), although both of these measures remain elevated relative to historical trends (Chart 4). High quits levels and rates reflect workers’ confidence in their ability to secure new employment; according to the FRB NY’s Survey of Consumer Expectations, 56.6% of people expect to find a job within three months if they were to lose their jobs today, just 0.4pp below July’s intra-pandemic peak of 57%.

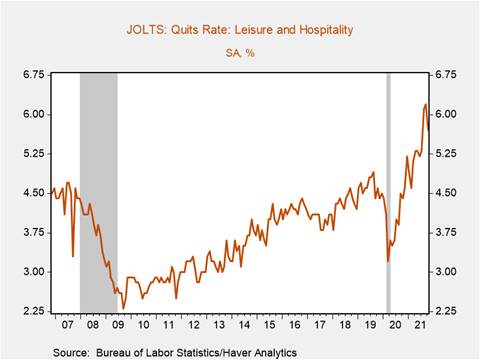

*October’s decline in quits could reflect heightened uncertainty due to the delta variant and rising nominal wages, particularly for lower wage employees, that have reduced job-switching incentives. For example, the quits rate for leisure and hospitality workers dropped to 5.7% in October, a 0.5 pp decline from September (Chart 5).

*Layoffs and discharges fell to 1.36m (-30k) as employers continue to hoard employees amid labor supply shortages that have made hiring more difficult. According to the NFIB, 58% of small businesses had few or no qualified applicants for job openings in October, well above the historical average of 40%.

Chart 1. Job Openings vs. Hires

Chart 2. Job Openings per Unemployed Person

Chart 3. Job Openings: Leisure & Hospitality vs. Manufacturing

Chart 4. Quits Levels

Chart 5. Quits Rate: Leisure and Hospitality

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.