JOLTS job openings and hires dip from record highs, but labor markets still tight

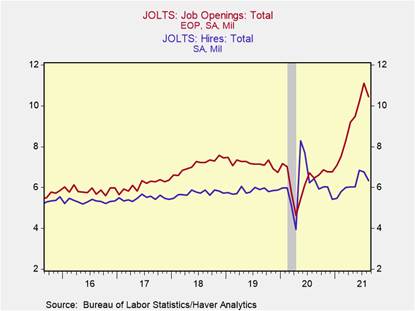

* JOLTS data for August showed a moderate 660k decline in job openings from an upwardly revised 1.1 million to 10.4 million and a 440k decline in hires from 6.8 million to 6.3 million, but both remained near all-time highs, indicating that labor markets in August experienced weaker demand due to delta variant related health concerns, but continued labor supply shortages (Chart 1).

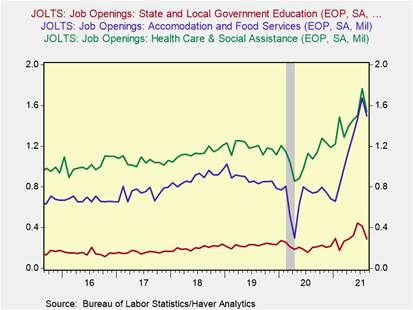

* Declines in job openings were concentrated in sectors most impacted by the surge in COVID-19 cases: accommodation and food services (-178k), state and local government education (-124k), and health care and social assistance (-224k) (Chart 2). Hiring was similarly constrained in these sectors with hiring in accommodation and food services falling by 240k and hiring in state and local government education falling 160k. The declining labor market activity in these sectors is consistent with the August Employment Report.

* Openings and hiring softened across a broad range of industries, but remain significantly elevated relative to pre-pandemic baselines despite moderate declines in August. For example, although openings declined by 36k in the manufacturing industry to 870k, they are more than double what they were in February 2020 (402k). In anticipation of the upcoming holiday season, and in response to increased retail foot-traffic and burgeoning supply chain disruptions, job openings in retail trade, and transportation, warehousing and utilities strengthened rising 4.7% and 7.4%, respectively.

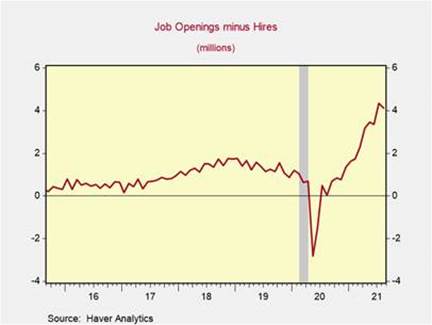

* Despite the decline in both job openings and hiring, the gap between hires and openings remains elevated at 4.1 million (Chart 3). The substantial gap between openings and hires in August points to labor market tightness, with demand for workers remaining strong, while labor supply is constrained. Factors that have dented labor supply include health concerns during the delta driven COVID-19 surge, uncertainty over the return to in-person schooling, and government subsidies that provide a cushion to people who are not working.

*The imbalance between labor demand and supply, evidenced by the gap between openings and hires, has contributed to accelerating wages. Average hourly earnings rose 0.4% in August, lifting their 6-month annualized increase to 4.5%, while average hourly earnings of production and nonsupervisory workers in the private sector are up 5.5% yr/yr. We anticipate that health concerns dissipate, demand for labor will remain strong, and labor market conditions will improve further even as supply constraints linger.

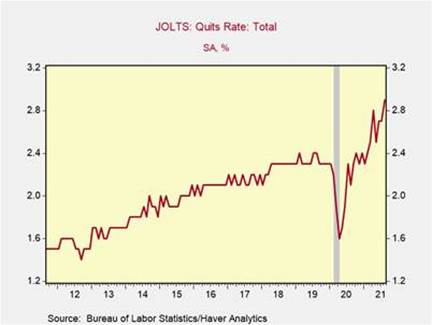

*The quits rate rose to a record high of 2.9% of the workforce, while the total private quits rate rose to a record 3.3%, reflecting the confidence workers have in securing new employment, and the improved bargaining position workers have given labor supply shortfalls (Chart 4). Quit rates are particularly elevated in sectors impacted by the COVID-19 surge, with the quits rate in accommodation and food services spiking to an all-time high of 6.8%.

Chart 1: Job Openings and Hires (millions)

Chart 2: Job Openings by Industry (millions)

Chart 3: Job Opening – Hire Gap (millions)

Chart 4: Quits Rate (%)

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.