JOLTS Report: Job Openings Decline in November but Labor Markets Remain Tight

*November’s JOLTS data point to the continued strength of the labor market recovery despite a modest decline in job openings (-529k) to a still lofty 10.6 million. November’s JOLTS report and establishment and household surveys present conflicting evidence on labor market conditions, but overall highlight sustained labor market tightness that has contributed to rising nominal wages. Hires edged up while quits levels and rates rose to all time-highs, reflecting the confidence workers have in their ability to secure new jobs. November’s data do not yet reflect the impact of the omicron variant, which will likely have an adverse effect on labor market conditions, particularly within the leisure and hospitality industry.

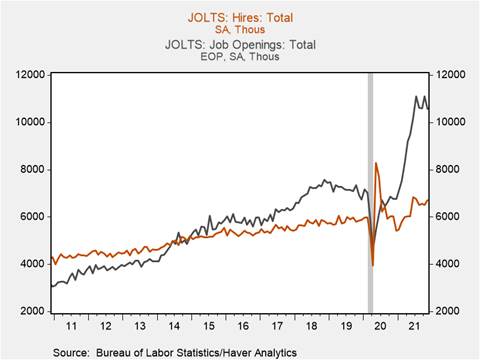

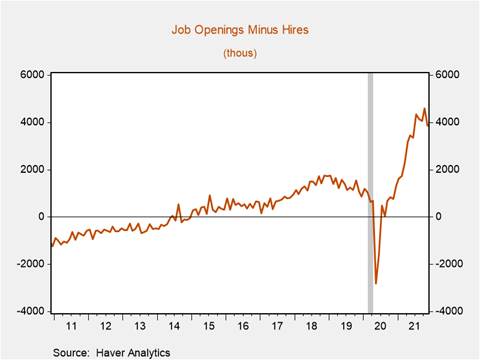

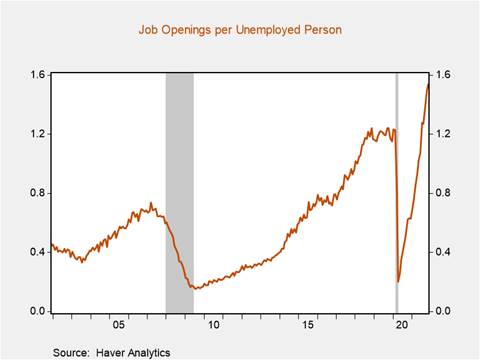

*Although job openings declined from 11.1 million in October to 10.6 million in November (-529k), they remain well above the 2019 average of 6.8 million, while hiring was robust, rising 191k to 6.7 million, the highest level since July 2021 (Chart 1). Consequently, measures of labor market tightness indicate demand for labor continues to exceed supply substantially. The gap between job openings and hires remained elevated at 3.9 million, 400k above its May 2021 level (Chart 2). Meanwhile, the number of job openings per unemployed person rose to an all-time high of 1.5, in part reflecting the decline in unemployment in November’s household survey (Chart 3). Stated differently, if every unemployed person found a job in November, there would still be enough open positions left to hire an additional 3.7 million people.

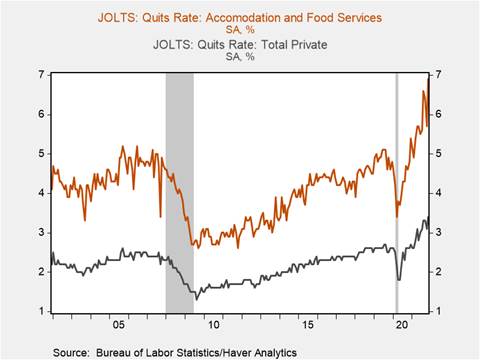

*The total number of quits rose to an all-time high of 4.5 million, underpinned by a 366k surge in private sector quits from 3.9 million to 4.3 million. The total quits rate and private sector quits rate both rose to all-time highs of 3% and 3.4%, respectively. Elevated quits and hires reflect both labor market tightness and a heightened degree of labor market churn, with anecdotal evidence suggesting workers are switching jobs in search of better pay, benefits, and work-life balance. Notably, quits rose 161k in food services and accommodation, lifting the quits rate to 6.9%, an all-time high and more than double the rate for the private sector more broadly, partially reflecting November’s rise in daily COVID-19 cases (Chart 4). The spread of the omicron variant and surge in COVID-19 cases may prompt a rise in quits among those employed in high-contact, in-person industries such as leisure and hospitality, consistent with prior episodes of elevated COVID-19 case counts. Also, almost half of the decline in job openings in November is attributable to declines in openings in food services and accommodation.

*Total private sector hires rose 165k to 6.3 million, with robust increases in construction (+48k), trade transportation, & utilities (+39k), and professional and business services (+45k). The increase in construction hiring reflects the November surge in housing starts and anticipated increases in home building activity as materials shortages ease. It is notable that many of the industries registering strong growth in hires are also those that have experienced substantial nominal wage increases. For example, average hourly earnings of production and nonsupervisory employees in trade, transportation & utilities rose 6.3% yr/yr in November and 6.7% for professional and business services employees.

Chart 1.

Chart 2.

Chart 3.

Chart 4.

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.