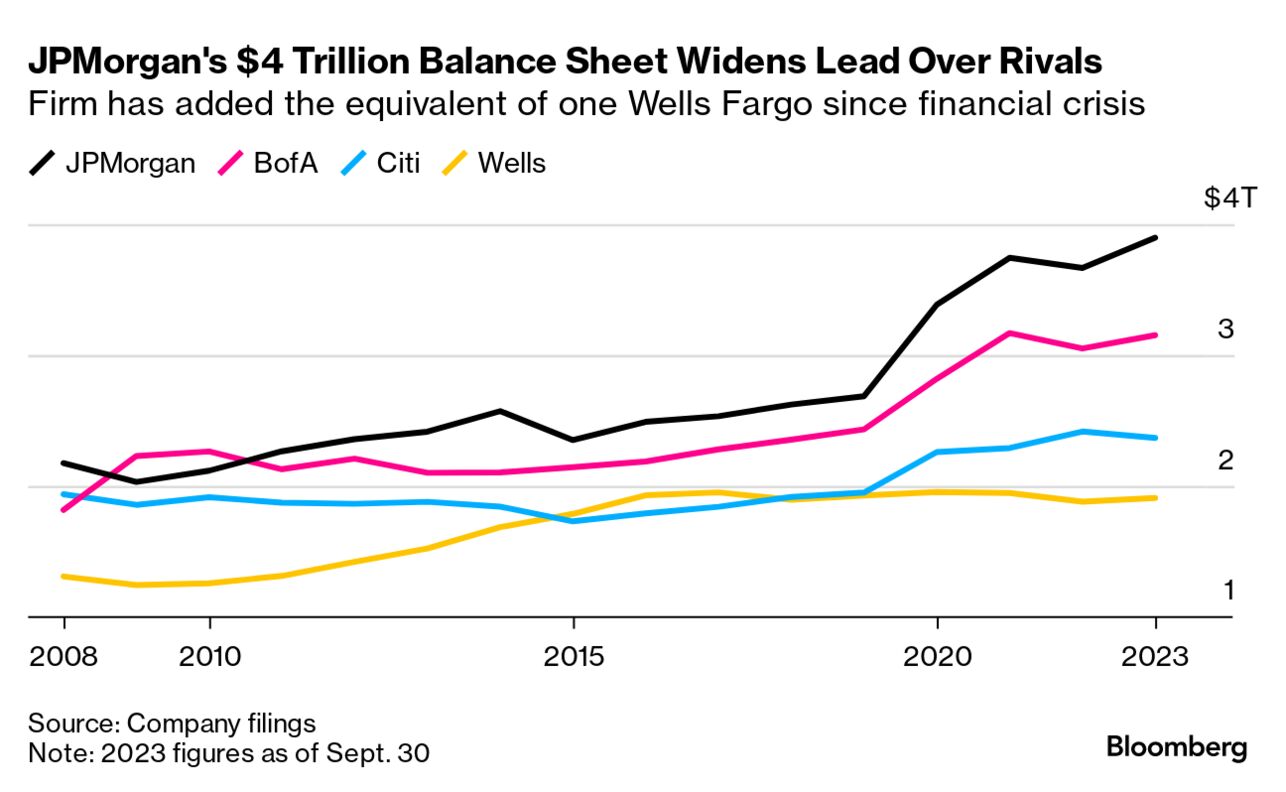

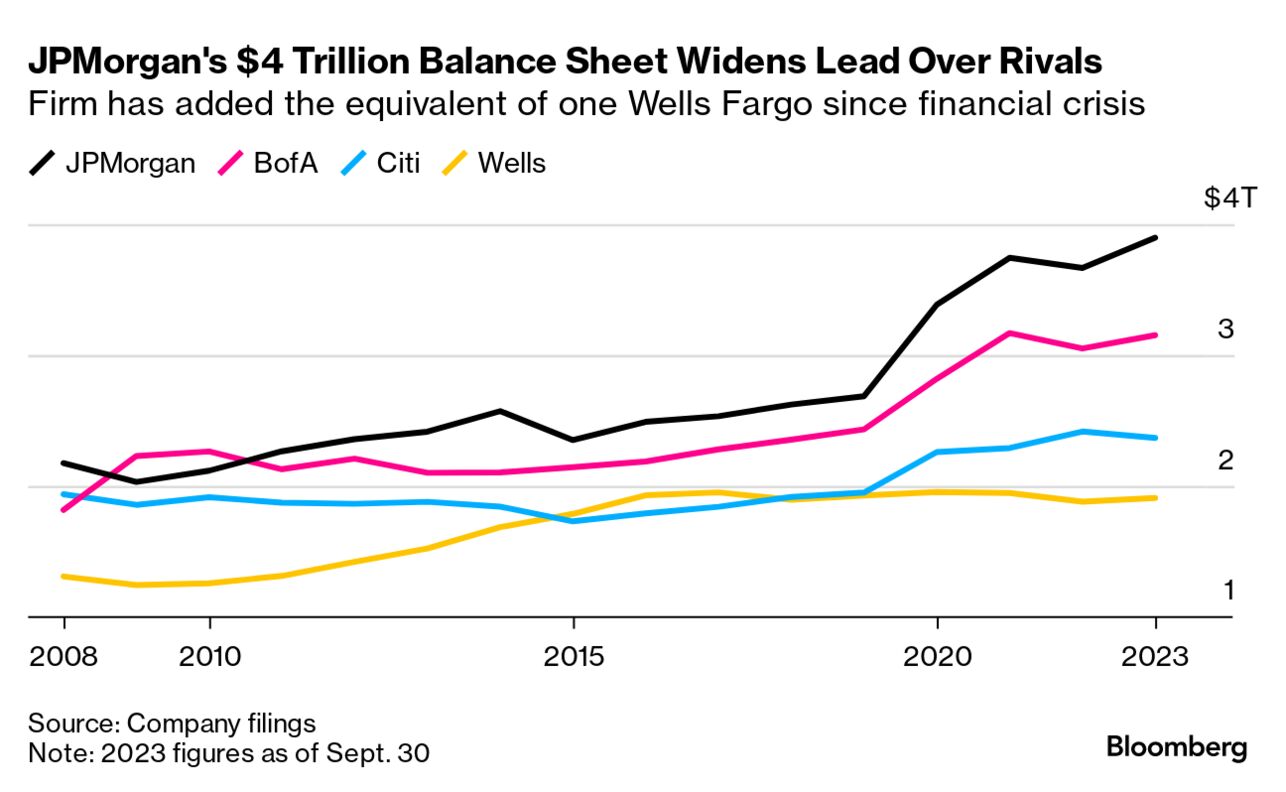

| For much of the American banking industry, 2023 was decidedly unkind. The first half was marked by the sudden implosion of a handful of regional banks while dozens of their brethren swooned. The culprit of course was the war on inflation—rising interest rates had slashed the value of assets and saddled US banks with $684 billion of unrealized losses. Many have spent heavily to keep depositors from leaving and some raised the possibility of defaults on commercial real estate loans. Bond-rating firms meanwhile have downgraded banks in batches. But where there are losers, there almost always are winners. And as a tumultuous year comes to a close, there is one big winner above all, and its name is JPMorgan.  As the spring bloodbath among regional banks began, nervous depositors with more than $50 billion began showing up at JPMorgan’s door. Bank executives went on to raise expectations for net interest income four times throughout the year, eventually pulling in so much cash that managers have taken to warning of “over-earning.” That’s put JPMorgan on track for the biggest annual profit in the history of American banking. Analysts predict that by the end of this month, its annual net income will be 36% higher than last year. By comparison, the combined earnings of the next five largest banks looks to be about 1%. For JPMorgan and its chief executive, Jamie Dimon, it was a year like no other. But not everyone is happy about that. —David E. Rovella Wall Street’s love affair with blank-check firms—more dryly known as special purpose acquisition companies, or SPACs—looks to be over. The finance fad that pushed companies onto the stock market during the pandemic is ending this year with a string of big bankruptcies and even bigger losses for shareholders. At least 21 firms that went public by merging with SPACs went bankrupt this year. The US soft-landing scenario that investors see for next year points to further gains in stocks. But it also dims the prospect of another stretch of outperformance for the technology giants that dominated 2023. One of the key themes behind their surge, which generated almost two-thirds of the S&P 500 Index’s advance this year, appears to have faded. China’s BYD Co. bills itself as the biggest car brand you’ve never heard of, but it might need a different tagline soon. The automaker is poised to surpass Tesla as the new worldwide leader in fully electric vehicle sales. When it does—and that’s likely to be quite soon—it will be both a symbolic turning point for the EV market and further confirmation of China’s growing clout in the global automotive industry. Not to mention another bit of bad news for Elon Musk.  A BYD Yangwang U8 electric SUV at the Shanghai Auto Show in April Photographer: Qilai Shen/Bloomberg The New York Times sued Microsoft and OpenAI for using its content to help develop artificial intelligence services, a sign of the increasingly fraught relationship between the media and a technology that could further upend the news industry. The technology firms relied on millions of copyrighted articles to train chatbots like ChatGPT and other AI features, allegedly causing billions of dollars in statutory and actual damages. “If Microsoft and OpenAI want to use our work for commercial purposes, the law requires that they first obtain our permission,” a New York Times spokesperson said. “They have not done so.” The Biden administration announced Wednesday a $250 million weapons and equipment package for Ukraine, its final one for the year. “Our assistance has been critical to supporting our Ukrainian partners as they defend their country and their freedom against Russia’s aggression,” Secretary of State Antony Blinken said. “It is imperative that Congress act swiftly, as soon as possible, to advance our national security interests by helping Ukraine defend itself and secure its future.” President Joe Biden has warned that the continuing refusal by Republicans to provide more assistance to Ukraine will only help the Kremlin.  A Ukrainian soldier watches as a howitzer fires on a Russian position in Donetsk Oblast, Ukraine, on Dec 24. Photographer: Serhii Mykhalchuk/Global Images Ukraine/Getty Images Managing your retirement is among the hardest of all financial problems, Allison Schrager writes in Bloomberg Opinion. The challenge is to make your money last a lifetime while facing uncertainty about the future of markets, your income, health and longevity. Meanwhile, misinformation and bad advice make it harder than it needs to be. So in an effort to make things a little easier, Schrager goes over three myths about retirement that you need to recognize. A US wind farm and transmission line billed as the largest clean energy project in the nation’s history has secured $11 billion in financing and started construction. Meanwhile strong wind generation and low demand during the holiday period sent electricity prices below zero in Germany, while wholesale markets turned negative for some hours in France, Denmark and Britain. Negative prices are occurring more frequently as the continent adds more weather-dependent renewable power.  Onshore wind turbines in Wilhelmshaven, Germany Photographer: Liesa Johannssen/Bloomberg The new year is nearly here, and as is custom, Bloomberg Pursuits rings out the old by running down the very best bottles to hit shelves during the past 12 months. While the sheer volume of great choices is expanding every year, finding these great bottles is getting harder. So this year, we’re pairing the aspirational with the obtainable. If you’re looking to hold on to something as an investment, heirloom or art piece, we have the best examples across all major categories of spirits. Alternatively, if you’re someone who merely wants a terrific bottle to open and enjoy now, corresponding analogs are right beside them.  Source: Vendors; Background: Getty Images Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg House at Davos: Meaningful change happens when the right people come together in the right place. Bloomberg House in Davos is where leaders in business, media and policymaking connect, exploring solutions to the world’s most critical challenges. Make our house your home base at the World Economic Forum, Jan. 15-18. Find us at Promenade 115, a five minute walk from the Congress Centre. Register to join. |