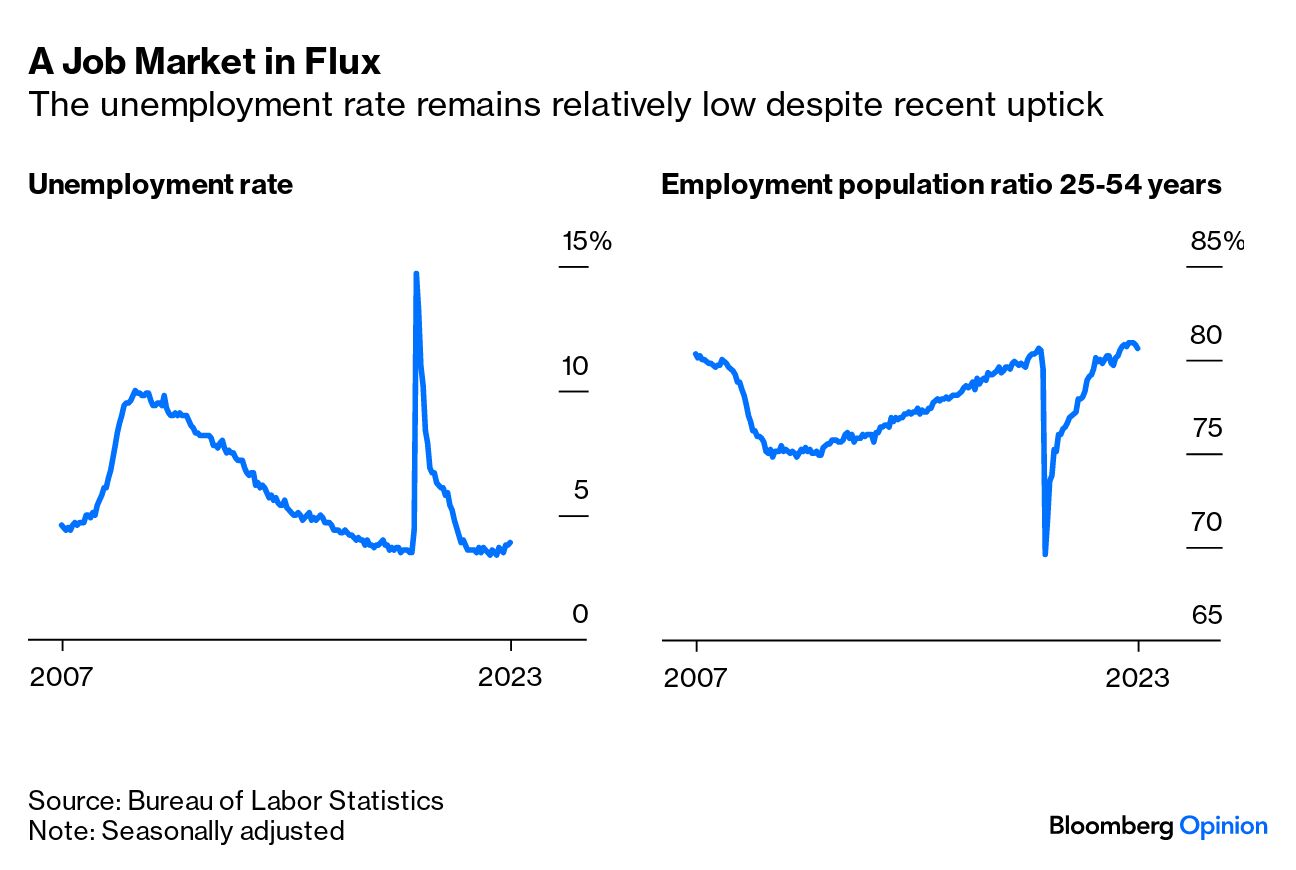

| US inflation slowed significantly in October, news that markets cheered as a strong indication the Federal Reserve is done hiking interest rates. The so-called core consumer price index, which excludes food and energy costs, increased just 0.2% from September, according to government figures. Economists favor the core gauge as a better indicator of underlying inflation than the overall CPI. The latter was little changed, restrained by cheaper gasoline. The new data on Tuesday lends even more weight to recent comments by Fed policymakers indicating they may be done raising rates. It also appears to put a new gloss on Fed Chair Jerome Powell’s strategy over the past two years for bringing the economy in for a soft landing. —Natasha Solo-Lyons and David E. Rovella But the world’s biggest economy doesn’t stop on a dime. Indeed, recent observations that the full effect of rate hikes has yet to manifest may prove prescient. Conor Sen writes in Bloomberg Opinion that while the odds of getting laid off remain very low, a small but growing percentage of people who are either unemployed or looking to change jobs face an increasingly challenging landscape. Bonus season on Wall Street is looking grim for bankers in an industry hobbled by inflation, bank failures and a deal-making slump. Next year will probably be no better. Merger advisers could see their payouts for 2023 slide as much as 25%, according to a report Tuesday from compensation consultant Johnson Associates. At regional banks, year-end compensation for professionals in retail and commercial businesses could fall 10% to 20%, the company found. The bad vibes are definitely showing. Wall Street analysts are dialing back the compliments paid to Corporate America at the fastest clip in years. “Good quarter,” “congratulations” and similar plaudits are drying up on quarterly earnings calls for S&P 500 companies, setting up 2023 for the biggest such annual decline since the Great Recession. The drop is even more pronounced when compared with the pandemic era, running 35% below the average pace in the previous three years. The US Justice Department has joined a group of international agencies investigating how thousands of bogus engine parts backed by forged documents ended up in planes around the world, as fallout grows over a scandal that has spread across the commercial aviation industry. Companies that allow remote work have experienced revenue growth that’s four times faster than those that are more stringent about office attendance, a new survey shows. The revelation upends the logic of companies that insist being in the office is more profitable for everyone. China plans to provide at least 1 trillion yuan ($137 billion) of low-cost financing to the nation’s urban village renovation and affordable housing programs in its latest effort to shore up the struggling property market. The floods, heat waves, storms and fires fed by global warming are getting worse across the US and will pose increasing danger to Americans unless greenhouse gas emissions are cut sharply and swiftly. The tools to do that are actually available and being adopted by communities nationwide. But it’s not happening fast enough to avert disaster.  Lahaina, Hawaii, after a firestorm destroyed the entire town. Photographer: Mario Tama/Getty Images North America - US shutdown risk drops as Democrats move to rescue GOP speaker.

- FDIC chair “deeply troubled” by workplace misconduct claims.

- Glencore built its empire on coal. Now it’s preparing to say goodbye.

- How Wall Street makes millions selling car loans customers can’t repay.

- Billionaire Leon Cooperman takes a stake in Manchester United.

- Bloomberg Work Shift: Gen Z is struggling to meet work deadlines.

- Bloomberg Opinion: Free speech has never been easier or more at risk.

Prices for used Rolex and Patek Philippe watches fell to fresh two-year lows last month. The Bloomberg Subdial Watch Index dropped 1.8% in October, sinking to its lowest level since 2021. The index is now down 42% since a high in April 2022. Here’s a closer look at how prices have fallen.  A Rolex Oyster Perpetual Datejust watch Photographer: Jose Sarmento Matos/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. The Bloomberg Canadian Finance Conference on Nov. 29 in New York brings together finance, government and business leaders from across various sectors to discuss advancements in their fields and how they are sustaining their leadership going forward. This year marks the eleventh anniversary of our Canada-focused event, and continues the tradition of providing timely, actionable insights and strategies for a global audience of leaders and decision-makers. Register here. |