|

|

Today’s letter is brought to you by Sidebar!

Do you want to level up your career in 2024?

As we all know, navigating a big career transition is hard to do.

Sidebar is a private, highly vetted leadership program for those who want to do more, do it better, and do it faster. Sidebar’s approach is focused around small peer groups, a tech-enabled platform, and an expert-led curriculum. Members say it’s like having their own Personal Board of Directors.

And it works: 93% of members say that Sidebar has made a significant positive change in their career trajectory.

Join over 15,000 top senior leaders from companies like Nike, Stripe and Amazon who have taken the first step at sidebar.com.

Request an invite to join before December 31st to become a founding member.

To investors,

The United States government has a heavy hand. Administration after administration spends billions of dollars, and untold amounts of time and energy, to concoct new rules and regulations for a variety of industries.

One of the most popular areas of conversation in the last two years has been bitcoin and cryptocurrencies. There have been politicians calling for the banning of the technology. Others have tried to drastically increase the tax treatment to be more abrasive. Some have suggested that anyone using this technology is a criminal or nefarious actor. And plenty of politicians and regulators have regurgitated warnings of danger related to the industry by invoking phrases like money laundering, terrorism financing, fraud, and a plethora of other words that the American people have been trained to fear.

The short story is that most of these fears are unfounded.

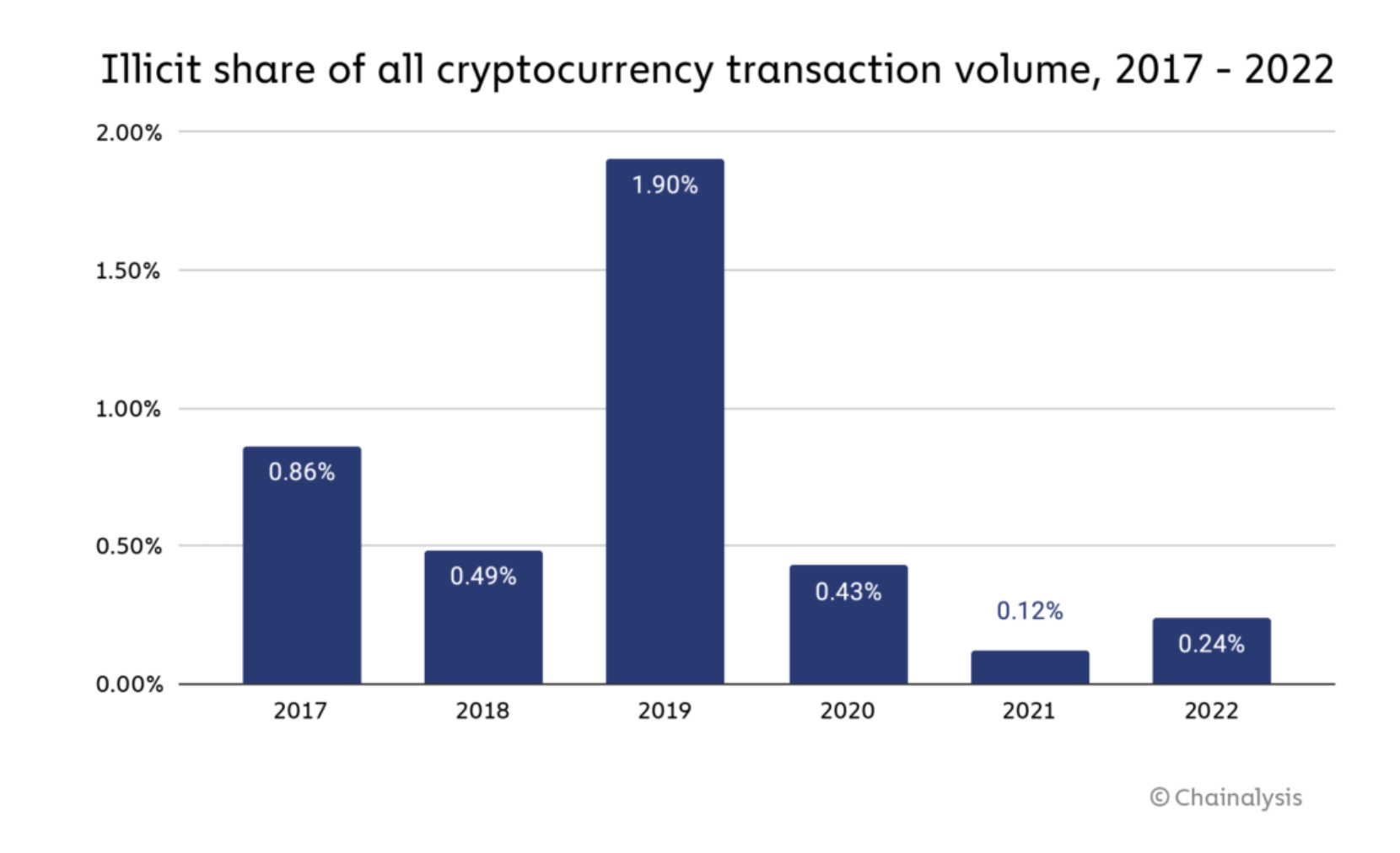

Chainalysis, a blockchain analytics firm, has been studying illicit transactions for years and consistently finds that less than 1% of all bitcoin transactions are related to some sort of illegal nature.

The facts don’t seem to matter in conversation between politicians and big bank executives though. Yesterday, Senator Elizabeth Warren and JP Morgan’s Jamie Dimon had an exchange that went viral online. In it, Dimon stated “the only true use case for it [cryptocurrencies] is criminals, drug traffickers, money laundering, and tax avoidance.”

He went on to say that if he were the US government, he would shut down the crypto industry.

Let’s put aside the hyperbole for a second and look at this situation more closely. First, the data suggests that less than 0.5% of all transactions in 4 of the last 5 years has been for illicit purposes. So Dimon’s claim is inaccurate.

The more eye-opening thing, which the internet peanut gallery was quick to point out, is that JP Morgan has been fined $39 billion in the last 15 years for various violations and illegal activity. To put that number in perspective, if you spent one bitcoin per day at today’s price, it would take you 2,430 years to spend enough bitcoin to equal the amount of fines that JP Morgan has paid in the last 15 years.

If you look at all major banks since the year 2000, the total fined amount grows to more than $300 billion. That is more than 1/3 of the total market cap of bitcoin right now.

But this is not an eye-for-an-eye though. The fact that JP Morgan and other large banks have been fined so heavily is a testament to the fact that bad people will use whatever means necessary to do bad things. It doesn’t matter how transparent bitcoin’s protocol is, nor does it matter how big the compliance team is at a big bank.

Nefarious actors will slip through the cracks in the traditional system and they will slip through the system in the new digital world as well.

We have to be very careful that we don’t overreact though. One historical example is the War on Drugs. Since President Nixon announced the global effort to crack down on illicit drugs in the US in 1971, we have seen a constant rise in drug use in America. Think of how prevalent the opioid pandemic is today — that flies in the face of the stated goal of the War on Drugs.

The harder that the system squeezed an action that citizens wanted to participate in, the more popular that action became.

Could that happen with cryptocurrencies? Well, it may already be happening.

“Learned something wild today. It’s now well known that USDT dominates USDC in Africa. But the reason is the compliant nature of USDC causes people to perceive it to be the “USA government coin” that can be censored. Whereas USDT is viewed as the wildwest uncensorable coin.”

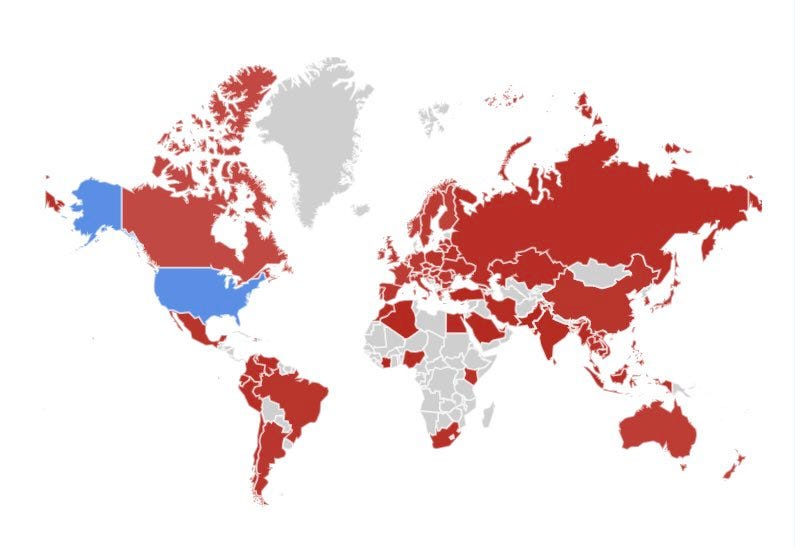

That may seem insane to people in the Western world but the data appears to back up the claim. We have seen USD Tether gaining in popularity, while USDC has been falling in recent months. Quite literally, the world is adopting the less regulated stablecoin.

Additionally, we can see from Google trends that the United States is the only area where USDC interest appears to be the dominant interest for stablecoins. (Blue is USDC and red is USDT below).

So why does all of this matter? Majority of market participants would agree that money laundering, terrorist financing, fraud, and other financial crimes are bad. We don’t want people doing that nefarious activity. Unfortunately, the activity is going to happen in any financial system, regardless of how abrasive the rules are against criminals.

Remember, criminals don’t follow the rules!

Lastly, if the United States overreaches in their attempt to control a decentralized, open-source industry, than they will see global adoption rise at a faster pace and the United States will have a smaller upside in that development.

I don’t envy policy makers and politicians in this situation. They have an impossible job. You don’t want bad actors. You also (hopefully) want the US to benefit from new technology. So how can they do this? The only viable path I see is to have the United States embrace the technology and work diligently to be responsible for as much of the innovation as possible.

If you like bitcoin and crypto, this is a big win for you. If you hate bitcoin and crypto, I will remind you to keep your friends close and your enemies closer.

Hope each of you has a great day. I’ll talk to everyone tomorrow.

-Anthony Pompliano

If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin.

Darius Dale is the founder & CEO of 42Macro.

In this conversation, we talk about their Weather Model, economy & financial market conditions, and his brand new strategy that incorporates bitcoin to outperform the standard 60/40 portfolio.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Darius Dale Reveals Bitcoin Strategy

Podcast Sponsors

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.