Labor market conditions and the Fedâs new strategic framework

*This paper, prepared by Mickey D. Levy for the Shadow Open Market Committee, January 7, 2021, addresses labor markets in the context of the Federal Reserveâs new strategic framework. The Fed has elevated the priority of its employment mandate, expanding it to âmaximum inclusive employment,â and introduced an asymmetric, flexible form of average inflation targeting featuring a âmake-up strategyâ to overshoot its longer-run inflation target. While the Fedâs new interpretation of its employment mandate is a lofty and laudable goal â the type that politicians promote â the Fed does not adequately define it and does not establish the monetary policy strategies for how to achieve it.

*After achieving 50-year lows in unemployment in 2019 â overall and for all groups of people including women, Blacks, Hispanics, younger people, and those with lesser educational attainment â as a consequence of the pandemic, there are now sizable shortfalls (U.S. labor market: big gains, big shortfalls, Berenberg Capital Markets, December 9, 2020).

*Labor markets are expected to recover but lag the recovery in GDP. Moreover, technological innovations and new products in response to the pandemic have introduced shifts in the supply and demand for labor such that some jobs will not return and other new ones will be created.

*Employment and labor market conditions are driven by demographics, education and skills, and fiscal and regulatory policies â all of which are beyond the scope of monetary policy. Shortfalls in employment must be addressed by appropriate non-monetary tools. The Fedâs monetary policies cannot lift sustained employment, and excessive monetary ease instead will overheat the economy and create unintended side effects.

*The Fed has finally acknowledged the flaws and unreliability of the Phillips Curve, but it has not replaced it with a viable framework that guides monetary policy. Over the last decade, the Fedâs artificially low interest rates and unprecedented asset purchases have failed to stimulate growth and 2% inflation that it has been predicting. We encourage the Fed to conduct basic research on the linkages between monetary policy and employment, the impacts of changes in its operating procedures on the monetary policy transmission channels, and factors that have changed the supply and demand for labor. Such research will help it identify, assess, and develop a strategic framework and the proper role of monetary policy in achieving the Fedâs objectives.

The Fedâs new strategic framework elevated its longer-run employment objective as a priority and broadened it to âmaximum inclusive employmentâ, and introduced a flexible form of average inflation targeting that features a âmake up strategyâ that overshoots its 2% inflation target for some period of time following a period of sub-2% inflation (Powell 2020). The Fed introduced asymmetries into each mandate, emphasizing its focus on âshortfallsâ rather than âdeviationsâ from maximum employment, and omitted any mention of the Fedâs response following periods of inflation overshoot of 2%.

Achieving maximum inclusive employment and maintaining stable low inflation with well-anchored inflationary expectations are lofty goals that characterize virtually perfect economic performance. No doubt, they meet the approval of Congress. From the current vantage point of pandemic-depressed employment and low inflation, the Fedâs near-term plan of action is clear: maintain its current zero interest rates and aggressive asset purchases, and rely on a discretionary approach to monetary policy.

However, the Fedâs longer-run interpretations of its objectives and its perception of how monetary policy will contribute to these goals are decidedly fuzzy. In particular, the Fedâs descriptions of maximum inclusive employment and its new flexible average inflation targeting strategy are inadequate, and its lengthy review of its âstrategies, tools, and communication practices it uses to pursue its congressionally-assigned mandatesâ did not establish any strategies or tools for achieving its newly interpreted goals (Levy and Plosser 2020). While the Fed has wisely acknowledged the Phillips Curve is flat and an unreliable predictor of inflation, it did not establish any replacement for explaining how the Fed would achieve its employment and inflation goals or the links between them, or consider what the Fed was capable of achieving or the limitations of monetary policy. Nor does the Fed distinguish between supply and demand factors imposed by the pandemic and government shutdowns, which would aid policy efforts to recovery.

It is normal for politicians to establish and promote high goals, including goals that are beyond their reaches, but the vagueness of the Fedâs employment mandate and its lack of a strategic plan for achieving its new objectives leaves too many unanswered questions. This note includes an assessment of labor market conditions and some observations, but most of the observations are in the form of questions. The Fed is encouraged to address these and related questions, and undertake the research that would help it to clarify its objectives and articulate a monetary policy strategy for achieving them.

Labor market conditions

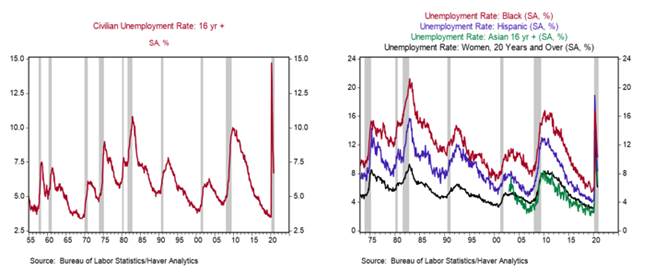

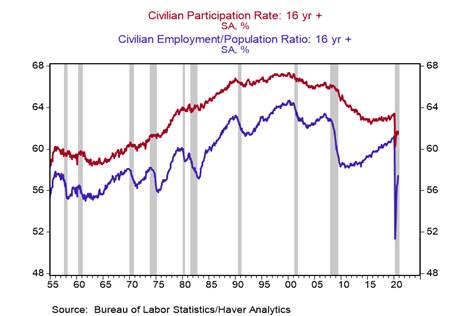

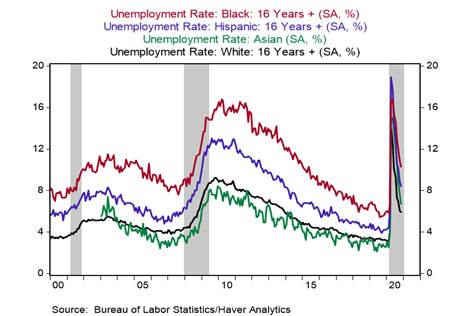

By many measures, labor market conditions were strong before the pandemic, with the unemployment rate reaching 50-year lows overallâit averaged 3.7% in 2019 and 3.5% in the six months before the pandemic struck (Chart 1). Historic low unemployment rates were achieved for different groups in the labor force, including women, blacks and Hispanics (Chart 2). Although nominal wage gains remained modest despite the low unemployment, real wages rose for several years. The Federal Reserve conducted most of its strategic review amid these strong labor markets and inflation that hovered modestly below its 2% target. On the negative side, although the labor force participation rate (LFPR) and the employment-to-population ratio had risen throughout the expansion from their lows in 2010, they remained below where they had been before the 2008-2009 financial crisis and well below their peaks in the late-1990s (Chart 3). This reflected changing characteristics in the demand and supply of labor that are influenced by demographics and a number of economic and social trends.

Labor markets felt the full brunt of the pandemic and government shutdowns in March-April 2020, whether measured as the declines in employment, spikes in unemployment or the decline in the labor force. Establishment payrolls fell 22.2 million. The unemployment rate spiked to 14.7% and far higher by adjusted calculations. The biggest hits occurred in the service-producing industries, particularly leisure and hospitality, transportation and retail trade. In addition to the spike in the unemployment rate, the measured labor force fell, contributing to the collapse in the employment-to-population ratio from 61.1% to 51.3%. By gender, age, education and race, unemployment rose the most for women; younger people; those with less educational attainment; and blacks and Hispanics (Levy and Reid 2020).

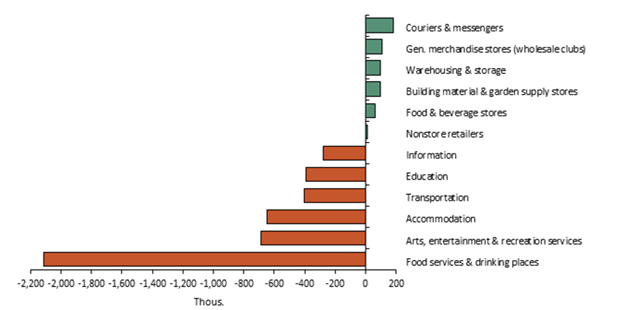

The magnitudes and speed of the decline and partial recovery in labor markets have been extraordinary compared to all other cycles (Charts 4 and 5). Between April and November, employment recovered 12.3 million, recouping 56% of its decline. Unemployment has fallen by nearly one-half from its April peak of 21 million, but it remains nearly double its pre-pandemic level of 5.8 million. The unemployment rate has fallen significantlyâto 6.7%, faster than most optimistic forecasts, reflecting the recovery in employment and the net reduction in the labor force. The employment-to-population ratio has recovered from an April low of 51.3% to 57.3%, but remains materially below its January level of 61.2%. The recovery in labor markets has been uneven by sector, closely reflecting the uneven economic recovery. Consumption and production of goods have rebounded robustly and housing activity has been strong, but services activities have struggled, particularly the leisure and hospitality sectors and transportation, and state and local government employment has incurred sharp declines (Chart 6).

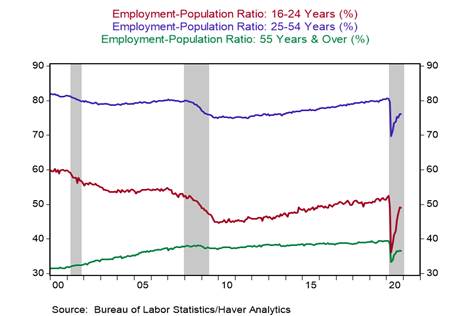

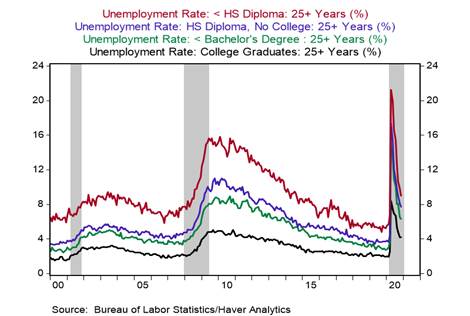

The recovery in labor markets has been uneven by gender, age, education and race. The unemployment rate of women has declined faster than for men, reflecting a modestly stronger recovery in employment. Despite these gains, female unemployment remains 81.8% above its pre-pandemic low, while male unemployment is 88.6% above its February low. The labor markets for younger people has recovered noticeably more quickly than the prime 25-54 working age population, although youth unemployment rates remain higher (Chart 7). People with less educational attainment have experienced less job recovery, and their gaps in unemployment have widened compared with those with college degrees (Chart 8). This reflects the lagging leisure and hospitality sectors. By race, the unemployment rates of blacks and Hispanics have fallen sharply but their gaps from the unemployment rate of whites has widened. Asians, who on average had a similar unemployment rate as whites before the pandemic, have experienced a slower job recovery and now have modestly higher unemployment rates (Chart 9).

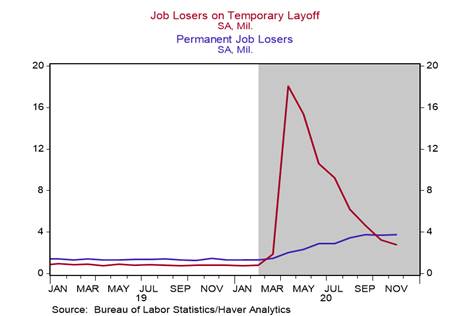

The vast majority of the layoffs in March-April were temporary or furloughs, but as the pandemic has persisted, the number of layoffs measured as temporary has declined sharply while the number of job layoffs recorded by the BLS as permanent has risen sharply to 3.7 million (Chart 10). This measure reflects some of the longer-lasting impacts of the pandemic and government shutdowns.

Observations and questions about the Fedâs employment mandate

Clearly, current labor market conditions are far shy of the Fedâs maximum inclusive employment mandate, with clear shortfalls from earlier peaks. However, the economy will recover. The Fed needs to establish parameters to clarify its longer-run employment objectives, even if they are not quantifiable. Otherwise, how can the Fed assess shortfalls once the economy gets back to normal?

For many decades, the Fed relied on the Phillips Curve to assess full employment and operationally geared monetary policy to the NAIRU, which linked inflation to deviations of the unemployment rate from an estimate of full employment, U*, the so-called nonaccelerating inflation rate of unemployment. Monetary policy would affect aggregate demand and the real economy, and Okunâs Law provided a rule-of-thumb that linked changes in the unemployment rate to deviations of real GDP growth from its potential. Deteriorations in these relationships and frameworks made them unreliable guidelines for conducting monetary policy. The Fed has slowly acknowledged their shortcomings. It no longer refers to the NAIRU, and Fed Chair Powell now emphasizes that the Phillips Curve is flat and that sustained maximum employment may be consistent with stable low inflation. These assessments are seemingly reasonable. But what is the Fedâs vision of maximum employment and how to best achieve it?

Were the record lows in unemployment achieved by virtually all groups during the last six months of the elongated 2009-2019 expansion appropriate benchmarks for âfull employmentâ? Overall, the unemployment rate averaged 3.5%, well below the 4% that Congress identified as the Fedâs mandate in the Full Employment Act of 1977. The Fed held to that benchmark for decades. The unemployment rate of various groups declined significantly. If these marks are shortfalls from maximum, what are the maximums or what parameters are appropriate to assess them? Do some other measures of unemployment better capture under-employment? Is the employment-to-population ratio a better measure? Should maximum employment be considered in the context of changes in real or nominal wages or inflation? These issues should be addressed alongside considering how they can be achieved.

Politicians would not consider these questions as reasonable and requiring a clear answer, but they are appropriate for the Fed, which emphasizes economic analysis, transparency and clear communications. The Fed drops the ball on this issue. In its âStatement on Longer-Run Goals and Monetary Policy Strategyâ, while the Fed emphasizes that âThe maximum level of employment is a broad-based and inclusive goal that is not directly measureableâ, it concludes âThe Committee considers a wide range of indicators in making these assessmentsâ. This statement is far too vague for operational guidance. Developing parameters for assessing the employment mandate and shortfalls from it would require careful research and thought by the Fed, but it would provide important insights and guidelines for the conduct of monetary policy.

What is the Fedâs role in achieving its maximum inclusive employment goal? The Fed fully understands that employment and labor market performance is determined by an array of non-monetary factors, including demographics, education and skills training, health, regulatory policies and fiscal policy, and its research staff analyzes these topics. Following the onset of the pandemic, Chair Powell has urged more aggressive fiscal policy support. The Fed needs to sort out the array of factors that influence labor market outcomes and identify which of the governmentâs policy tools are most appropriate to achieving desired outcomes. This will help clarify the Fedâs capabilities.

The pandemic and government shutdowns were negative supply and demand shocks to the economy, and some of their influences may have lasting impacts. A better understanding of the particular influences of these factors would be useful in developing policy prescriptions. Monetary policy affects aggregate demand. In response to the pandemic, new technologies and products and economic activities have emerged that may persist well after the pandemic ends. This will affect the supply and demand for certain labor market skills and groups. Shortfalls of employment from desired maximums and shifts in labor markets stemming from the pandemic require policies in education and skills training, regulations and government fiscal supports. They are beyond the capabilities of monetary policy.

Even if the economic contraction stemming from the pandemic and government shutdowns was entirely a demand-driven phenomenon, which seems unlikely, skill levels and productivity vary widely in the workforce. Relying exclusively on monetary policy to achieve maximum inclusive employment would lead to excess demand for high skilled/high productivity labor and presumably overheating and unintended side effects.

Clarifying the characteristics of the labor market and monetary policy would help to avoid misperceptions by Congress and the public about the Fedâs role and capabilities.

More broadly, the Fed is wise to have acknowledged the unreliability of the flawed Phillips Curve, but it needs to replace it with an operational framework for conducting monetary policy. It may seem inappropriate and naïve to ask how the Fedâs monetary policy affects employment and labor markets, and their linkages, but this question is highly relevant in light of some of the marked changes that have unfolded since the financial crisis. The Fed has changed some key operating procedures. Its interest rate and balance sheet policies have been unprecedented. Some of the key precepts that have guided the Fedâboth in the economy and the monetary policy transmission channelsâhave clearly changed. The Fed seems to be pursuing its new objectives for employment and inflation with the monetary policies that in the past did not achieve the Fedâs goals.

Analytical insights from the Fedâs post-financial crisis policies and economic outcomes would improve current policy deliberations. Why did the Fedâs sustained zero interest rates and massive quantitative easing fail to stimulate an acceleration of aggregate demand or stronger economic growth? Why did they fail to generate higher inflation? Employment rose, but would it have done so in the absence of QEIII and sustained zero interest rates? Why did the monetary policy transmission channels behave differently than before the financial crisis? Why did the Fedâs macroeconomic model persistently over- estimate real economic growth and under-estimate the decline in the unemployment rate? The weaker-than-expected wage gains were a continued surprise to the Fed. The Fed remains puzzled by the modest shortfall of inflation from the Fedâs target. Its explanationâand its recipe for the futureârelies heavily on its ability to manage inflationary expectations.

These are tough questions. Research into them and related topics are necessary to develop a reliable, systematic way for the Fed to achieve its new mandates. It would be a big task, but worth it.

References

Mickey D. levy and Charles Plosser, âThe Murky Future of Monetary Policyâ, Shadow Open Market Committee, September 30, 2020 and Hoover Institution Monetary Policy Conference Series, October 1, 2020.

Mickey Levy and Roiana Reid, âU.S. Labor Market: Big Gains, Big Shortfallsâ, Berenberg Capital Markets, December 20, 2020.

Jerome Powell, âNew Economic Challenges and the Fedâs Monetary Policyâ, speech delivered at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, August 27, 2020.

Chart 1. Unemployment Rate Chart 2. Unemployment Rates for Groups

Chart 3. Labor Force Participation Rate and Employment-to-Population Ratio

Chart 4. Employment Following Expansion Peaks

Sources: Bureau of Labor Statistics and Berenberg Capital Markets

Chart 5. Unemployment Rate Following Expansion Peaks

Sources: Bureau of Labor Statistics and Berenberg Capital Markets

Chart 6. Best and Worst Employment Changes by Sector, February-November 2020 (in 1000s)

Chart 7. Employment-to-Population Ratio by Age Group

Chart 8. Unemployment Rates by Educational Attainment

Chart 9. Unemployment Rates by Race

Chart 10. Temporary Versus Permanent Layoffs

Mickey Levy, mickey.levy@berenberg-us.com