Labor market stresses amid âsubstantial progressâ toward the Fedâs employment mandate

Note: use âLink to PDFâ to view the full report and updated labor market dashboard charts. Inflation Watch, the companion piece to this report covering inflationary conditions will be published in the coming days.

*This report updates our enhanced labor market dashboard that builds upon the dashboard of 12 indicators originally developed by former Federal Reserve Chair Janet Yellen. It helps to assess the labor market recovery from the pandemic and progress toward the Fedâs employment objective established in its new strategic plan (âUpdated expanded labor market dashboard indicates âsubstantial progressâ has been made toward the Fedâs employment mandateâ, August 12, 2021).

*We conclude that 1) labor market indicators have recovered significantly, and âsubstantial progressâ has been made toward the Fedâs maximum inclusive employment mandate; and 2) labor market shortages and other stresses have emerged that have constrained even faster recovery in labor markets and the economy. We anticipate that those stresses may persist longer than many observers expect.

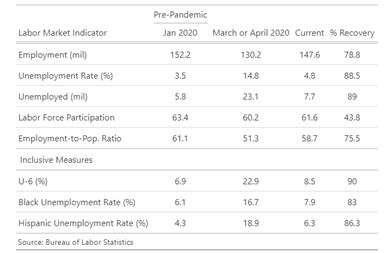

*Table 1 summarizes Bureau of Labor Statistics data on the Spring 2020 pandemic collapse and sharp rebound in labor market data. The recovery of most key labor market data has far exceeded all but the most optimistic forecasts. As an overall assessment, labor market conditions are currently similar with those that existed during mature stages of prior economic expansions.

*Establishment payrolls have recovered 78.8% of their pandemic decline. The number of unemployed has fallen 89% of its pandemic surge and the unemployment rate has recovered 88.5% of its temporary spike. The labor force participation rate recovery has been lessâ43.8%--but establishment payrolls have recovered 78.8% of their earlier decline, resulting in a 75.5% recovery in the employment-to-population ratio. U-6, the broadest measure of underemployment that includes marginally attached and part time workers, has retraced 90% of its pandemic spike. The unemployment rates of black people and Hispanic or Latino people have recovered 83% and 86.3%, respectively, from their pandemic spikes.

Table 1: Select Labor Market Indicators

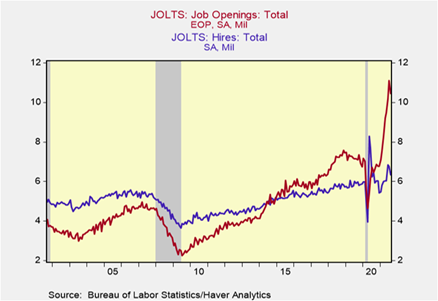

Chart 2: JOLTS Job Openings vs. Hires (millions)

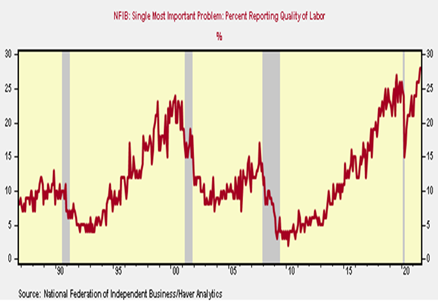

*The National Federation of Independent Businesses (NFIB) that includes several million small businesses conducts a survey of its members and among other questions asks them to identify among ten items the single most important problem they face. In the most recent survey, 28% of NFIB respondents identified âquality of laborâ (a record high going back over three decades), 10% identified âcosts of laborâ (near record high), and 13% identified âinflationâ, near a record high (Chart 3). A near record low of only 4% identified âpoor salesâ as their single most important problem. Medium and large-sized businesses are expressing the same concerns. This underlines the observation that aggregate demand in the economy is strong, while labor shortages and stresses are constraining hiring and economic activity.

Chart 3: NFIB Single Most Important Problem: Percent Reporting Quality of Labor

*The Fed has been very slow to come around to acknowledge that labor markets have made âsubstantial progressâ toward its maximum inclusive employment mandate, its subjective requirement for announcing that it will begin to taper its asset purchases. While the Fed has not established any numeric targets for its maximum inclusive employment objective, its benchmark seems to be the labor market conditions that existed just before the onset of the pandemic. It is noteworthy that these conditions were achieved at the end of the longest economic expansion in U.S. history.

*The expanded labor market dashboard shown below clearly indicates that substantial progress has been made and current conditions are similar to mature stages of prior expansions, and that supply shortages are constraining the pace of recovery, while demand is strong and not the problem. The Fed forecasts further significant improvement in labor markets. In its September Summary of Economic Projections, the median FOMC member forecast is that the unemployment rate will fall to 3.8% by year-end 2022 and to 3.5% by year-end 2023 and remain at 3.5% in 2024. These are well below the Fedâs estimates of longer-run full employment.

*At the same time, the Fed has acknowledged that the higher inflation has met its required make up strategy following the prior years of low inflation. Accordingly, the criteria are in place for the Fed to announce that it will taper its asset purchases. An announcement on the near-term horizon is consistent with our earlier expectation (âStrong U.S. Growth, Inflation and the Fedâs Challengesâ, February 11, 2021).

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (âBerenberg Bankâ). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCMâs prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.