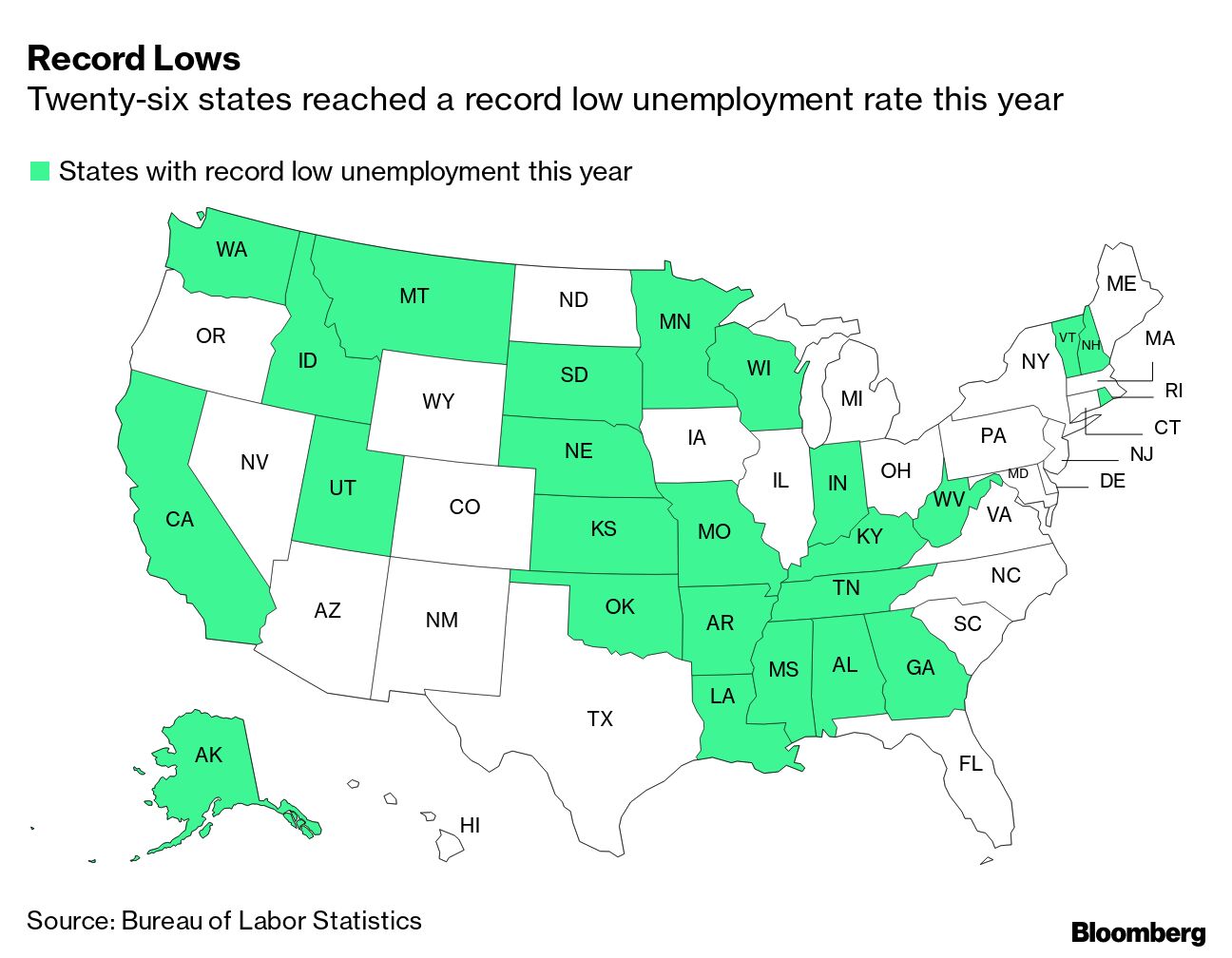

| The US mortgage industry is seeing its first lenders go out of business after a sudden spike in lending rates, and the wave of failures that’s coming could be the worst since the housing bubble burst about 15 years ago. There’s no systemic meltdown looming this time around, mind you, since there hasn’t been the same level of excess and because many of the biggest banks pulled back from mortgages after the financial crisis. But market watchers still expect a string of bankruptcies, and that means a lot of people getting fired. —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. While Elon Musk has plenty of detractors on and off Wall Street, Scott Burg may be the first distressed-bond manager to make a multibillion-dollar options bet that Musk’s Tesla will be “squashed like a bug.” The unemployment rate declined in more than half of American states in July, with a record 22 of them reporting jobless rates at or below 3%. Nationally, US unemployment is at a half-century low. Russia’s Gazprom says its main pipeline needs some maintenance, so it’s going to stop delivering natural gas to Europe for three days—just as Germany rushes to fill storage sites and further squeezing energy supplies among countries that have sanctioned Russia for its war on Ukraine. European benchmark futures soared as much as 9%.

The White House said Friday that Ukrainian President Volodymyr Zelenskiy should take part in a Group of 20 summit in Bali if Vladimir Putin attends, after Indonesia’s leader said the Kremlin leader would probably show up.  Ukraine President Volodymyr Zelenskiy and Russian President Vladimir Putin Photographers: Dimitar Dilkoff, Mikhail Klimentyev/Sputnik/AFP/Getty Images The US Justice Department must release a 2019 memo advising then-attorney general Bill Barr on how to handle the conclusion of the Mueller investigation and the department’s decision not to charge Donald Trump, a federal appeals court ruled. A small Australian research lab tucked away in a coastal town, 70 kilometers (43 miles) north of Sydney, says it has developed a patented technology using a catalyst that can turn hydrogen and oxygen into superheated steam capable of driving a power-station turbine.

China sentenced Chinese-Canadian financier Xiao Jianhua to 13 years in prison and fined his company Tomorrow Holding 55 billion yuan ($8.1 billion), bringing an end to a long-running saga that has seen many of the tycoon’s business interests reined in since he was seized in Hong Kong more than five years ago.  Xiao Jianhua Source: The New York Times/Redux Between movie theaters, fitness centers and full-on amusement parks, American shopping malls have scrambled for years to attract new visitors to counter plummeting foot traffic. Even before the coronavirus struck, the concept of the mall—once so central to suburban life—was increasingly viewed as an anachronism. Now, with pandemic precautions falling by the wayside and brick-and-mortar shopping eyeing a revival, it’s looking like there may be a strategy for the old standby to survive amid the hordes of Amazon delivery vans: Grocery stores.  The high-end food chain Eataly, seen here inside the Westfield mall in New York’s World Trade Center complex, is one of many grocery chains that may help American malls survive. Photographer: Christopher Goodney Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. IBM Automate—Singapore: From relocations to resignations to major changes in work processes, the future of work continues to change rapidly. Join Bloomberg Live on Sept. 13 virtually or in-person in Singapore for the IBM Roadshow on Intelligent Automation: Creating the Workforce of the Future. We’ll talk with business and IT executives to explore how automation helps companies meet these challenges. Register here. |