To investors,

Western Union is one of those businesses that the average American has heard of, but doesn’t pay attention to on a daily basis. The approximately $9 billion market cap company is essential for the people of more than 200 countries and territories that rely on their transfer rails to send money back and forth to family and loved ones.

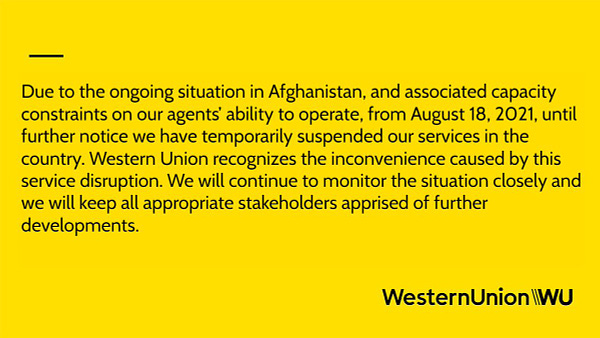

One of the countries that no longer has access to Western Union is Afghanistan. This is because the company decided to suspend all services to the embattled country until the current situation is better understood. Yes, you read that right. The money transmitter that is one of the two most popular services in the country has decided to shut down operations at the exact time that the average citizen needs help the most.

Afghanistan receives just under $800 million a year in remittances and it makes up approximately 4% of GDP. These aren’t massive numbers from a global perspective, but they are incredibly meaningful to the people on the ground that rely on Western Union for financial access.

It was infuriating to see this statement from the business. Rather than capitulate and shut down operations, they didn’t even attempt to increase agent capacity to deal with an increase in demand for their services. But it is useless to get mad. There is nothing that you or I can do about these types of situations.

Instead, the only solution is to build a better system. That is exactly what Jack Mallers and Strike are doing, which is interesting because Jack released a video today that shows how valuable his product has become.

You can click here to read his entire Twitter thread that explains how the technology works. To the untrained eye, this transaction may look like any other financial payment on your favorite fintech app. But let’s unpack exactly what is happening.

Jack’s technology and users are able to immediately transact with Bitnob users, although the two companies don’t know each other, nor do they have any formal relationship. This is like Cash App allowing you to send money to Venmo. It would never happen in the legacy world. The systems aren’t built on open standards. They are walled gardens. Which brings us to the next point.

Jack was able to immediately connect to Bitnob’s node right after they connected to the Lightning Network. He now has the cheapest, most instantaneous remittance option between the US and Nigeria. Strike didn’t build that. Bitnob didn’t build that. It was built by bitcoin and the Lightning Network over the last decade. Absolutely incredible.

The Lightning Network is an open system that anyone can plug into. No one can censor you. No one can shut you down. You don’t need millions of dollars in venture capital to build your own network. You don’t need to strike business development deals. You don’t need to hire thousands of employees.

You can simply set up a Lightning node and immediately have access to a global payments system that offers superior functionality to any legacy platform. Now compare the two different systems — Western Union vs Bitcoin and Lightning.

You can’t. One is a thing of the past and the other is a peek into the future. They are headed in two different directions. But guess what the best part is? That regardless of the technical superiority of the Lightning Network, the critical component is that it is censorship resistant. No one can decide to cut off a country’s access. No one can stop you from sending or receiving value on the network.

Bitcoin doesn’t solve every problem in the world. However, it does solve the remittance problems that many Afghan citizens are experiencing right now. That doesn’t begin to address all of the challenges that these people are dealing with right now, but it at least addresses the money issue.

It is no secret that I believe Jack Mallers is building one of the most valuable technology companies in the world. Strike is innovating in a place where the average entrepreneur and operator doesn’t yet understand how to play. That is the best time to be building. Make sure you don’t blink — this is going to happen very fast :)

Have a great weekend. I’ll talk to everyone on Monday.

-Pomp

SPONSORED: Amber Group is a leading global crypto finance service provider operating around the world and around the clock with a presence in Hong Kong, Taipei, Seoul, and Vancouver. Founded in 2017, Amber Group is committed to combining best-in-class technology with sophisticated quantitative research to offer clients a streamlined crypto finance experience.

The platform now services over 500 institutions and 100,000+ individual investors across the Amber Pro web platform, the Amber App, as well as their 24/7 trading desk. To date, Amber Group has cumulatively traded more than $330 billion across 100+ electronic exchanges, exceeding $1 billion in assets under management. In 2019, Amber Group raised $28 million in Series A funding led by global crypto heavyweights Paradigm and Pantera Capital, with participation from Polychain Capital, Dragonfly Capital, Blockchain.com.

Click here to sign up now.

THE RUNDOWN:

A16z Leads $4.6M Investment in Yield Guild Games: Decentralized gaming startup Yield Guild Games has raised $4.6 million in a funding round led by venture capital firm Andreessen Horowitz, YGG announced Thursday. Other participating investors included venture capital firm Kingsway Capital, Infinity Ventures Crypto, Atelier Ventures and the gaming entrepreneur Gabriel Leydon. Read more.

Wells Fargo Launches Passive Bitcoin Fund for Wealthy Clients: Wells Fargo on Thursday registered a private bitcoin fund with U.S. regulators, becoming the latest mega-bank with an indirect crypto investment vehicle for its wealthiest clients. A source familiar with the matter told CoinDesk the new fund is passive, a break from earlier reports that Wells Fargo would pitch wealthy investors with an actively managed offering.Read more.

Coinbase to Add Over $500M in Crypto to Current Holdings: Coinbase will be purchasing more than $500 million in cryptocurrency to add to its holdings, the exchange giant’s CEO and co-founder Brian Armstrong tweeted on Thursday. Armstrong wrote that the firm had "received board approval" to add these assets to its balance sheet. He also wrote that Coinbase would invest 10% "of all profit going forward in crypto." He added that he expected "this percentage to keep growing over time as the cryptoeconomy matures," and that he hoped to "operate more of our business in crypto."Read more.

Binance US Taps Joshua Sroge to Be Interim CEO: Joshua Sroge has become Binance.US’s interim CEO, replacing Brian Brooks, who resigned unexpectedly earlier this month from the U.S. arm of crypto exchange Binance. Sroge joined Binance.US in January 2020, serving as its CFO. Read more.

Galaxy Digital Launches DeFi Index Tracker Fund: Galaxy Digital, the listed cryptocurrency trading firm run by Mike Novogratz, has launched a decentralized finance (DeFi) index fund, a passively managed vehicle that tracks the performance of the newly launched Bloomberg Galaxy DeFi Index. Announced Thursday, the Galaxy DeFi Index Fund seeks to provide institutional investors access to returns based on the performance of DeFi tokens. It offers exposure to major decentralized lending and exchange platforms like Uniswap, Aave, Maker, Yearn and others. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Codie Sanchez is a reformed journalist, turned institutional investor to cannabis investor and advisor, to now Founder at Contrarian Thinking and Cofounder of Unconventional Acquisitions.

In this conversation, we discuss cash flow, buying businesses, angel investing as a scam, mental toughness, due diligence checklists, and much, much more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Polymarket - Polymarket is the world’s leading information markets platform where you can trade on the most pressing global questions and see unbiased, real-time data on what the market thinks will happen – all on the blockchain. Will the US have more than 100,00 covid cases before 2022? For a limited time, sign up with referral code “Pomp” to get your first trade reimbursed up to $100. Click here to get started!

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Cosmos is building the Internet of Blockchains, marking a new era of interoperability, scalability, and usability. The free flow of assets and data between blockchains with bridges to Ethereum and Bitcoin will unleash the potential of DeFi, NFTs, and much more. Dive into Cosmos at cosmos.network/pomp

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

LMAX Digital - the market-leading solution for institutional crypto trading & custodial services - offers clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy bitcoin, ether, and over 30 other cryptocurrencies. Offering industry-leading security, insurance and uptime, Gemini is the go-to trusted platform for beginner and sophisticated investors alike. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

Amber - Invest, trade, swap, and earn crypto with Amber App, where new users can receive 16% APR on BTC, ETH, and USD Stablecoins! Click here to sign up now.

Bubble - Do you have a business idea you’ve been dreaming about, but don’t know how to actually start building it? Use Bubble’s drag-and-drop tool to develop custom, interactive, multi-user web apps in hours. Go to Bubble.io/pomp and the first 500 readers will get their first month free on any of Bubble’s paid plans.

Mask Network - The portal to the new, open internet. Building on top of the existing social networks, the Mask extension allows borderless cryptocurrency transfer, decentralized file storage and sharing, decentralized finance, and many other features that were once impossible to interact with on traditional social media. Visit mask.io/pomp and use the extension to start exploring the decentralized application world.

Okcoin - Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Matrixport - Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Go download the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

Masterworks - Masterworks.io is the leading platform for blue-chip art investing with over 185,000 registered users. They have purchased over $180MM in art from artists like Banksy, Basquiat and KAWS.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber.