|

|

To investors,

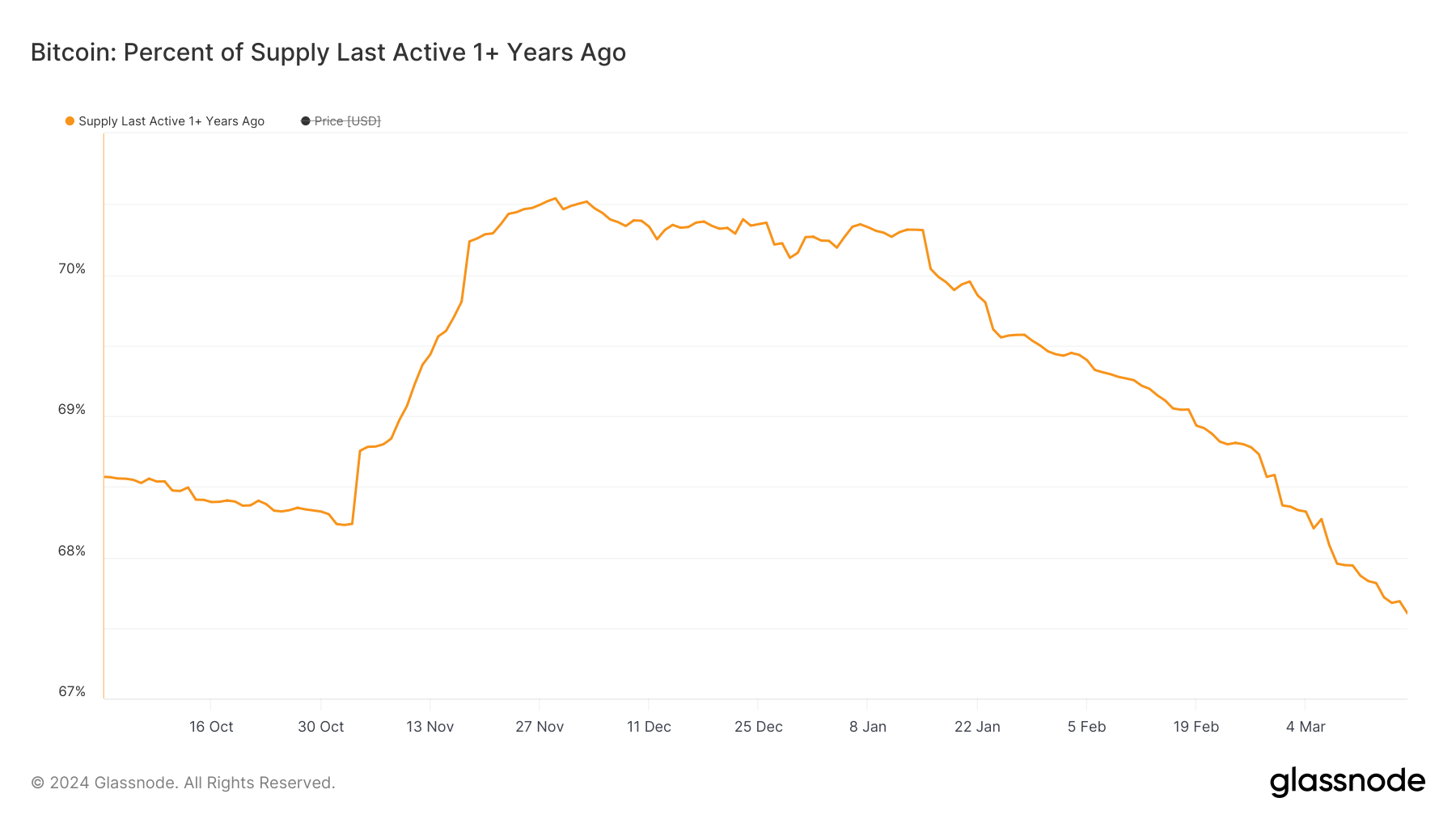

Bitcoin holders that previously showed strong-hands are starting to sell their bitcoin. This shouldn’t be a surprise — as the price of bitcoin rises, some percentage of holders are willing to sell their assets to take profit off the table.

We can see the number of bitcoin in the circulating supply that had not moved in at least 1-year topped out at just over 70% from November 2023 to late January 2024.

If zero bitcoin holders were willing to sell their bitcoin at the current price levels, the price of bitcoin would have to keep going up aggressively until the net new demand from spot ETFs could find a clearing price in the market.

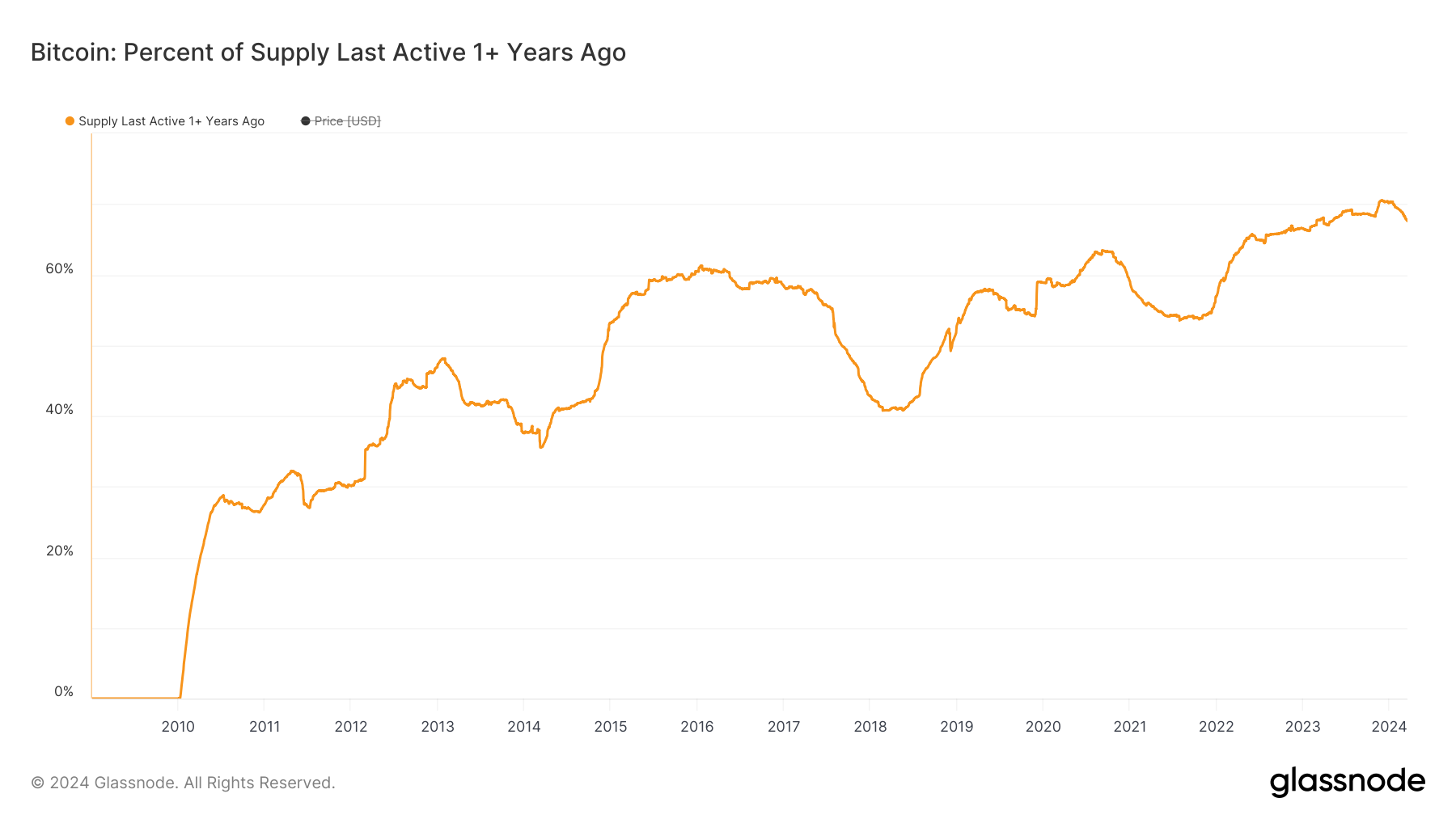

Let’s zoom out and look at this same metric over time.

You can see a similar trend occurred in 2013, 2017, and 2020. Bitcoin holders began to sell their bitcoin as the bull market got kicked off. The selling of bitcoin continued to accelerate as the market saw prices increase over time.

Technically this chart is showing activity, so holders could also be spending their bitcoin, but for the purpose of our analysis we are going to consider that selling as well. Regardless of whether you are selling bitcoin for USD, a product, or a service, you are still getting rid of your bitcoin.

So a big takeaway from this metric is that the bull market has definitely begun. A small percentage of bitcoin (< 5%) that was previously dormant is now on the move. The 60% year-to-date increase in price, and the 140% increase over the last 12-months, has convinced some holders to part with their bitcoin.

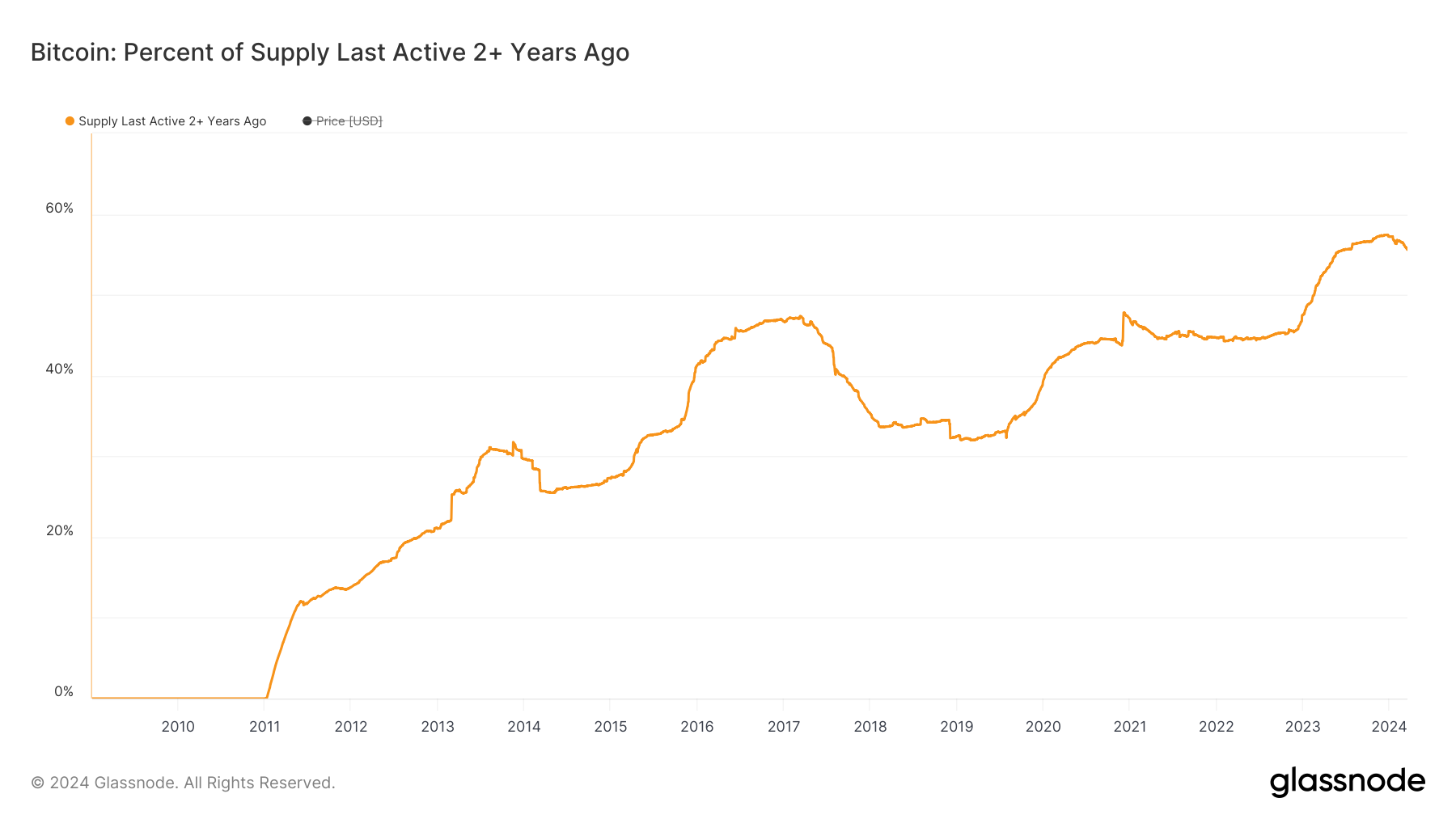

This trend is confirmed by looking at the percentage of bitcoin that has not moved in the last 2-years as well. We saw a top to that metric in January 2024 as well.

We see the same thing when looking at the net change of the 30-day supply for long-term bitcoin holders. The deep drawdowns in red started in 2013, 2017, and 2020.

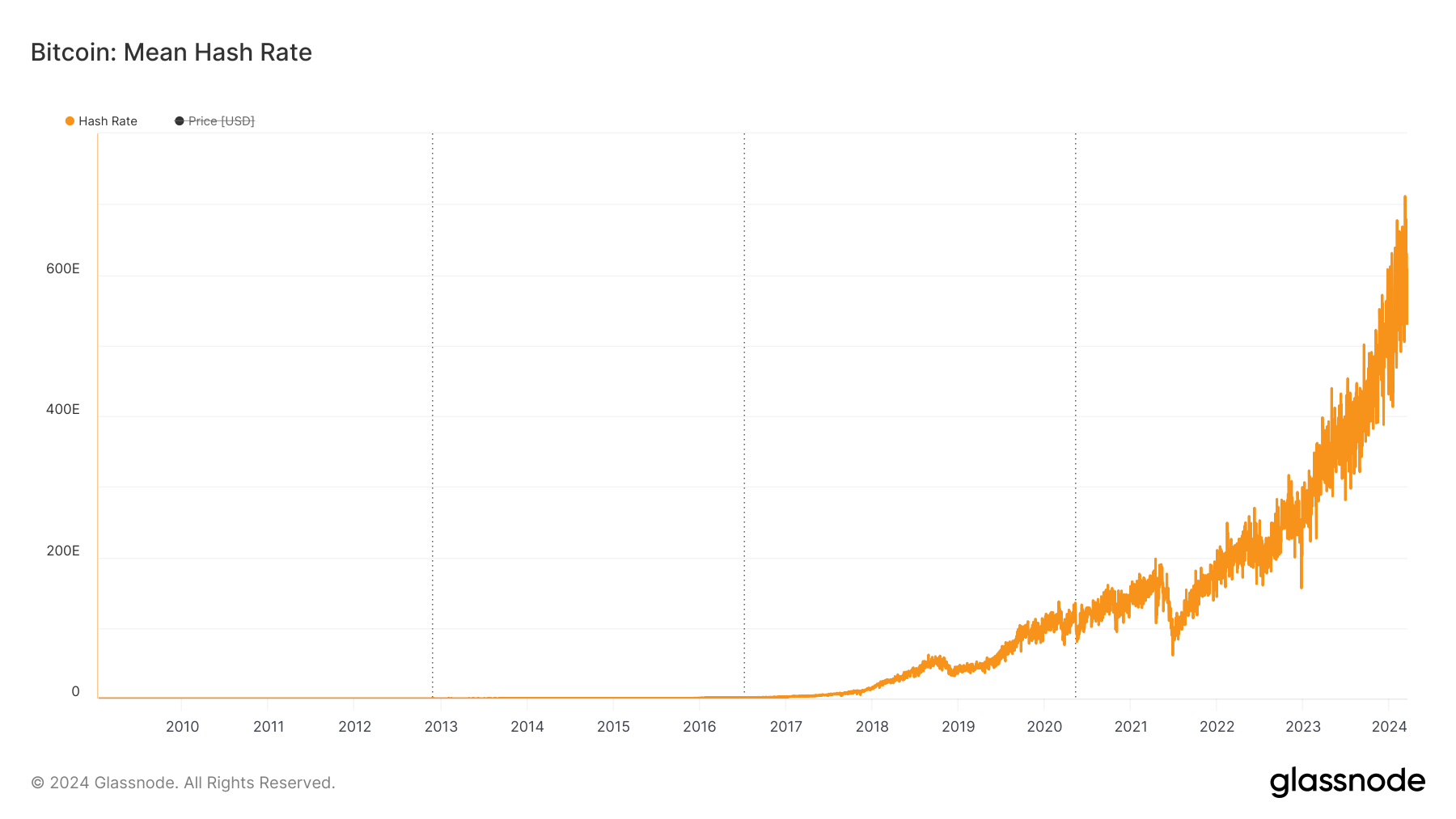

It seems like we will be able to add “2024” to that list by end of year. The good news? Bitcoin’s network is completely oblivious to what is happening with the asset’s dormancy. We have continued to see hash-rate increase at an exponential rate and we hit a new all-time high last night.

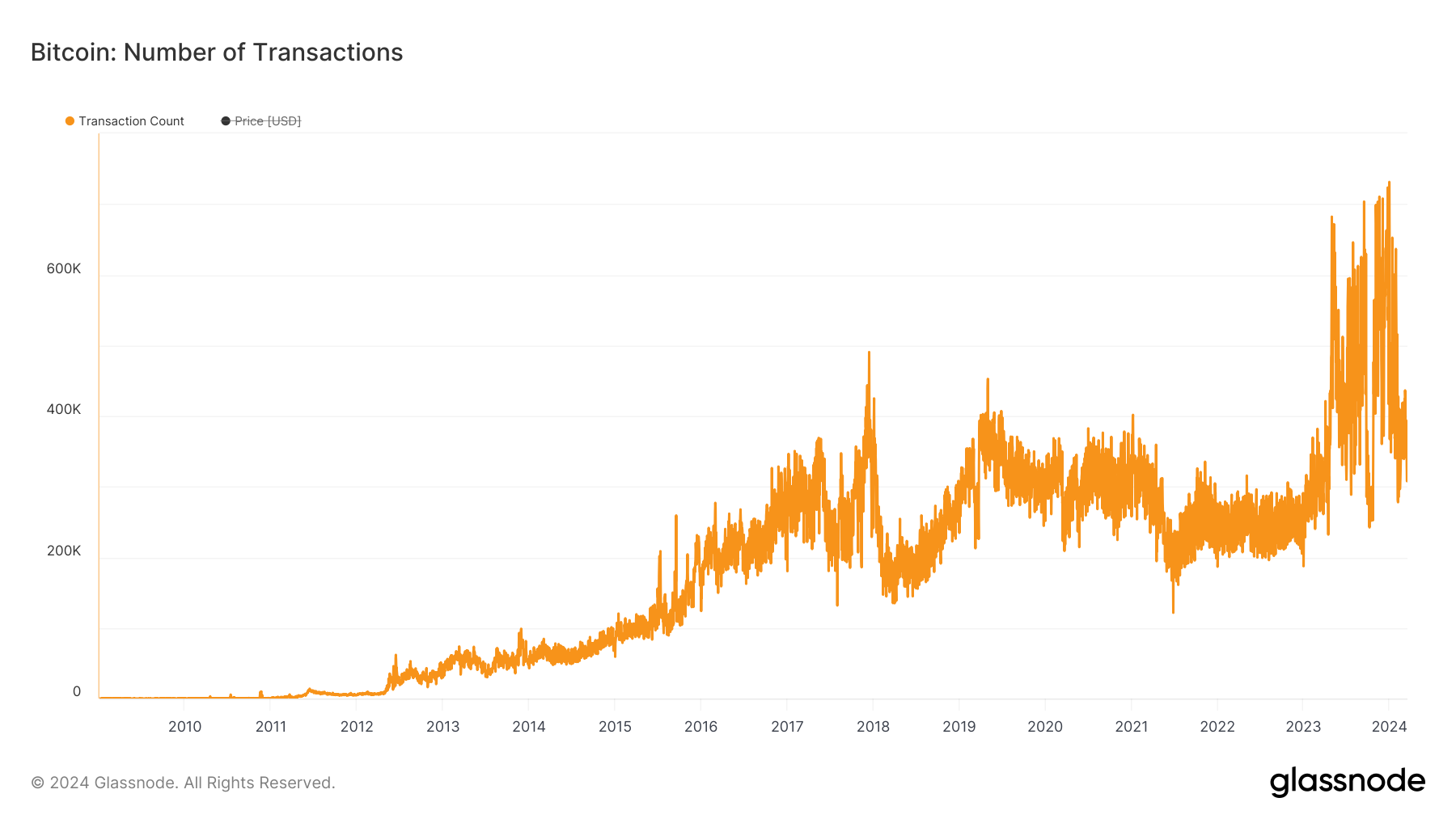

And interestingly enough — the number of successful transactions on the bitcoin network has seen a step-function change over the last 18 months or so.

I am not personally changing anything in my portfolio at the moment due to this information, but I am spending a lot of time watching it. The market is showing us that the weakest hands in the bitcoin industry have found their pain tolerance threshold to be around $70,000 per bitcoin.

They either sold because they needed to or they felt that the current offering price was more than sufficient. Most of the bitcoin holders, especially those who have been holding for at least 1 year, are not yet convinced that bitcoin’s price is high enough to part with their digital currency.

Just as in past cycles, this will change in the coming months or years. But in order to find out where that clearing price is, bitcoin’s price will have to continue to appreciate.

Hope you all have a great start to your week. I’ll talk to each of you tomorrow.

-Anthony Pompliano

Natalia Karayaneva is the Founder & CEO of Propy.

In this conversation, we talk about the real estate market, how blockchain technology can potentially make transactions cheaper and faster, why she is launching a brand new product, PropyKeys, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

Crypto & Real Estate Discussion with Natalia Karayaneva

Podcast Sponsors

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.