Here is an excerpt from a recent issue of The Daily Dirtnap:

If you think that a trade will make you virtuous, you will be more willing to accept losses.

People do this all the time. Everything in markets is a battle of right versus wrong, good versus evil. People today don’t trade to make money, they trade to fight for a cause. What is the cause du jour? Protecting the poor retail investor from all the conmen and scammers. How do you do this? You sell short TSLA, the biggest scam stock of all time, run by the biggest scammer of all time.

The thing is, the stock market doesn’t care about your causes. The stock market doesn’t care that you’re trying to do good. And by the way, all these short sellers out there, are absolutely no different than the ESG promoters of the last couple of years. In both cases, they are trying to do good. Remember, there are no heroes in trading, only rich people and poor people.

There are countless examples of this over time. The bitcoin people—it wasn’t really about number go up, it was about creating a superior monetary system and crushing government monopolies over state-run currencies. These starry-eyed idealists eventually got what was coming to them. With short selling, it takes on an even greater significance, because people are trying to expose fraud, which is viewed as a public service.

I have said this many times before in TDD: short selling is very hard. And it never pays to play for the zero. You only get the zero if there are genuine liquidity problems. I get the impression that there are a bunch of people who have been short and right who will never cover. Because it’s not about making money, it’s about being right. That is the first chapter of the handbook they give you on your first day on Wall Street. It is not about being right, it is about making money. So yes, if you think that a trade will make you virtuous, you will be willing to accept an unlimited amount of losses.

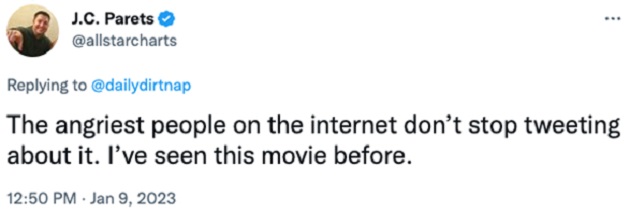

What I’m referring to here is the explosion of bearish sentiment on Twitter (and elsewhere) following last year’s -20% return, in which all the speculative stuff—special purpose acquisition companies (SPACs), the ARK Innovation ETF (ARKK), Tesla (TSLA), and the other EV manufacturers—got caned. FTX was a fraud. There was other shady stuff going on. Some people lost a lot of money on this stuff. There is indignation. “We are going to correct the excesses of the last bear market with our tweets.”

People are so angry. So angry. If you ever find yourself in a position where a stock is making you angry, you probably have no business being a trader. If you ever find yourself in a position where politics is making you angry, you probably have no business being a politician. The stock doesn’t care that you’re taking it personally, and the fact that you are taking it personally is going to distort your judgment.

Avoiding Bad Neighborhoods

I have a rule about this: I don’t go back into a bad neighborhood. If I trade a stock poorly, get whipsawed, and buy the highs and sell the lows, I don’t trade that stock ever again. I don’t go back into the bad neighborhood. Because I know I won’t be objective. I will be trying to win my money back, which is never a good position to be in.

[100% Immunity to Market Volatility?] The “Strategic Portfolio” provides you with access to consistent, reliable, and potentially wealth-building returns while also offering near 100% immunity from market volatility. Click here to build the future you deserve. |

Full disclosure: I don’t currently have a position in TSLA. I have at three points in the past. All three were successful. I’m just standing back as an observer, watching people lose their minds over this.

The old-school trend traders tell you to never get emotional about a trade. Well, that advice has gone completely out the window.

It’s not that I’ve ever gotten emotional about trades before. I’m a human being. If I’m making money, I’m happy; and if I’m losing money, I’m sad. But I’m never angry. At least—I’m never angry at a stock or the CEO of the company. I’m angry at myself for not managing risk. If you’re doing this good guys/bad guys routine, look in the mirror—you may be the one wearing the black hat.

People are as angry now as they were happy in January of 2021. Whenever emotions are at their peak and running high in a trade, there is a big turning point coming. This is another way of saying: “Look up! A piano is about to fall on your head.”

Music

Please check out my latest mix, Assault—it’s a banger. Guaranteed to get your working at 5X speed. Or dancing. I hope you like it. Please click here.

Jared Dillian

Suggested Reading...