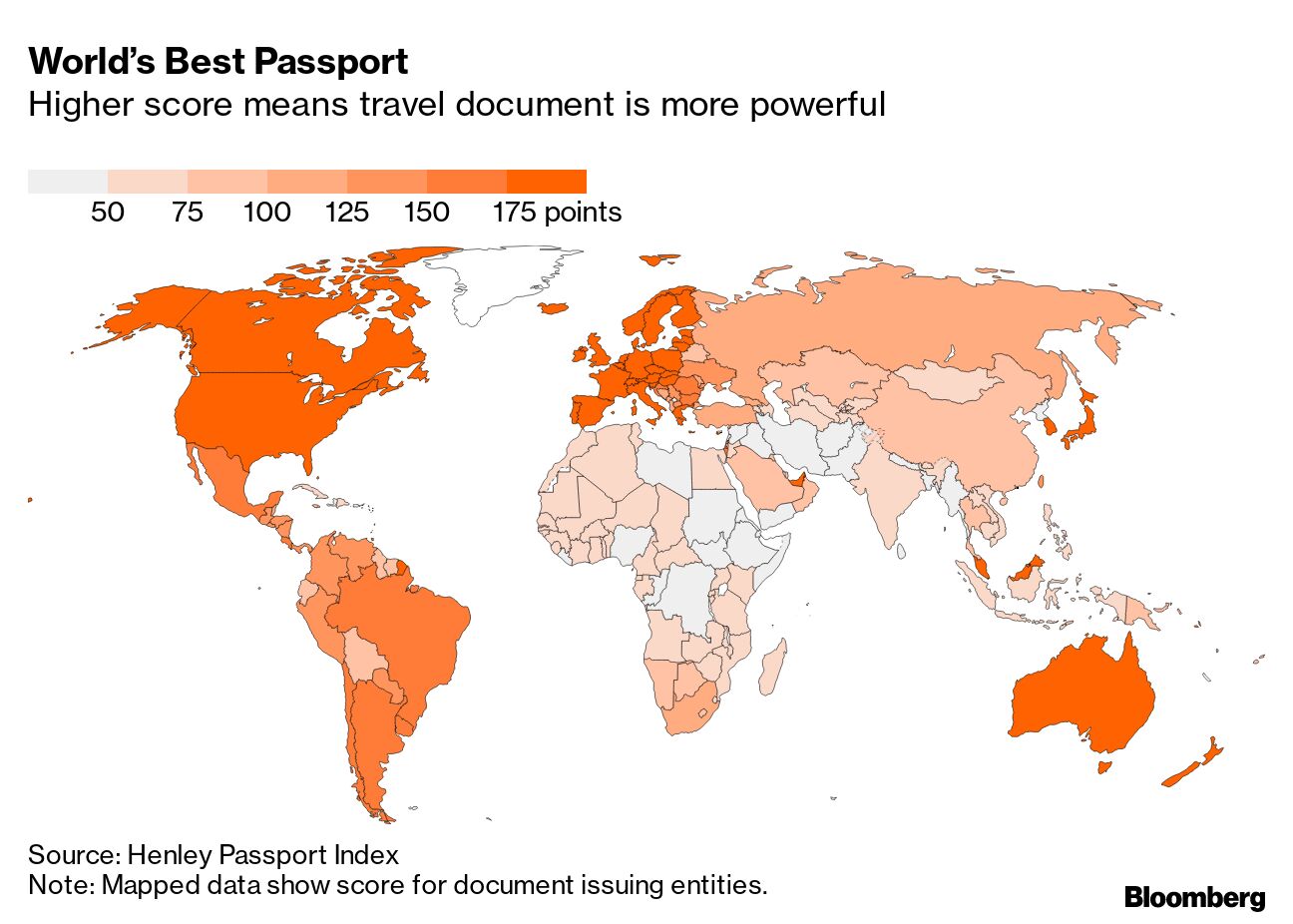

| Long maligned as the debt-addicted corporate raiders of Wall Street, private equity firms are resorting to an unusual maneuver to get deals done as borrowing costs spiral. They’re taking the leverage out of leveraged buyouts. Several firms have announced new acquisitions in recent weeks without debt financing in place, effectively backstopping the entire purchase price—in some cases north of $2 billion—with cash from their own funds. Interest rates are rising relentlessly and big banks are failing to offload the tens of billions of dollars worth of sinking buyout debt stuck on their books. Even capital-rich private credit funds, long-heralded as the savior of LBO financing, have cut back. —David E. Rovella New US home construction declined in September and permit applications for single-family dwellings fell, adding to evidence that the highest mortgage rates in two decades are sapping demand and discouraging new builds. AT&T is said to be in discussions to create a joint venture that would invest billions of dollars on fiber-optic network expansion. The company is working with Morgan Stanley to help bring in an infrastructure partner to the venture, which is expected to be valued at as much as $15 billion. General Motors is considering adding an electric midsized pickup truck to its lineup of Hummer vehicles. A smaller, electric Hummer is still just a design concept in GM’s California studio, but it has a good chance of going into production and is seen as a priority project. GM already builds the large electric Hummer pickup and will begin building a full-size SUV early next year.  GMC Hummer electric vehicles on the production line at a GM assembly plant in Detroit. Photographer: Emily Elconin/Bloomberg While oil prices have declined over the past few weeks, President Joe Biden said US oil producers shouldn’t be returning record profits to shareholders via higher stock buybacks and dividends while Russia wages war on Ukraine. He is stepping up his administration’s criticism of the energy industry while tapping strategic reserves amid still-high gasoline prices. More emails involving Donald Trump’s former attorney John Eastman feature evidence of potential postelection criminal activity by the ex-president and his adjutants, a federal judge in California found. US District Judge David Carter on Wednesday ordered the disclosure of eight documents that Eastman argued should be shielded from a congressional committee investigating the Jan. 6 attack on the US Capitol. Eastman argued they were privileged, but the judge ruled the crime-fraud exception controls. Carter, an appointee of Democratic President Bill Clinton, earlier this year held that Trump “more likely than not” attempted to obstruct Congress’s certification of the 2020 election and engaged in a conspiracy to defraud the US. The Jan. 6 committee has called it an attempted coup.  John Eastman Photographer: Andy Cross/MediaNews Group/The Denver Post/Getty Images As Russia declares martial law in territory it doesn’t fully control and tries to degrade Ukraine’s infrastructure with strikes reportedly killing scores of civilians, on the battlefront he continues to lose. Russian authorities admitted they are fleeing the occupied city of Kherson as Kyiv pushes forward with its southern counteroffensive. Military strategists in the West are war-gaming a possible nuclear escalation by Vladimir Putin. They’re also pondering the role disobedience could play, Andreas Kluth writes in Bloomberg Opinion. What if Putin gives the order but others in the chain of command refuse to execute it? Should the US and its allies try to sway those individuals now? Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. This country’s passport provides hassle-free entry to 193 countries, one more than those from Singapore and South Korea, according to the latest Henley Passport Index from Henley & Partners, an immigration consultancy. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The fifth annual Bloomberg New Economy Forum will be held in Singapore Nov. 14-17, convening public and private sector leaders with ambitious ideas, ample capital and the courage to act on the pressing issues facing the global economy. Learn more and get exclusive alerts to watch the livestream. |