The Strategic Investment Conference has dominated my week in the best way possible. I’ve spoken with several friends we’ve had here on Global Macro Update, including Felix Zulauf, Louis Gave, and Pippa Malmgren.

A few themes keep coming up. One is the increased importance of stock picking, as the market broadens out, no longer wholly dominated by a handful of tech stocks. Here’s Louis:

We are in an inflationary boom. We are now in a market that is moving from being just a handful of stocks, that is your mag seven, to a much broader market where energy is participating. Materials, industrials, financials, small caps, you name it.

I have been saying something similar for months. We are at the start of a paradigm shift that will favor informed stock picking over passive index investing. For many, particularly younger investors who’ve only known a tech-dominated stock market, this is a big shift.

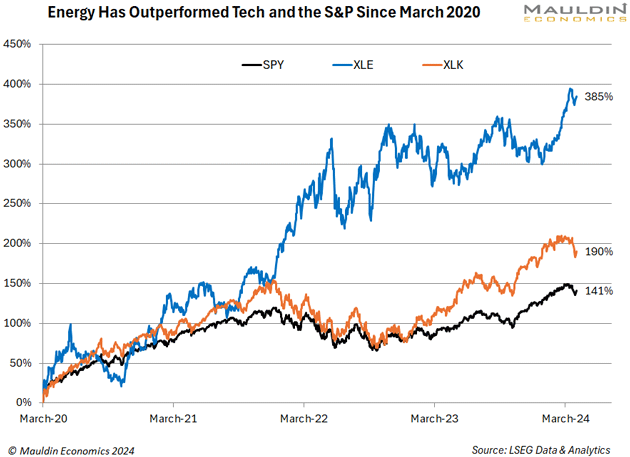

Louis mentioned energy, saying it had replaced bonds as “the new anti-fragile asset of choice.” He also noted that energy has outperformed both tech and the S&P since the COVID bottom, which you can see in the chart below. The Energy Select Sector SPDR Fund (XLE) has soared 385% since March 2020, beating both the SPDR S&P 500 ETF Trust (SPY) and the Technology Select Sector SPDR Fund (XLK) by a wide margin.

Energy has been a focus here in this letter, and in Macro Advantage, where we hold two US oil and gas producers in our portfolio—including one billionaire investor Leon Cooperman highlighted in his discussion at the SIC. Nick Glinsman also mentioned it in our recent Global Macro Update interview. It’s nice to have such esteemed company.

Many people would like to lean more heavily on fossil fuel alternatives, including me, but until we build more nuclear power plants, the world will continue to run on oil and gas. Global demand for oil isn’t likely to peak until 2030, and production hasn’t kept up. As I’ve noted before, we are in a late-cycle commodity rally that you don’t want to fight.

The right oil companies also serve as geopolitical hedges. International tensions remain elevated—just ask Pippa, whom I interviewed at the SIC on Wednesday. She reinforced her call that we are already in World War III, with a “hot war in cold places” and a “cold war in hot places.” With so much geopolitical risk, energy prices could spike if supply is interrupted. And if they don’t, you’ll get paid a handsome dividend to hold your hedge.

Felix Zulauf, a permanent favorite at the SIC, shared his thoughts on oil, too. Here’s Felix:

Of course, if we have a recession, there will be a quick shakeout. There could also be a shakeout in the oil price, maybe down 15% or something like that, easily. But you buy it and you hold it, two, three years from now, it'll be a lot higher. That's the next bubble that I see.

My bullishness on energy goes beyond oil. Here in the US, new EPA regulations announced this week could soon shutter many coal plants. This would leave a substantial void, as coal still accounts for around 10% of US energy consumption. Natural gas can and should take its place. It’s cheap, relatively clean, and the US produces copious amounts of it as a byproduct of oil production.

As I recently mentioned, I believe natural gas will be the most important global commodity of the decade. I am looking to add more exposure—beyond what I already have through oil and gas producers—through select infrastructure companies.

It is impossible to squeeze all the fantastic insights I’ve heard this week into a single letter. You can still get a pass to watch the full recordings and participate live next week. More on that here.

I will return with new Global Macro Update interviews after we wrap up the SIC. For now, here are some final thoughts from Felix:

I think we are at the crossroad where growth begins to underperform and value begins to outperform. That means that financial assets begin to underperform real assets, so commodities will become more important.

Commodities, particularly energy commodities, deserve a place in every investor’s portfolio right now. Getting that right could help you avoid a lot of the pain that may lie ahead.

Thanks for reading.