This week, I’m turning to you. Many of you write in on a weekly basis, which I appreciate.

Thanks for the new ideas for me to look at, as well as the feedback on existing names.

With that, let’s dive into the mailbag and answer your questions.

WestRock, Activision, and First Citizens

Scott wrote in:

I bought WestRock Co. (WRK) based on the company strength and industry position; this was before the Smurfit merger announcement. Recession may come (probably it will due to the rapid rate hikes), but people still buy consumer products, so I'm taking the long view (five-plus years) for this one to work out. If the price drops, hopefully I'll have the conviction to keep adding to my position. Keep up the excellent work. Activision Blizzard (ATVI) and First Citizens BancShares (FCNCA) (now a core holding) have all worked out nicely (amazingly, in FCNCA's case!).

Yes, we were fortunate with the WestRock timing. But whoever coined the saying “good things happen to cheap stocks” is right on the money here.

The combined Smurfit WestRock will be a giant in the containerboard sector—a sector that is not getting disrupted by some new tech startup or AI or what have you. The deal is fair to both sides, and the synergies they’ll extract are substantial.

I still own and hold WestRock.

Thanks for the positive note re: Activision. I’d love to find another one like that (and Twitter). But these are very episodic… you can’t predict if or when they’ll show up.

And on First Citizens, yes, it is a core holding for me as well. It’s not terribly expensive here at 1.1X tangible book value. My only worry is how many hedge funds seem to have piled into the name. If there’s a bump in the road, so to speak, they might sell first and ask questions later.

Thanks for the note, Scott!

The Fed Model

Next up, Ryan wrote:

I love your writing and thinking. Thank you. I have a question: Why do you use the forward PE of 18.5 based on one-year estimates (inverted to be a 5.4% "yield") and a 10-year US Treasury bond yielding 4.48%? Why not use one-year for both? I ask this because I recently purchased a nine-month CD with a yield of 5.4%, which is FDIC insured. Thanks.

P.S. I live in Cleveland and am a fan of Cleveland Cliffs, but their stock price doesn't seem rational. I guess fundamentals are on a "break" for now. LOL.

Thanks for the compliment, Ryan.

Ryan is referring to a piece I wrote on the Fed Model. The reason I compare the 10-year Treasury to the S&P 500 earnings yield is twofold.

First, this is what the Fed Model calls for—those are the two “inputs” in the model.

And second, it makes sense. The earnings from S&P 500 companies are long-duration. They’re meant to exist not for one year or 10 years… but to infinity. Equities are ultra-long-duration assets.

By comparing the 10-year to the S&P 500 earnings yield, we’re attempting to match the duration of two long-duration assets. This keeps the math “apples to apples.”

And on Cleveland Cliffs, yes, I am eagerly waiting for what I believe to be inevitable: US Steel selling to Cleveland Cliffs. I suppose I am talking my book because I think it’s a great deal, and I want it to close. But also, I see no other possible buyer. The deal just makes sense.

Targeting Spinoffs

Next, Doug wrote:

I have been following this newsletter for nearly a year now and have been impressed with many of the recommendations and have bought quite a few, specifically the mergers. Recently, I have been wondering about the opposite—splits or, specifically, divestitures. Could they present an opportunity as well? Any thoughts or ideas would be appreciated.

Great question. Yes, I actively look at nearly every spinoff, divestiture, etc. Many of these ideas, however, are smaller. They’re small caps.

As such, I don’t write about them in Smart Money Monday. I have at least six different spinoff ideas in my other research service, High Conviction Investor. If you’d like to learn more about my premium advisory, you can read all about it here.

Thanks, Doug!

Dollar General

Another reader wrote in on Dollar General (DG):

You don't talk about the high debt/equity ratio of 286%. That's very high. What if rates remain high or get higher? That's in my view a major risk many investors do still underestimate.

Thanks for this. It’s a fair point, in that Dollar General does have debt. However, I don’t look at leverage on a debt-to-equity basis for operating businesses. That metric is more relevant for banks and other financial companies.

I compare DG’s debt in relation to its cash flow, which is (loosely) represented by its EBITDA. And on a debt-to-EBITDA basis, Dollar General is levered around 2.2X gross debt to EBITDA. Note that this calculation excludes the capitalized value of future lease expense.

Tetra wrote in:

News gets worse for DG. They put their stores not only in rural areas but also in many urban, underserved areas. Our town (Cathedral City, CA) is solidly middle class, but there are regular robberies or violent altercations outside the nearby store that result in injuries. Many strata have rapidly disintegrating social cohesion, and we see it in these types of stores. Executives admit they need more employees, and to support their people better, but we are talking about criminal attacks. There will be no quick fixes. I would not even bother to follow.

Tetra, this is a great point. The bet by owning Dollar General here is that it can solve some of these issues. Said differently, I think what you’ve identified is currently priced into the stock.

As I’m sure you’ve seen, retailers such as Target, Walgreens, and even Walmart have opted to close stores in high-crime areas where there is little to no enforcement. This, of course, only hurts the local population and the employees at those stores. It’s a tragedy.

If crime and theft continue, Dollar General will likely follow suit and close locations.

Another reader wrote in regarding Dollar General:

Nice piece. Please do a similar look at Advance Auto Parts (AAP). Thank you.

Thanks for this. Yes, Advance Auto Parts has been on my radar for a number of years. It’s one of the few public companies headquartered here in Raleigh, North Carolina.

I was chatting with an extremely smart and successful investor friend of mine. The topic of Advanced Auto Parts came up. The issue with the company, in his mind, is margins.

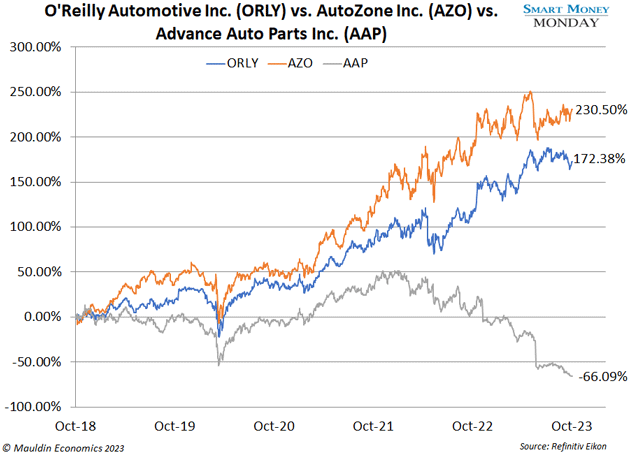

AutoZone (AZO) and O’Reilly Automotive (ORLY) are two of AAP’s competitors.

They have materially higher margins than AAP and have had those for many years. AutoZone, for instance, has gross margins of 52%. Advance Auto Parts, on the other hand, has gross margins of 43%. This is a huge spread.

The reason for this is likely industry structure. AutoZone and O’Reilly buy parts directly from manufacturers, while Advance Auto Parts has many different suppliers in the purchasing chain that eat away at the margin it earns.

I’m watching Advance Auto Parts, but it’s not high on my list for the time being.

That wraps up the mailbag for this week. Thanks for all the comments and questions—keep them coming!

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Suggested Reading...