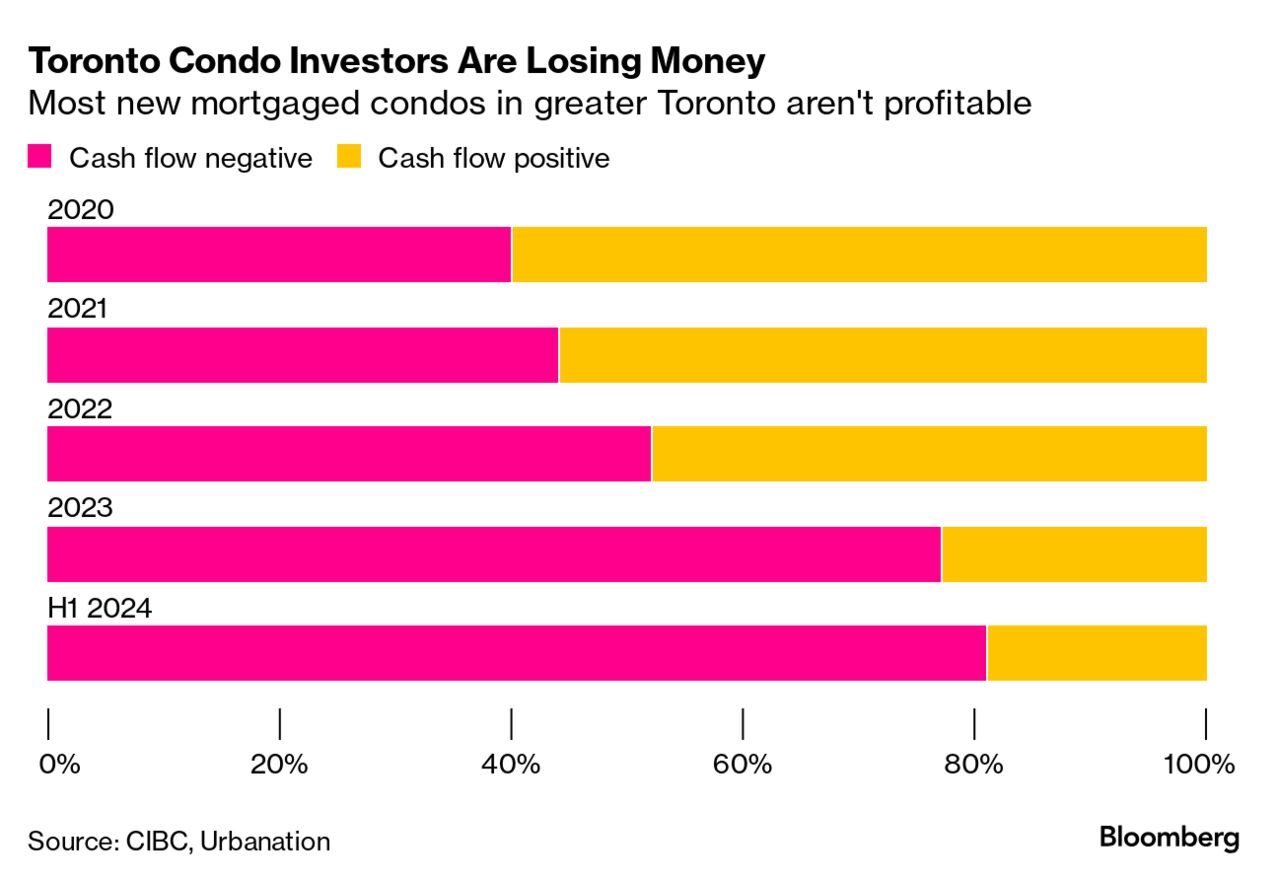

| It’s been a week since a global mini-panic sent markets tumbling. With the dust now settled and breathless headlines behind us, equities have basically recovered what they lost. The upheaval has been attributed in part to a small policy shift from the Bank of Japan and US traders who read too much into labor data. But that isn’t to say the event should be dismissed. The way it unfolded so rapidly—and just as quickly faded out—has provided a very big lesson. It exposed just how vulnerable markets are to a strategy hedge funds exploited to bankroll hundreds of billions of dollars of bets in every corner of the world. —David E. Rovella Ukrainian President Volodymyr Zelenskiy publicly confirmed that his forces had seized a chunk of Russian territory, saying the operation was being conducted to protect his country’s border areas. Some 386 square miles in Russia’s Kursk region have been taken. Ukraine now controls “areas from which the Russian military was striking our Sumy region,” Zelenskiy said. “Our operations are purely a security issue for Ukraine, to free areas near the border from Russian troops.” Meanwhile a rattled Vladimir Putin abruptly interrupted one of his adjutants who said Ukraine had taken control of 28 Russian towns and villages. “The Russians have been severely embarrassed,” said Matthew Savill, military sciences director at the Royal United Services Institute in London.  Volodymyr Zelenskiy Photographer: Hollie Adams/Bloomberg B. Riley Financial’s shares lost more than half their value amid a new round of writedowns and a widening US investigation into whether it gave investors an accurate picture of its financial health. The Securities and Exchange Commission is said to be assessing whether the Los Angeles-based boutique investment bank adequately disclosed the risks embedded in some of its assets. The agency is also said to be seeking information on the interactions between founder Bryant Riley and longtime business partner Brian Kahn, the former chief executive of Franchise Group—one of B. Riley’s larger investment holdings. The inquiry includes a review of possible improper trading by other insiders. While it may seem like the only difference between extended-release Mucinex and its generic store-brand counterpart is the price tag, the generic potentially exposes users to a deadly cancer-causing chemical. Millions of Americans who buy the store-brand option at various major US chains such as CVS, Walmart, Target and Walgreens are unknowingly choosing a drug that risks containing a potent carcinogen called benzene, according to a Bloomberg analysis of government data. Adani Group’s stocks fell after Hindenburg Research accused India’s chief market regulator of having conflicts of interest that prevented a thorough probe into fraud allegations against the conglomerate. In a report published Saturday, Hindenburg alleged that Madhabi Puri Buch—the chairperson of the Securities and Exchange Board of India—and her husband invested in offshore entities that were allegedly part of a fund structure in which Vinod Adani—the brother of billionaire Gautam Adani— also had investments. Foreign investors pulled a record amount of money from China last quarter, likely reflecting deep pessimism about the world’s second-largest economy. Should the decline continue for the rest of the year, it would be the first annual net outflow since at least 1990. Foreign investment into China has slumped in recent years after hitting a record $344 billion in 2021. The slowdown in the economy and rising geopolitical tensions have led some companies to reduce their exposure, and the rapid shift to electric vehicles in China also caught foreign car firms off guard, prompting some to withdraw or scale back their investments.  Kenya’s finance ministry is working to bring back some of the tax measures that the nation’s lawmakers were forced to abandon after weeks of deadly protests. The taxes that aimed to raise about 344 billion shillings ($2.7 billion) in the current fiscal year were scrapped after the demonstrations led to the deaths of more than 61 people and forced President William Ruto to fire his entire cabinet. Some of the proposed taxes included increasing levies on essentials such as bread and diapers. Shemeer Ahmad is stuck with a condominium investment outside Toronto that’s losing hundreds of dollars every month. The entrepreneur purchased a two-bedroom apartment in 2019 as rents were rising and real estate seemed like a safe bet. Now he’s losing around C$830 ($604) every month as high mortgage rates and other costs suck up more than what he receives in rent. He could sell, but he’s worried he would lose tens of thousands of dollars on it. “I’m in this kind of ‘Catch 22’,” Ahmad said. “It’s simply a bad investment.” And he definitely isn’t alone.  - Generation X is more afraid of running out of money than death.

- Equinox-owned Blink Fitness follows other gyms into bankruptcy.

- J&J gets plaintiff backing for $6.5 billion baby powder accord.

- Scotiabank follows through on growth plans with KeyCorp deal.

- Canadian youth are finding it harder to get a job. Here’s why.

- Bloomberg Originals: The making of Sam Altman’s eyeball scanner.

- Bloomberg Opinion: Walz’s investment strategy makes him an outlier.

David Moot assumed he’d never be able to afford a beachfront home on the Massachusetts coast, his vacation retreat for nearly 20 years. So when he spotted one on Cape Cod listed at a surprisingly low $395,000, he jumped on it. But there was a catch: The ocean might soon be at his doorstep. The house in Eastham sits just 25 feet from an eroding sand bluff. With the tides projected to encroach 3 feet closer each year, his investment could get swept away within a decade. “Life’s too short, and I just said to myself, ‘Let’s just see what happens,’” said Moot, 59. “It’s going to eventually fall into the ocean, and it may or may not be in my lifetime.” Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily. Bloomberg Power Players: Join us in New York on Sept. 5 during the US Open Tennis Championships and hear from leaders working to identify the next wave of disruption that could hit the multibillion-dollar global sports industry. With us will be A-Rod Corp founder Alex Rodriguez, Boston Celtics co-owner Steve Pagliuca, Carlyle Executive Chairman and Baltimore Orioles owner David Rubenstein and US Women's National Team forward Midge Purce. Learn more. |