|

|

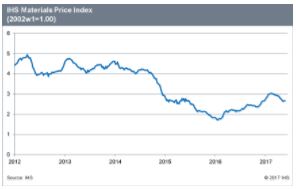

Markets experience further uptick as oil prices drive MPI higher

|

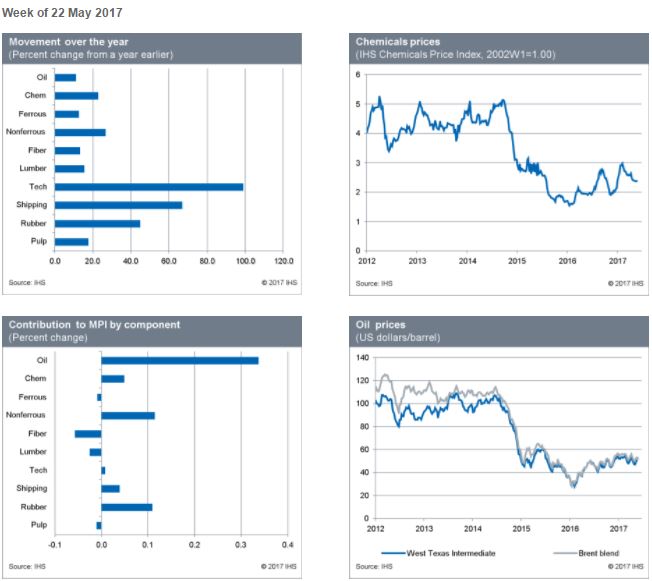

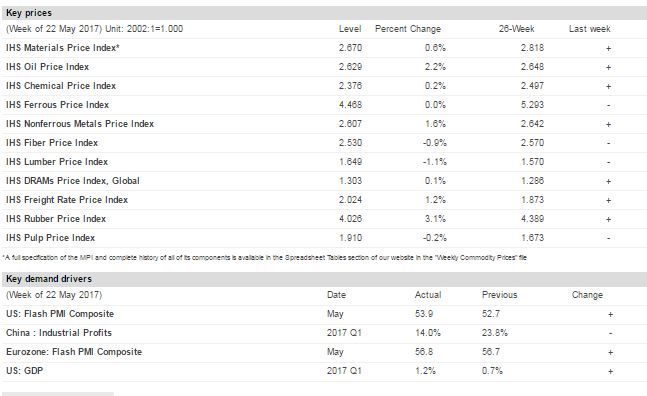

Last week the IHS Materials Price Index (MPI) gained 0.6%, a second successive weekly increase and the first consecutive rise since February. Once more, strong gains in oil markets early in the week propelled the index higher, with the sub-component gaining 2.2%. Additionally, rubber prices increased 3.1% to hit their highest level in a month.

Oil prices rose last week as markets digested the extension of OPEC's production agreement. However, prices began to slip late in the week as the initial positivity this deal provided failed to hold. In rubber markets, prices picked up following a disappointing two months in which prices had slumped on global oversupply worries. Indeed, markets welcomed the news that the Association of Natural Rubber Producing Countries, which accounts for around 90% of global natural rubber production, is to focus on price stability.

The macro environment last week was also supportive of commodity price gains, with the US dollar continuing to slip. In Germany, an unrevised first full reading of first-quarter GDP growth came in at 0.6%, a decent rate for the Eurozone's largest economy. In the United States, there was a strong flash reading for the composite purchasing managers' index (PMI), as a strong pickup in services pushed the measure higher to 53.9. Despite these solid announcements last week, there remain several challenges for commodity markets over the rest of the year. Higher US interest rates, questions about additional US infrastructure funding, and, most importantly, slowing Chinese growth point to continued volatility in the months ahead.

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Increase at Slower Pace in May, IHS Markit Says

|

The headline IHS Markit PEG Engineering and Construction Cost Index registered 54.0 in May, down from 57.0 in April. |

Both the materials/equipment and labor categories showed increases, though compared to April, the cost increases were not as broad. The materials/equipment price index came in at 55.2, almost five points lower than in April, which was one of the highest figures recorded in the survey’s history. “Steel prices peaked in April and are now beginning to weaken. Price drops will continue through at least the third quarter, more likely until the end of the year,” said John Anton, senior principal economist at IHS Markit. “Upside risk comes from the ‘Buy American’ proposal for pipelines, which is causing concern among energy buyers and plate consumers. If the proposal is enacted in its strongest form, there could be shortages in supply and allocation.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|