To investors,

I am often asked about my opinion on bitcoin and the crypto industry. While it is easy to articulate the answers to specific questions, I’ve recently found it difficult to express my macro view of the industry. That all changed on Friday when I read this tweet by Brandon Quittem.

Brandon explained my view of the industry better than I could. After reading the tweet, here is how I would explain my current framework:

There was a computer science breakthrough in 2008 that solved the double spend problem. That solution (a blockchain) created an inflection point in what was possible in the digital world. Certain attributes like scarcity, immutability, and trust-less transactions could now be applied to all industries.

The creation of blockchain technology has led to two separate revolutions that are under way. One is a monetary revolution and the other is a technology revolution. While these two revolutions share a similar technology, they are very different in nature.

The monetary revolution has manifested itself in bitcoin. This is disruption in the purest form. Fiat currencies lack transparency, have variable monetary policies, are highly unpredictable, and require third parties for transactions. Bitcoin is the exact opposite — fully transparent, with a programmatic monetary policy, completely predictable, and removes the need for a third party. The monetary revolution will be winner take (nearly) all, which means that monetary maximalism is the only natural end state.

The technology revolution has manifested itself in thousands of non-bitcoin crypto assets. There are commodities, equities, and debt.

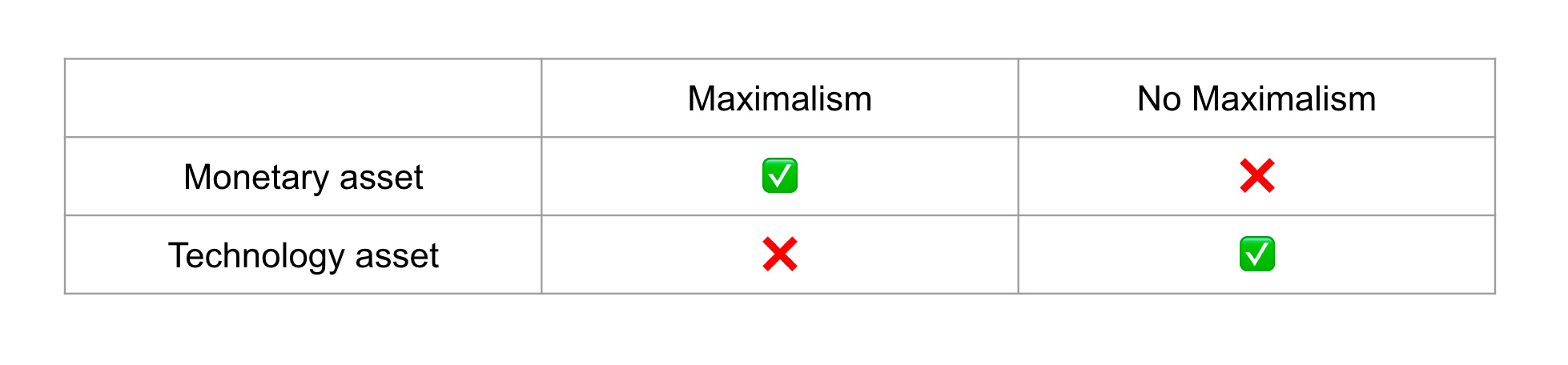

The identification of two separate revolutions is important because it gives us a framework to discuss the importance of monetary maximalism, while still acknowledging tremendous value accrual to non-monetary assets.

Before we look at the crypto industry, let’s look at the traditional financial system. Investors understand that it wouldn’t make much sense to compare the US dollar to Amazon. They are two different assets. It also wouldn’t make sense to compare Amazon to oil or the US dollar to steel. They are all different types of assets.

The exact same thing is true in the bitcoin and crypto markets. Comparing bitcoin to NFTs doesn’t make a lot of sense. They are two different applications of a technology that are attempting to solve two different problems. The same could be said about comparing Bitcoin’s layer one to any smart contract platform’s layer one blockchain. They are different applications of a technology that are trying to solve different problems.

Let’s dive deeper into each component of this analysis. The monetary revolution is an important one for reasons that we have discussed over the last few years in this letter. We must remember that monetary maximalism is the historical norm, rather than a new idea. US citizens are USD maximalists. European citizens are Euro maximalists. Chinese citizens are Renminbi maximalists. When it comes to currencies, maximalism drives resilience and value.

The same is true for digital currencies as well. The maximalist viewpoint is a product of a market structure that presents outsized reward to the competition winner. As Brandon Quittem said, monetary maximalism is rational. With that said, maximalism is exclusive to the currency category.

The technology revolution has thousands of small teams of entrepreneurs and operators working relentlessly to innovate in various industries. Any level of maximalism, whether from a technology or application perspective, would be highly irrational. The value accrual in this revolution will be similar to the stock, commodity, or debt markets. Thousands of companies accrue value. Thousands of commodities accrue value. And thousands of debt mechanisms accrue value.

Imagine if you were a python maximalist. Or an iOS maximalist. Or an Amazon maximalist. If you picked the right technology or company, you could make money - but you would miss out on the thousands of other assets that also created and captured value. You also would be ignoring the fact that someone can always build faster, cheaper technology. Maximalism in anything but a currency is irrational.

Maximalism is appropriate in currencies. Maximalism is inappropriate in equities, commodities, or debt. Both statements can be true at the same time.

There are still many unanswered questions for those that hold this worldview. What is the proper asset allocation strategy? How should you think of portfolio construction if you’re a pure capitalist who wants to optimize returns? How about if you want to capture an attractive financial gain, while also helping to usher in more good in the world?

The crazy part is that if monetary maximalism ends up playing out how I believe it will, bitcoin will eventually be incredibly stable in value. The price of goods and services will be denominated in bitcoin and the average bitcoin holder won’t see any level of volatility. When this occurs, people will have a choice to simply spend less than they make in an effort to save bitcoin. Or they will be available to invest in other assets to acquire more bitcoin than what they would simply be allowed to save.

As a student of investing and markets, it is hard to see a world where every individual stops investing completely and moves to a saver-only economy. So the more rational outlook is that monetary maximalists will hold the majority of their wealth in a global store of value (bitcoin), while also investing in other opportunities that they believe will help them acquire more bitcoin.

This investment in non-monetary assets will force investors to hold an open mind and ensure no technology maximalism. Innovation happens too quickly to hold a rigid perspective on one non-monetary technology. You can do this with a monetary asset because technological superiority isn’t essential, but you can’t do it with technology assets.

This conversation is hard to have on the internet because it requires the acknowledgement of nuance. You can’t simply say “maximalism is bad!” or “maximalism is good!” You actually have to articulate that both statements are true — it just depends on which revolution you are referring to.

Lastly, my personal focus in recent years has almost exclusively been on bitcoin. The only crypto asset that I hold personally is bitcoin and it makes up 90%+ of my liquid net worth. I’ve made investments in other things, including for-profit private companies, layer two technologies, and even blockchain-agnostic services like insurance or node infrastructure. There is so much opportunity to generate outsized returns in this industry. I still focus on bitcoin though because it isn’t about the money to me. I genuinely believe that bitcoin will usher in a world that creates more freedom, economic prosperity, and opportunity for billions of people around the world.

Just because I focus on one area doesn’t mean that I believe other areas won’t gain value, nor does it mean that I’m actively rooting against those founders, users, communities, or technologies. It just means that I’m following the thing that I’m personally most interested in. When an industry is being created from (basically) scratch, it is impossible for any one investor to be educated on every single sub-vertical. Sometimes knowing where you don’t have an advantage is just as important as knowing where you do.

My guess is that plenty of people will disagree with the framework of monetary maximalism and technology competition. That is fine with me. I’d love to hear the dissenting points of view. Plus, the market is the ultimate referee. If I’m right, I’ll see it in my portfolio. If I’m wrong, I’ll be financially hurt.

That is the beauty of a capitalistic society. I’m excited to see how it plays out. Hope each of you has a great start to your week. I’ll talk to everyone tomorrow.

-Pomp

SPONSORED: Unstoppable Domains allows you to replace cryptocurrency addresses with a single, easily-readable name like mine, Pomp.crypto. Instead of worrying about getting 1 character wrong in a long string of random letters and numbers, get your own Unstoppable Domain here.

THE RUNDOWN:

PayPal Brings Crypto Service to UK Customers: PayPal is extending its crypto service to the U.K., allowing customers to buy, sell and hold four different cryptocurrencies on its platform. Users will be able transact in bitcoin, ether, litecoin, and bitcoin cash for as little as £1 ($1.40), PayPal said. The rollout is the first expansion of PayPal's crypto offering outside the U.S. The process will begin this week and should be available to all eligible customers within the next few weeks. Read more.

Inside Afghanistan’s Cryptocurrency Underground as the Country Plunges Into Turmoil: Farhan Hotak isn’t your typical 22 year-old Afghan. In the last week, he helped his family of ten flee the province of Zabul in southern Afghanistan and travel 97 miles to a city on the Pakistani border. But unlike others choosing to leave the country, once his relatives were in safe hands, Hotak then turned around and came back so that he could protect his family home – and vlog to his thousands of Instagram followers about the evolving situation on the ground in Afghanistan. Read more.

How Bitcoin Is Preparing For An Explosive Bullish Break: On Saturday Benzinga ran a poll on Twitter asking whether people think Bitcoin would hit $50,000 this weekend. As of Sunday afternoon 71% of respondents chose ‘yes.’ Although Bitcoin may need a few days for further consolidation as the apex cryptocurrency looks to be preparing for another run north. Read more.

OKEx Establishes $10M Fund for GameFi Projects: Crypto exchange OKEx said it is launching a $10 million fund to help develop GameFi, or “play-to-earn,” projects. The cash will come from the exchange's $100 million OKEx BlockDream Ventures fund, which invests in blockchain projects, the company said. GameFi introduces financial mechanisms into games, allowing users to make money by playing. Read more.

Sweden’s Government Forced to Return $1.5M in Bitcoin to Drug Dealer: The Swedish government has been forced to return over $1.5 million in bitcoin to a drug dealer after its value surged while he was in custody. Authorities in Sweden seized 36 BTC from the drug dealer, worth just under $150,000 at the time of his prosecution two years ago, according to a report Friday by U.K. newspaper The Telegraph. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Graham Krizek is the Founder and CEO of Voltage, which provides simple bitcoin infrastructure to everyone.

In this conversation, we discuss the Lightning Network, how it works, why it is so valuable, current progress, the importance of infrastructure, and how products are leveraging Lightning.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Polymarket - Polymarket is the world’s leading information markets platform where you can trade on the most pressing global questions and see unbiased, real-time data on what the market thinks will happen – all on the blockchain. Will the US have more than 100,00 covid cases before 2022? For a limited time, sign up with referral code “Pomp” to get your first trade reimbursed up to $100. Click here to get started!

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Cosmos is building the Internet of Blockchains, marking a new era of interoperability, scalability, and usability. The free flow of assets and data between blockchains with bridges to Ethereum and Bitcoin will unleash the potential of DeFi, NFTs, and much more. Dive into Cosmos at cosmos.network/pomp

Choice is a new self-directed IRA product that allows you to buy Bitcoin with tax-advantaged dollars, while still holding your private keys. You can go to retirewithchoice.com/pomp to sign up today.

LMAX Digital - the market-leading solution for institutional crypto trading & custodial services - offers clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp2020” when you sign up for one of their metal cards today.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy bitcoin, ether, and over 30 other cryptocurrencies. Offering industry-leading security, insurance and uptime, Gemini is the go-to trusted platform for beginner and sophisticated investors alike. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

Amber - Invest, trade, swap, and earn crypto with Amber App, where new users can receive 16% APR on BTC, ETH, and USD Stablecoins! Click here to sign up now.

Bubble - Do you have a business idea you’ve been dreaming about, but don’t know how to actually start building it? Use Bubble’s drag-and-drop tool to develop custom, interactive, multi-user web apps in hours. Go to Bubble.io/pomp and the first 500 readers will get their first month free on any of Bubble’s paid plans.

Mask Network - The portal to the new, open internet. Building on top of the existing social networks, the Mask extension allows borderless cryptocurrency transfer, decentralized file storage and sharing, decentralized finance, and many other features that were once impossible to interact with on traditional social media. Visit mask.io/pomp and use the extension to start exploring the decentralized application world.

Okcoin - Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Matrixport - Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Go download the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

Masterworks - Masterworks.io is the leading platform for blue-chip art investing with over 185,000 registered users. They have purchased over $180MM in art from artists like Banksy, Basquiat and KAWS.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber.