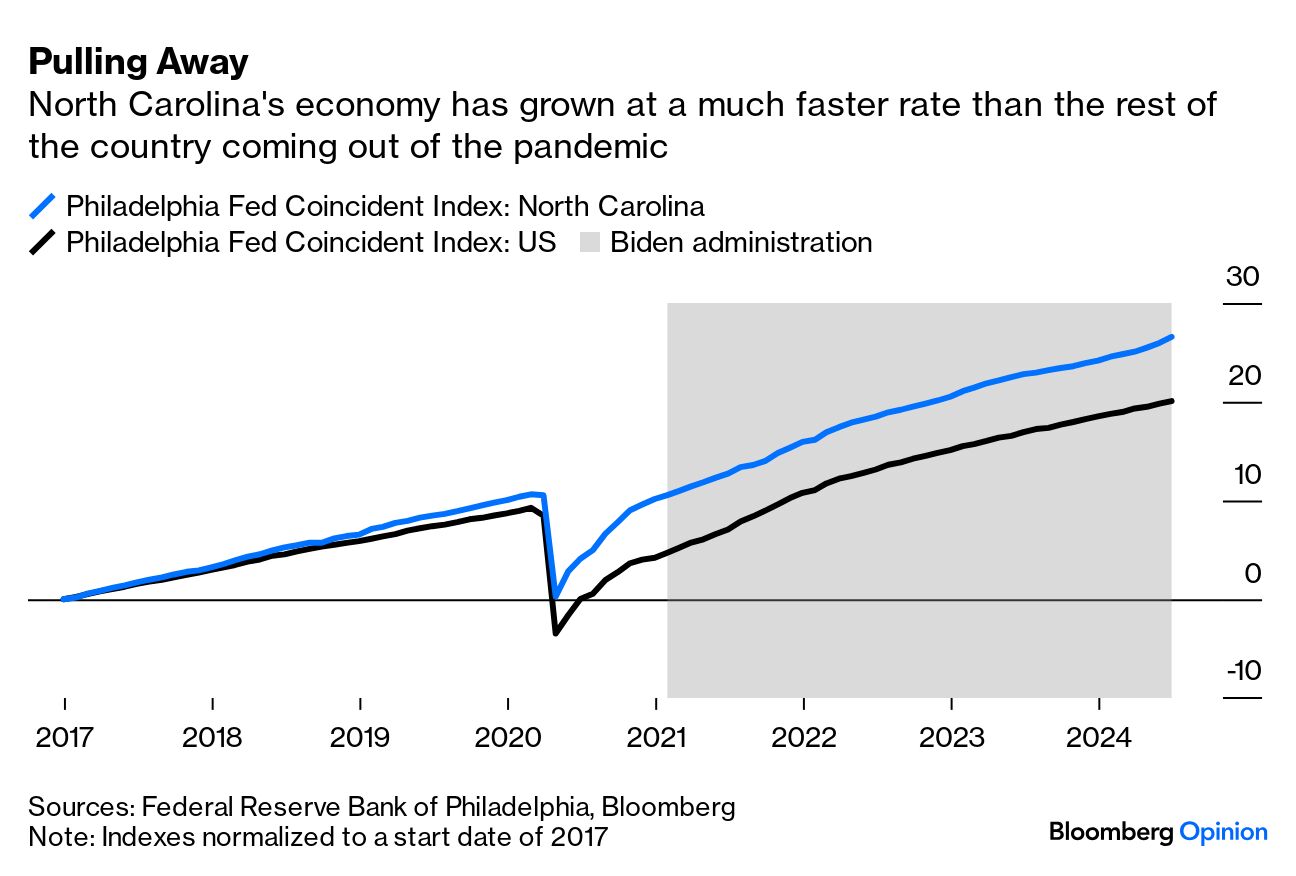

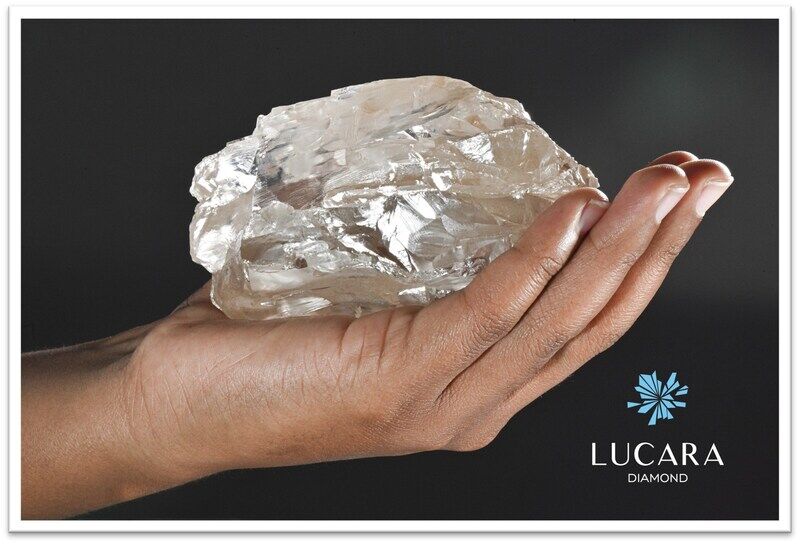

| The amount of cash in money-market funds has surged by more than $100 billion so far in August, pushing assets to a record as investors lock in lofty yields before the US Federal Reserve starts cutting interest rates. Much of the latest increase in money-market fund assets came from retail investors, which totaled $21.4 billion. Institutional investors added about $3.45 billion, offset by an exodus from the prime space—a response to a set of Securities and Exchange Commission regulations slated to take effect later this year, which has caused some funds to shutter and investors to shift around their allocations. —David E. Rovella Ever since President Joe Biden told Americans last month he wasn't running for re-election and endorsed Vice President Kamala Harris to succeed him, public opinion has shifted. For the first time, Democrats are leading in most of the seven so-called swing states—Arizona, Georgia, Michigan, Pennsylvania, Nevada, North Carolina and Wisconsin. Perhaps nowhere is the race for the Oval Office more transformed than in North Carolina, Matt Winkler writes in Bloomberg Opinion. The ninth-most populous state with almost 11 million people could deliver for Harris the way it did for Barack Obama. The issue for Harris, however, is that North Carolina's prevailing media narrative is no different from that other swing states, he writes. Which is to say, it omits the superior growth in gross domestic product, jobs and personal income the state has witnessed under Biden—something it never experienced under Donald Trump.  About those rate cuts. Just in case you’ve been on a desert island (without Wi-Fi) for the past few months, the Fed is indeed expected to start cutting rates in a few weeks, making it cheaper for companies and banks to borrow money while leaving investors happy and savers glum. Just for affirmation, two central bank officials said from the economic conclave in Jackson Hole, Wyoming, on Thursday that they believe it’s appropriate for the Fed to begin lowering interest rates soon, and that the pace of subsequent cuts should be “gradual” and “methodical.” The developed world’s top central banks are entering new territory: For the first time, they’re engaging in joint quantitative tightening. Last month’s decision by the Bank of Japan to steadily shrink its portfolio of bond holdings in coming years means it’s now engaging in balance-sheet contraction alongside the Fed, European Central Bank and Bank of England. While QT is different in each jurisdiction, it involves a withdrawal of the liquidity that central bankers pumped into their economies during the pandemic crisis by buying bonds. When the Fed conducted QT for the first time, policymakers were blindsided by unanticipated disruptions to money markets. While Chair Jerome Powell has said the Fed learned its lesson and pledged a halt before trouble emerges, there’s no guarantee of smooth sailing. Thailand became the first country in Asia to detect the new mutated strain of the mpox virus, as the pathogen spreads to more regions since the World Health Organization declared the outbreak in Africa a new global health emergency. The patient who tested positive was a European male who arrived in Bangkok last week from Africa. The newer strain—with a fatality rate of 3%—has been spreading across several African countries and is reported to have killed more than 500 people in the Democratic Republic of Congo. Children and adolescents are also getting sick, with known fatal cases exceeding 60% among patients under the age of 5. BMW pulled ahead of Tesla and led Europe’s electric-vehicle market for the first time last month, extending the German carmaker’s strong run of growth as other manufacturers struggle. Sales of fully electric BMWs in the bloc jumped by more than a third. Tesla’s registrations declined 16%. Tesla is ceding market share in Europe to the likes of BMW and Volvo. European auto buyers registered a total of 139,300 new EVs last month, down about 6% from a year ago. Canada’s two biggest railways shut down early Thursday after talks with union leaders failed, immediately blocking arteries of North American supply chains that carry about C$1 billion ($740 million) per day in trade. More than 9,000 employees at Canadian National Railway and Canadian Pacific Kansas City were locked out after a deadline passed without an agreement on a new contract. Members of the Teamsters Canada Rail Conference had voted to strike over a number of issues, including scheduling and worker fatigue. A massive 2,492-carat diamond—the second-largest stone ever unearthed—has been recovered from a mine in Botswana. The stone, found at the Karowe mine that’s run by Canada’s Lucara Diamond, isn’t that much smaller than the 3,106-carat Cullinan Diamond, the world’s largest, which was discovered in South Africa almost 120 years ago.  A 2,492-carat diamond from the Karowe mine in Botswana Source: CNW Group/Lucara Diamond Corp. If you gaze at the just-announced Ming 20.01 Series 3 watch in normal daylight, you’ll easily observe the minute and hour hands. A continued inspection might reveal the chronograph feature, and watch aficionados may very well detect the instantaneous jumping minutes feature. But turn off the lights and you’ll be met with a visual effect unlike anything you’ve seen before. A glowing array of tiny shapes seems to float between the hands and the mechanical components in the case underneath. Altogether, it looks like a spiral galaxy that’s been paused midswirl.  The Ming 20.01 Series 3 in the dark. Photographer: Ming Thein/Horologer Ming Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily. Bloomberg Screentime: The entertainment landscape is shifting rapidly. Cable empires are crumbling, streaming giants face new challenges and innovative forces are rising. Join our resident entertainment expert Lucas Shaw on Oct. 9-10 in Los Angeles for an unparalleled experience traversing the future of media. Network with industry titans, immerse in live experiences and enjoy a curated collection of local eats. Get your tickets today. Learn More. |