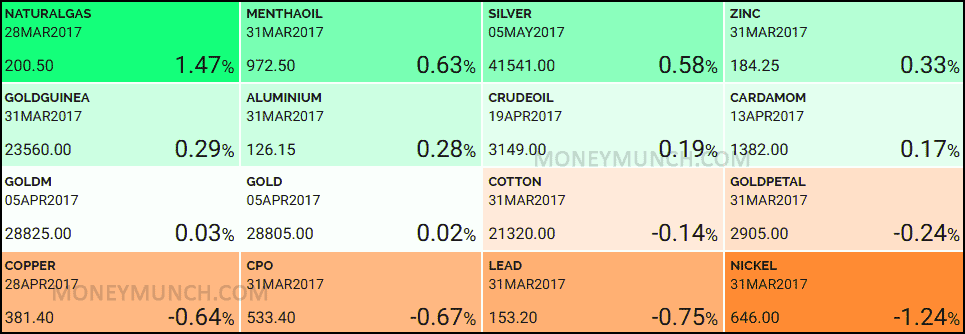

We have mentioned many times in previous newsletters, “COMEX volatility because of political uncertainty”. Do you know, three trillion dollars gained in the U.S. markets after U.S. election? Major commodities were up last week. 0.25% interest rates risen last week and gold futures increased 2.67% & silver futures increased 2.75%!

Since March beginning crude oil future was declining but it had slightly recovered 1.16% on last week. The noticeable thing is crude oil future price doesn’t impact much on MCX energy sector black oil. And the interesting thing is MCX Natural gas moving upside like a boss!