Crude Oil is Starting 2018 Strong but there’s Undeniable Risk to the Downside

Since 4000 level, I’m recommending to buy crude oil. Almost in last 20 publication mentioned buying. You may explore it by visiting this link: Click Here

Since 4000 level, I’m recommending to buy crude oil. Almost in last 20 publication mentioned buying. You may explore it by visiting this link: Click Here

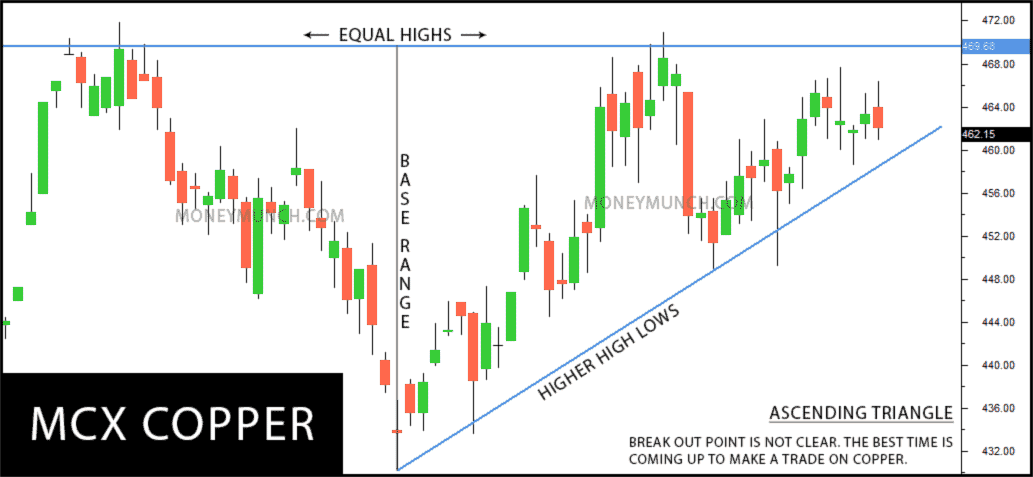

But now, day by day volatility is increasing. My last target is 5000 level. While it was running at 4385, I had written to buy for 4700 – 5000 level on April 15, 2018 article. The crude oil price increases total 848 rupees in 6 weeks.

How many of you bought the crude oil stocks? Do you know, technical indicators are indicating downward on Crude Oil WTI Futures stocks? But the buying pressure is increasing too. What will happen in this week?

To know, subscribe our premium service now.