This is NSE equity daily chart of DABUR India.

MoneyMunch.com |  |

- If we found long term buyers on DABUR, … enter!

- Part III: Weekly Analysis of Crude oil

- MCX Trading Alerts: Silver, Natural gas & Zinc

| If we found long term buyers on DABUR, … enter! Posted: 08 Apr 2019 12:08 PM PDT |

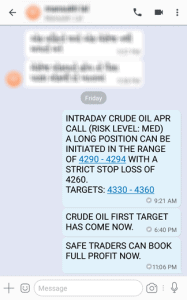

| Part III: Weekly Analysis of Crude oil Posted: 08 Apr 2019 02:59 AM PDT

The second target of crude oil has come (Profit Rs.25,000/lot). Even our premium subscribers are also in buying since 24 March. Do you think it will touch the 4500 levels before this weekend? Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post Part III: Weekly Analysis of Crude oil appeared first on Moneymunch. |

| MCX Trading Alerts: Silver, Natural gas & Zinc Posted: 08 Apr 2019 12:55 AM PDT Is Now The Right Time To Invest In Silver?

But this is not an assured confirmation for the uptrend. Yes! A downtrend can be confirmed if silver breakout the support level and close below it consecutively. And this downfall can drag down the silver’s price up to 36600 – 36200 – 36000 – 35800 levels. Note: a sideways trend will continue between 38000 to 37200 range. An Uptrend will confirm after breakout 38000 level. Don’t think much about downtrend. It’s time to focus on Intraday trading.

Should we keep selling Natural gas?Yes! But after 182.6 level. Complete breakout will require.

Important note for Zinc tradersAs per the last Zinc forecasts, it has touched all levels. It’s very close to the all-time high (232.7 level). Short-term/long-term investors must wait now. This week, we might see above the 230 level with sideways movements. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post MCX Trading Alerts: Silver, Natural gas & Zinc appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |