Do you remember our last Research on PEL? This stock was bought by us and CMP 1700 +. Its was Free research.

MoneyMunch.com |  |

| Short or Long will fill your pocket on TVSMOTOR? Posted: 22 Oct 2019 12:39 AM PDT The following patterns have been found,

We are seeing an excess at the demand line from which can be certain that a small excess can be found on the supply line. Resistance for TVS motors between 466-472 range. If anything does not change fundamentally due to this and next week, this stock will take reversal toward 418-400. Let move for closer look and trend. On the daily chart, Total 3 patterns have been plotted by this TVS MOTOR which is following,

The Price rotation and Tails are important roles to identify the change in it. Presently, the stock price is in a channel with the supply line, therefore we are expected Tail or Overlapping at the value high. Focus on volume, the volume is rising with price. If the volume will continue to raise then, we can see up-break out with targets 498-505 but the resistance 463-468 for short sellers and profiting for targets 428-411. We are seeing an excess at demand line from which can be certain that a small excess can be found on the supply line. Resistance for TVS motors between 466-472 range. If anything does not changes fundamentally due to this and next week, this stock will take reversal toward 418-400. The post Short or Long will fill your pocket on TVSMOTOR? appeared first on Moneymunch. |

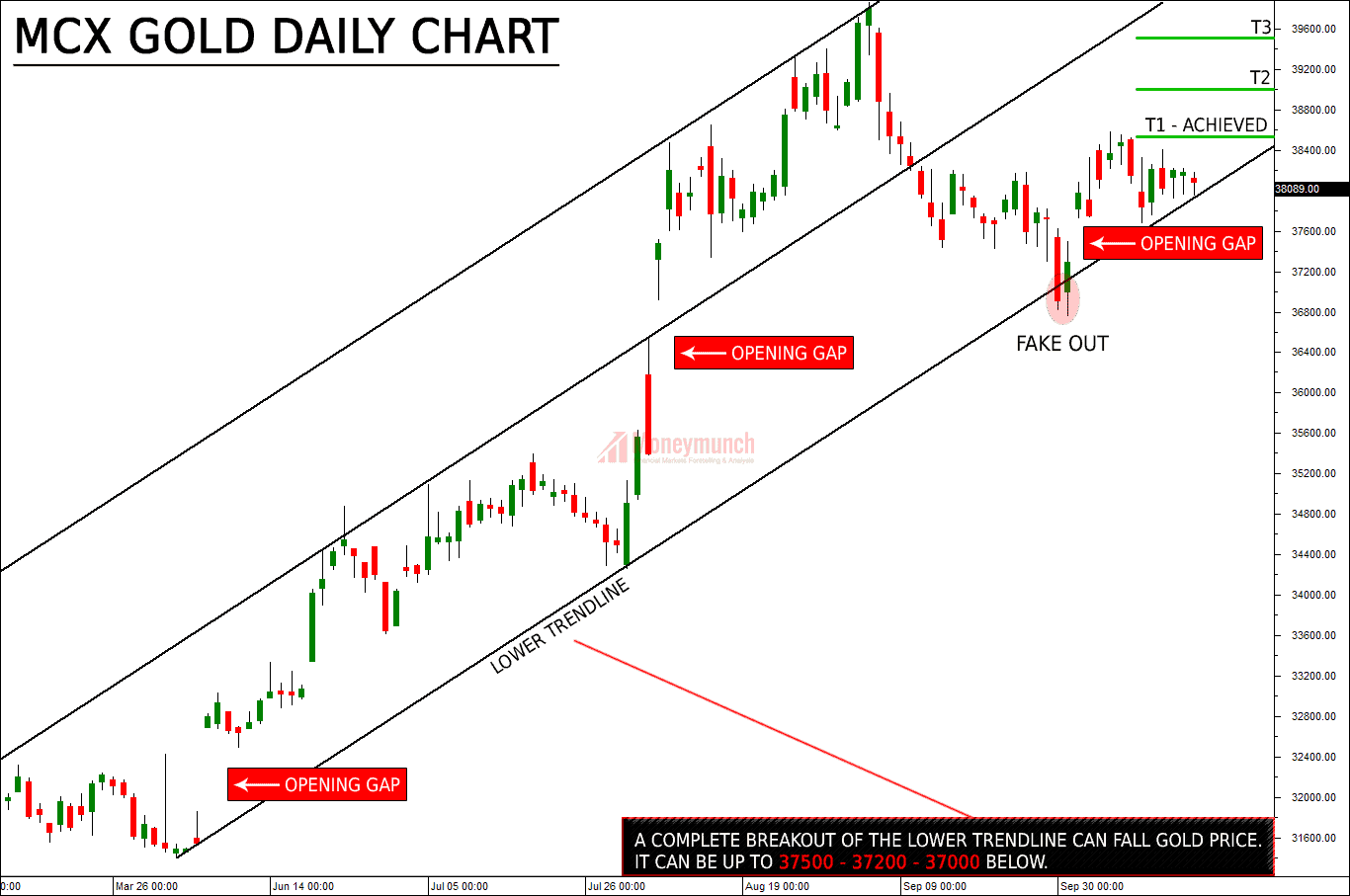

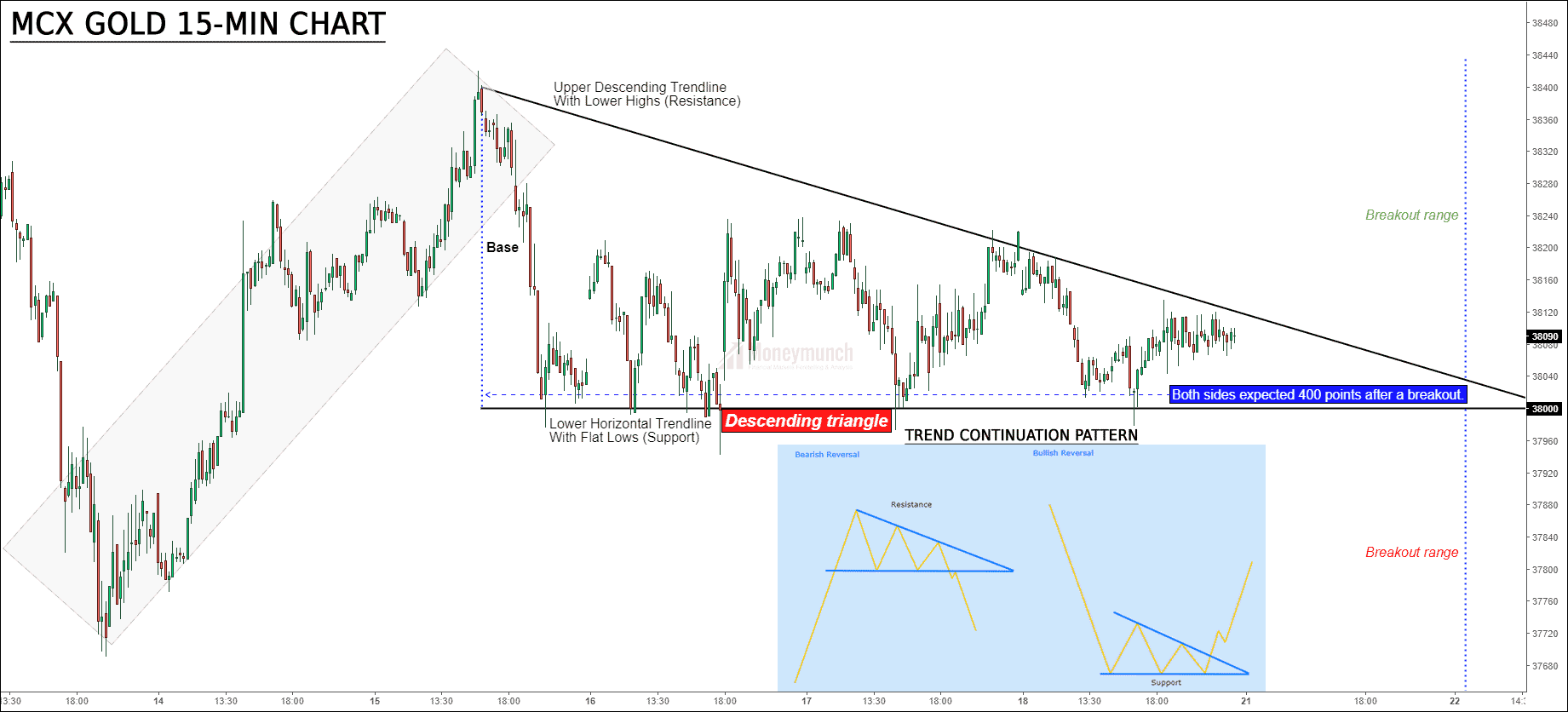

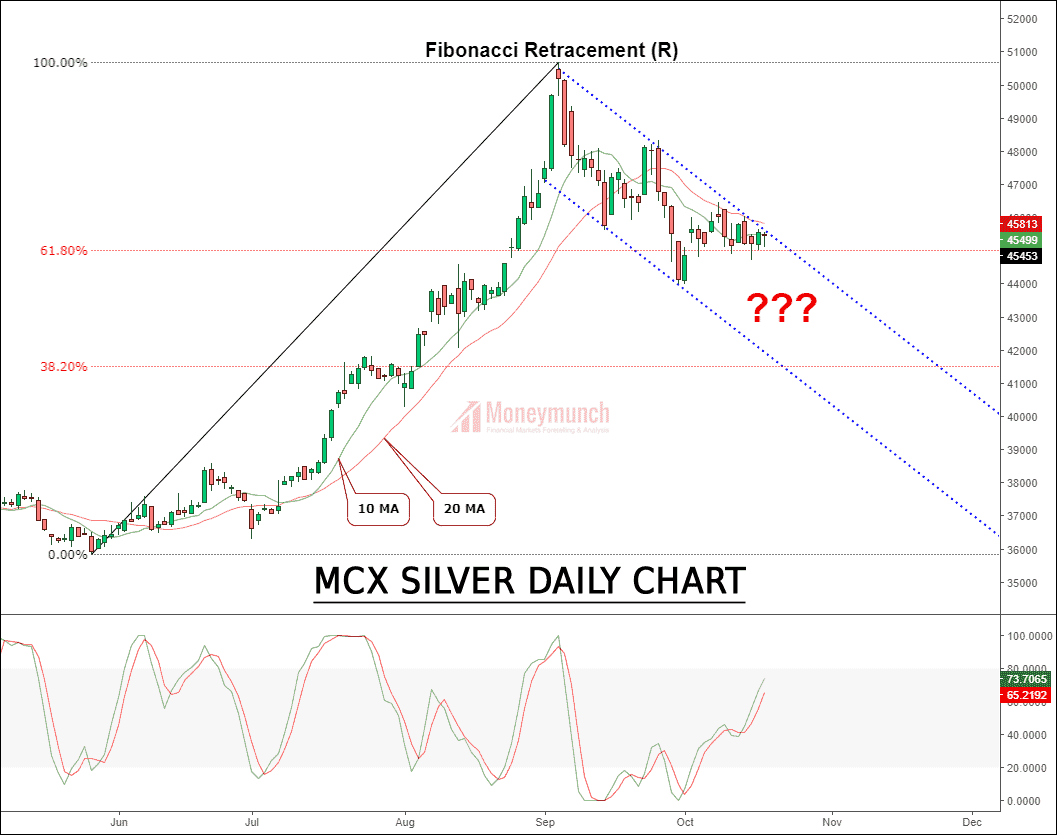

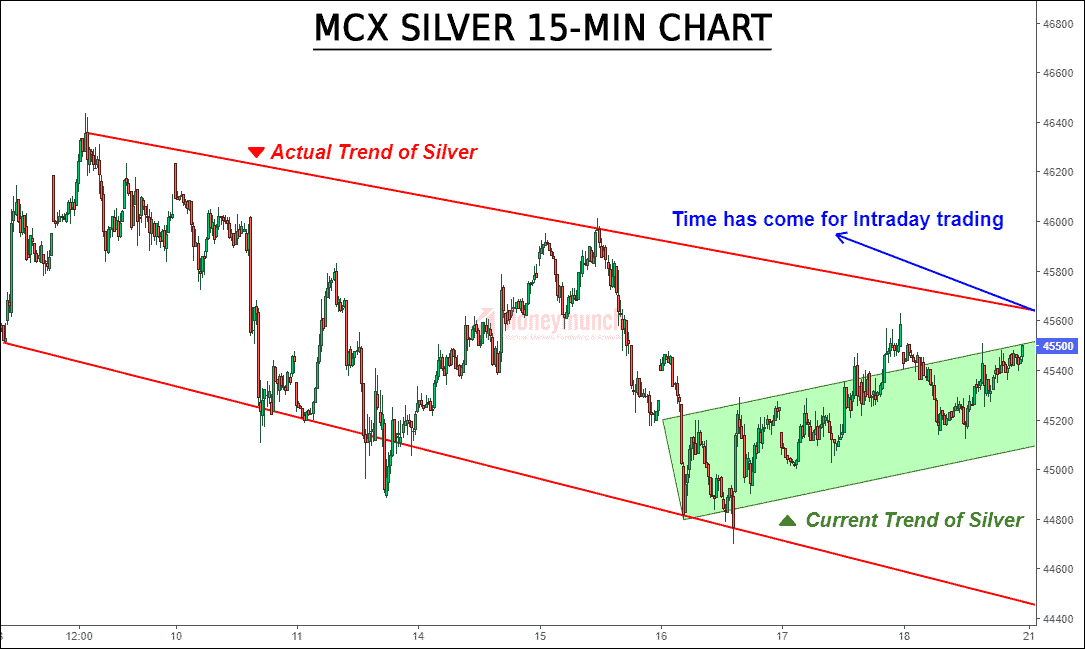

| These Charts Will Confirm MCX Gold & Silver Next Move Posted: 21 Oct 2019 03:59 AM PDT Special report: MCX Gold Tips & ChartsGold prices are moving as per my chart update since August month. If you missed, read the following calls.

The gold is following the lower trendline since March 2019. See the below chart: A clear picture of Gold Trend is here: Here is the key of Gold 400 points (Rs.40,000/L). Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post These Charts Will Confirm MCX Gold & Silver Next Move appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |