MoneyMunch.com |  |

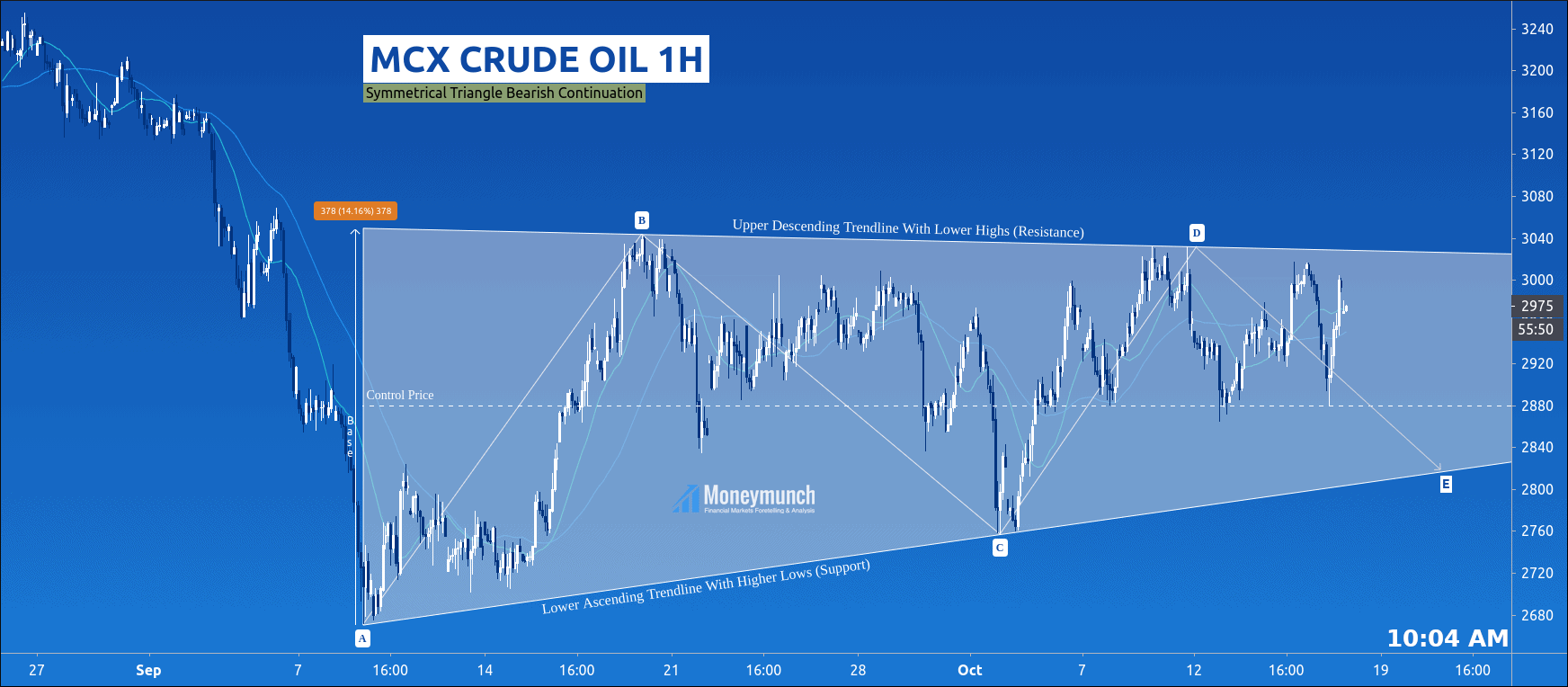

- MCX Crude Oil Hourly Charts In-Depth Analysis

- Complete market cycle of Elliott wave over the NIFTY:

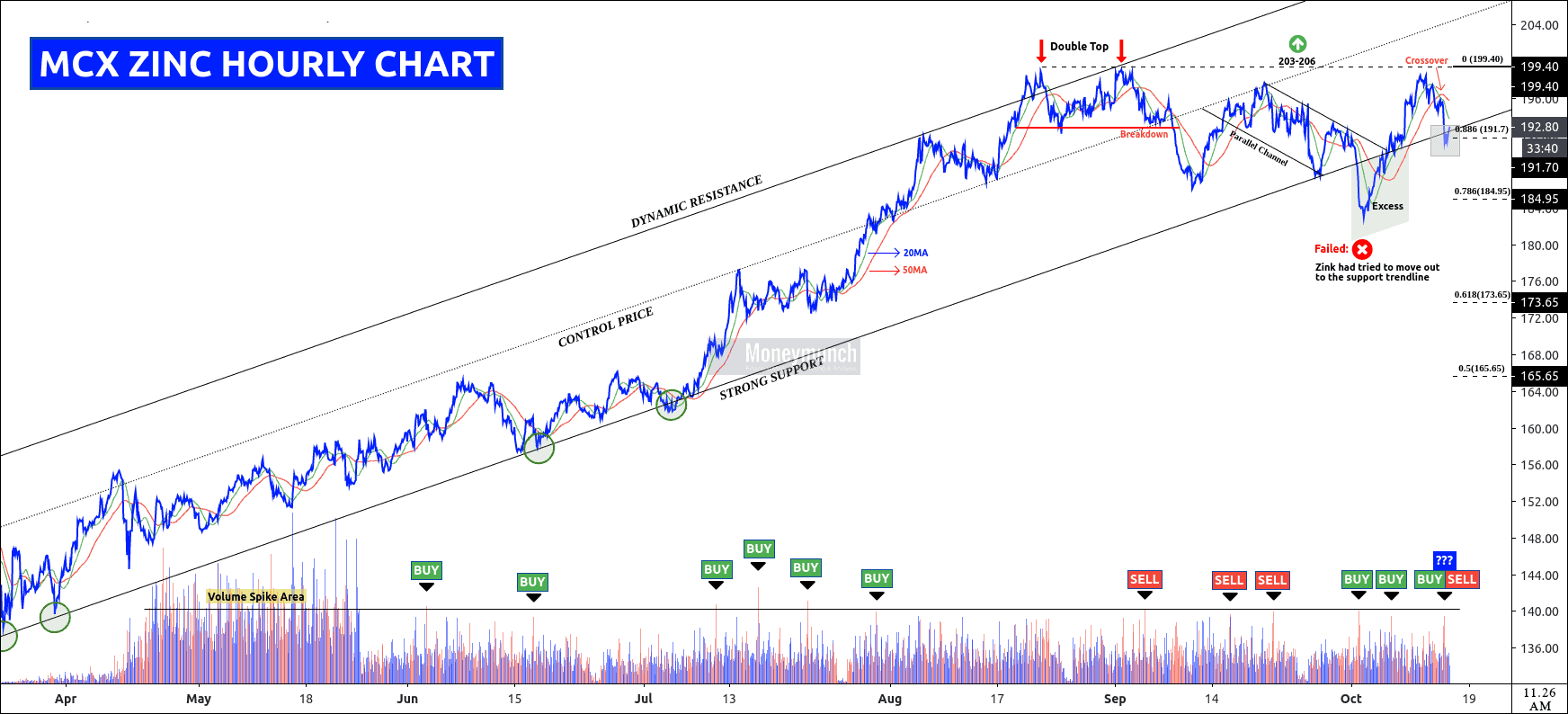

- MCX Zinc Ready For Another Rally Attempt

| MCX Crude Oil Hourly Charts In-Depth Analysis Posted: 15 Oct 2020 10:09 PM PDT FOR THE DAY TRADERS: Intraday traders can sell or buy based on control price. The last expected stop is at E. So, we may see crude oil at/below 2840 – 2820 level. FOR SHORT-TERM INVESTORS: Upper breakout’s targets: 3130 – 3200 – 3280+ Beware to tail, fakeout, and excess. Accurate entry-level, target and stop-loss is available for the premium members only. Base Metals Trading Calls Update: MCX Zinc Ready For Another Rally AttemptYesterday I had an updated intraday trading call on Zinc. It has made a high of 194.55 level and closed at 194.35. Will it reach the first & second target or not? Bullion Update: MCX Silver’s Next Target 65200 by the Elliott WaveI had updated an intraday call on the silver the day before yesterday while its price was running nearby the 61500 levels. It has reached the first target before collapsing. So, what are you expecting ahead? Will silver hit the next targets or keep falling? To get more information about MCX Trading Alerts, subscribe now. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post MCX Crude Oil Hourly Charts In-Depth Analysis appeared first on Moneymunch. |

| Complete market cycle of Elliott wave over the NIFTY: Posted: 15 Oct 2020 03:59 AM PDT

I have described the complete market cycle of Elliott7653 on the weekly chart of nifty as well as two model structural development which are Motive and corrective. Now that I’ve reviewed all types of waves, I can summarize their labels as showed in the nifty chart. The post Complete market cycle of Elliott wave over the NIFTY: appeared first on Moneymunch. |

| MCX Zinc Ready For Another Rally Attempt Posted: 14 Oct 2020 11:16 PM PDT Zinc is going upward since April. Recently, it has broken the strong support trendline and made an excess. At present, it’s running at a strong support line. So what are you expecting next? Technically, the crossover of 20 & 50 MA indicating a downtrend ahead, and multiple volume spikes are a direct sign for an uptrend. Simple Trading Strategy for the Intraday Traders:The day traders can keep buying above 0.886 value of retracement for the target of 194.6 – 196 and above. Breakout of 199.4 means boom..!!! It can fly from there for 203 – 206 levels. According to the Fibonacci retracement & moving average, zinc will collapse soon to the value of 0.786. So, short-term investors can go for 185 levels. Further information I will update to premium subscribers via Moneymunch’s mobile app. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post MCX Zinc Ready For Another Rally Attempt appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |