MoneyMunch.com |  |

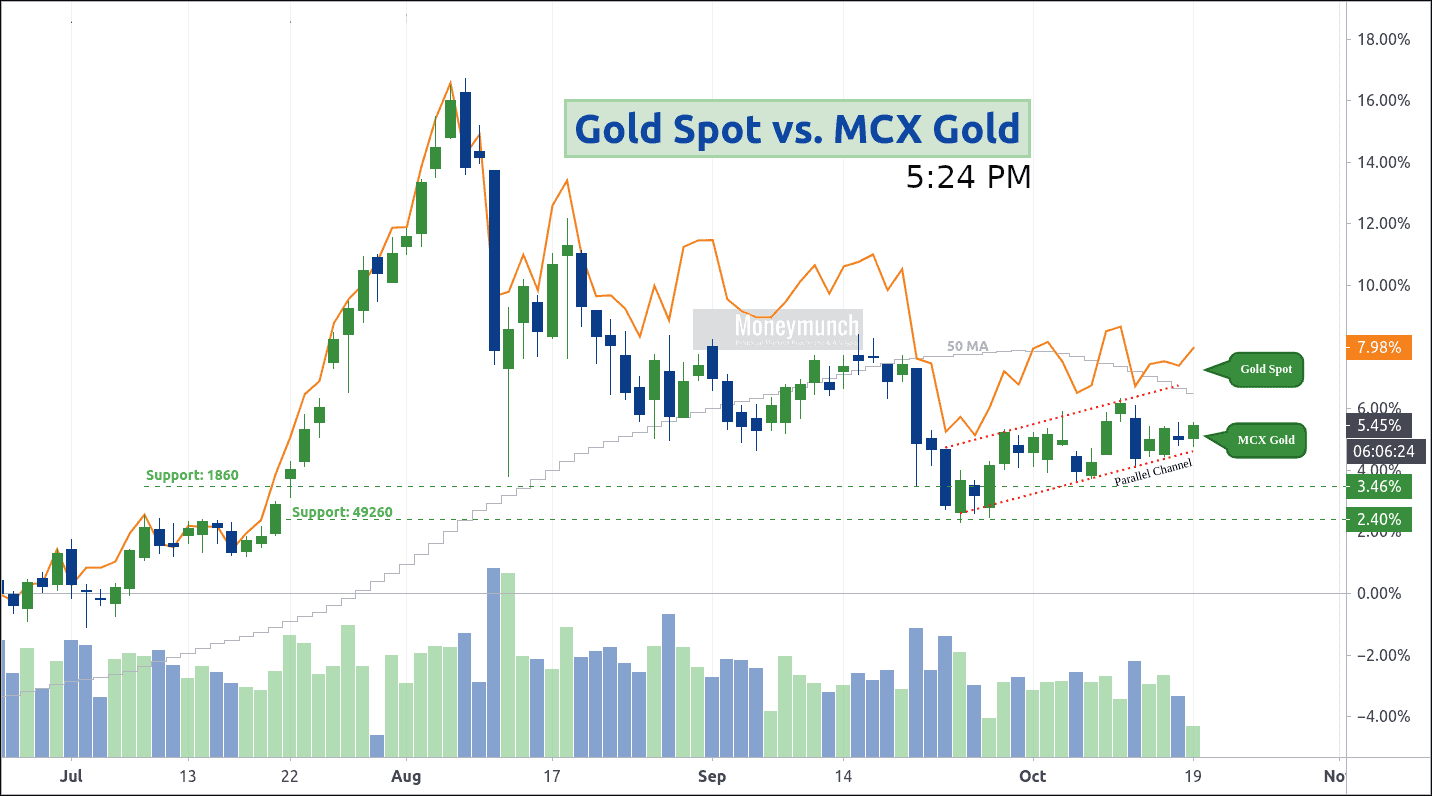

| Gold Spot vs MCX Gold – Weekly Reports & Tips Posted: 19 Oct 2020 05:22 AM PDT Here I have compared Gold Spot (CFD) with Indian MCX Gold to identify this week’s trend. In the chart, there are two different support levels. Wherein support level 1860 is for gold spot, and 49260 for the MCX gold. I have used moving average and volume on Indian gold. At present, 50 MA is turning downside. If it breaks the parallel channel (PC), gold will fall for 50000 – 49860 – 49500 levels. According to this chart, gold is trying to climb upward after hitting the PC. And if it remains into the PC, we may see 51000 – 51500+ levels before the weekend. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post Gold Spot vs MCX Gold – Weekly Reports & Tips appeared first on Moneymunch. |

| The price moving towards the FIVE Wave in bulls market NIFTY! Posted: 19 Oct 2020 04:24 AM PDT FIRST Wave: (Leading Diagonal Contracting) SECOND Wave: (The 50% Retraced) THIRD Wave: (Impulsive and Extended) FOUR-Wave used Technique : (of Channeling to determine Five Wave) FIVE Wave: (Price is currently toward this wave) The post The price moving towards the FIVE Wave in bulls market NIFTY! appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |