MoneyMunch.com |  |

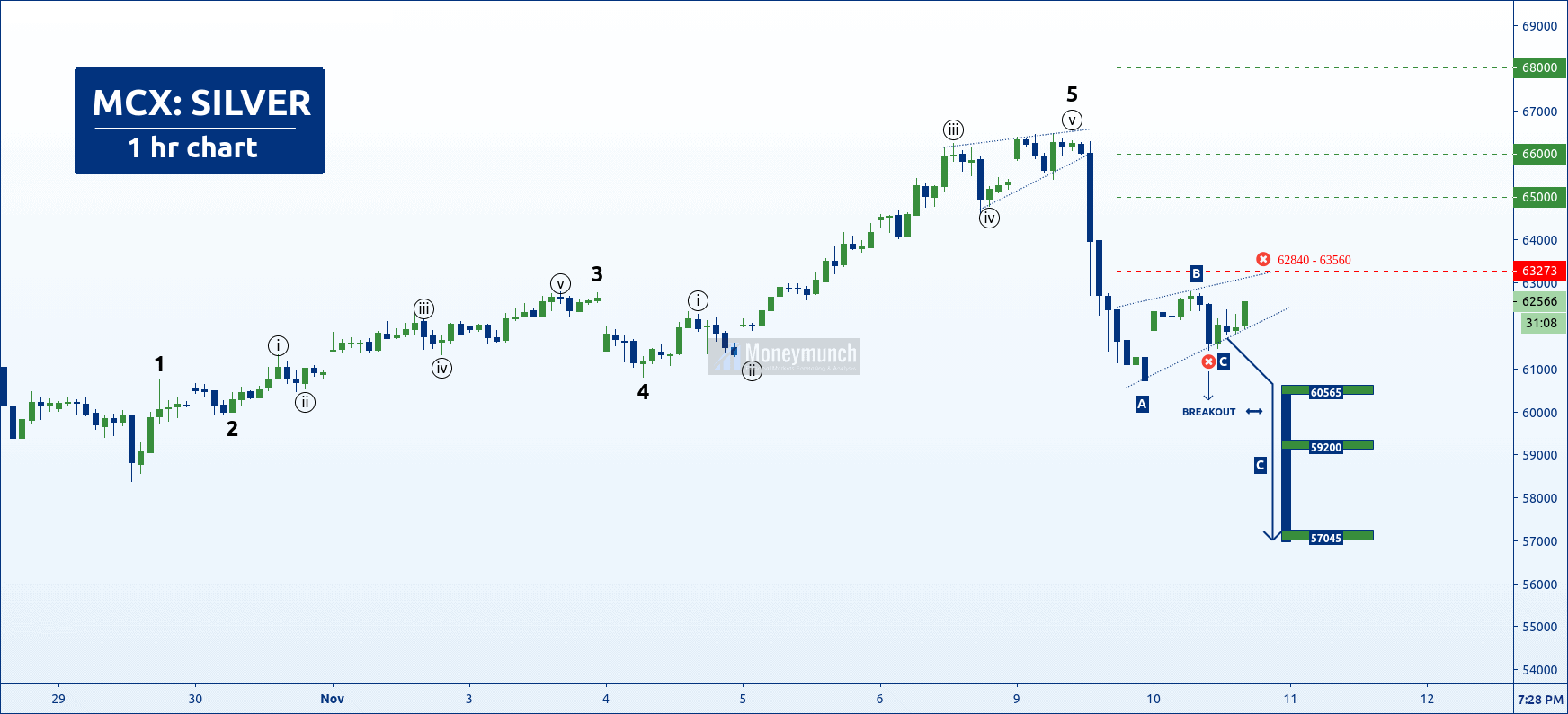

| Elliott Wave Vision on MCX Silver Posted: 10 Nov 2020 06:42 AM PST Silver made a bullish Elliott wave . The fifth wave is including a diagonal. After the fifth wave, there is an ABC correction. Silver can move upside to 62840 – 63560 levels. Expected C range: 60565 – 59200 – 57045 The correction will over at 63560 to change the current trend. And upside rally will resume for the levels of 65000 – 66000 – 68000+. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post Elliott Wave Vision on MCX Silver appeared first on Moneymunch. |

| Posted: 10 Nov 2020 01:18 AM PST This defined the 12798 area as critical short-term resistance. It is important to note that the stock reversed after the AB=CD completion point will test. Although the BC projection was an important calculation within the PRZ of the pattern, the completion of the equivalent AB=CD structure was the defining limit. The chart of the price action in the PRZ shows the near-perfect reversal just the PRZ at 12798 nearby expecting… I outlined that important level is at 12798 and Terminal Bar will decide for reversal confirmation. I have mixed use Breakdown + Elliott Modied Basic Rules… The post AB=CD at 12798 for NIFTY. appeared first on Moneymunch. |

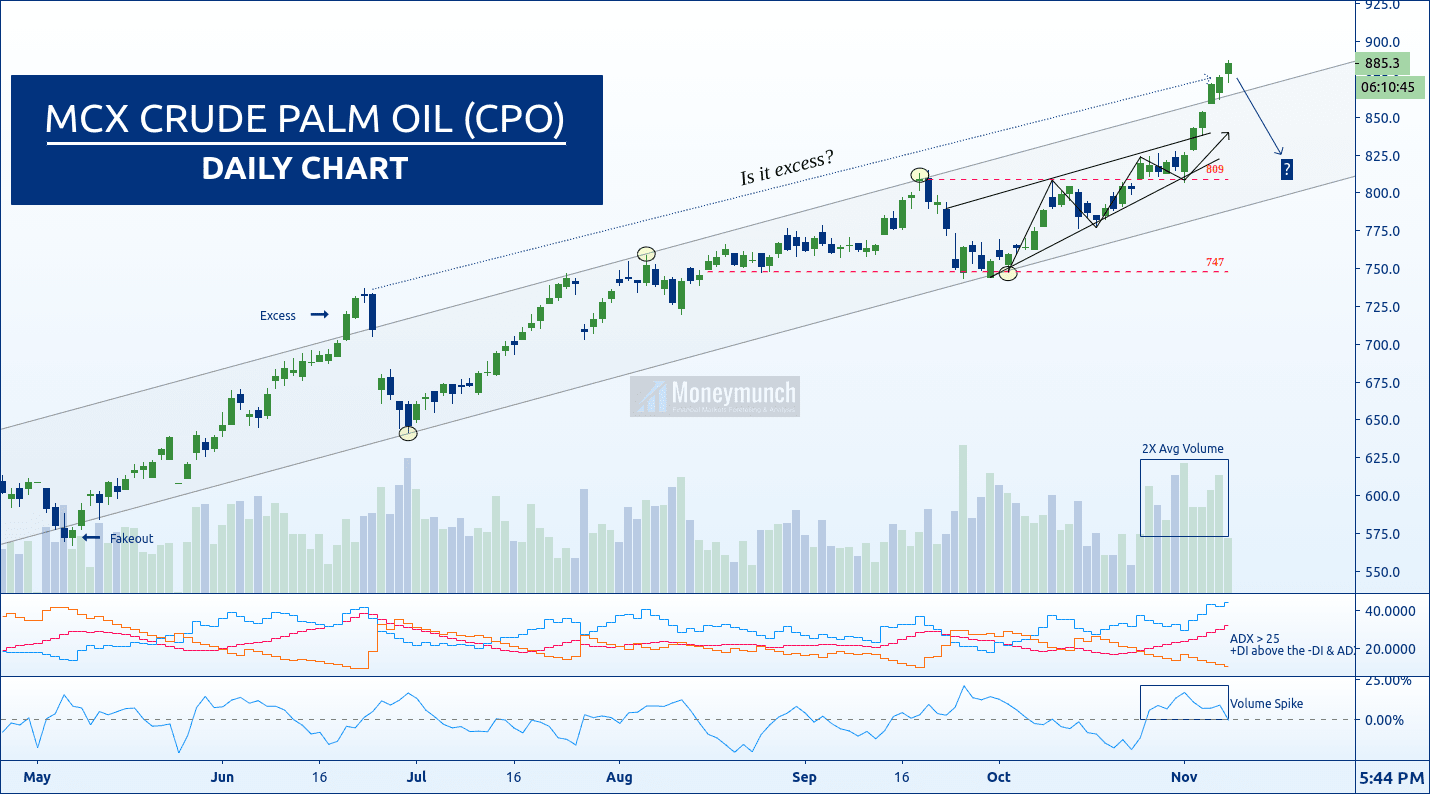

| Will MCX Crude Palm Oil touch the 900? Posted: 09 Nov 2020 04:37 AM PST Currently, MCX Crude Palm Oil (CPO) shows an uptrend. By following the ADX , we can say that the trend will rise because ADX is greater than 25 (ADX>25), and +DI is above the -DI. Right now, the trend is crossing the parallel channel. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post Will MCX Crude Palm Oil touch the 900? appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |