MoneyMunch.com |  |

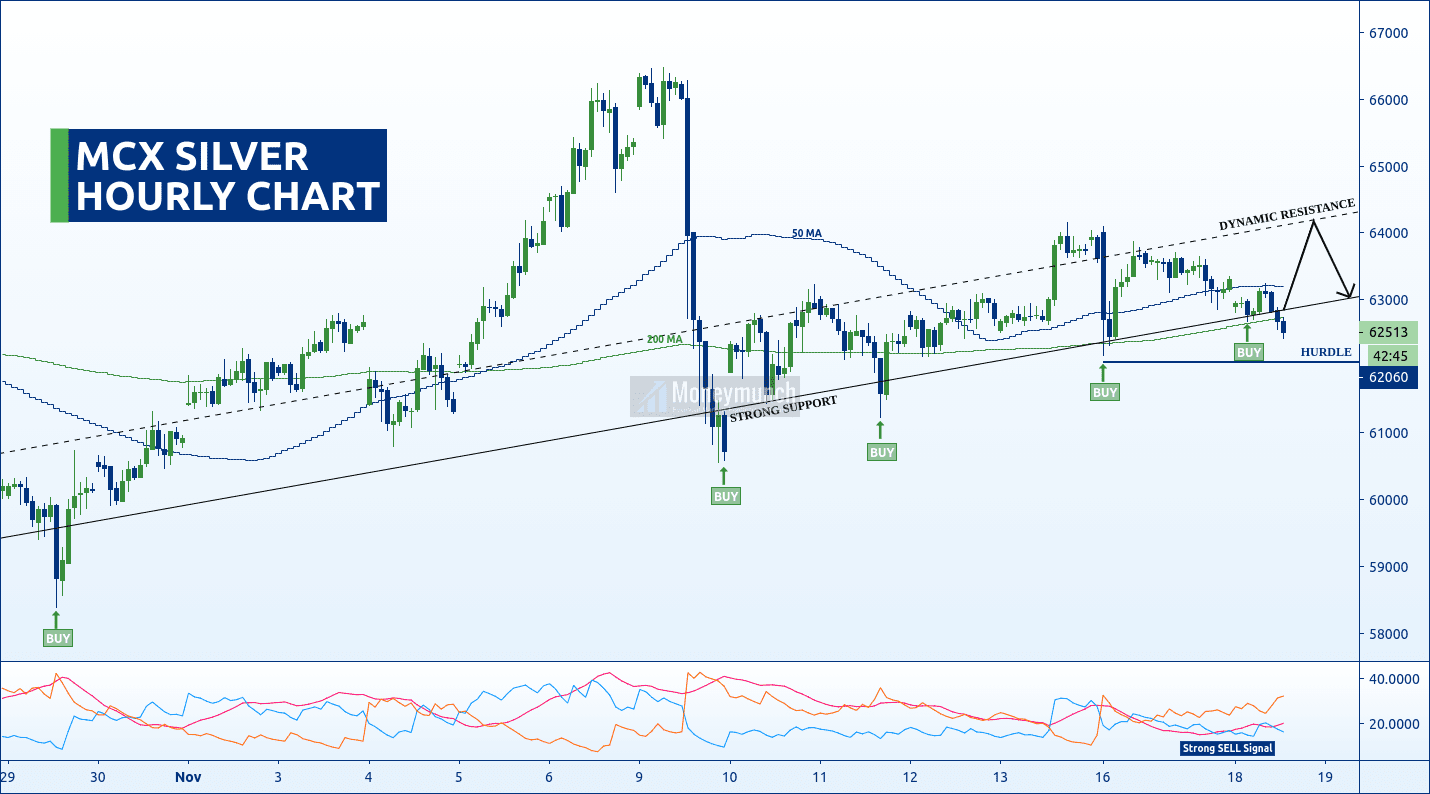

| MCX Silver Trading Strategy for the Intraday Traders Posted: 18 Nov 2020 04:08 AM PST Silver is growing slowly. According to this chart, silver is trying to move upside from the strong support trendline. It’s a potential reversal point based on a support trendline. Currently, it has broken a strong support trendline. We have chances to see a tail, fakeout, or excess here. That can be up to a hurdle. And the hurdle breakout is a direct sign of a downtrend. After all, 200 MA is recommending further advance here. So, we can pick the silver mega lot for the targets of 63000 – 63360 – 63660 – 64000+. Safe traders can wait for a 50 MA breakout before entering as well. If You Own MCX Copper, Look Out Below

On 16 Nov trading session, copper has made a high of 551 and touched the first two targets. Click here: Will MCX Crude Palm Oil touch the 900?

Currently, CPO is running nearby 926 levels. Accurate entry level, stop loss, and targets are available for premium members only. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post MCX Silver Trading Strategy for the Intraday Traders appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |