MoneyMunch.com |  |

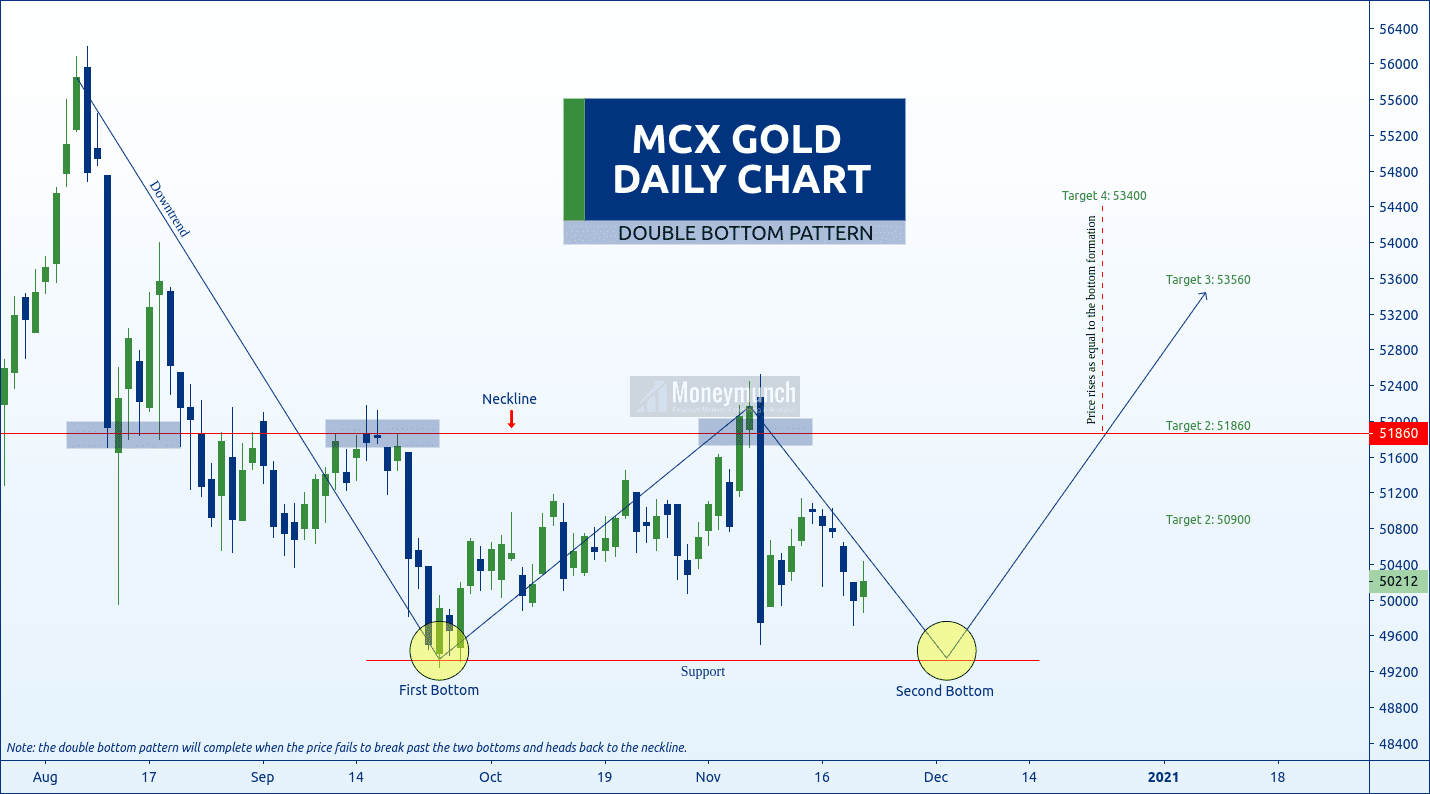

| MCX Gold Double Bottom – Potential Reversal Posted: 21 Nov 2020 05:26 PM PST In the last two weeks, MCX gold has lost -2003 points. We may see a continued downtrend up to the support line (Range: 49600 – 49200). Intraday traders can play between freefall by taking it as a target. As mentioned in the chart, the double bottom pattern will complete when the price fails to break past the two bottoms and heads back to the neckline. Short-term targets: 50900 – 51860 But if gold fails to complete the double bottom pattern by breaking the support line, we may see continue downward movements. And the gold price will come at/below 48760 – 48000 levels. If it happens, I will update you ASAP. Subscribe to get accurate entry-level, stop loss, and targets during the market hours. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post MCX Gold Double Bottom – Potential Reversal appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |