MoneyMunch.com |  |

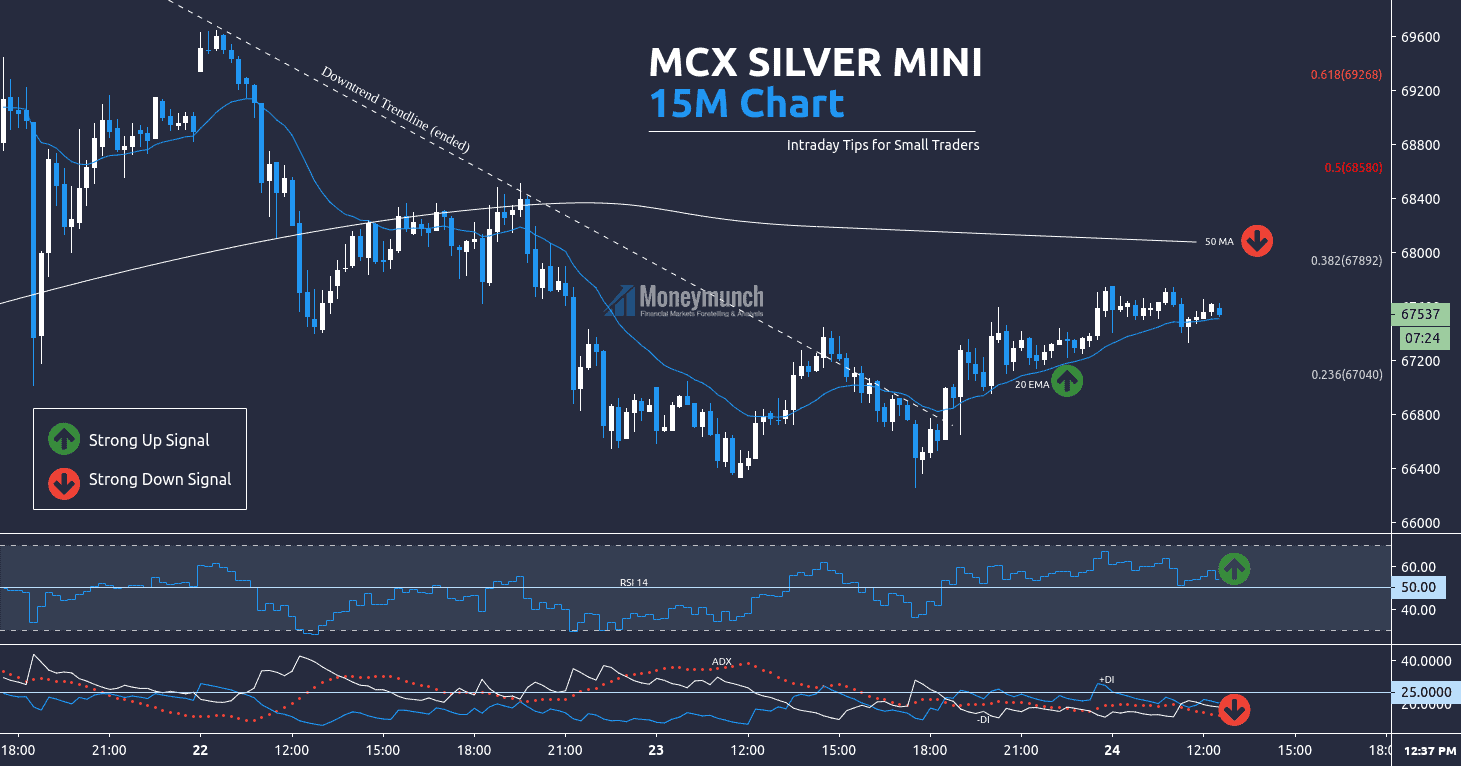

| MCX Silver: Intraday trading strategy & tips Posted: 23 Dec 2020 11:24 PM PST This is MCX Silvermini 15 minutes chart. I have used here moving average, Fibonacci, DMI, and RSI. Fib Levels: T 71496 and B 65664 Silver will try to touch 0.382 (67892) from here. It will act as resistance. Moreover, there is a 50 MA. If silver breaks both, it will fly from there and touch 68580 levels. Intraday traders can play between it. But if it takes a U-turn from 50 MA and breaks the 20 EMA, be ready for the following targets: 67060 – 66600. Should you buy or sell now? Do you want MCX calls by message with accurate entry-level, targets, and stop-loss? [LAST CHANCE] Subscribe now and get 50% OFF on commodity pricing plans: click here → This special offer will end today. A few hours left, hurry up! Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post MCX Silver: Intraday trading strategy & tips appeared first on Moneymunch. |

| Posted: 23 Dec 2020 10:08 PM PST The “Bat pattern” incorporates the 0.886XA retracement, as the defining element in the Potential Reversal. By keeping stop-loss as 13747 sell NIFTY, TARGET can be 13536 2nd target 13403 or still down. The post The Bat Pattern on the NIFTY: appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |