MoneyMunch.com |  |

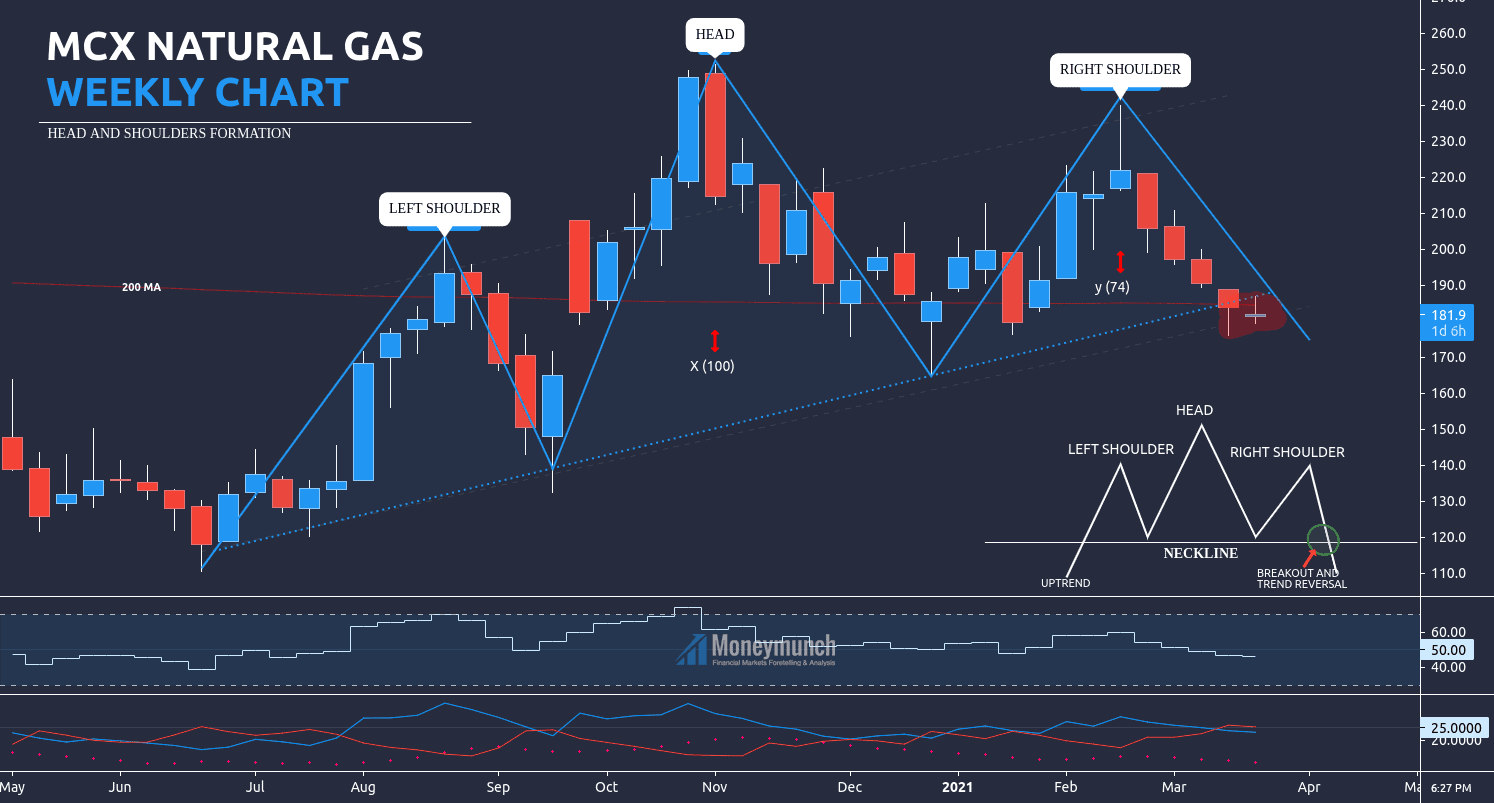

| MCX Natural Gas Head and Shoulders Trading Setup Posted: 25 Mar 2021 06:20 AM PDT Natural gas Head and Shoulders Suggesting Price CrashMCX Natural gas has made head and shoulders patterns on the weekly timeframe. And the two shoulders are overlapping. Sell confirmation is line breakout. Recently, it has broken 200 moving average. If it shows closing price below the neckline and 200 MA consecutively, NG will fall nonstop. X and Y are the formation’s size. Here is the value of x 100 and y 74. So, according to H&S formation, it can collapse up to 112 – 86. Hurdle: 196 Here are H&S, RSI, MA, and DMI throwing sell signals. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post MCX Natural Gas Head and Shoulders Trading Setup appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |