MoneyMunch.com |  |

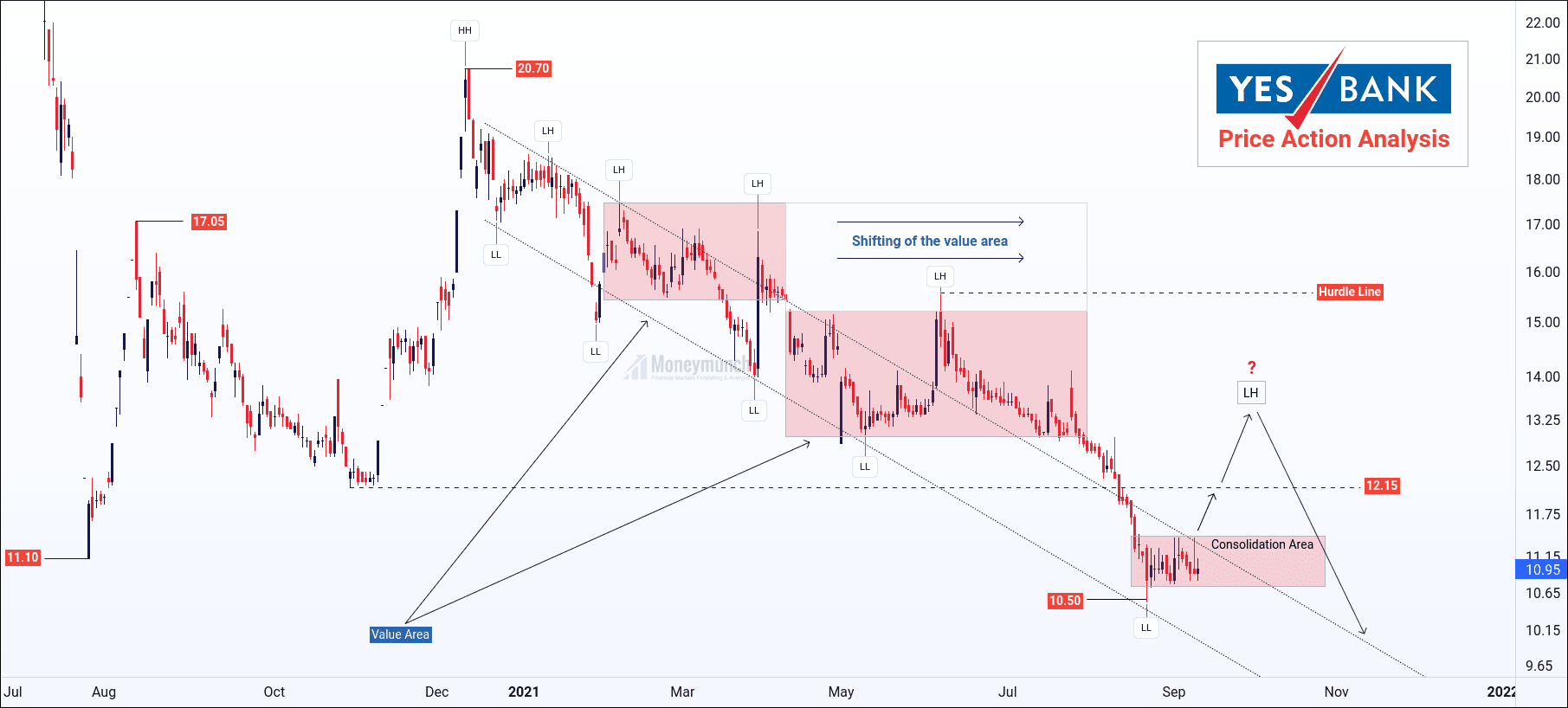

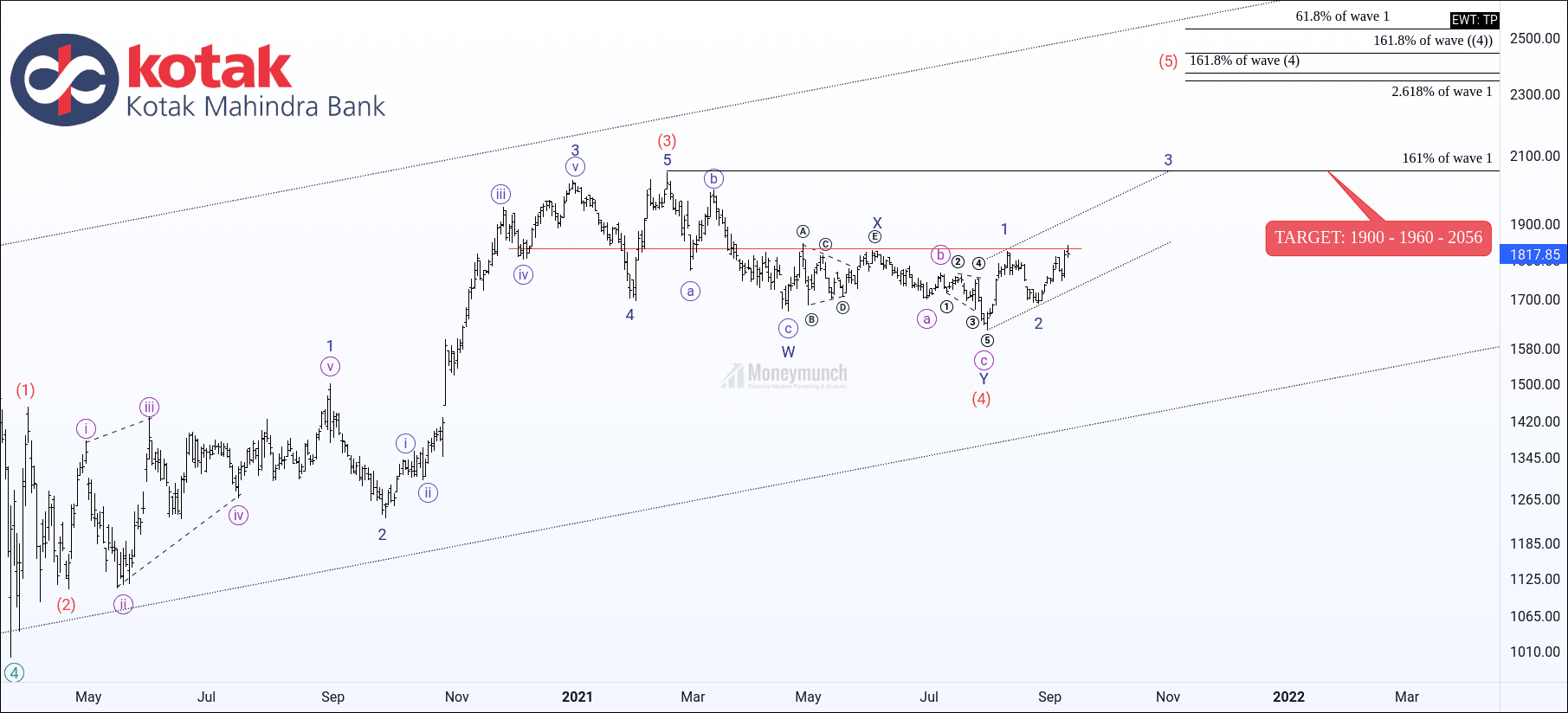

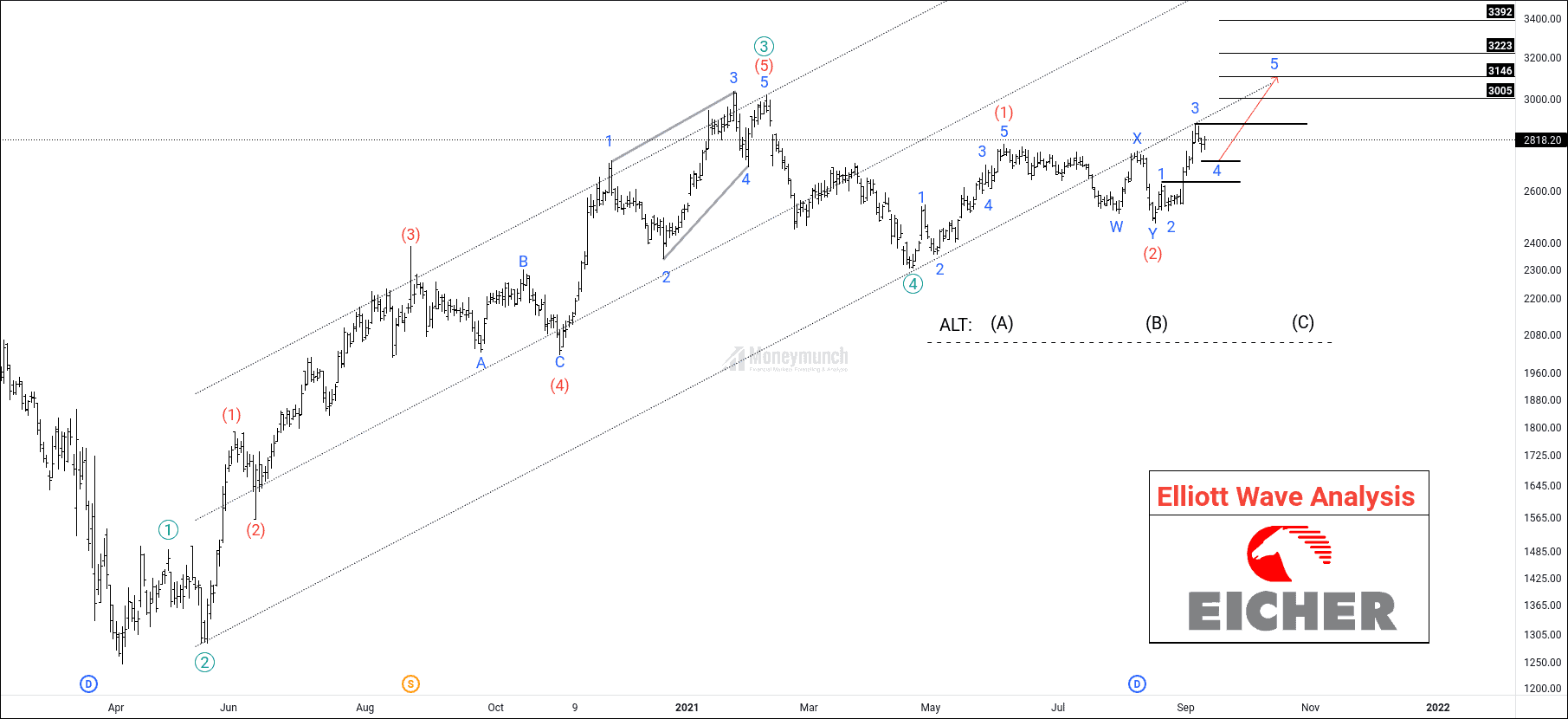

| NSE Free Calls on Kotak Bank, YES Bank, and Eicher Motors Posted: 12 Sep 2021 07:15 AM PDT YES Bank: Price action analysis & trading tipsThe YES Bank stock has started falling for a long period. If it breaks the consolidation area, it will keep collapsing, and we may see 10 – 9.60 levels soon. It’s under that range from the last 17 days. But according to price action analysis, it will try to jump up to make a new LH. It can be nearby the 12.15 – 13.5 range. Safe investors can start selling nearby dynamic LH with the stop loss above the hurdle line. Kotak Bank Has An Explosive Rally AheadNSE Kotak Mahindra Bank has started marching upside because it has completed wave ((4)). Its fifth wave will end nearby the retracement of wave ((4)) of 161.8% and sub-wave of (4) of 161.8%. So, long-term investors may hold for the targets of 2345 – 2446 – 2536. At present, intraday & short-term investors can also jump on this stock. Kotak bank prices may move forward up to 1900 – 1960 – 2056 levels to hit the halfway of wave 5th. Consecutive closing above the level of 1832 is a direct buy signal. A short reversal is expected at the last target of 2056. NSE Eicher motors price will drive upward moreIntraday traders and short-term investors can buy nearby sub-wave 4 of wave (3). NSE Eicher motors are making waves ((5)). We may see the following targets soon: 3005 – 3146 – 3223 – 3292 Invalidation: Wave 4 can never exceed the starting point of wave 1. Sub-wave 4 can’t touch sub-wave 1 of wave (3). The post NSE Free Calls on Kotak Bank, YES Bank, and Eicher Motors appeared first on Moneymunch. |

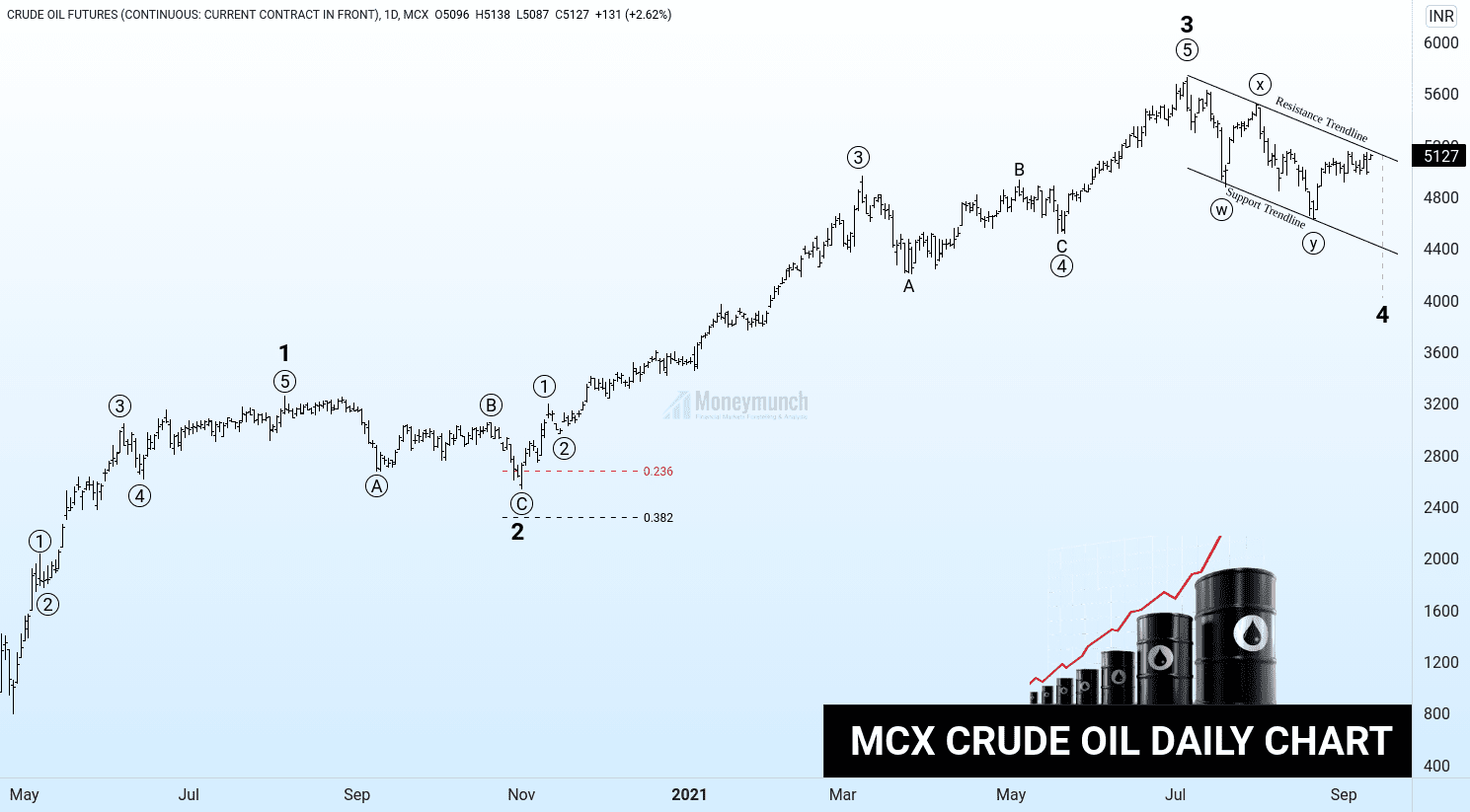

| Will Crude Oil Hit 5400 Next Weekend? Posted: 12 Sep 2021 05:52 AM PDT Crude oil has started moving forward since May. And it will not stop here. It’s just a WXY correction. According to Elliott’s wave theory, it has completed the sub-wave under the 4th wave. It’s consolidation time. Crude oil prices may fluctuate between the range of 4000 – 5400. Hence, long-term investors can keep buying crude oil. So, what about short-term investors and intraday traders? If you look into 4 hours chart, it seems bullish from here. Crude oil is trying to break the resistance trendline. Whenever that the resistance trendline break, then we may see the prices at 5300 – 5400+. Kindly note, if crude oil remains below to resistance trendline, then do not buy. What happens if it does not break the resistance trendline?I will update my next MCX crude oil report. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post Will Crude Oil Hit 5400 Next Weekend? appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |