MoneyMunch.com |  |

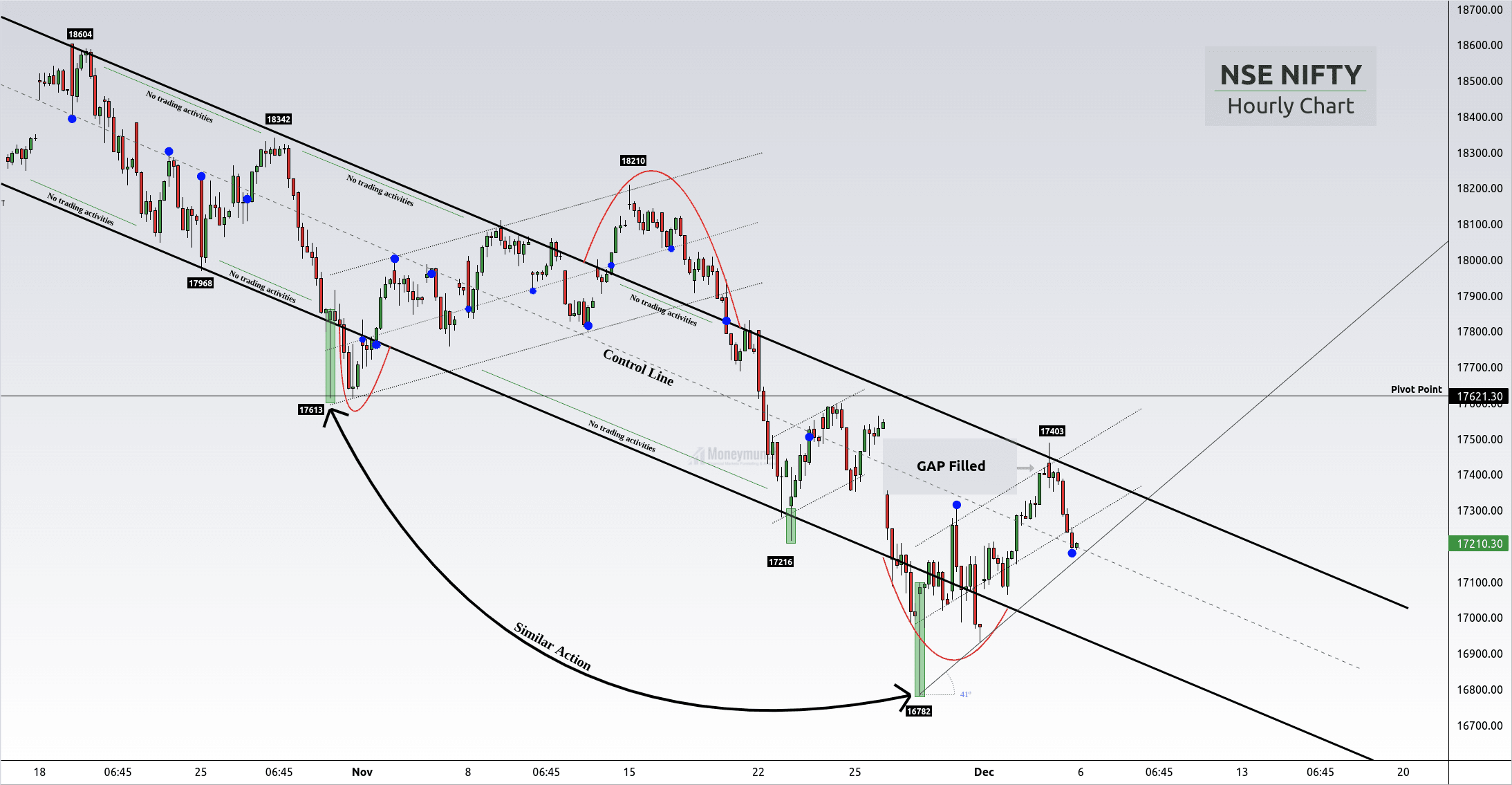

| Nifty Today: The Case Of Initiative And Response Between Bulls & Bears Posted: 05 Dec 2021 01:19 AM PST Nifty has continued forming the descending channel. Price has made three excess areas on the lower band. It means that bear traders are continuously trying to break down the descending channel. Price is following the control line with nine spot confirmation. The trend will change after a breakout of the upper band, and it will drag the nifty price at my pivot point. And that pivot point will act as a hurdle. Hence, it has to climb up to that. And if that happens, then it will keep moving forward non-stop. Otherwise, there is a high chance that the price will create an excess. This pivot has provided three successful reversals on the upper band. Bearishness may drive nifty for one more leg down. Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post Nifty Today: The Case Of Initiative And Response Between Bulls & Bears appeared first on Moneymunch. |

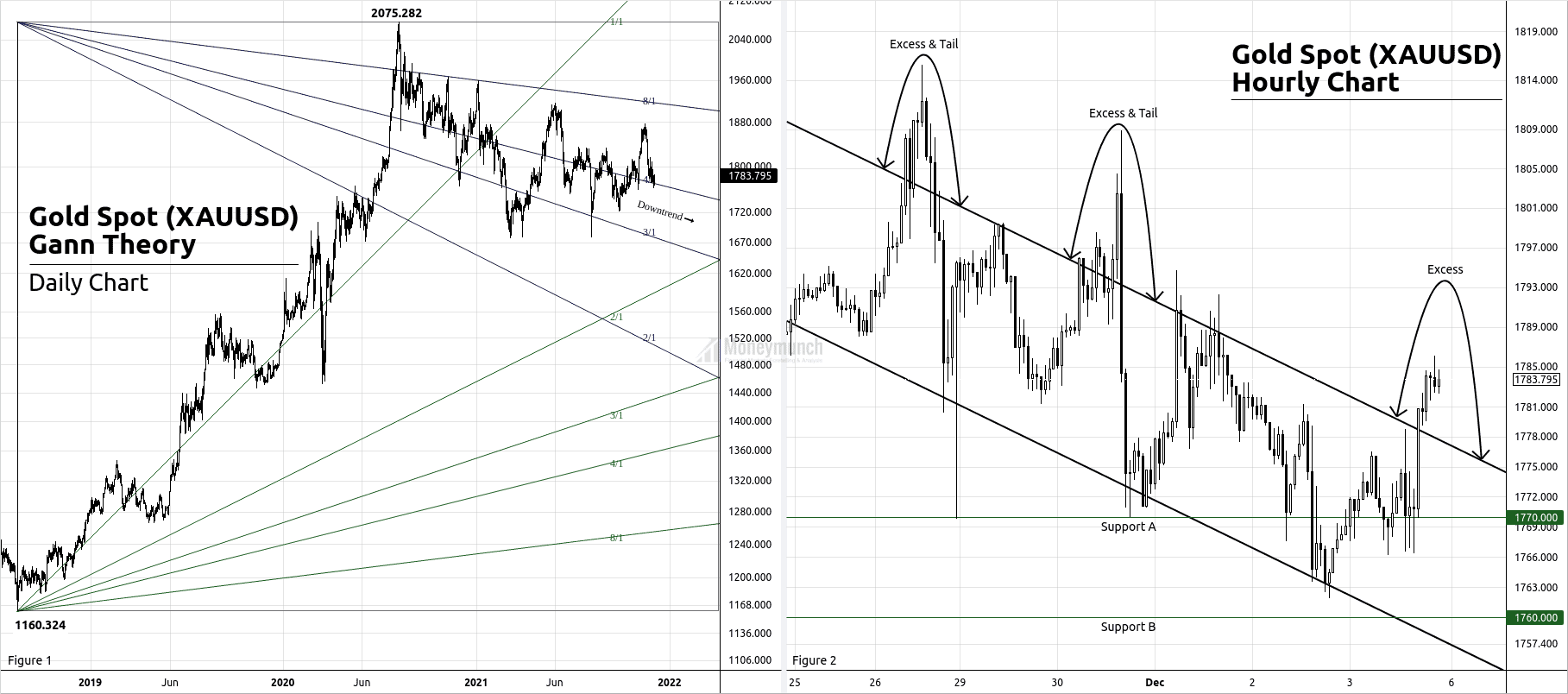

| Gold Spot (XAUUSD) Time for Consolidation & Lower Volatility Posted: 04 Dec 2021 10:24 PM PST Click on the chart to enlarge See the above chart wherein I have used the Gann Angles as support & resistance. As per the rules of All Angles, when the stock price breaks an Angle, it will rotate to the next Angle. Gold Spot is under a downtrend until the breakout of 8/1. But that’s all about the long-term view. If you see the above Gold Spot’s hourly chart, there are two supports. And if XAUUSD repeats the game of excess & tail, then the downtrend will begin. Hence, be ready for the levels of $1752 – $1726 – $1680 below. Gold Spot can hold the downtrend by staying above 4/1. If it happens, then we will see $1830 – $1860 – $1900+ levels. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post Gold Spot (XAUUSD) Time for Consolidation & Lower Volatility appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |