Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access.

MoneyMunch.com |  |

- NIFTY FUT Trade Setup For Premium Subscribers (1:3 Risk Management System)

- NSE – Nifty & Apollotyer Tips & Updates

- Premium Calls: TATA MOTORS FUTURES

| NIFTY FUT Trade Setup For Premium Subscribers (1:3 Risk Management System) Posted: 14 Dec 2021 08:54 PM PST Only premium subscribers can read the full article. Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access. Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post NIFTY FUT Trade Setup For Premium Subscribers (1:3 Risk Management System) appeared first on Moneymunch. |

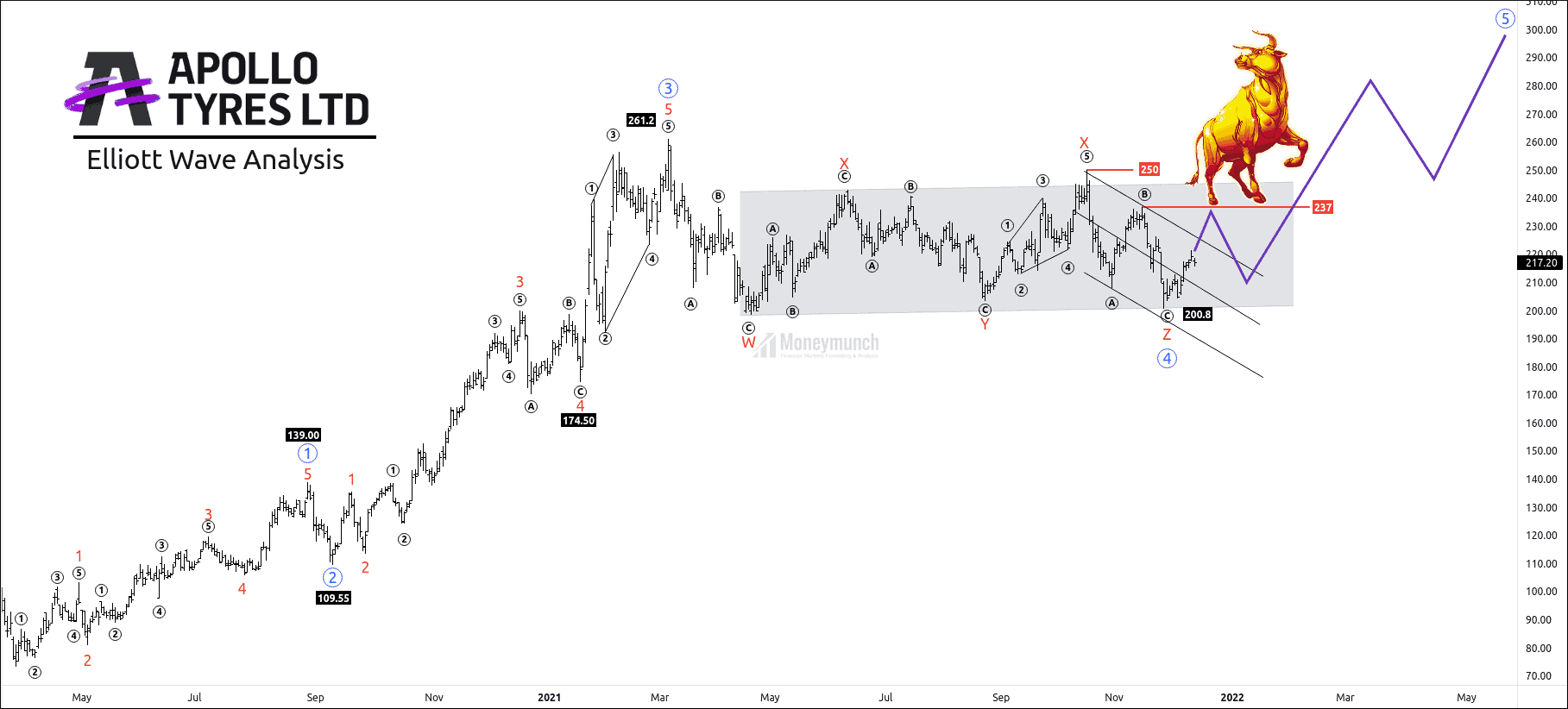

| NSE – Nifty & Apollotyer Tips & Updates Posted: 14 Dec 2021 03:15 AM PST Will bull traders drive Apollotyer above Rs.300?APOLLOTYER is preparing for a bull run. After completion of the 3rd wave at 261.2. Price had started a corrective wave ((4)) and took 38 weeks to finish this structure. Wave Formations and Fibonacci relationships: Wave ((2)) is a zigzag move. Fibonacci retracement of wave 2 is 50% of 1st impulsive wave at 109.55. Sub-wave of wave 2 fulfilled the rule of equality (wave A= wave C) Wave ((3)) is an extensive impulse. 3rd wave has 261.8% retracement of 1st impulsive at 261. Wave ((4)) is a triple three with a 3-3-3-3-3 wave structure. What will happen next? (Note that the ending point of the corrective wave is the starting point of an impulsive wave.) Target 1: 237 Target 2: 250 Target 3: 279 Target 4: 297+ The safe traders can wait for the breakout of wave X. Invalidation: pullback can’t break the low of wave ((4)) NIFTY UPDATENifty has exactly performed as I described on the 13 Dec hourly chart. First, click the below link to read that Nifty Tips again: First, nifty has touched the first three upside targets on the same day. And It has started collapsing to break downward targets of 17465-17408-17312. Today nifty has made a low of 17225.8 and completed all targets. What’s next? I will update you soon. NSE Package (20% OFF)Time is running out. We are going to close the special offer. Subscribe Now → Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post NSE – Nifty & Apollotyer Tips & Updates appeared first on Moneymunch. |

| Premium Calls: TATA MOTORS FUTURES Posted: 13 Dec 2021 09:03 PM PST Only premium subscribers can read the full article. Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access. The post Premium Calls: TATA MOTORS FUTURES appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Lock

Lock