Buyers neither faced the falling knife nor paused the bloodbath, and the sellers won the day.

MoneyMunch.com |  |

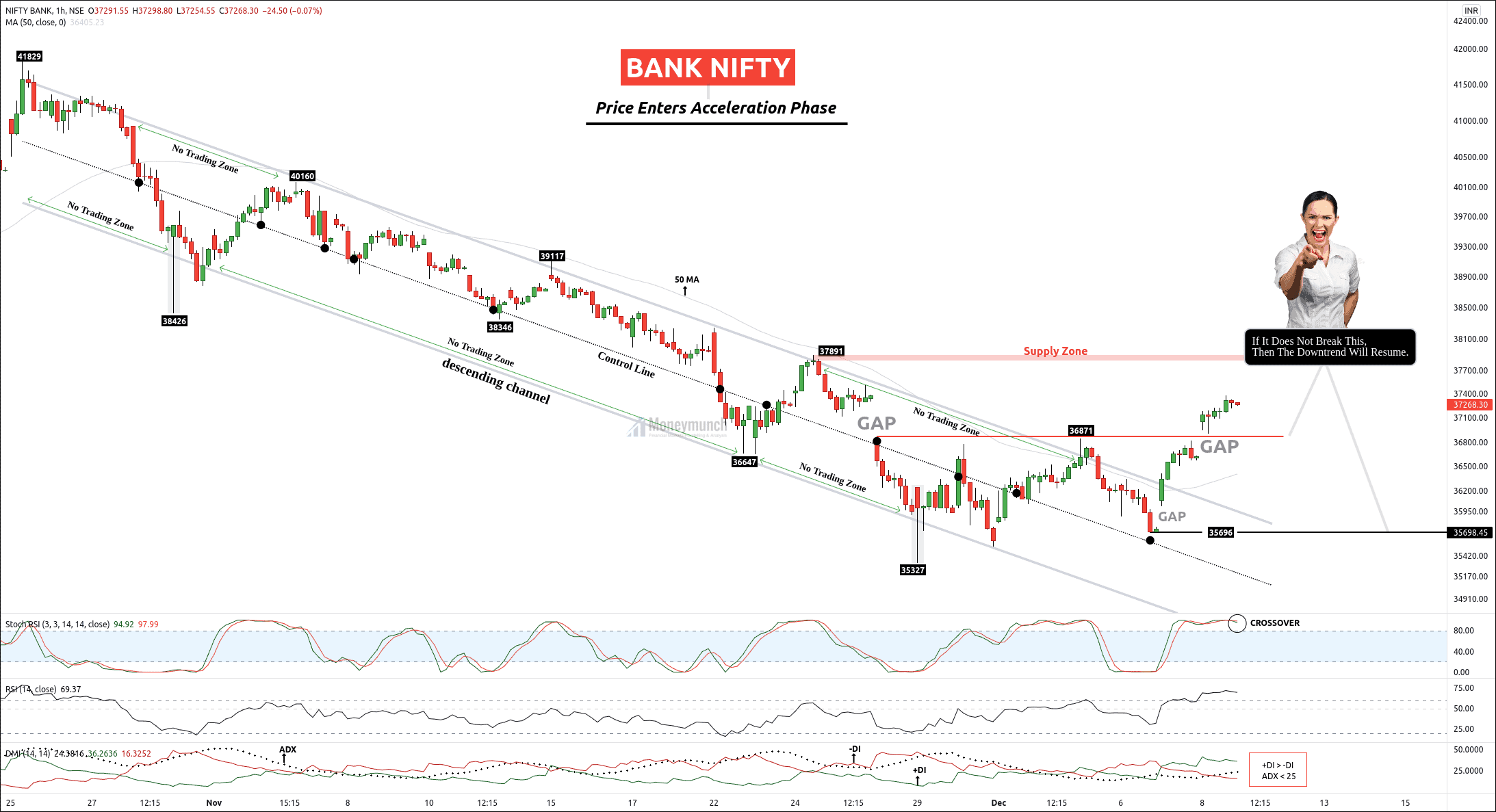

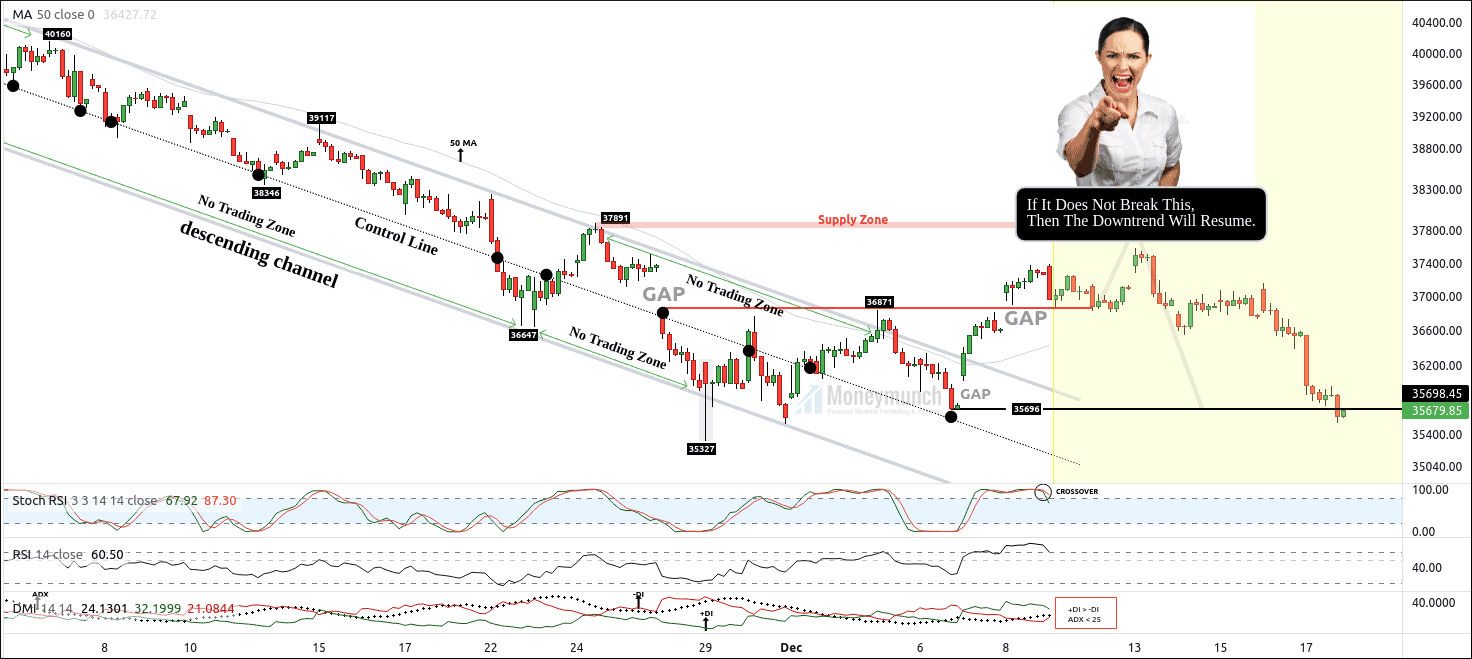

| Bank Nifty Illustrates That Don’t Buy At Dip Blindly Posted: 19 Dec 2021 05:44 AM PST Price had stuck in the descending channel, and we had a chance to see the maximum move of 37800 due to the supply zone.

Price had started an upward move and made a high of 37581. 2:35 PM, Bank nifty reached the last target of 35696 and made a low of 35535. Even if you have traded after the breakout of 36871, you could have 1164 points in just three days. If you missed this opportunity, I am sure you are not getting late in the 12th-anniversary offer, which is about to finish: Click Here To Join Now → Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post Bank Nifty Illustrates That Don’t Buy At Dip Blindly appeared first on Moneymunch. |

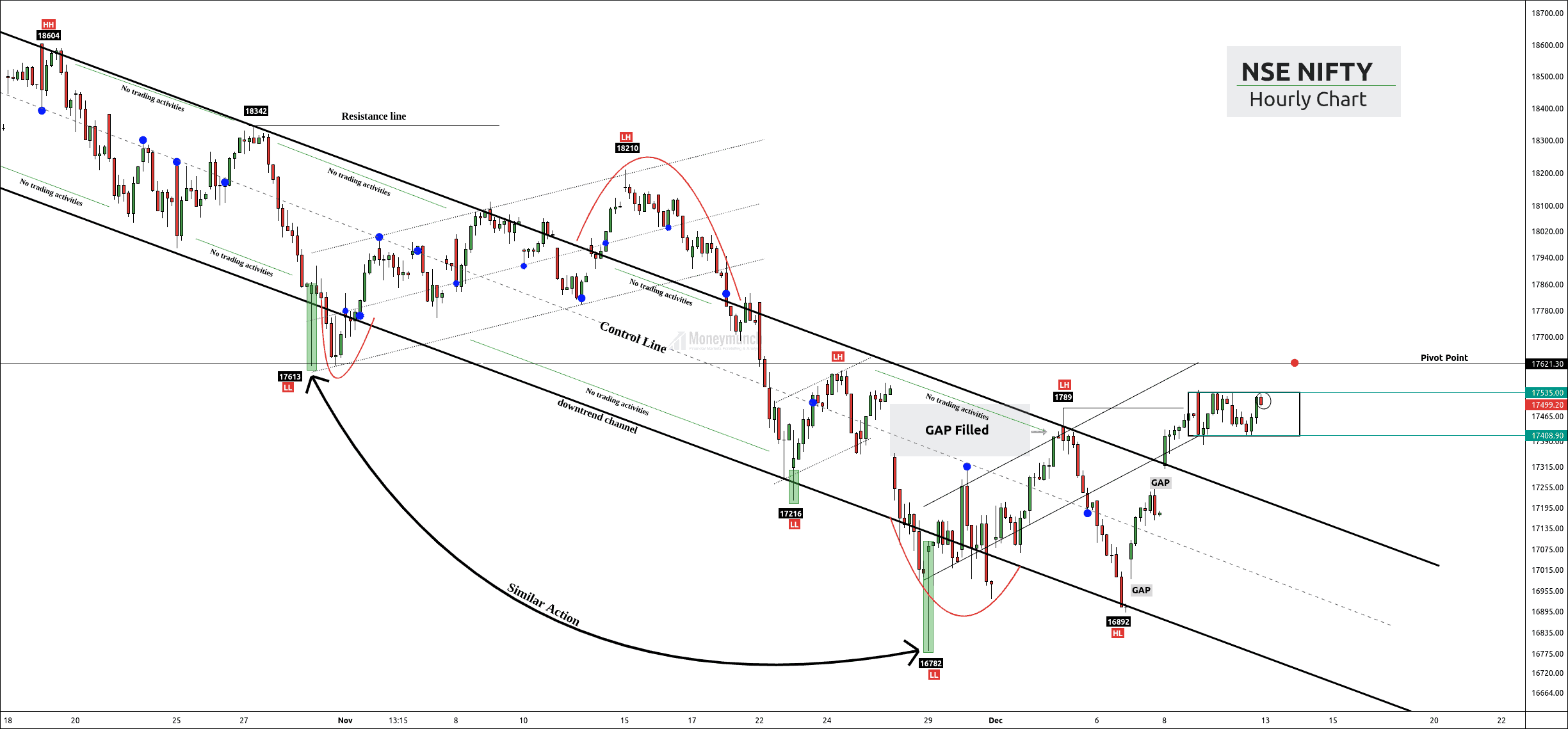

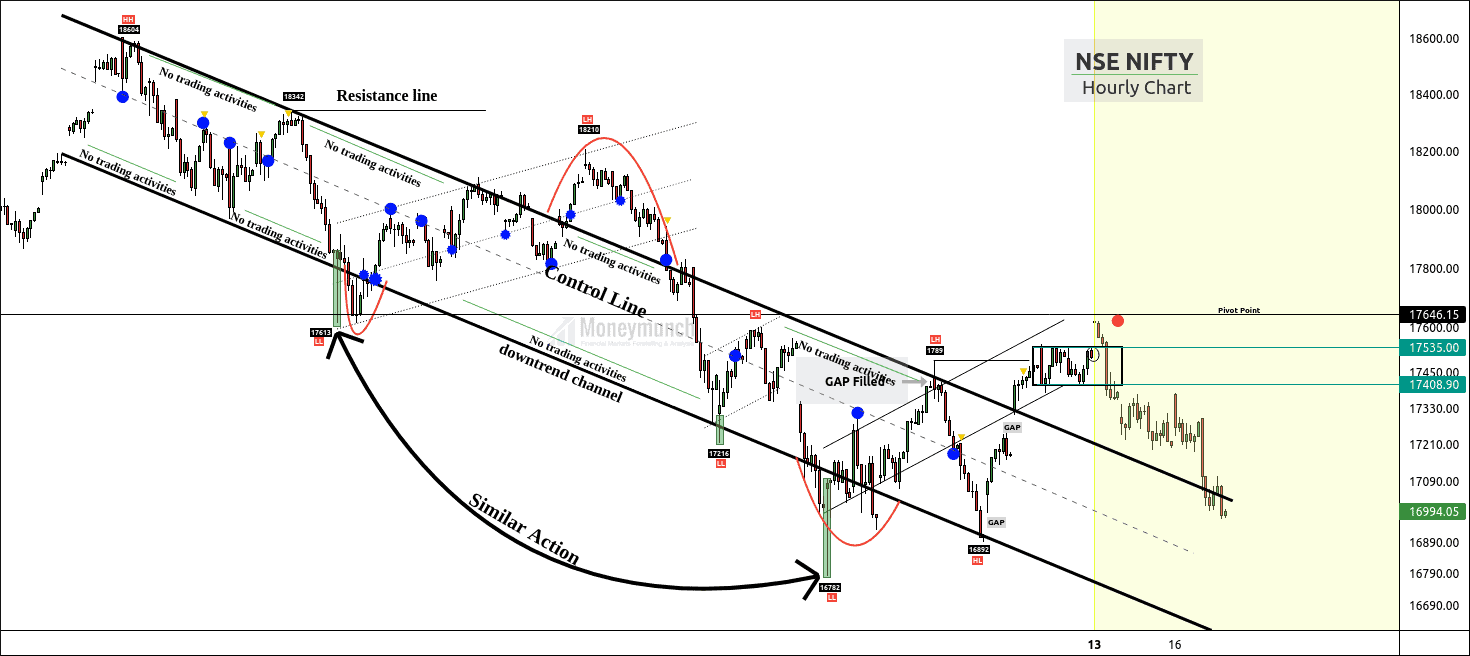

| Nifty Can Step Back Here To Get The Following Targets Posted: 19 Dec 2021 05:18 AM PST Nifty was out of the downtrend channel, but it hasn’t confirmed the bull run by breaking the nearest lower high. There was an important pivot point of 17646. I have mentioned the following targets (Click here to read that nifty report):

Nifty made a gap-up morning and hit all upside targets of 17554-17586-17618. The pivot point has supplied to exceed the demand, and our downside targets have been reached by nifty. It’s a sure thing that after losing one opportunity, you will find another but, if you lose this 12th-anniversary offer, it won’t come back again: Click Here to Join Now Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post Nifty Can Step Back Here To Get The Following Targets appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |