Before:

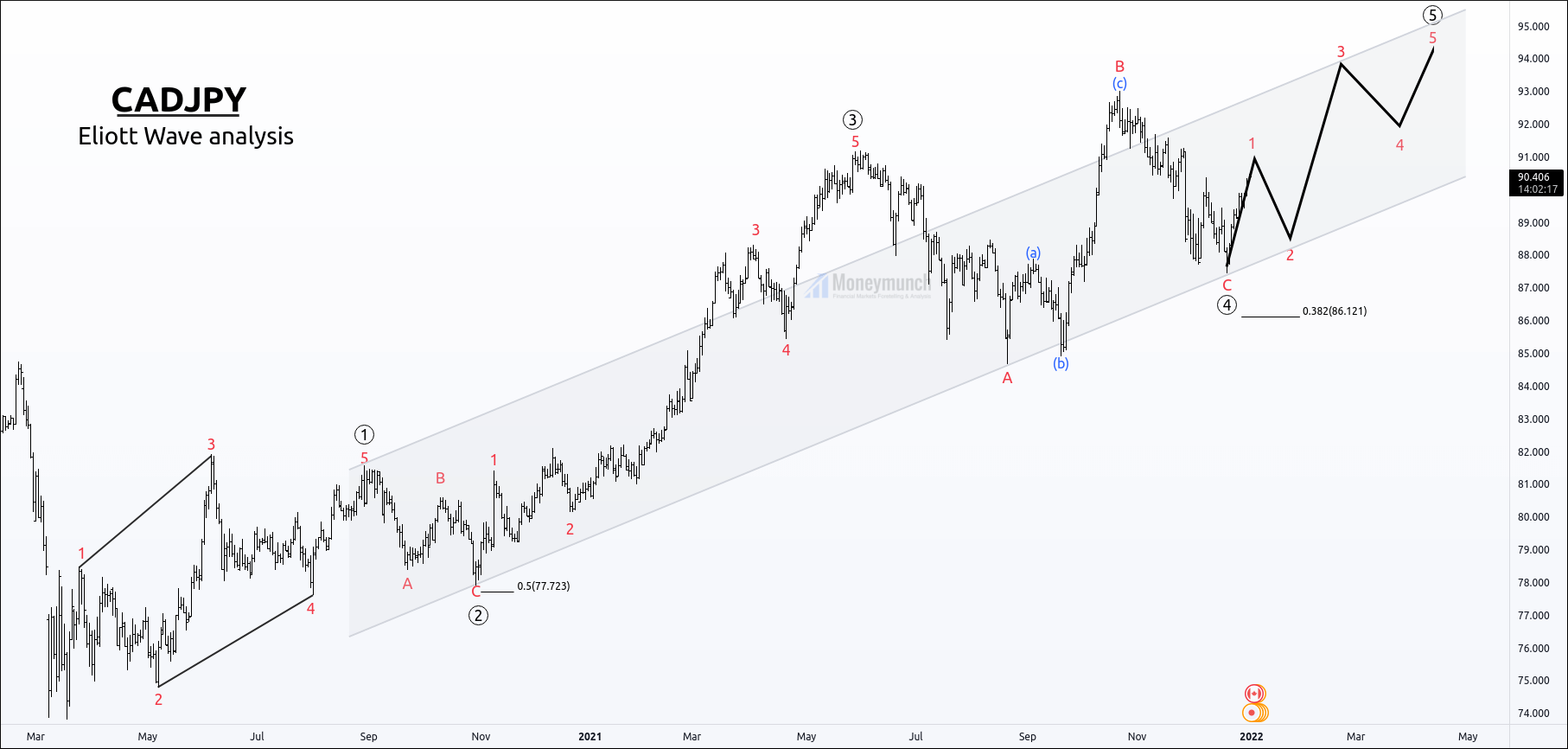

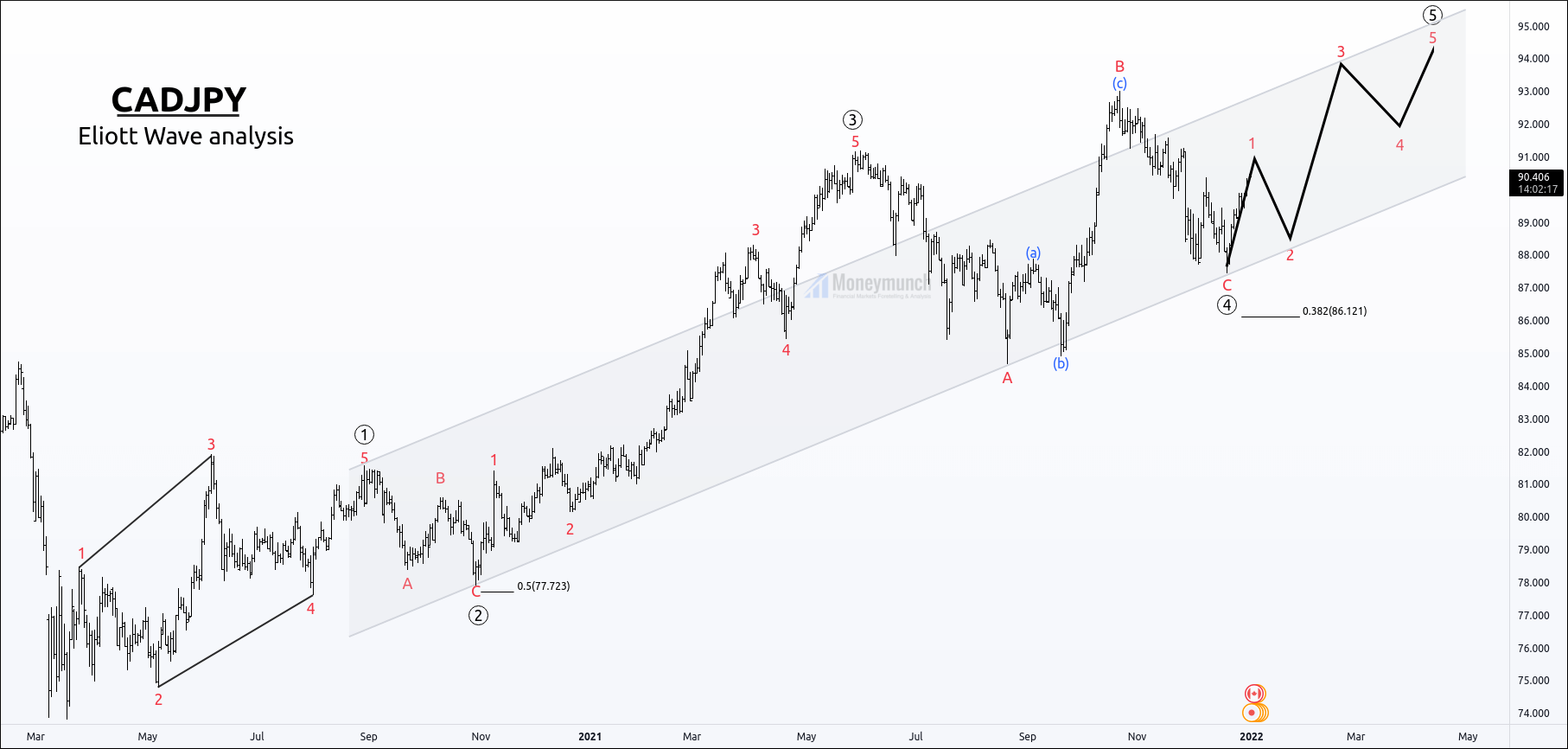

CADJPY was forming a last impulsive wave 5 of primary degree.

It had completed the corrective structure, running flat.

After accomplishing the C leg, the price surged from 87.48 to 90.

Price was above 50-MA, which was the indication of a strong trend. It was a beginning of a new impulsive move. I found that the price can make a big move up to 93.84.

As I mentioned in my previous article, “We can expect the following targets 91.46-92.29-93.849“.

Click Here to read the previous research report.

After:

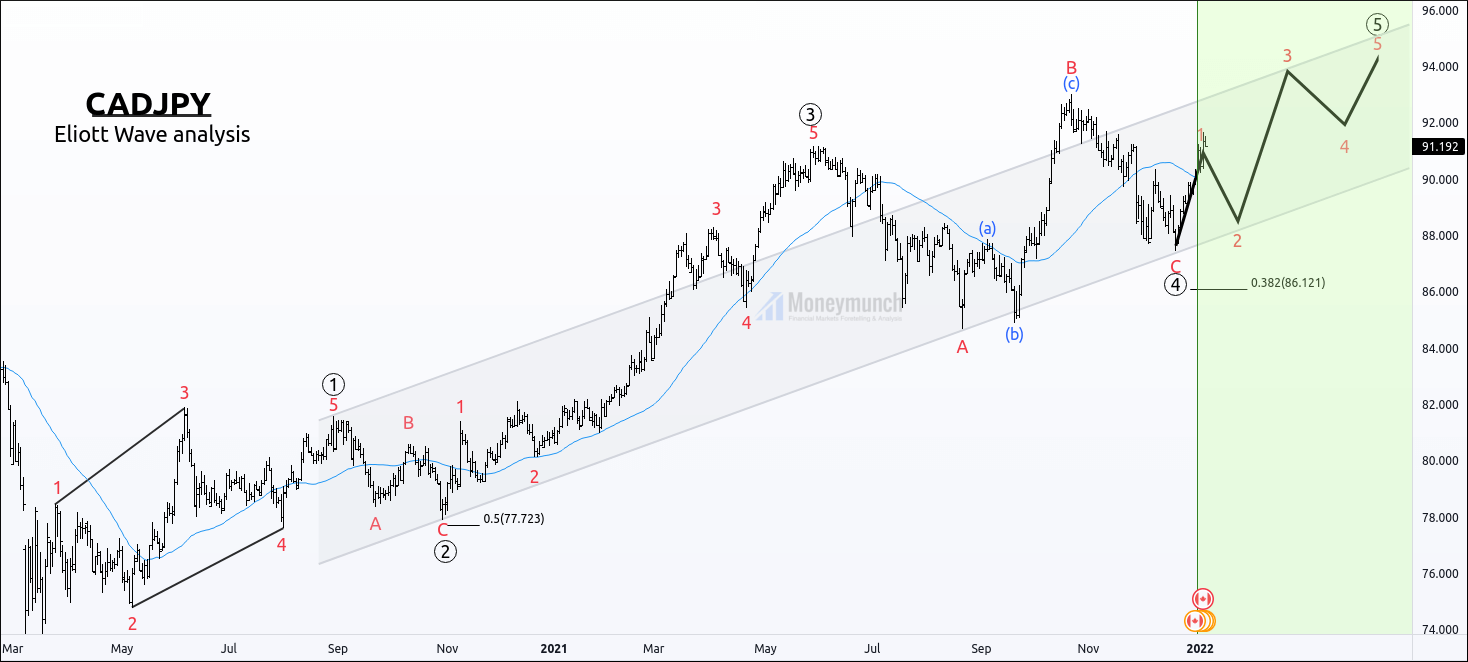

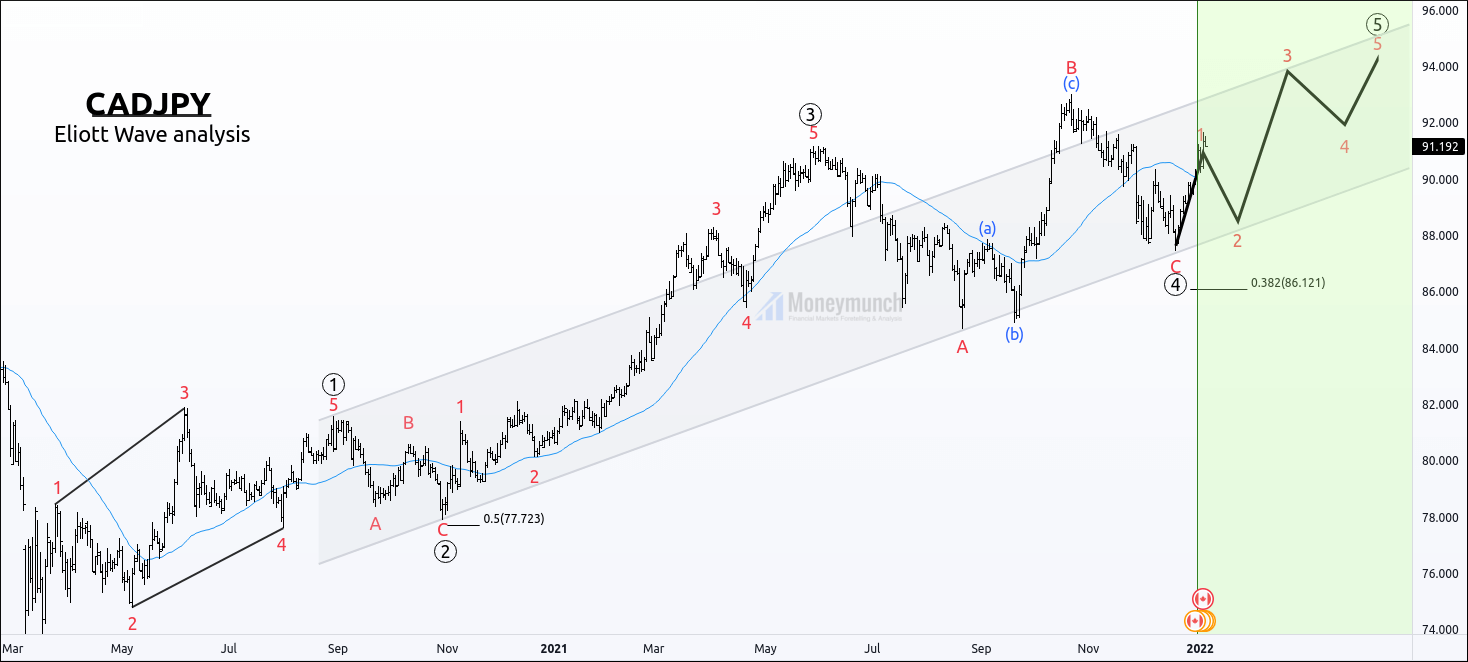

Price broke the 50-MA & minor resistance of 90.382.

Yesterday, CADJPY reached the first target of 91.46 and made a new high of 91.667.

Although the price is gaining momentum, it never moves in a straight line.

It will create a series of highs and lows to create an uptrend.

Would you like to get our all forex (fx) updates instantly? We have an option for you.

Click Here: Free Forex Tips

Do you want to get Premium Calls only?

Click Here: Premium Forex Tips

If you have any questions or concerns about Forex Market then contact by following ways:

Email: support@moneymunch.com

Phone: +91 903 386 2706

Have you any question/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock