MoneyMunch.com |  |

- Will ICOMODEX Energy Reach 7500 Before March End?

- High confidence Trade-setup for ACE Construction.

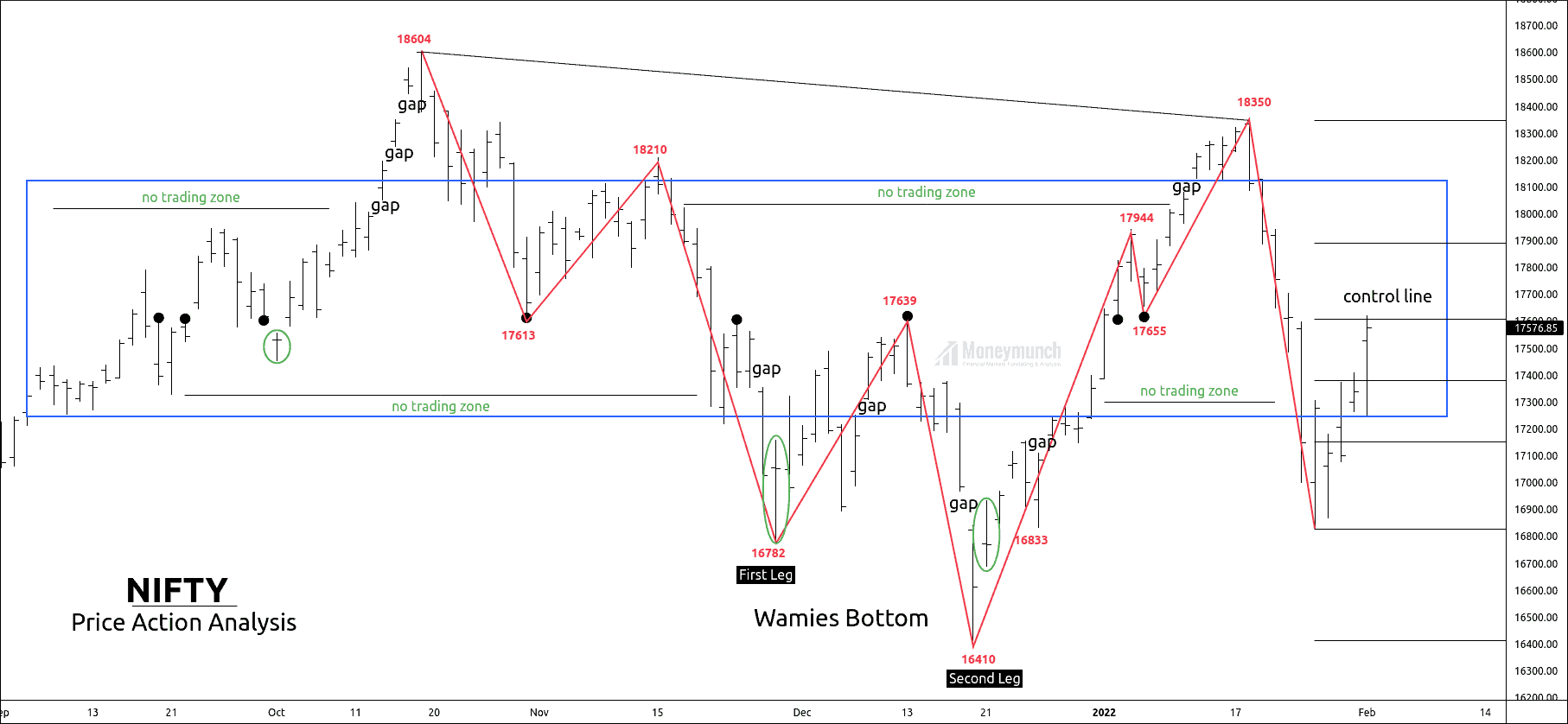

- Nifty Outlook: Is This The Last Pivot zone For The Bears?

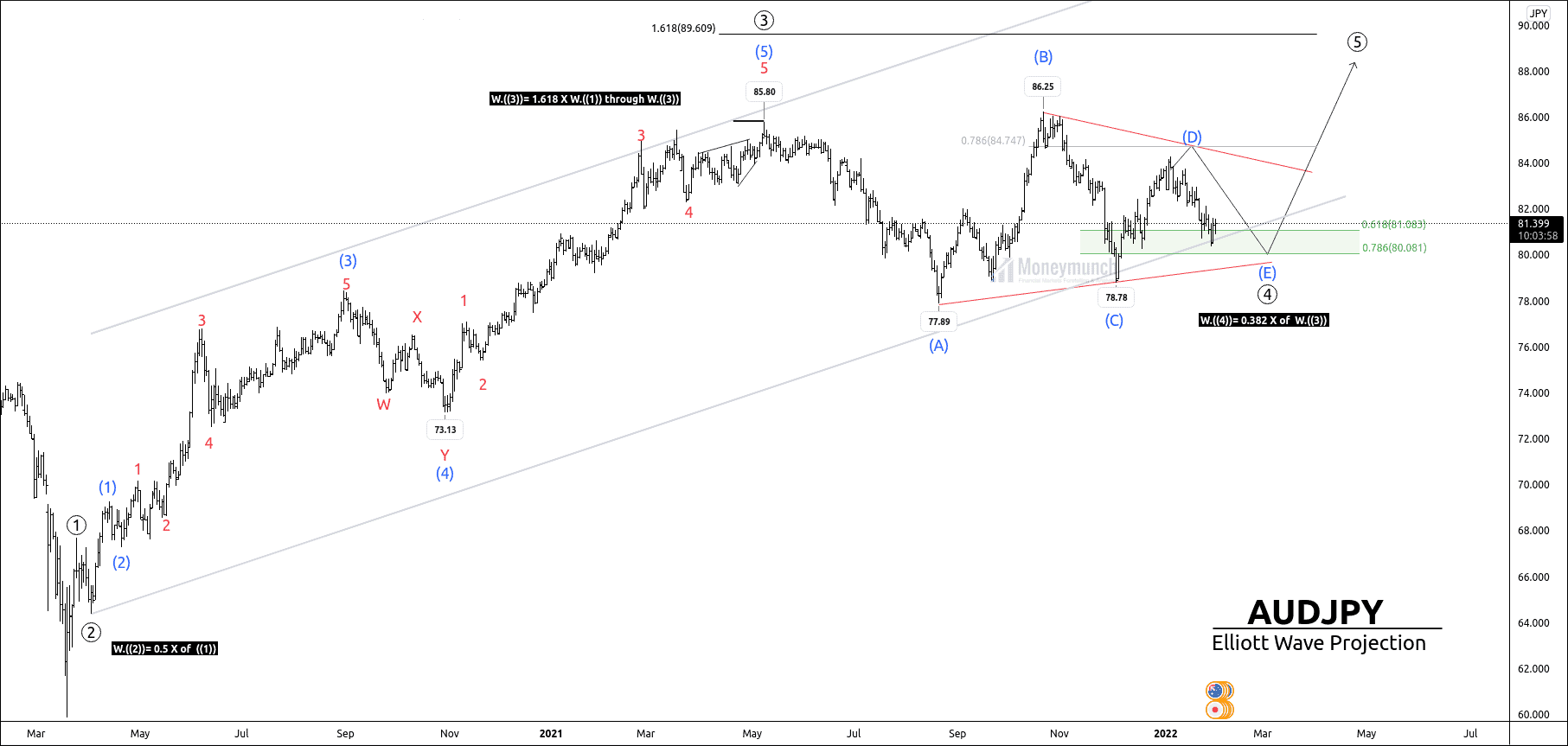

- AUDJPY: Will AUDJPY Confirm Its Bull Run?

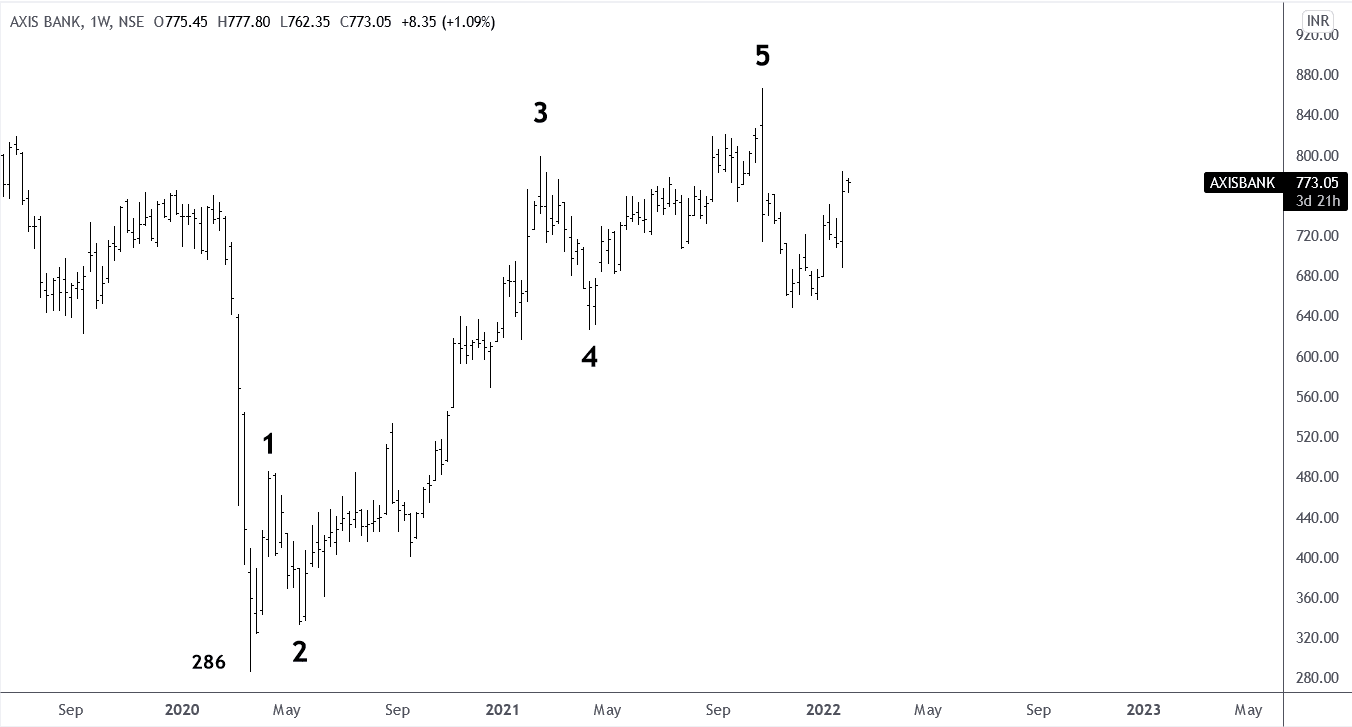

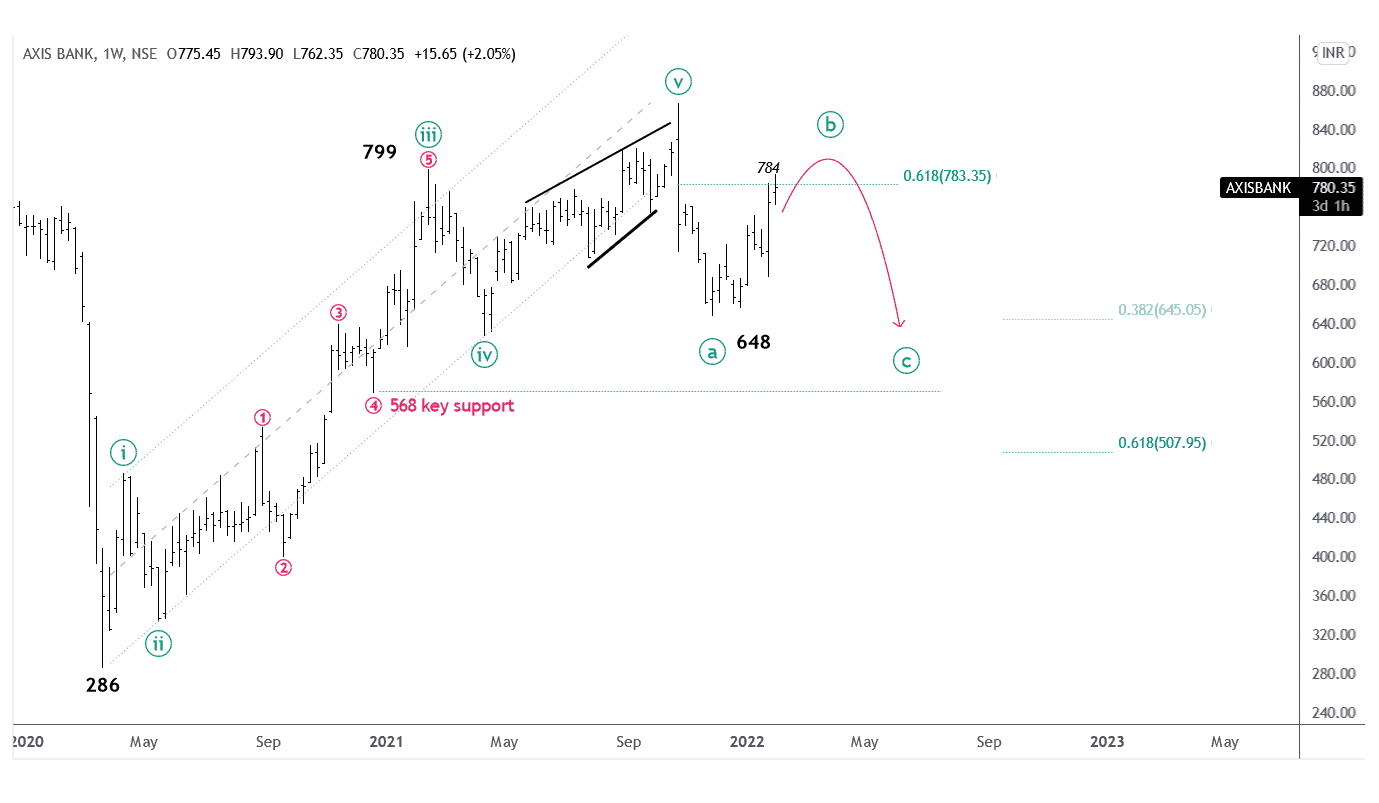

- Wave Counting & Head & Shoulders Pattern on multi-time frame for AXISBANK.

- EURCAD: Bullish Scenario is Active!

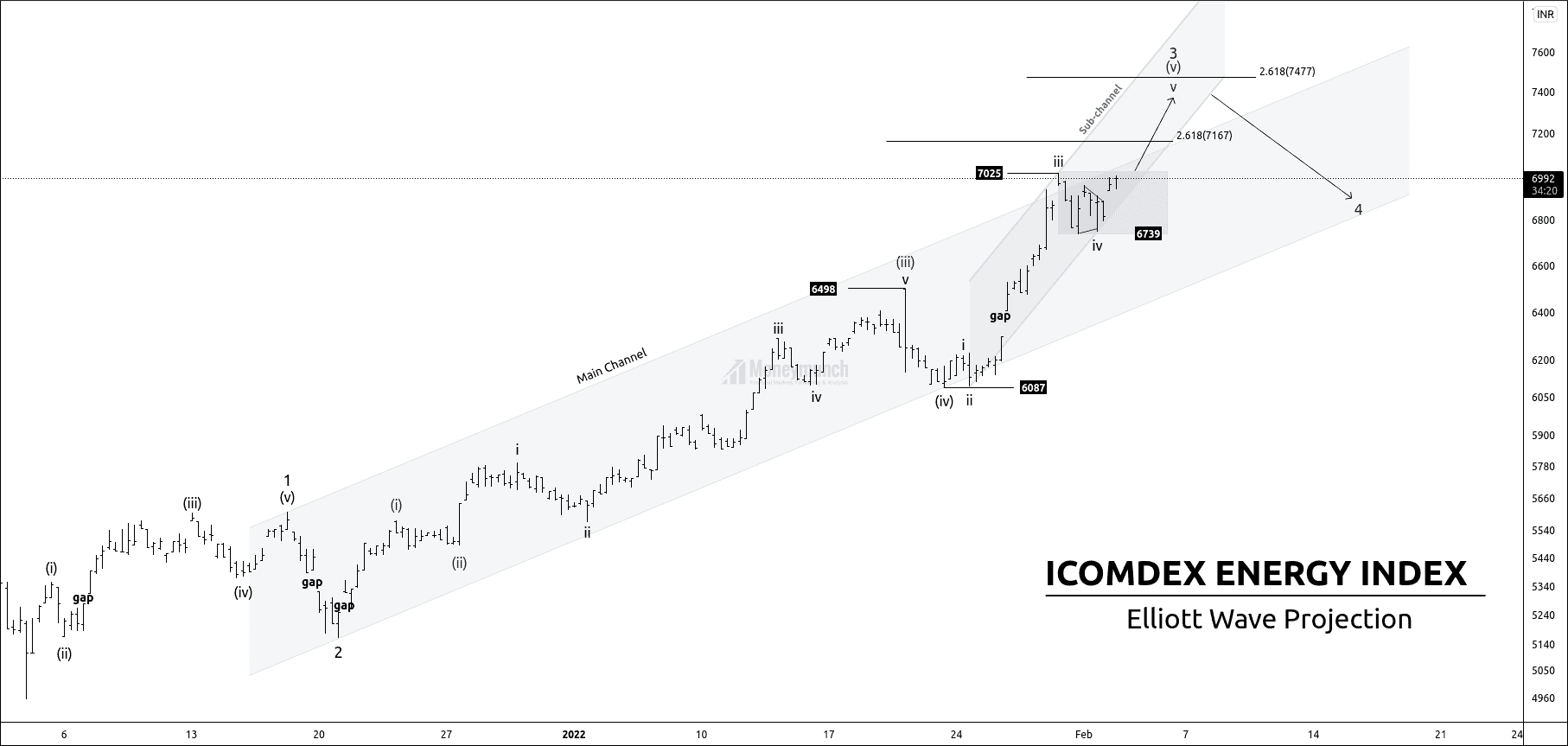

| Will ICOMODEX Energy Reach 7500 Before March End? Posted: 02 Feb 2022 03:24 AM PST ICOMODEX Energy is forming an impulsive wave 3. Price has finished the corrective wave (iv) of wave 3, and the price is establishing an impulsive wave (v) of wave 3. Price is about to make the last leg v. If the price breaks the high of wave iii, it can make an upward move of 7135 – 7290- 7355 -7477. After the accomplishing of wave 3, the price will fall and break the acceleration channel. What are the turning points for the prices? + Wave 3 can finish at 2.618 (7477) reverse Fibonacci retracements of wave iv. I will upload further information for intraday traders. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post Will ICOMODEX Energy Reach 7500 Before March End? appeared first on Moneymunch. |

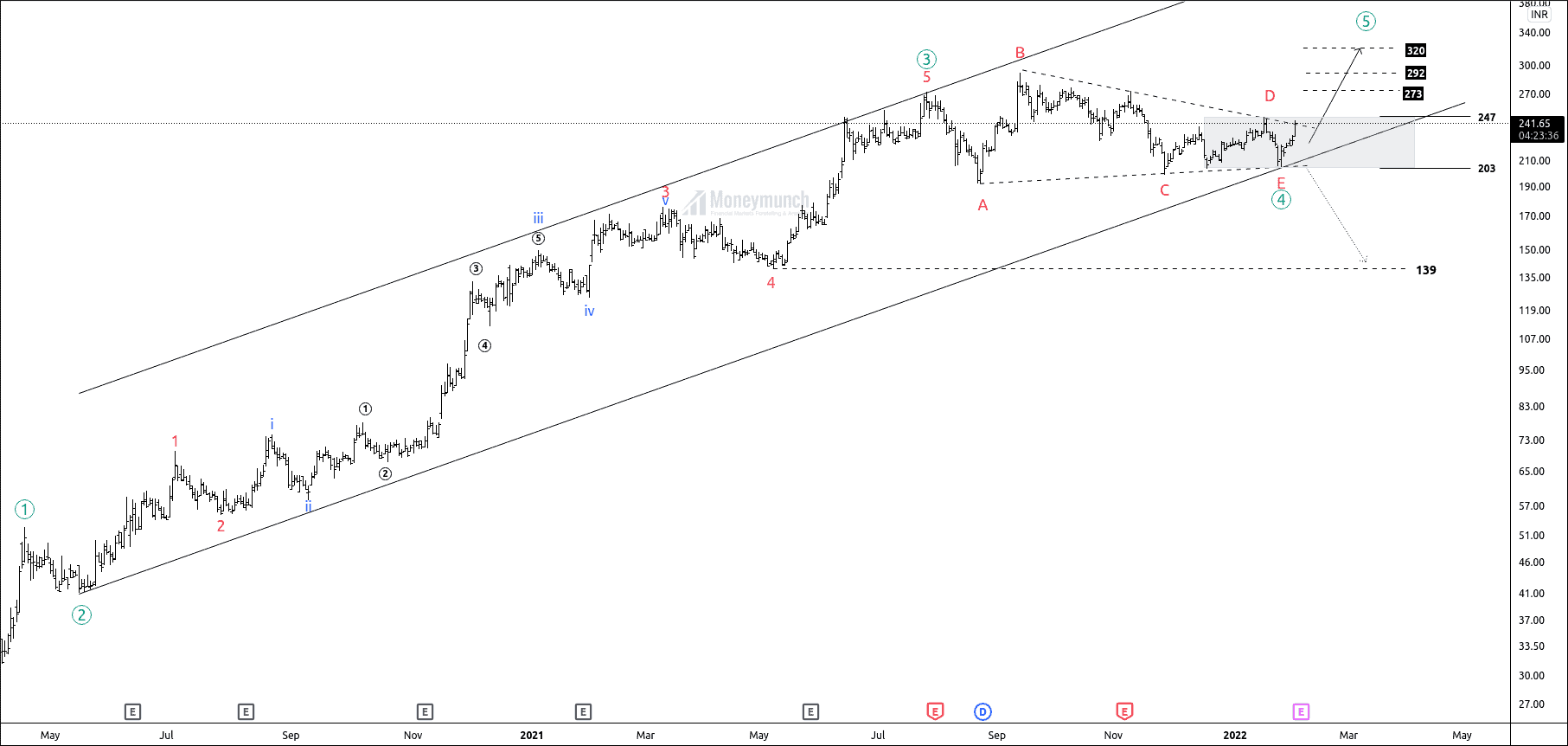

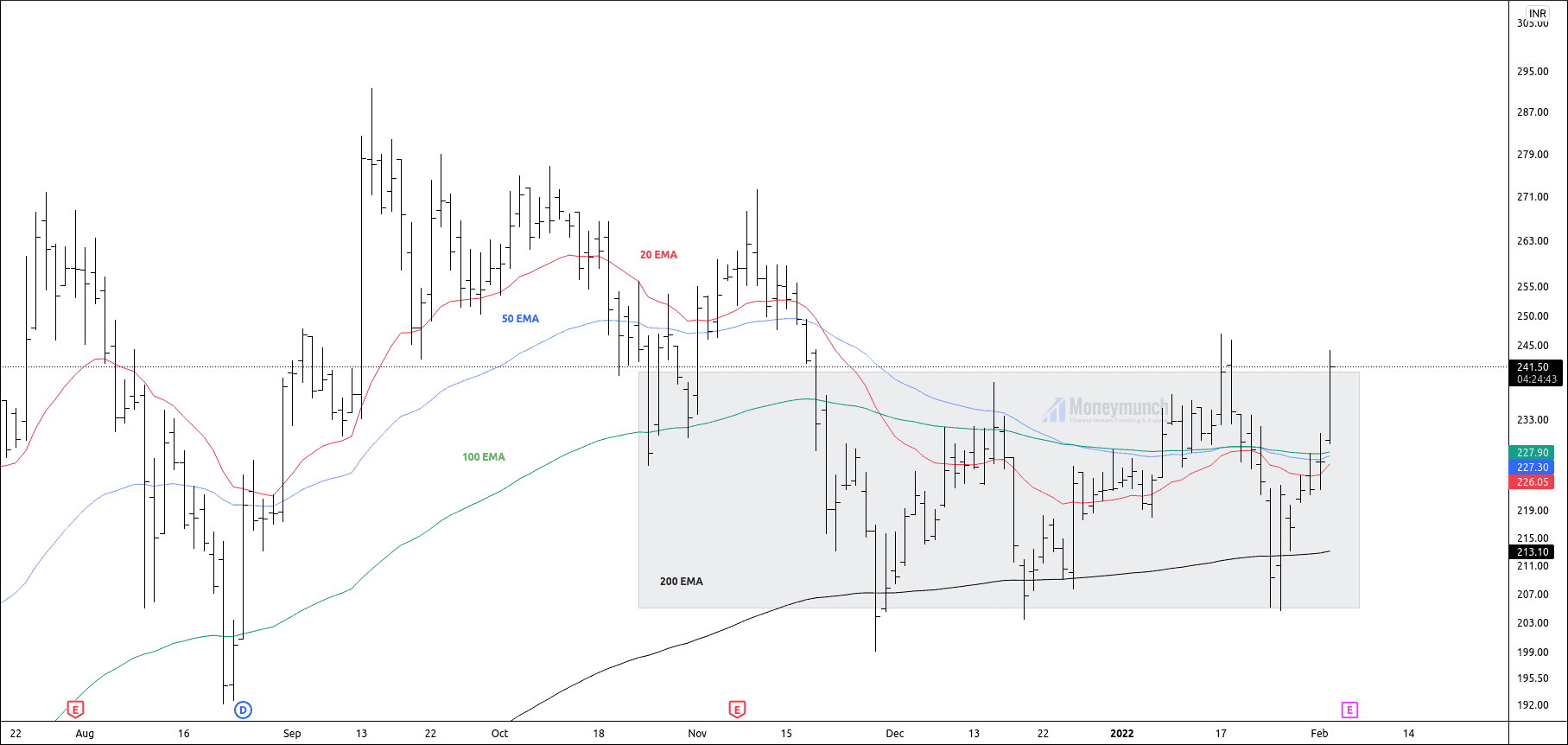

| High confidence Trade-setup for ACE Construction. Posted: 01 Feb 2022 10:03 PM PST ACE construction is forming a contracting triangle of waves ((4)). Wave ((1)) wave ((2)) Wave ((3)) Wave ((4)) Wave ((5)) We can expect the following targets of 273 – 292 – 320+ after the breakout of the B-D trend line. In case, if price breaks the A-C trend line to completed wave E, it can fall up to 139. According to Elliott wave, wave (4) ends near the lower degree of wave 4. In this chart, we can see the crossover of multi-exponential moving averages. And the price is formed a value area for more than two months. Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post High confidence Trade-setup for ACE Construction. appeared first on Moneymunch. |

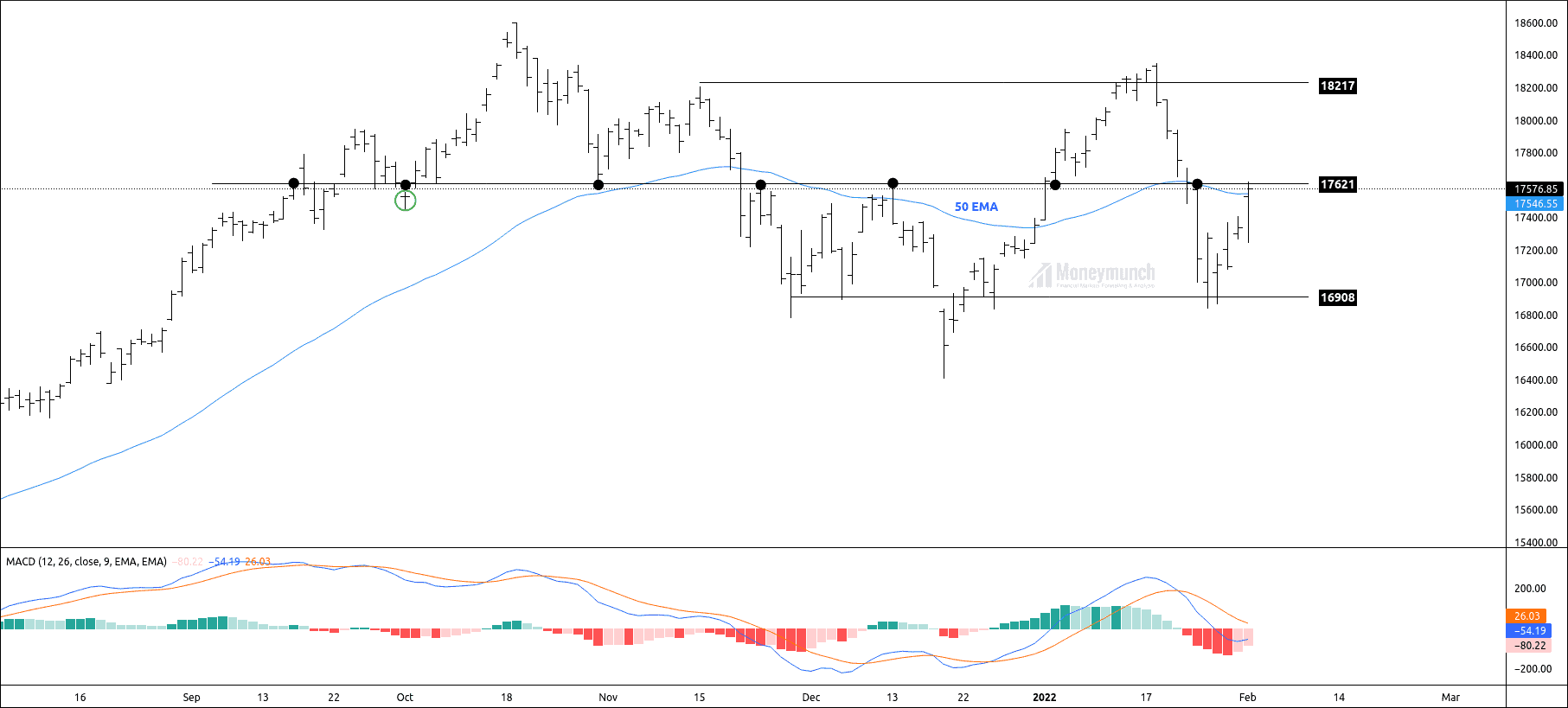

| Nifty Outlook: Is This The Last Pivot zone For The Bears? Posted: 01 Feb 2022 07:32 PM PST After creating the low of 17836, we have seen a price surge to 17623. Nifty again reached the pivot zone 17621. If nifty sustains above 17621, traders can buy for the following targets 17680-17765-17841+. Also, a price above 50 EMA indicates the presence of bulls in the current juncture. Please note that the rejection of the pivot zone indicates that the price is not going above. Price had broken out of the value area, and I suggested buying nifty after price entered into the parallel channel. Currently, the price is on the control line. It controls the up and down movements inside it. It is called pivotal because of how price oscillates around it. Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post Nifty Outlook: Is This The Last Pivot zone For The Bears? appeared first on Moneymunch. |

| AUDJPY: Will AUDJPY Confirm Its Bull Run? Posted: 01 Feb 2022 04:14 AM PST AUDJPY is forming a contracting triangle. Price had completed the (D) wave, and I have given the short-term selling targets of wave (E) of wave ((4)).

Price has reached all of these targets. Click Here to read the previous article. The ending point of wave (E) is the starting point of an impulsive cycle. Safe traders can enter after price make an excess on the lower band of the channel. Invalidation: Breakdown of the A-C trend line. Would you like to get our all forex (fx) updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Forex Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post AUDJPY: Will AUDJPY Confirm Its Bull Run? appeared first on Moneymunch. |

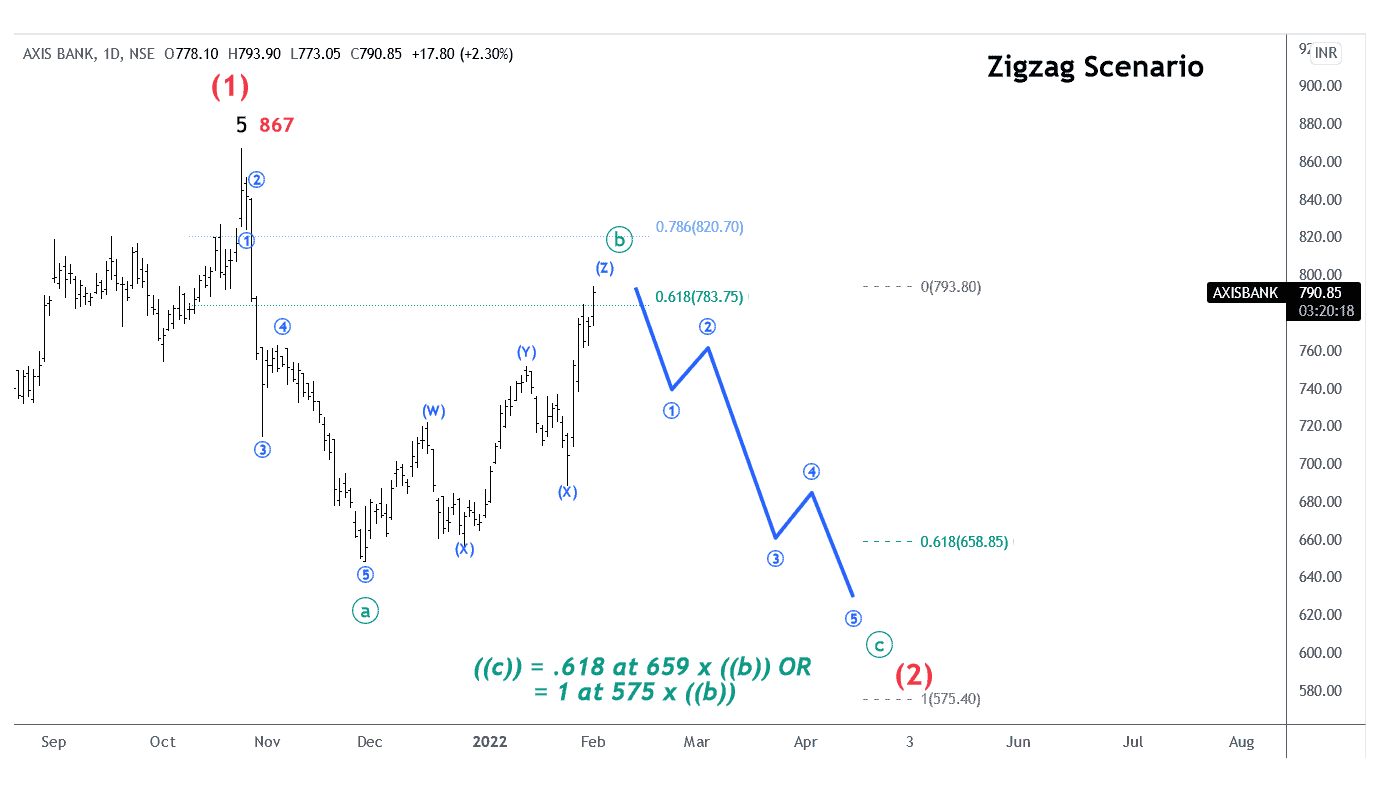

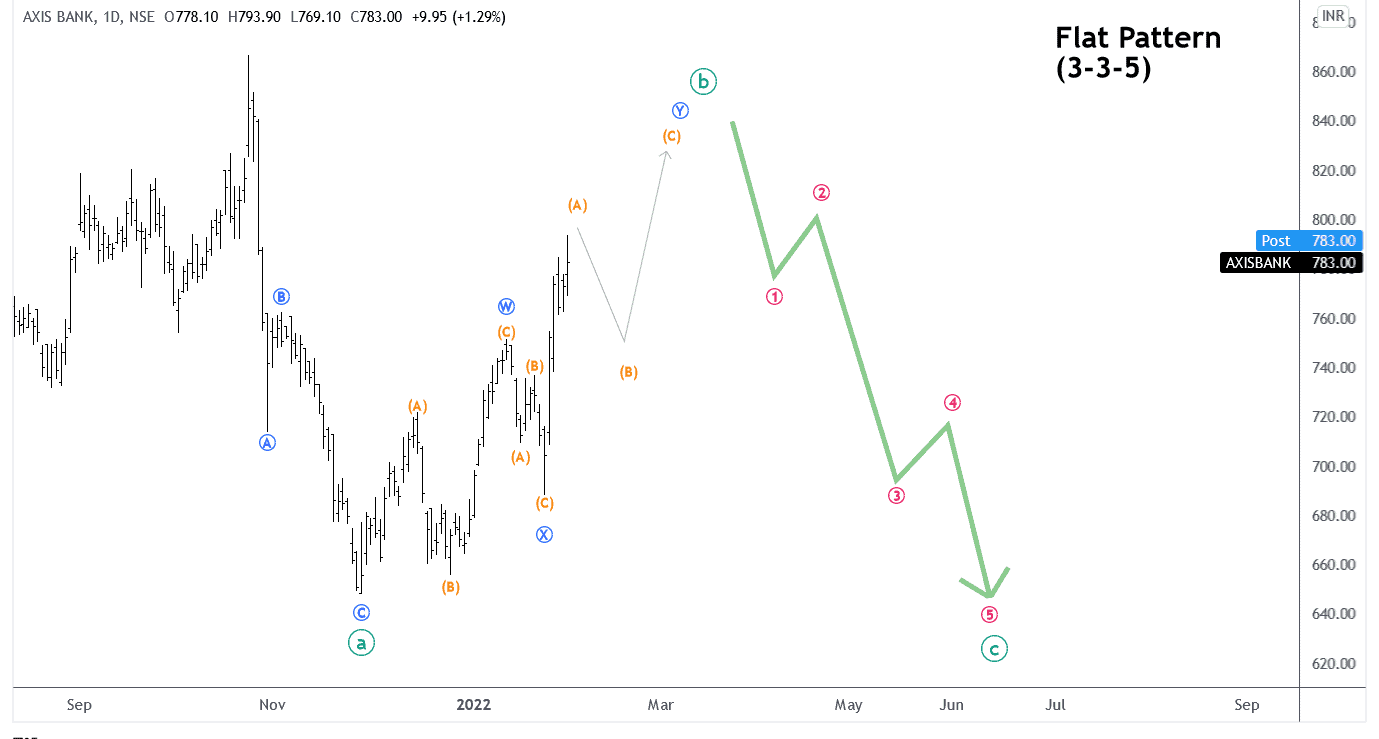

| Wave Counting & Head & Shoulders Pattern on multi-time frame for AXISBANK. Posted: 01 Feb 2022 03:18 AM PST First, we’re going to do a review of the wave principle if you are new or beginners. The wave principle is a form of technical analysis that is based on crowd psychology and pattern recognition. What the wave principle does is provide the context of you and it does so by means of two different modes.

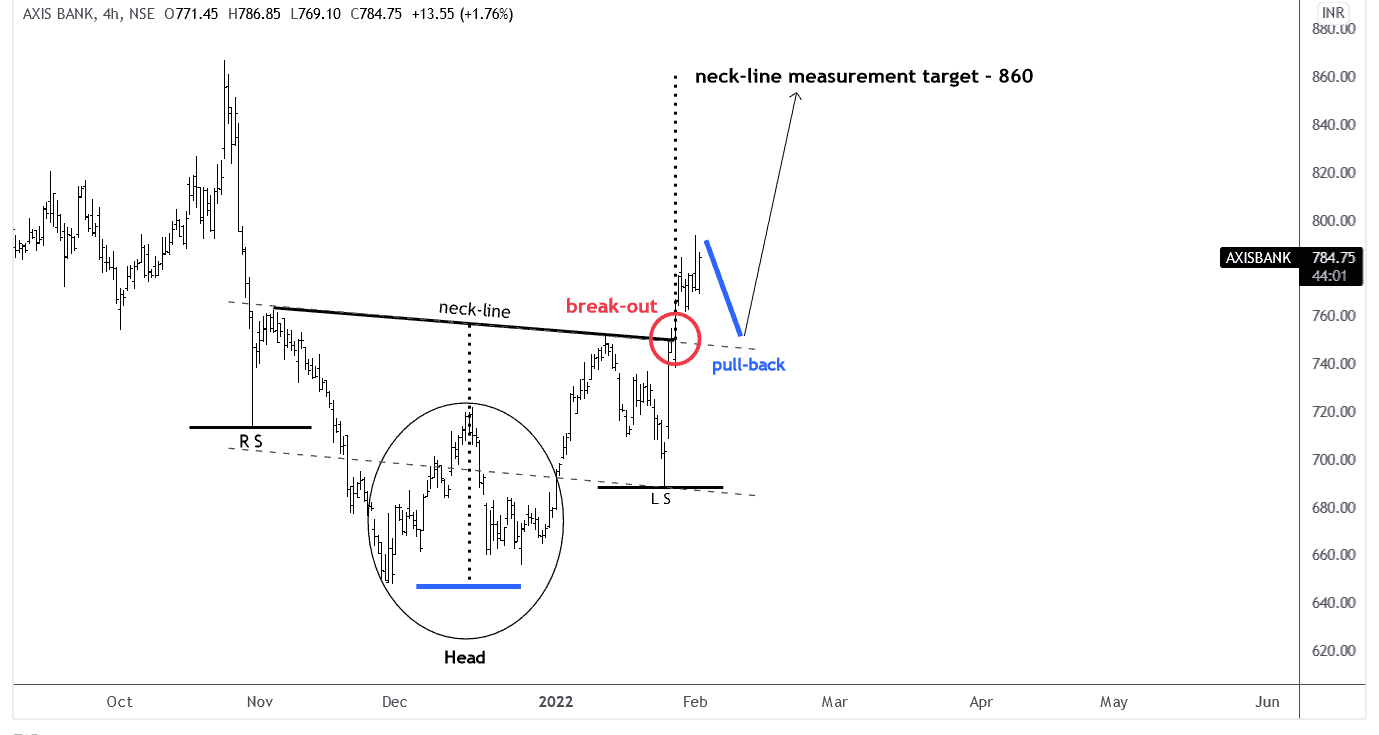

Within the Motive wave family we have two types: impulse wave and diagonal. For the Corrective wave family we have 3 types: Zigzag, Flat and Triangle. Let’s first examine what an impulse wave looks like. This is what a classic or standard “Elliott Wave” impulse wave real-time example in above chart. It is a 5 wave non-overlapping move waves 1,2,3,4 and 5. Therefore, those who have some experience with the wave principle will recognize the “wave 3” as an extended wave. Here, within this move to the upside, this impulse wave. The reason it’s so important is that it defines the trend of the next launcher degree, therefore this could be either “wave (1)” or “wave (B)”. Now there’s some rules that pertain to the structure. Rule 1) is that wave 2 never retrace more than 100% of wave 1, meaning it cannot fall below this extreme starting point of wave 1. Rule 2) is, wave 3 never be the shortest impulse wave. It doesn’t necessarily have to be the longest but it can never be the shortest. Rule 3) of an impulse wave is that wave 4 never ends in the price territory of wave 1 because it’s a rule violation and thus it’s not an impulse wave. AxisBank weekly price chart under the corrective phase. The price 784 already tested of retracement 61% for wave ((b)), of wave ((a)). I’m looking at the Price Action candle as a turning point as evidence. In this Axis Bank price chart, the “Motive phase” has been unfolded clearly with 1,2,3,4 and 5 by respect of all Elliott wave rules. There are two possibilities at higher degree either wave (1) or (B) but, wave (B) can not have 5 subwaves therefore, we can say this is the wave (1) because of 5 waves evidence. Let’s assume forward that the wave (1) red is at higher degree therefore, now the price will follow ABC correction for corrective phase which can be one of 3 patterns, flat, zigzag and triangle. In other words, the price is going to print wave (2). Before looking into 3-corrective patterns(flat, zigzag and triangle) one by one, we will shift the lower timeframe as Daily. For the zigzag pattern (5-3-5), the sub-wave ((b)) can not overlap the origin of the wave ((a)). If this is sharp zigzag, then price will not move beyond the .786(821). The price is already at or near .618(784) fib. ratio. For Flat pattern (3-3-5), looking for pullback for wave (B) and then next can be (C) up-ward of wave ((b)). “Head and Shoulders” pattern. I do like the head and shoulders pattern and the reason why I like the head and shoulders pattern is just because it’s easily discernible on a price chart, and offers a number of good parameters to actually trade. It was actually popularized by Edward,and Magee in their book “technical analysis of stock trends” and essentially consists of a left shoulder ahead in a right shoulder. And then what you do is the little intervening low between the left shoulder and head. That would be right here. Let me go ahead and identify and neckline measurement. It’s important to understand with respect to “Neckline Measurement” that in neckline measurement represents the minimum objective of the pattern and that simply.The distance between the head and the neckline. Again, this trend line right here projected up-ward from the breakdown point. The neck-line from head distance came actual 100 points over. From the break-out point, we can expected 100 points up move. Head & Shoulders Pattern on Weekly price chart: Brief Summarized:- Weekly Trend: Corrective pattern (downward trend) – long term support 38.2% at 645 & 61.8% at 508 but the price has not started for this track. Daily Trend:

4 hours Time-Frame: After a little pullback at neck-line, the price can push upto 850 – H & S pattern. Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post Wave Counting & Head & Shoulders Pattern on multi-time frame for AXISBANK. appeared first on Moneymunch. |

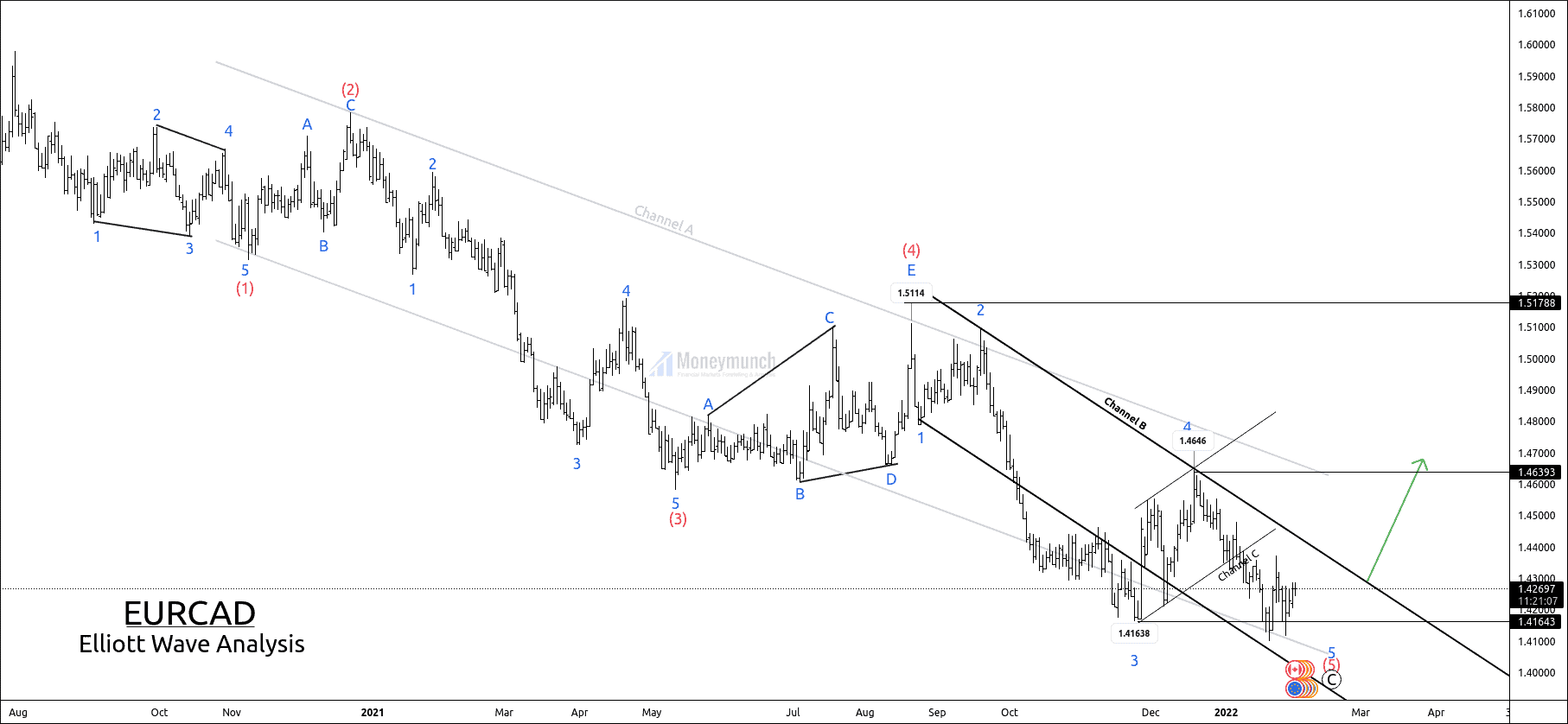

| EURCAD: Bullish Scenario is Active! Posted: 01 Feb 2022 03:04 AM PST EURCAD is forming a downtrend channel. In my previous idea, I have mentioned that, If the price breaks down channel C, the following targets for Wave 5 will be 1.4313 – 1.42520 – 1.41652- 1.41156. Click Here to Read previous article. Currently, the price is heaving correction, but safe traders can enter after the breakout of the C channel. After making wave (5), if the price breaks the B channel, it can go for 1.4377 – 1.4466 – 1.4569 – 1.4645+. And Price will start a new 5-wave impulse structure. Invalidation is available for premium subscribers. Please note that without a breakout, trend changes may not be possible. Only premium subscribers can read the full article. Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access. Would you like to get our all forex (fx) updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Forex Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post EURCAD: Bullish Scenario is Active! appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Lock

Lock