MoneyMunch.com |  |

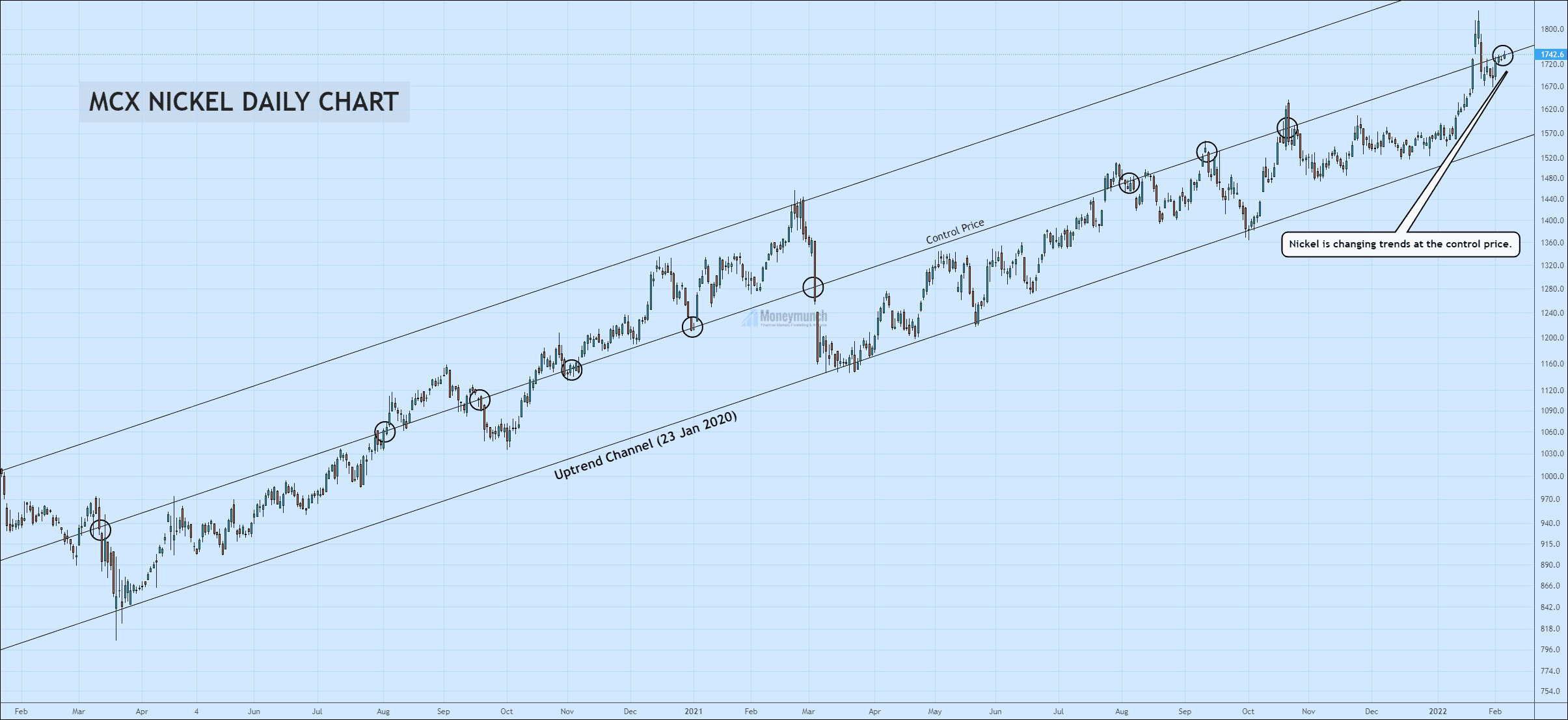

| 2020’s Uptrend Channel Is Everything For MCX Nickel Posted: 06 Feb 2022 01:42 AM PST MCX Nickel is following the above uptrend channel from 23 Jan 2020. And making a good trade opportunity for commodity traders. Nickel’s upward trend is not over yet. But we may see a downfall below the control price, and it can be up to 1686 – 1620. But what happens if it breaks the control price?It’s a 100% sign for a buy signal. But intraday or short-term investors should confirm that breakout before proceeding. And they must look out for candle’s fakeout. Afterward, be ready for the targets of 1800 – 1840 – 1876+. Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post 2020’s Uptrend Channel Is Everything For MCX Nickel appeared first on Moneymunch. |

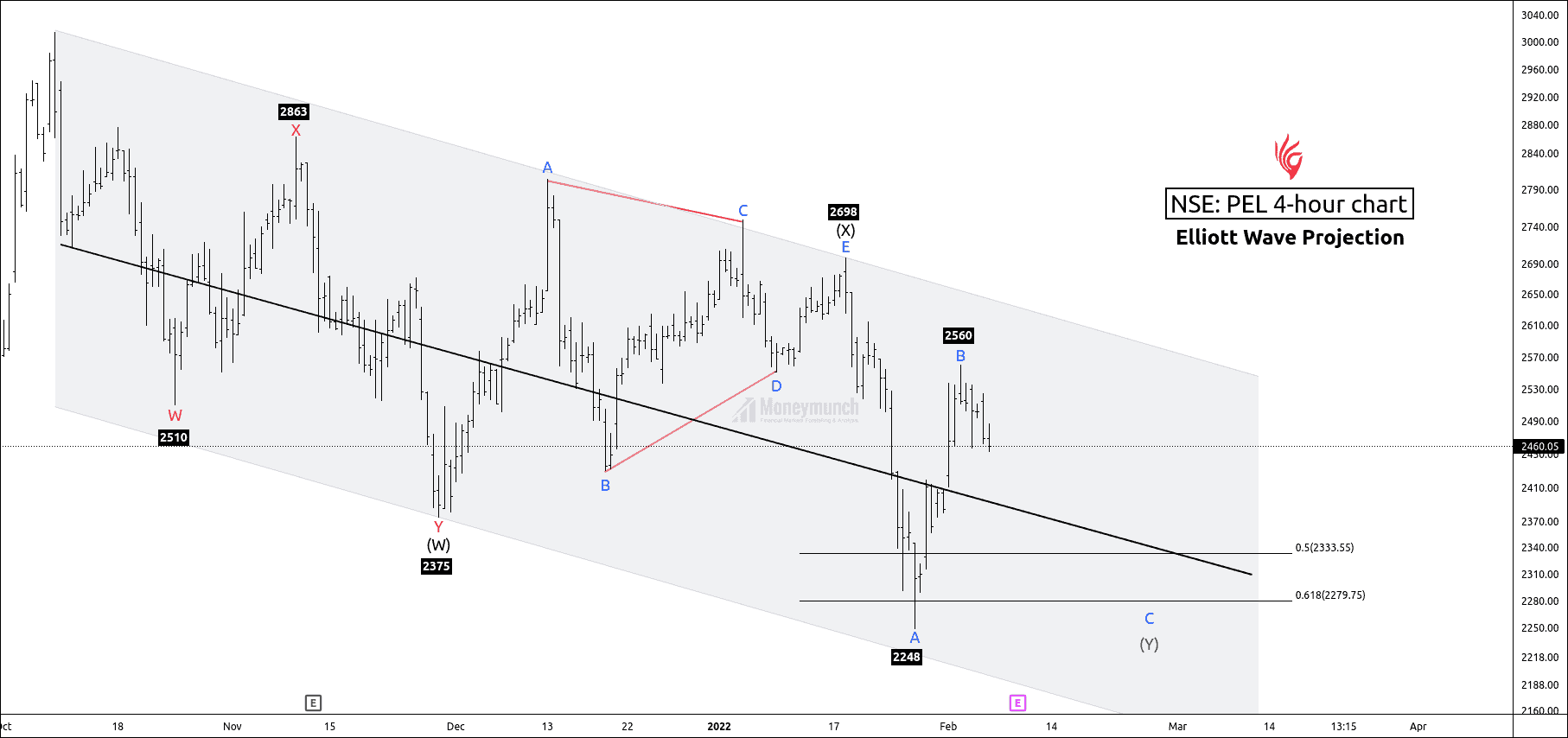

| NSE PEL Is Preparing for 2400 – 2301 Posted: 06 Feb 2022 12:00 AM PST TARGETS: BUT DON’T TRADE BLINDLY. Read this following research to get how it is making selling opportunities for the intraday traders. PEL is forming a double combination pattern on the 4-hour timeframe chart. Price has constructed LL(lower-low) and LH(lower-high) to confirm the bear’s existence. Wave Formations: Wave (Y): The culmination point of wave C: Invalidation: For premium subscribers only. Only premium subscribers can read the full article. Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access. Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post NSE PEL Is Preparing for 2400 – 2301 appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Lock

Lock