MoneyMunch.com |  |

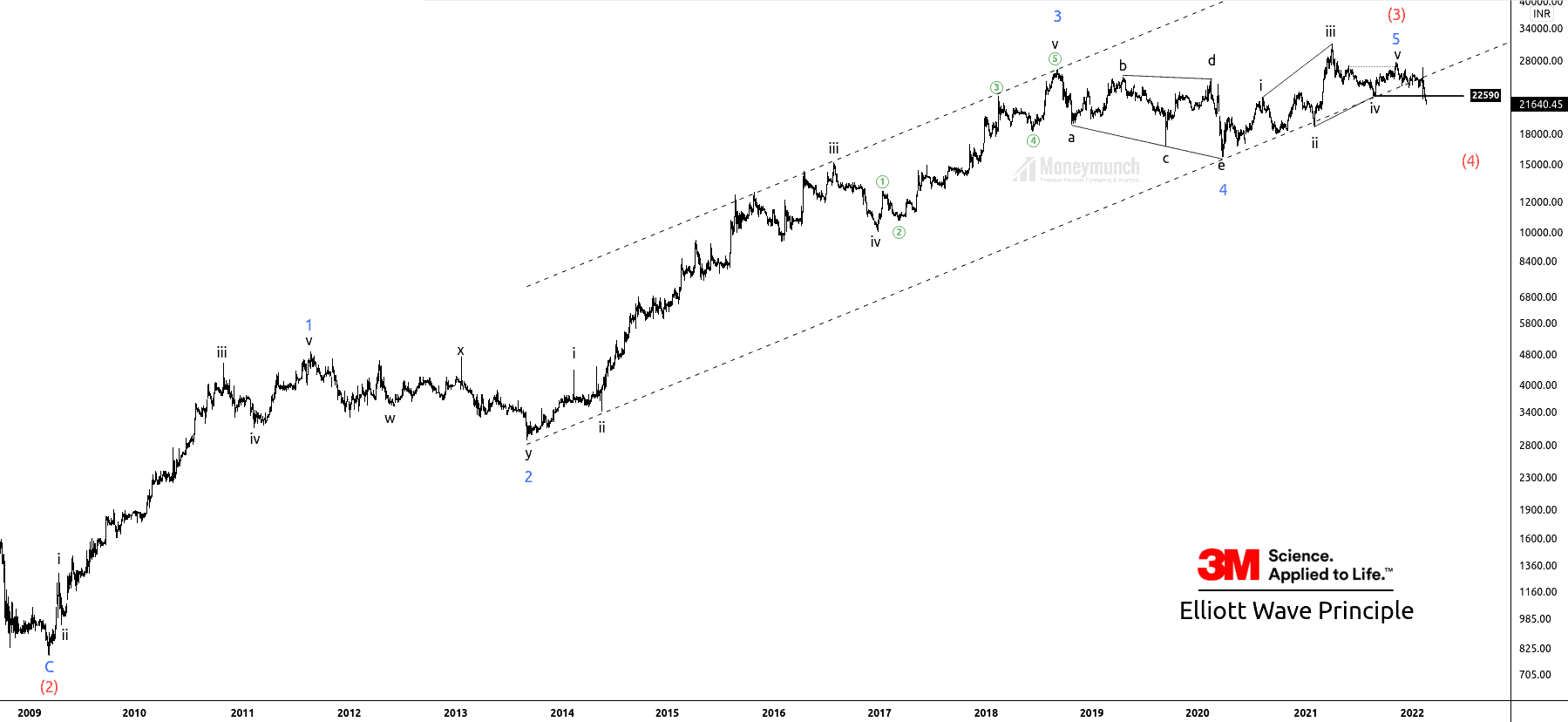

| NSE 3MINDIA Bearish Mode Activated Posted: 18 Feb 2022 03:04 AM PST Basic Tenets: Elliott’s wave principle consists of eight waves. 1. Motive structure: 2. Corrective structure Now, let’s look at the 2-day chart of 3MINDIA. Timeframe: 2 day Sub-wave 5 of wave (3) has ceased, the terminating wave v of ending diagonal. Price has broken down the corrective wave iv at, 22590, which signals bearish sentiments. After breaking the main channel, the price started falling sharply. Calculation of wave (4): Timeframe chart: 4-hour Price has broken down the sub-wave iv of the ending diagonal of wave 5. Traders can initiate a short position for the following targets of 21010-20557. Invalidation and entry are available for only premium subscribers.

Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post NSE 3MINDIA Bearish Mode Activated appeared first on Moneymunch. |

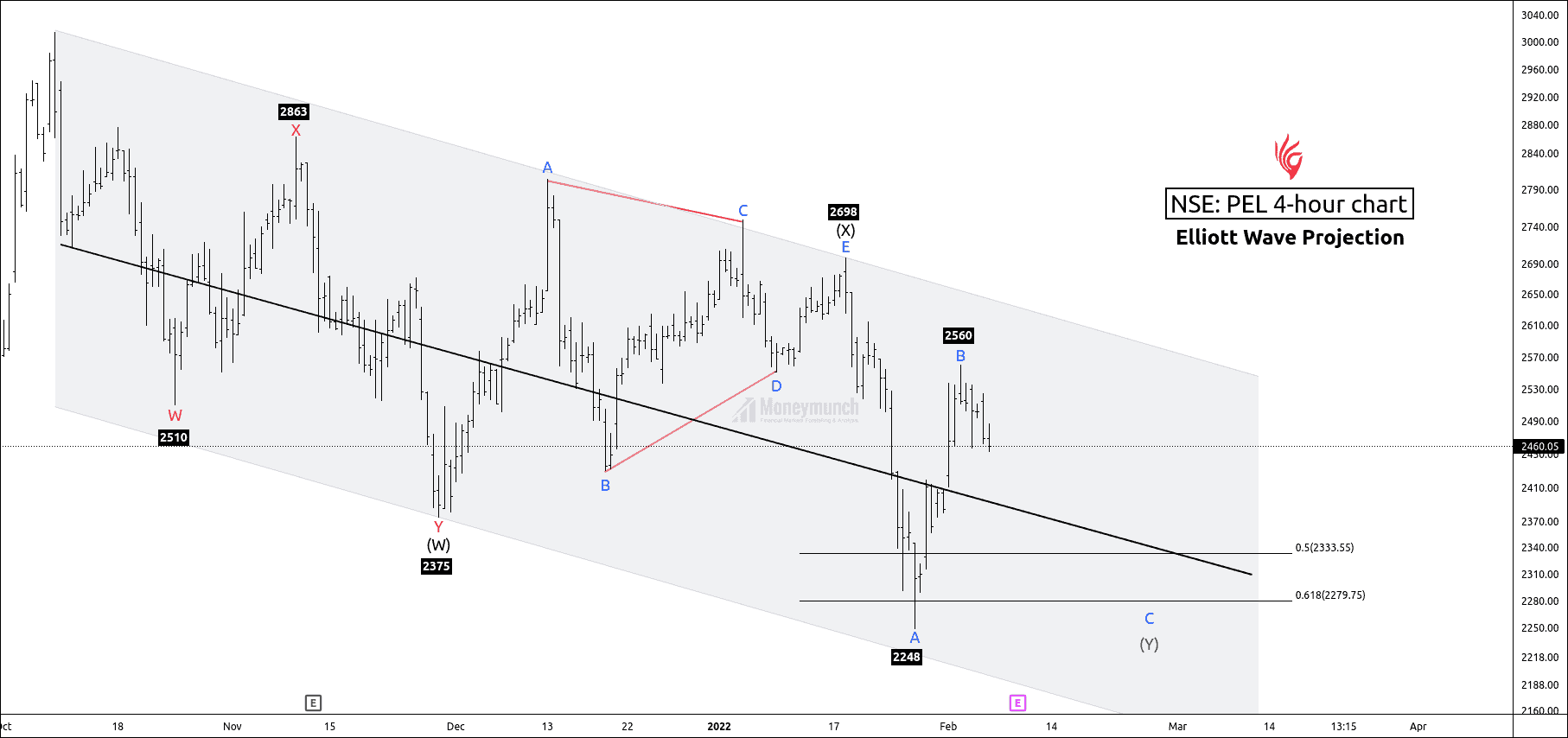

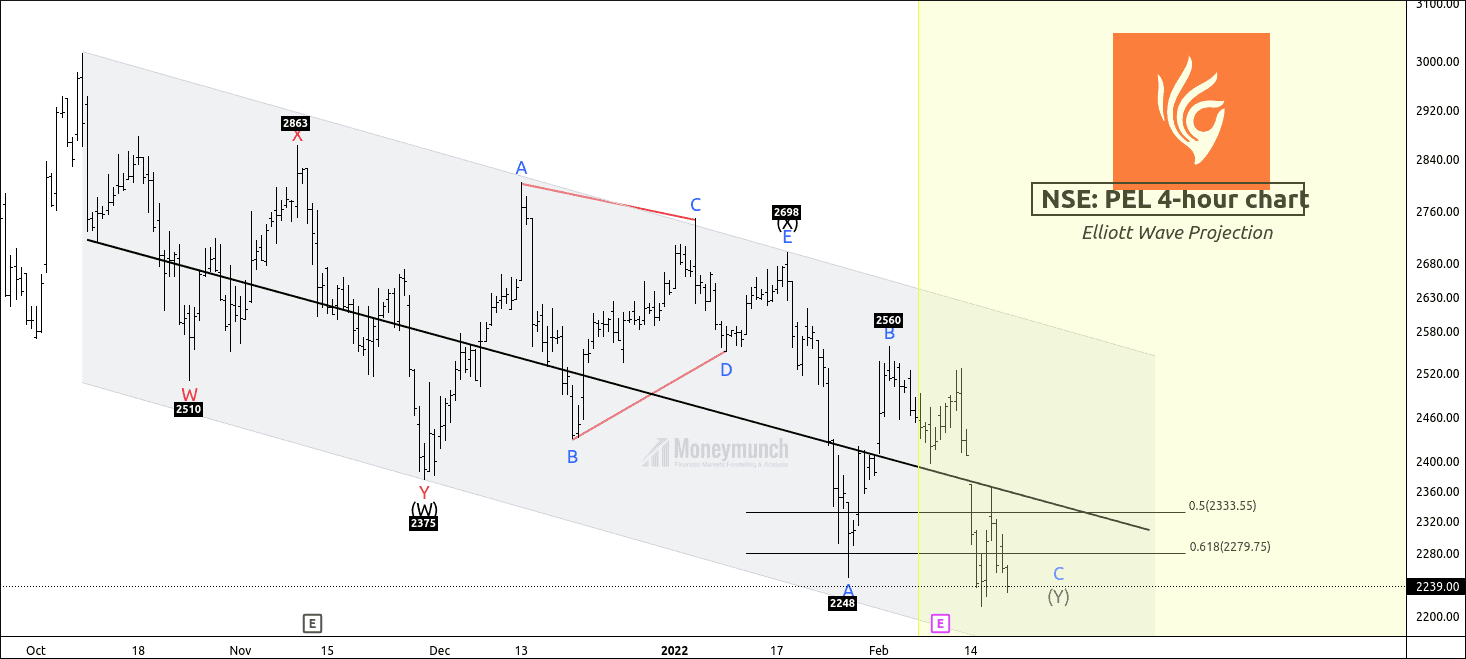

| NSE GPIL & PEL Sellers Crushed Buyers Posted: 17 Feb 2022 02:57 AM PST PEL: PIRIMAL ENTERPRISE Before: PEL has formed a double three corrective structure. Price had completed wave B of complex correction W-X-Y. As the price formed in the downward channel and the Y wave was to cease, the price had bearish sentiments.

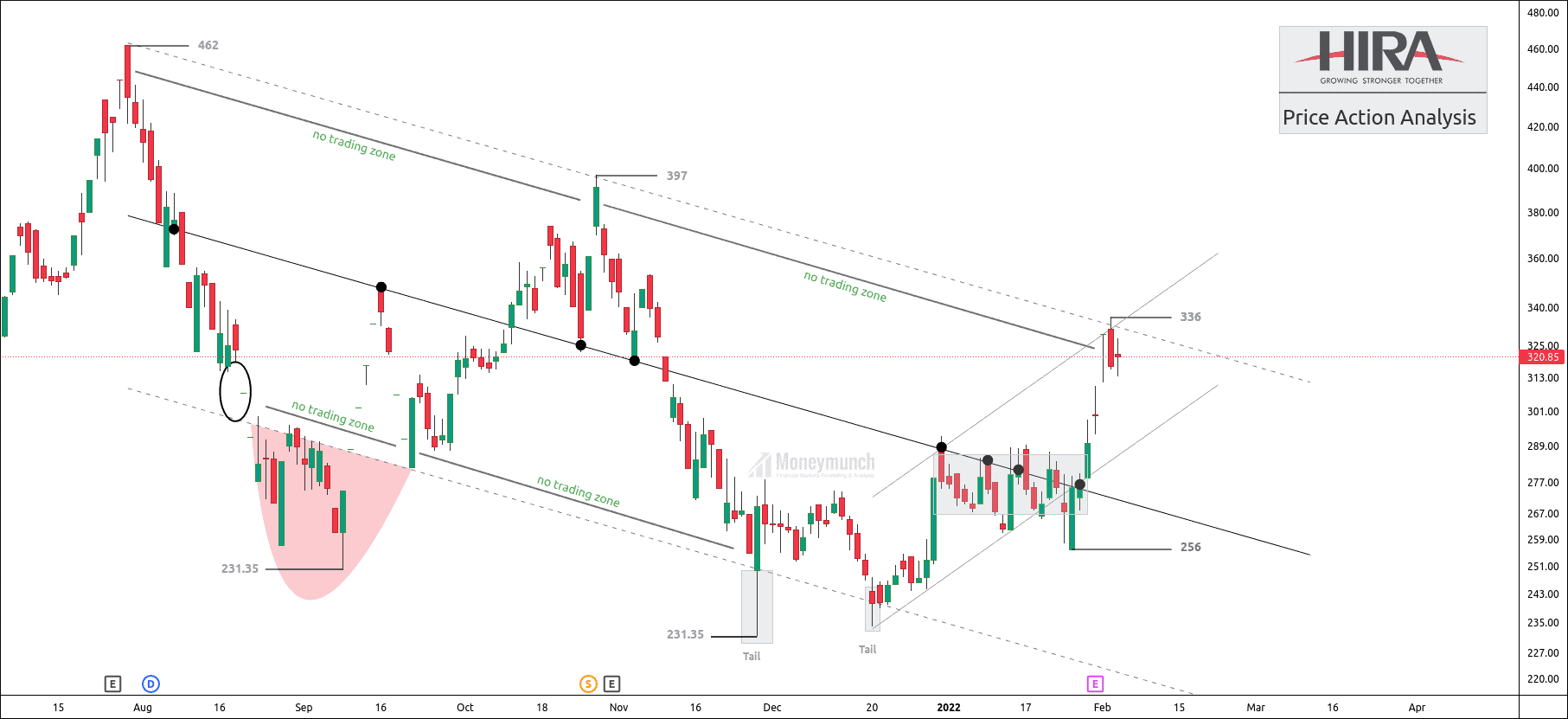

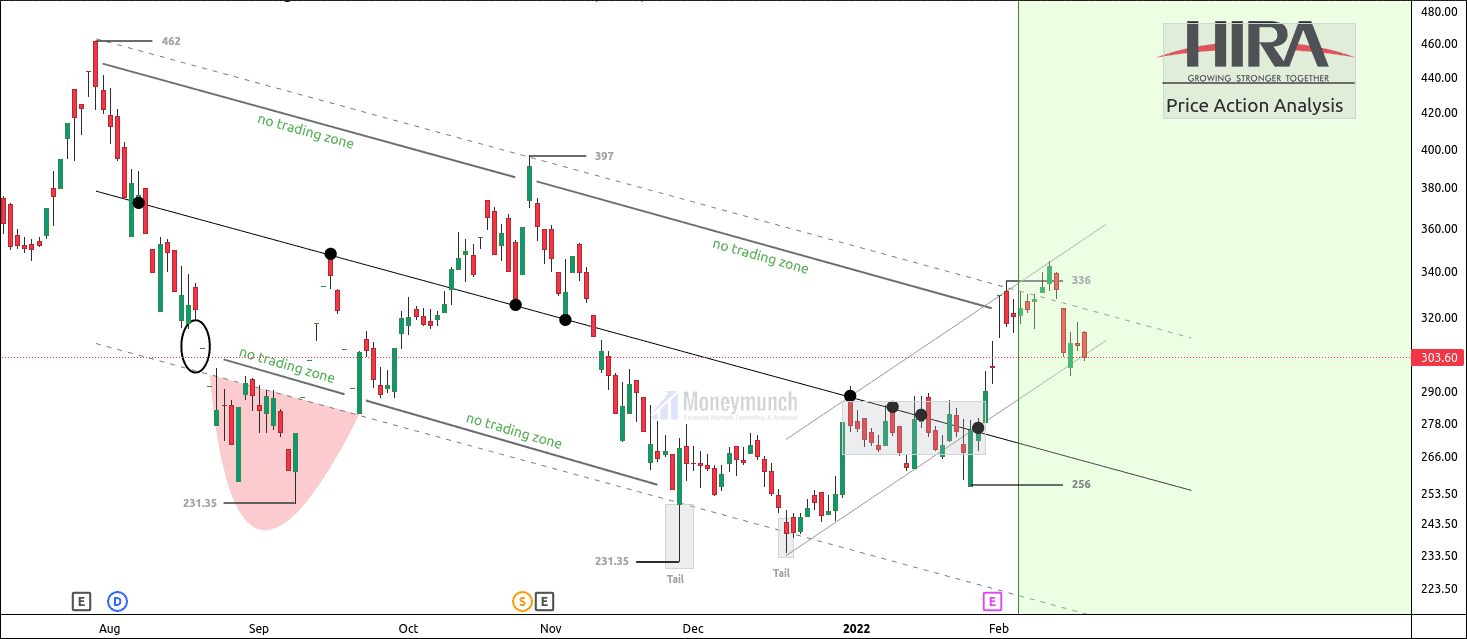

After: 8 February: Price reached the first target of 2400 and made a low of 2996. 14 February: Price reached the 2nd target at 2376. Price reached the 3rd target at 2301. Price reached the 4th target at 2279. Only premium subscribers can read the full article. Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access. GPIL: Godawari Power Before: PEL has formed a downward corrective structure. Price was at the upper band of the parallel channel. The upper-band indicates supply pressure where sellers exceed buyers. The price has provided two successful rejections from the upper band. GPIL had bearish the sentiments.

After: At the upper band, the price couldn’t break the upper band of the parallel channel. 14 February: GPIL reached the First target of 313. 15 February: GPIL reached the second target of 304. What’s next? Price is at the lower band of the parallel channel. And if the price breaks down the minor parallel channel, it can travel up to the control line of the downward channel. Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post NSE GPIL & PEL Sellers Crushed Buyers appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Lock

Lock