MoneyMunch.com |  |

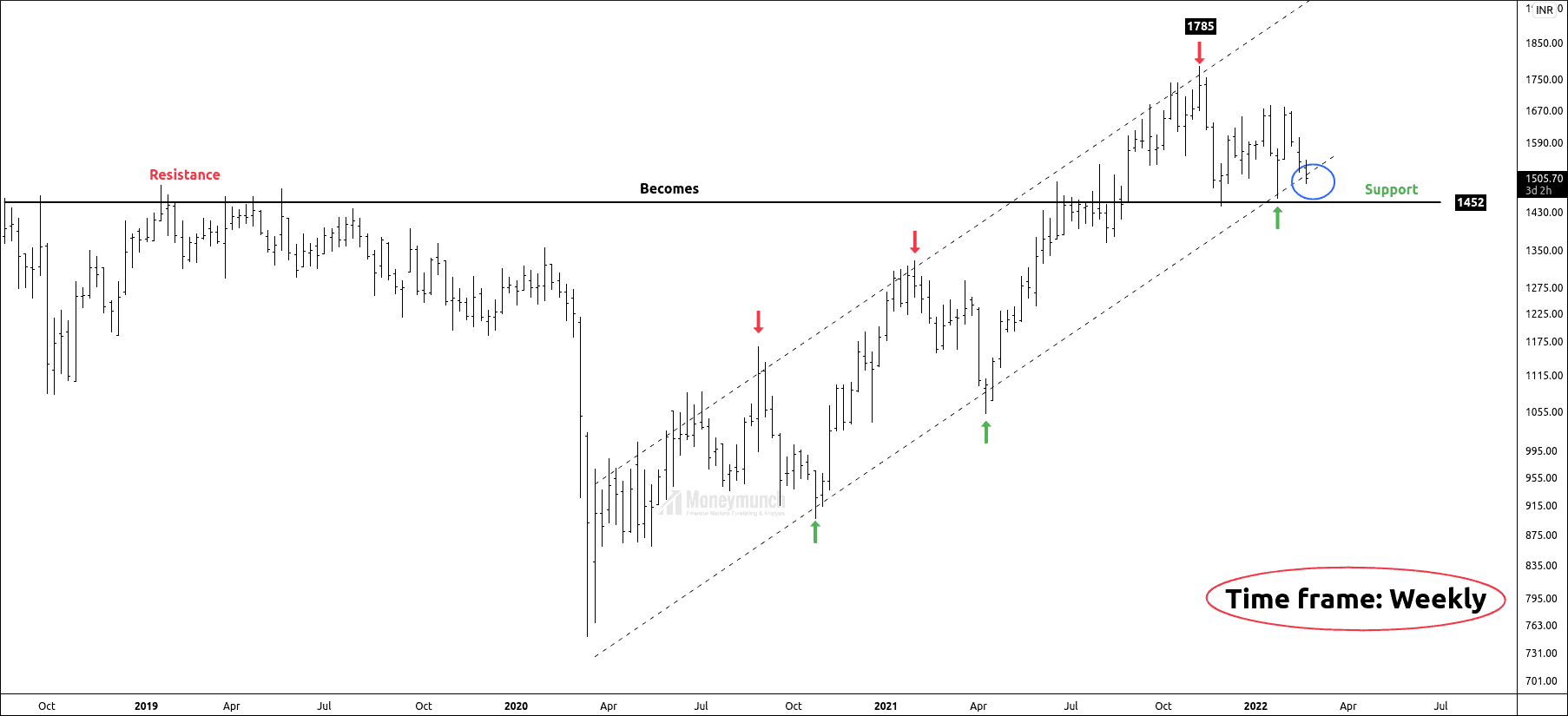

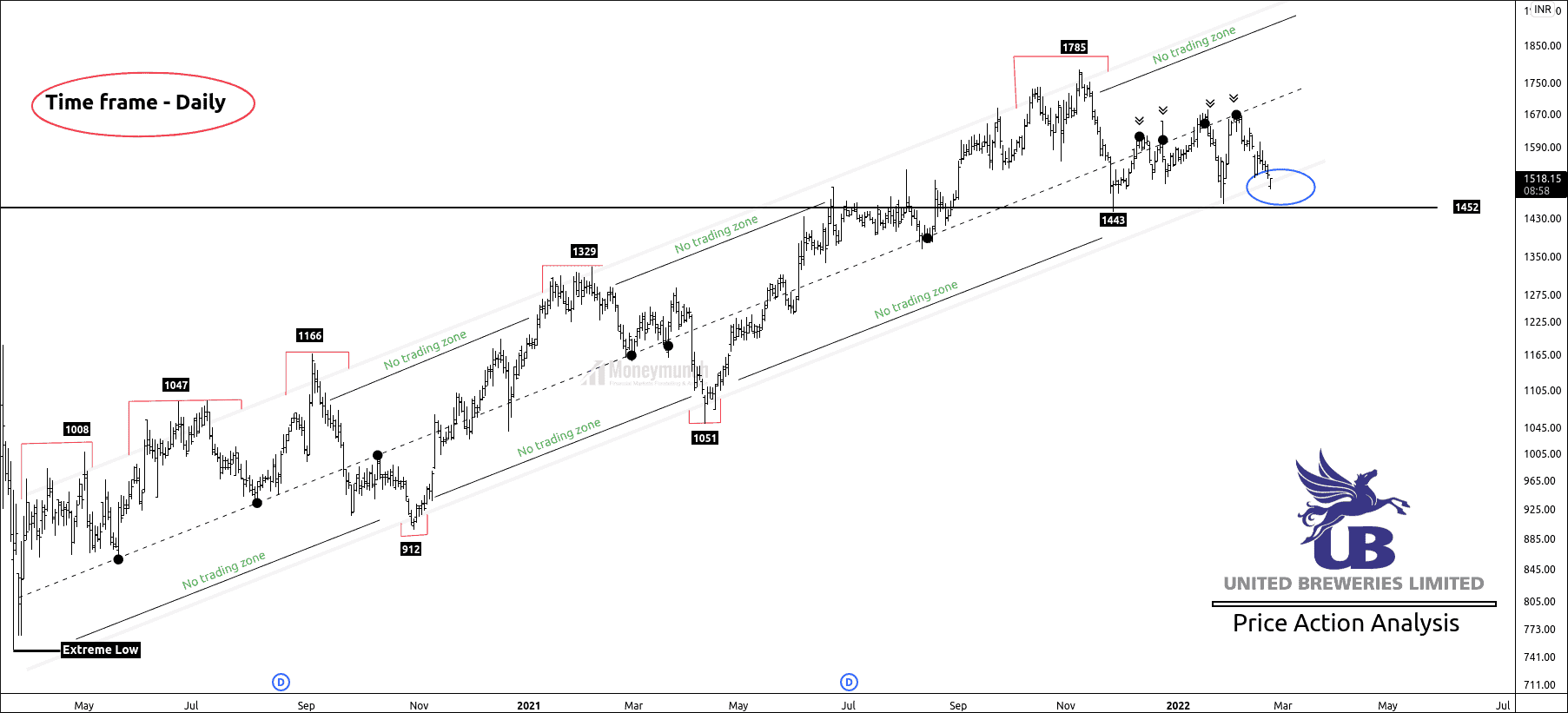

| NSE UBL Is Declining, But Major Support Is Ahead Posted: 22 Feb 2022 02:18 AM PST UBL created an all-time high at 1785 and started declining to overcome the demand pressure. The stock has respected equilibrium in the parallel channel. If the price breaks the parallel channel, it has to break the pivot level 1452. Or the price will give a fake-out and enter into the channel. The level of 1452 was a monthly resistance level, which became the support level for the current price. We can strong move below this level, and rejection will lead us to the end of correction. After creating the extreme low of 749.50, UBL has started forming an ascending channel. Excess: In this channel, we can see five excess at the upper band of the Parallel lines. Excess – 1008 Excess – 1047 Excess – 1166 Excess – 1329 Excess – 1185 We also have two excess on the lower band of the parallel channel. Excess – 912 Excess – 1051 It indicates that supply pressure has always tried to push the price up. At high prices, bulls realized that They couldn’t push anymore. Seller started controlling demand pressure by supply. Bull responded to selling pressure with a responsive move. Less excess on the lower band means that buyers haven’t missed responding. No trading zone: No trading zone is an extent wherein speculators or investors are avoid trading. At the upper band, the length of the no trading zones is similar. Zone 1: 80 bars, 117 days Zone 2: 82 bars,124 days Control Line: The Control line has provided nine touches to the price. Price has tried to break the control line more to three times, but it couldn’t break the control line, and the price fell to the lower band of the parallel channel. Stand Point: We are using a pivot zone at 1452 to avoid fake-outs. If the price breaks the pivot level, it can go for 1390-1311. Hence, the price is bullish only above the pivot level. I will upload further information before tomorrow’s market bell. Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post NSE UBL Is Declining, But Major Support Is Ahead appeared first on Moneymunch. |

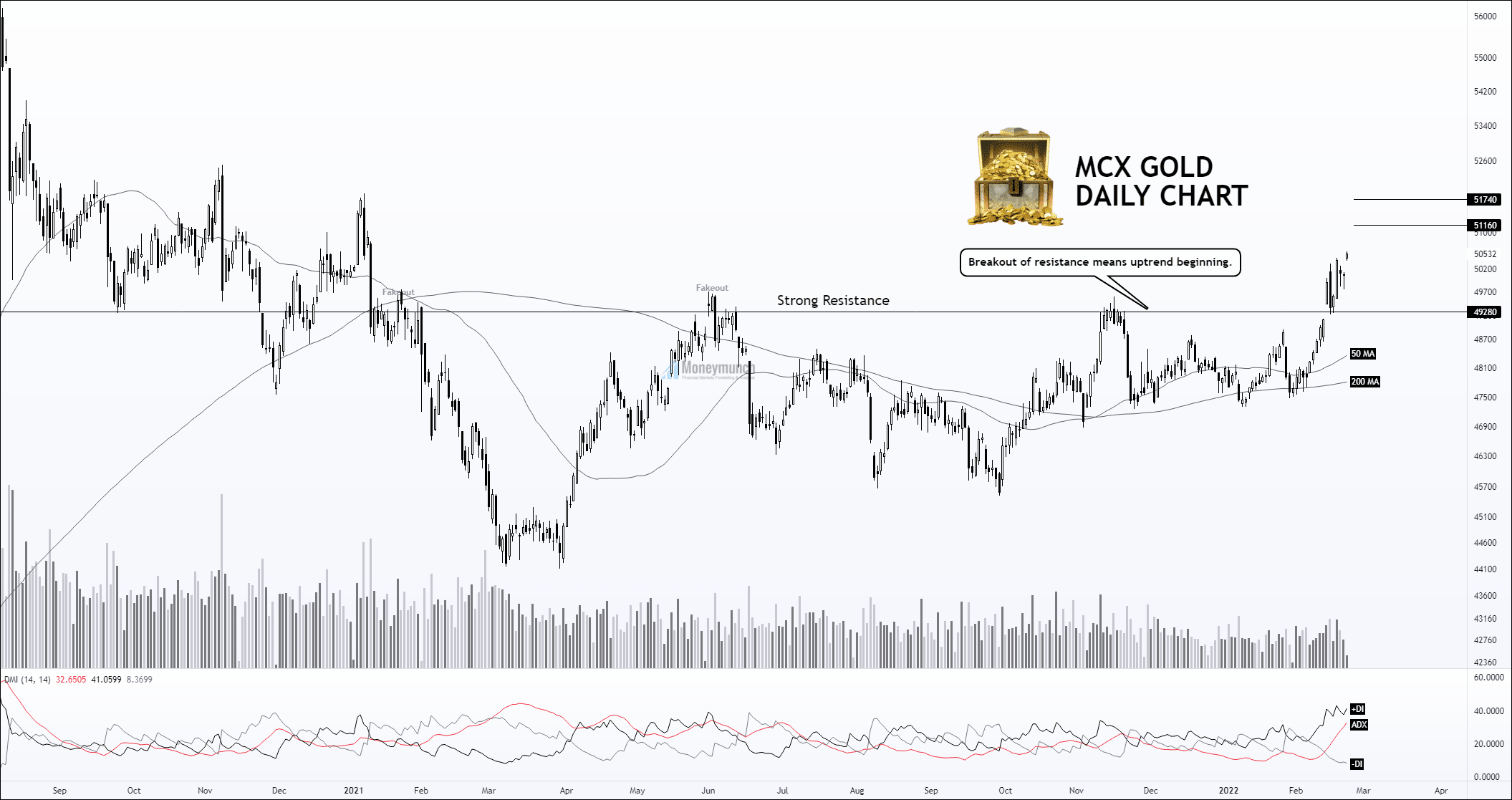

| MCX Gold’s Bullish Mode Activated Posted: 21 Feb 2022 10:57 PM PST Did you read the 26 Jan 2021 article on Gold? Wherein I have highlighted a strong resistance (SR) which is 49280. It has broken down on 14 Feb 2022. That indicates the MCX gold uptrend is unfolding here. If it consecutively remains above the SR, we will see the gold price above 51160 – 51740. The following indicators have been indicating impending advance: Watch significant releases or events that may affect the movement of gold, silver, and crude oil. Tuesday, Feb 22, 2022 Thursday, Feb 24, 2022 Would you like to get our all commodity updates instantly? We have an option for you. Do you want to get Premium Calls only? If you have any questions or concerns about Commodity Market then contact by following ways: Have you any question/feedback about this article? Please leave your queries in the comment box for answers. The post MCX Gold’s Bullish Mode Activated appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |