MoneyMunch.com |  |

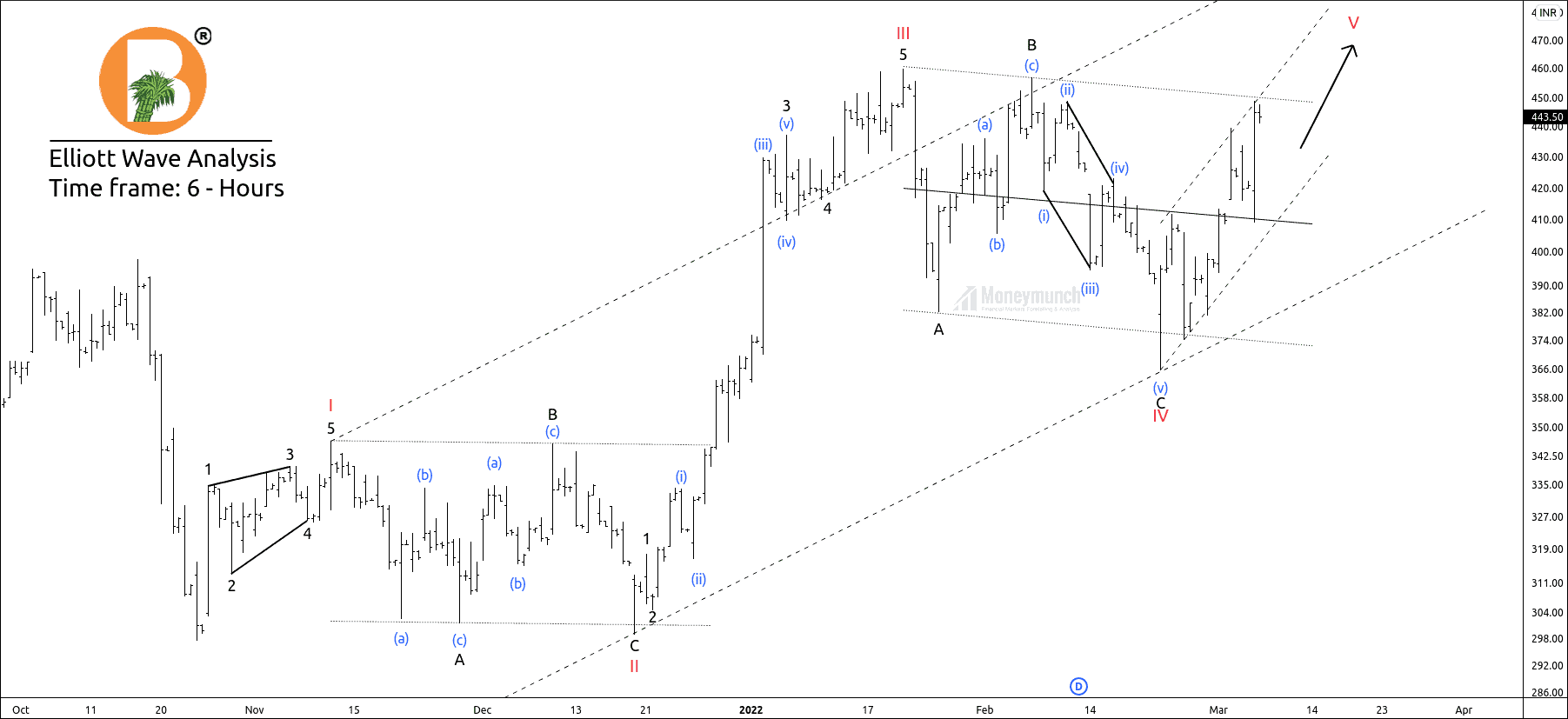

| NSE Balramchin & Britannia Elliott Wave Projection Posted: 07 Mar 2022 06:30 PM PST BALRAMCHIN has accomplished the corrective wave IV, and the price has started forming impulsive structure V. If the price breaks high of wave B, we can expect the following targets: 460 – 476 – 489+ for wave V. If the price fails to break the high of wave B, we will wait for the pullback to enter. However, the breakout of wave B can be an intention that causes a new high, where demand pressure will exceed supply pressure. After accomplishing the final wave V, the price will start A-B-C correction. Only premium subscribers will get entry, exit & stop loss. NSE Britannia Sellers Are Active In Widespread Against Buyers Britannia has broken down the crucial support level of 3320. It is the metaphor of a bearish move. The invalidation point for free subscribers is the high of the previous sessions. Entry-level & invalidation: Available for premium subscribers only. NSE NIFTY Is Has Started Forming Wave CHow many of you traded on NIFTY call? |

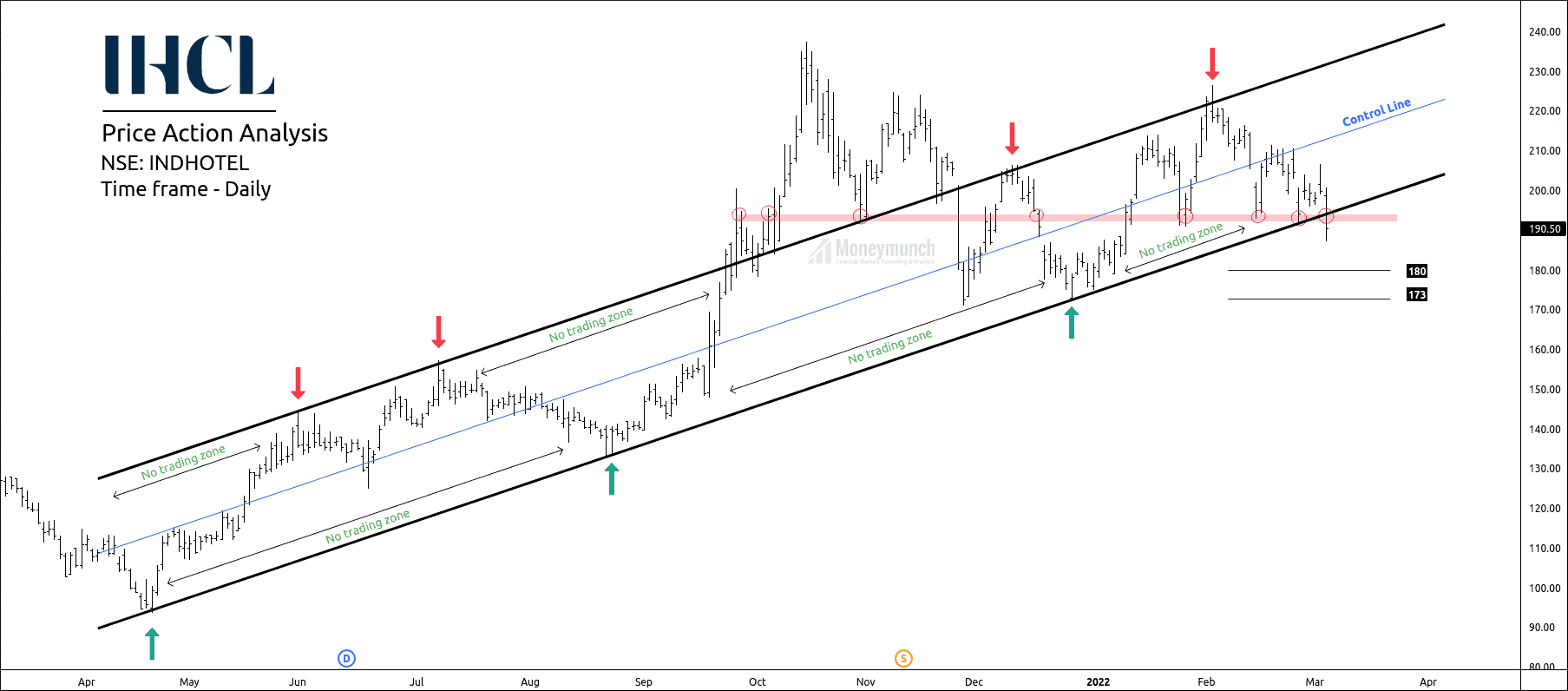

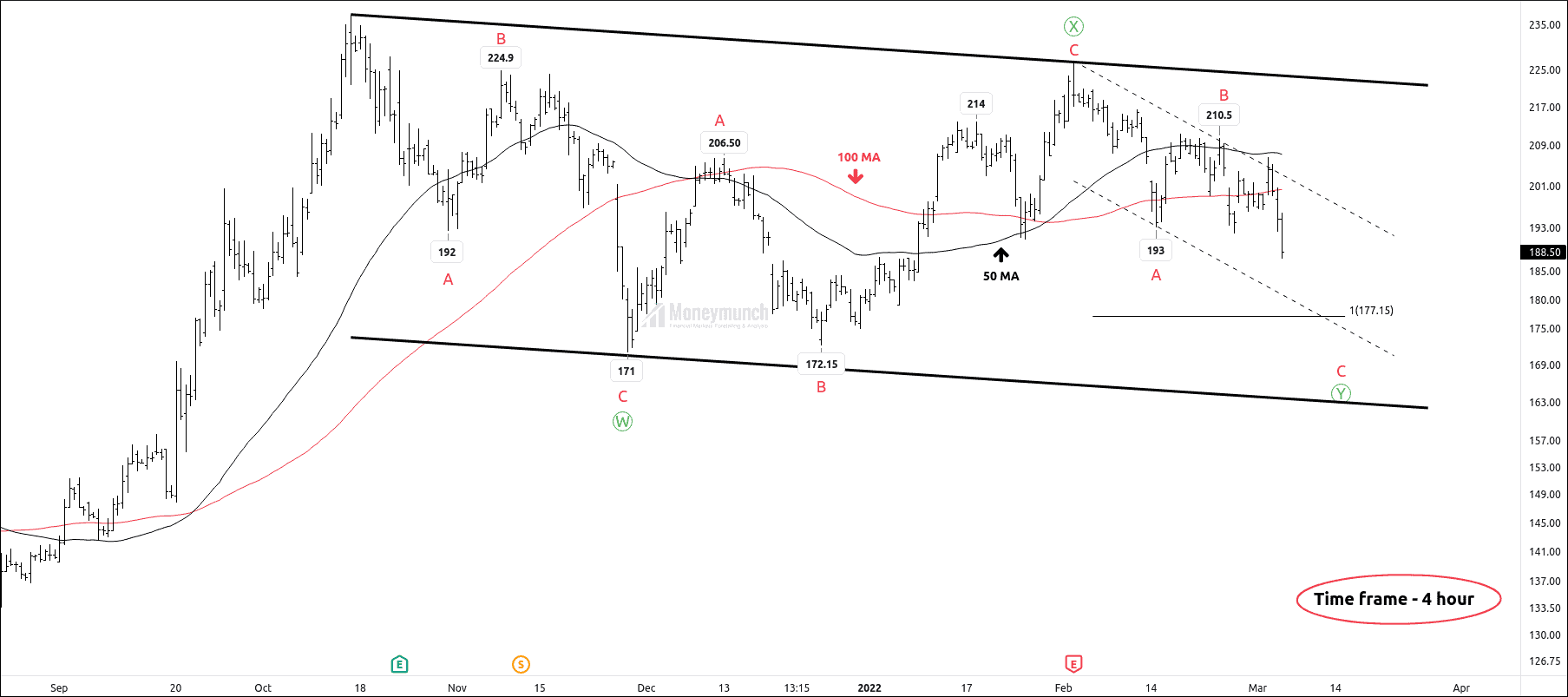

| NSE COALINDIA & INDHOTEL – Bearish Outlook Posted: 06 Mar 2022 06:30 PM PST INDHOTEL is on the lower band of the parallel channel, and we have a pivot zone of 192. Premium subscribers will get a High-confidence trade setup on our application. INDHOTEL has accomplished wave B of wave ((Y)) and marching for final wave C of wave ((Y)). Price has broken down wave A at 193, and it is a bearish signal. Wave C can occur at 100% Fibonacci extension at 177 (wave A = Wave B). However, if the price breaks the level of 177, it may fall for the lower band of the main corrective channel. Indicator study: NSE Coal India Bearish Again Rejected At the ResistanceCoal India has failed to break SEP 2021 high. And it took a reversal from the level of 197.75. Here, selling pressure is increasing due to speculators. We may see the following targets on Monday’s trading session: 177 – 172 – 165. Entry-level & invalidation: Available for premium subscribers only. Invalidation level has an important role here because that will change the direction of stock from downtrend to uptrend. Would you like to get our share market updates instantly? Do you want to get premium NSE calls? If you have any questions or concerns about the stock market, don’t hesitate to contact me:

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers. The post NSE COALINDIA & INDHOTEL – Bearish Outlook appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |