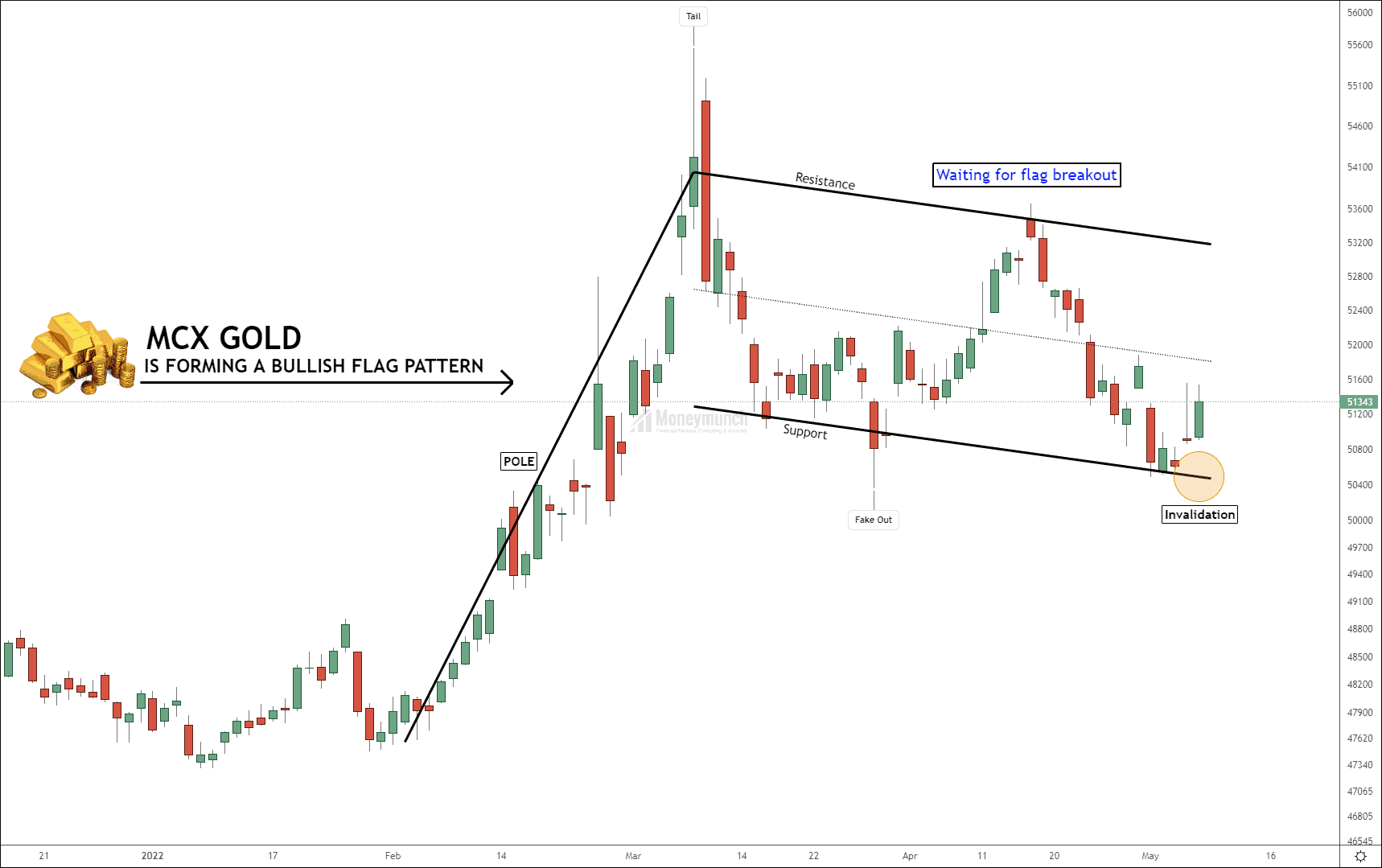

In the previous trading session, MCX Gold made a high of 51538 and closed at 51343 (+444). A question is, is it moving upward?

To identify uptrend:

There are two hurdles to continuing the uptrend. It should break out the 5th May high or settle above the control line.

According to the above chart, Gold is forming a bullish flag pattern. And we’re waiting for a breakout of the flag pattern. This breakout will skyrocket the gold price, and we can see 6400+ points of bullish movement here. Long-term target for gold 58000 – 60000.

Gold downtrend confirmation:

But if gold breaks the support trendline (invalidation), then a downtrend may start. And if it happens, I will update you asap.

At present, intraday traders can keep buying for targets of 51500 – 51800+ levels.

Watch significant releases or events that may affect the movement of gold, silver, and crude oil.

Monday, May 09, 2022

04:30 FOMC Member Bostic Speaks – Medium Impact

11:00 Investing.com Gold Index – Medium Impact

18:15 FOMC Member Bostic Speaks – Medium Impact

Tuesday, May 10, 2022

17:10 FOMC Member Williams Speaks – Medium Impact

18:00 FOMC Member Bostic Speaks – Medium Impact

21:30 EIA Short-Term Energy Outlook – High Impact

Wednesday, May 11, 2022

00:30 FOMC Member Mester Speaks – Medium Impact

02:00 API Weekly Crude Oil Stock – Medium Impact

04:30 FOMC Member Bostic Speaks – Medium Impact

18:00 Core CPI (MoM) (Apr) – Medium Impact

20:00 Crude Oil Inventories – High Impact

22:31 10-Year Note Auction – Low Impact

23:30 Federal Budget Balance (Apr) – Low Impact

Thursday, May 12, 2022

10:30 Natural Gas Storage – Low Impact

13:30 IEA Monthly Report – Medium Impact

Friday, May 13, 2022

08:30 Import/Export Price Index (MoM) – Low Impact

11:00 FOMC Member Kashkari – Medium Impact

12:00 FOMC Member Mester Speaks – Medium Impact

13:00 U.S. Baker Hughes Oil Rig Count – Medium Impact