MoneyMunch.com |  |

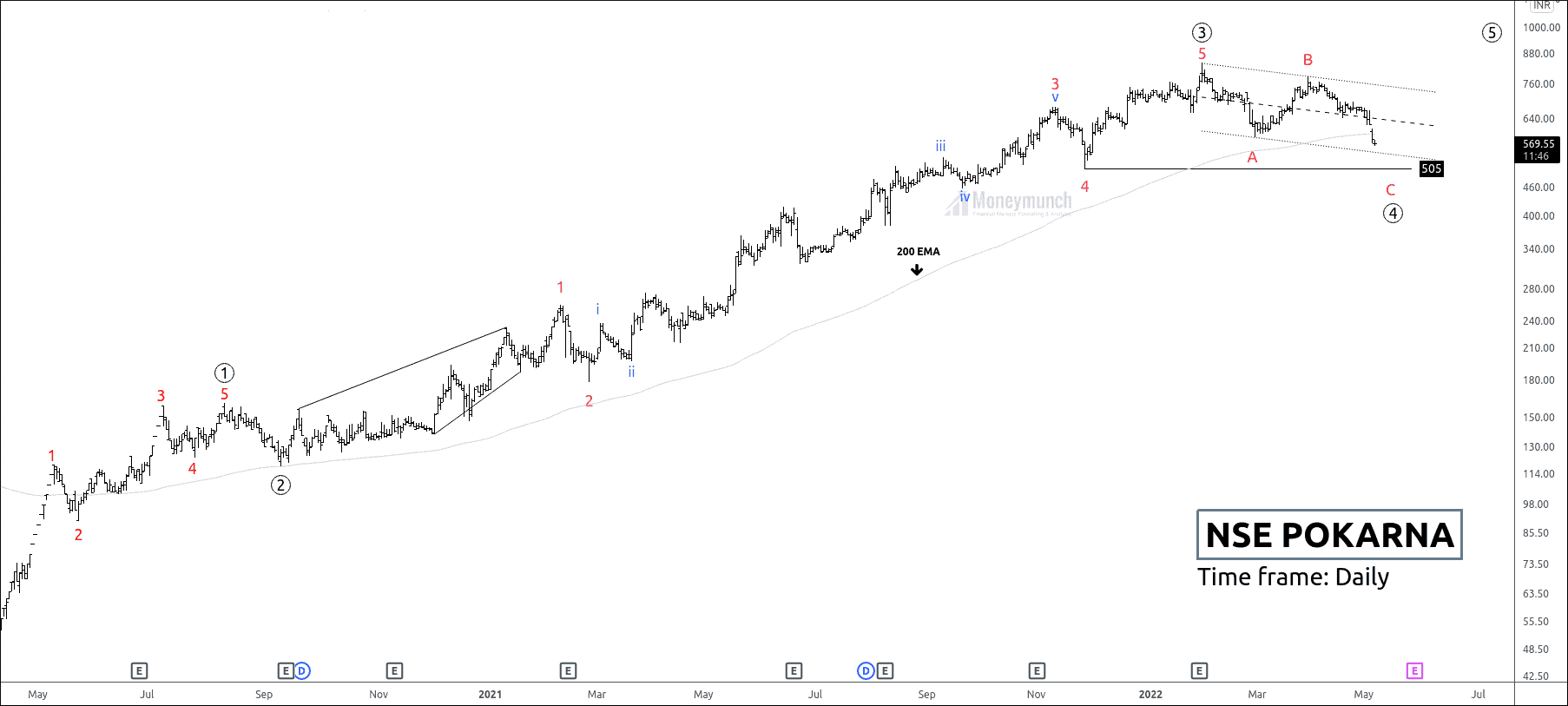

| Pokarna Stock Is a Money-Making Machine Posted: 09 May 2022 02:58 AM PDT Pokarna has completed its impulsive wave c of the corrective wave ((4)). Wave C has traveled 100% Fibonacci extension of wave A at 548. Currently, the price has broken down the A wave at 585. If it sustains below 585, traders can expect the following targets: 558 – 536 – 505. 505 is strong support because corrective wave 4 accomplish near the corrective wave 4 of a lower degree. If the bull fails to keep the price above this level, we can see a big downfall. Otherwise, the price will touch the control line and then the upper band of the descending channel. I will upload further information soon. Would you like to get our share market updates instantly? Click the link to join: Free Stock Tips Do you want to get premium NSE calls? Click the link to subscribe: Premium NSE Stock Tips If you have any questions or concerns about the stock market, don't hesitate to contact me:

The post Pokarna Stock Is a Money-Making Machine appeared first on Moneymunch. |

| NSE NIFTY & BANKNIFTY Outlook For Intraday Traders Posted: 08 May 2022 06:55 PM PDT Is Bank Nifty Resuming Its Bearish Move?Bank Nifty is occurring in the range between 34700 and, 33370. To get a tradable move, traders should wait for the breakdown of this range. Traders can short below 34100 for the following targets: 33803 – 33540- 33452. In this phase of declining, traders must wait for a confirmation signal. Buyers can enter above 34700. Is Nifty Preparing For 15950?Nifty is forming in the range of 17500 – 16340. Price will face a consolidation if it trades between these levels. We can see big impulsive moves after the price breaks this level. Today, We will see a gap down in nifty with a speculative boom. Premium subscribers can wait for the future & options setup. Would you like to get our share market updates instantly? Click the link to join: Free Stock Tips Do you want to get premium NSE calls? Click the link to subscribe: Premium NSE Stock Tips If you have any questions or concerns about the stock market, don't hesitate to contact me:

The post NSE NIFTY & BANKNIFTY Outlook For Intraday Traders appeared first on Moneymunch. |

| You are subscribed to email updates from Moneymunch. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |